November 2024 Dividend Income Report — Documenting monthly dividend income and investment activity to chronicle the journey to financial independence.

I am not a licensed investment advisor, and the content of this post does not constitute professional investment advice. The information provided reflects my personal investment experiences and opinions, and should not be interpreted as a recommendation to buy or sell any stocks or other investments. Before making any investment decisions, please seek the advice of a qualified and licensed investment advisor. All opinions expressed are my own and are based on my personal perspective and experiences. This post may contain affiliate links to products/services I personally use and endorse.

The Dividend Income Investor blog is pleased to announce dividend income results for November 2024.

November 2024 was another strong month for year-over-year growth, with this month’s earnings putting me on track to hit my $2,000 total dividend income target for the year.

In addition, November was an excellent month for dividend raises, and I reached another exciting milestone—surpassing $7,000 in total dividend income since starting this journey.

That said, I must admit that my total dividend income since 2017 pales in comparison to this year’s impressive total gains. It’s truly been an outstanding year for overall returns.

The last time we saw stock market returns perform this well was in 2021, which was followed by a more challenging year for total returns. With that in mind, I’ve already begun reevaluating my portfolio allocation and considering my strategy for the year ahead. Given the market’s potential for volatility, I’m leaning toward a more defensive approach to help protect against potential downside. Of course, I will stay true to my core investment strategy, which focuses on dividend-generating stocks and ETFs. My emphasis remains on high-quality, undervalued assets that offer strong potential for long-term total returns. As always, I take a contrarian approach, aiming to acquire these opportunities when they are temporarily out of favour with the market.

With so many highlights to cover, I’ll skip the further commentary and dive straight into the numbers.

November 2024 Dividend Income Highlights

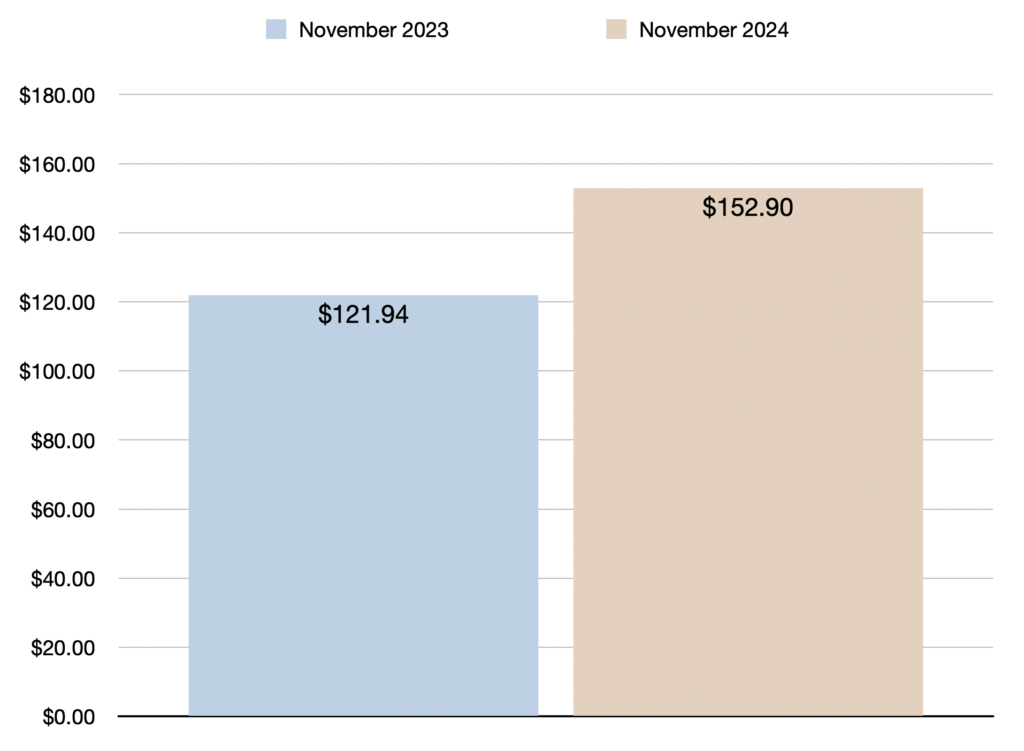

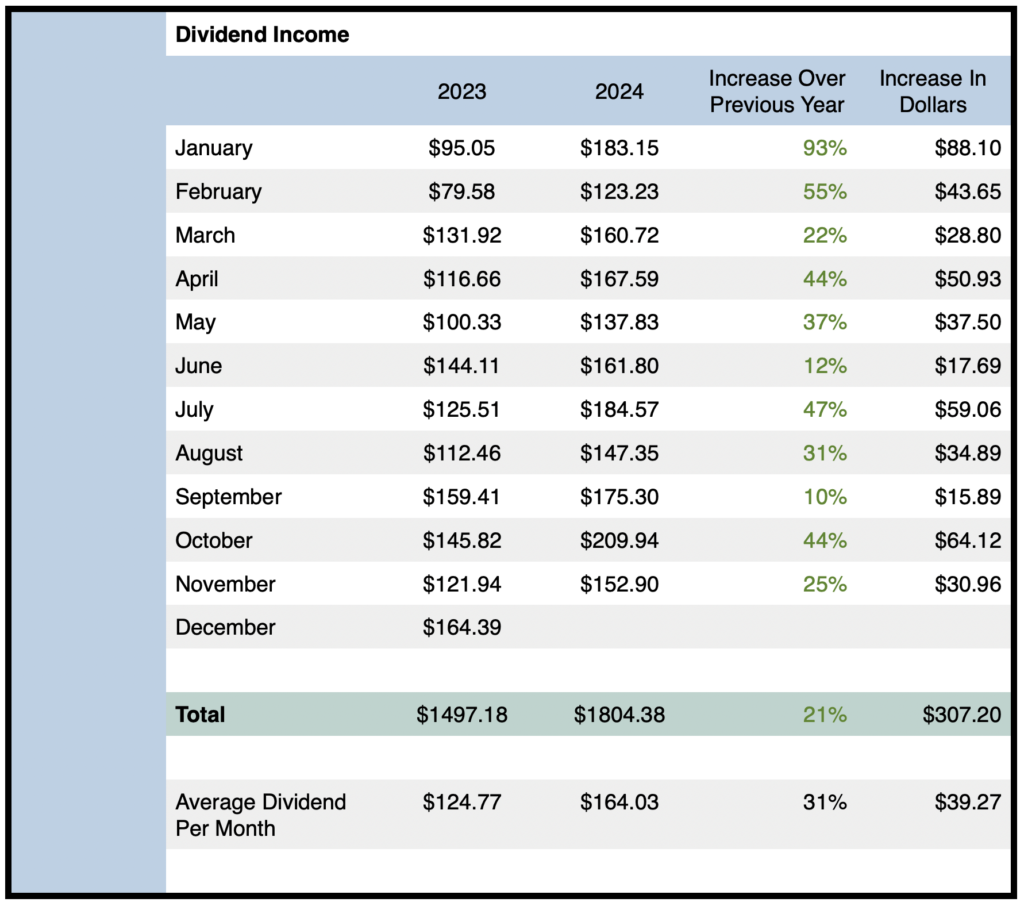

- Total dividend income earned in November 2024 was $152.90

- Year-over-year (YOY) dividend income increased by 25% or $30.96 compared to November 2023

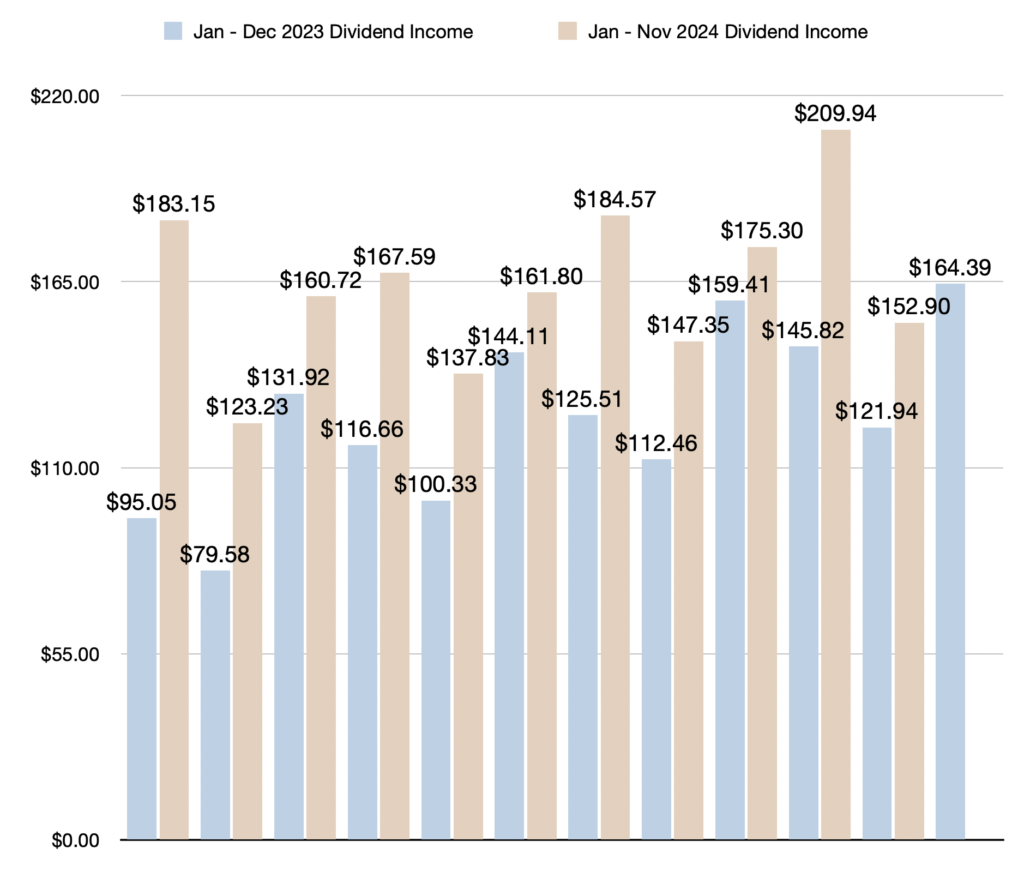

- Year-to-date (YTD) dividend income (January – November 2024) is up to $1804.38 (Up 21% or $307.20 compared to Full Year Dividend Income In 2023)

- YTD dividend income is up by 35% or $471.59 compared to the first eleven months of 2023

- Quarter-over-quarter (QOQ) dividend income increased by 4% or $5.55 compared to August 2024

- Average monthly dividend income in 2024 is $164.03 (Up 31% or $39.27 per month compared to 2023)

- All-time dividend income since June 2017 reached $7099.88

- Dividend raises were announced by 3 companies: $T.TO, $CTC.A, & $SU

November 2024 Dividend Income Earnings — $152.90

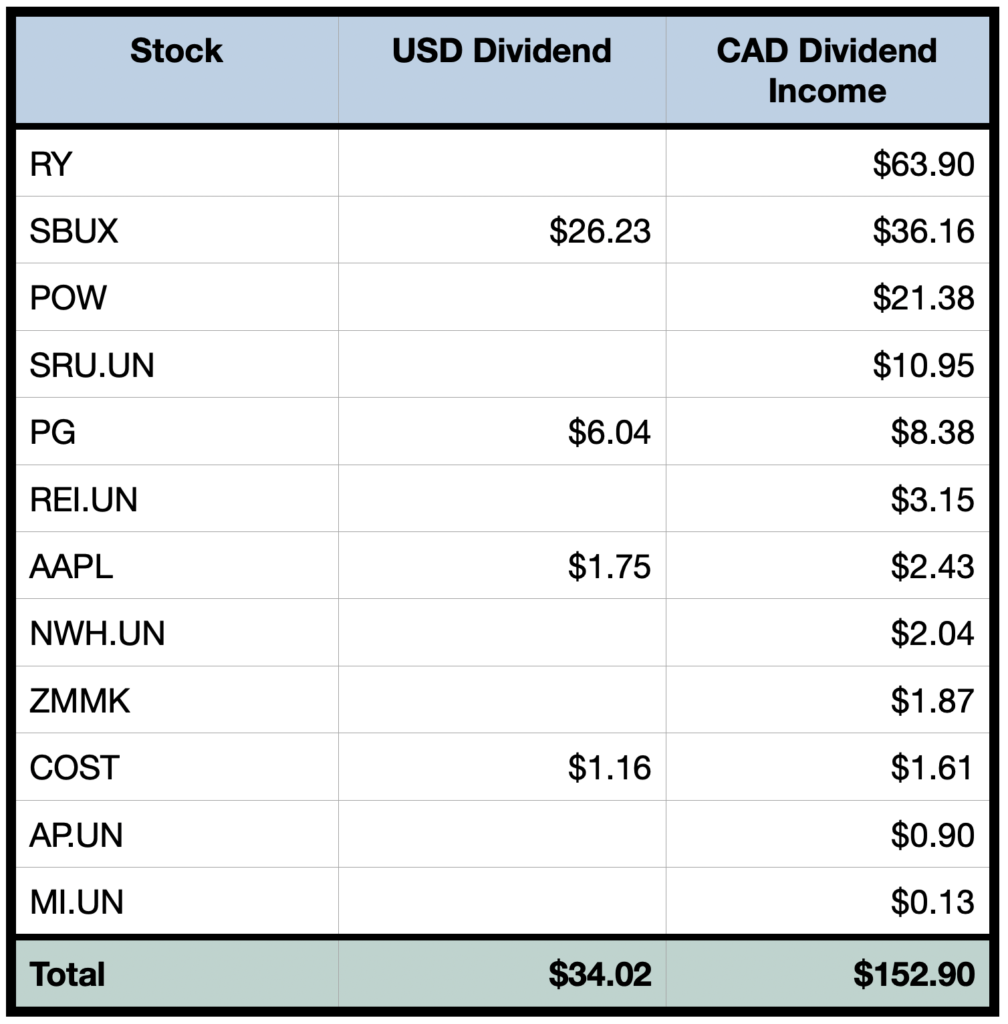

Total dividend income for November reached $152.90, representing a 25% year-over-year increase—a rise of $30.96 from the $121.94 received in November 2023.

It’s also noteworthy that year-over-year dividend income growth in November is rising, despite the larger portfolio size. YOY growth increased from 18% in 2023 to an impressive 25% in 2024. This acceleration in dividend income is a very positive sign for my investment strategy.

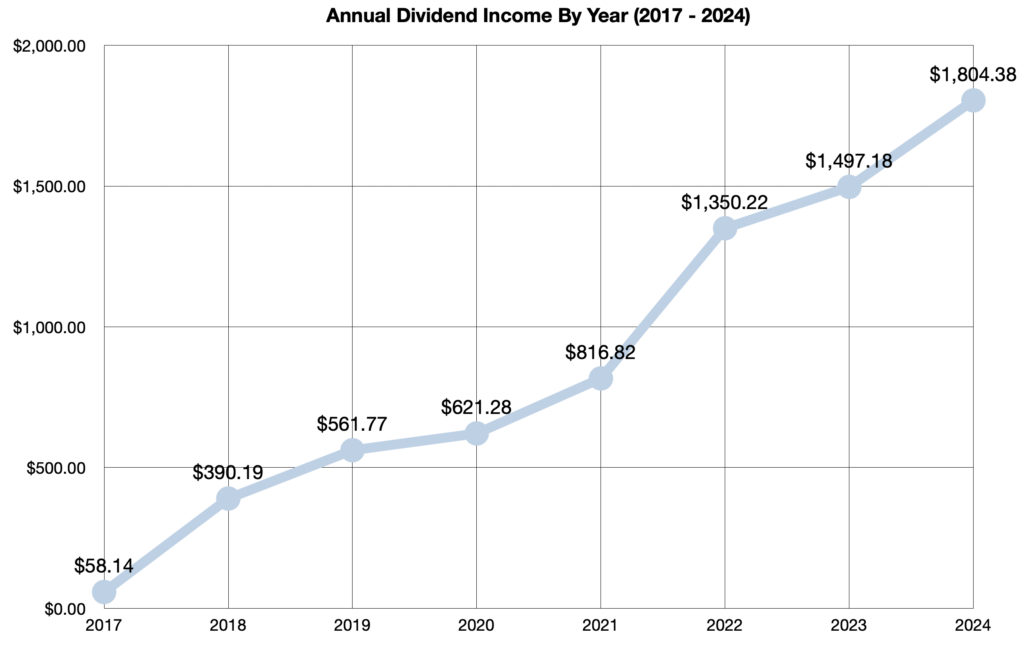

Year-to-date dividend income reached $1,804.38, which already surpassed the total from 2023 last month. With one month remaining to earn more, total dividend income for 2024 is up by 21%, or $307.20, compared to the entire dividend income for 2023.

The numbers compared to this time last year are even more impressive. Dividend income for the first eleven months of 2024 has surged by a remarkable 35%, or $471.59 more than in the same period of 2023.

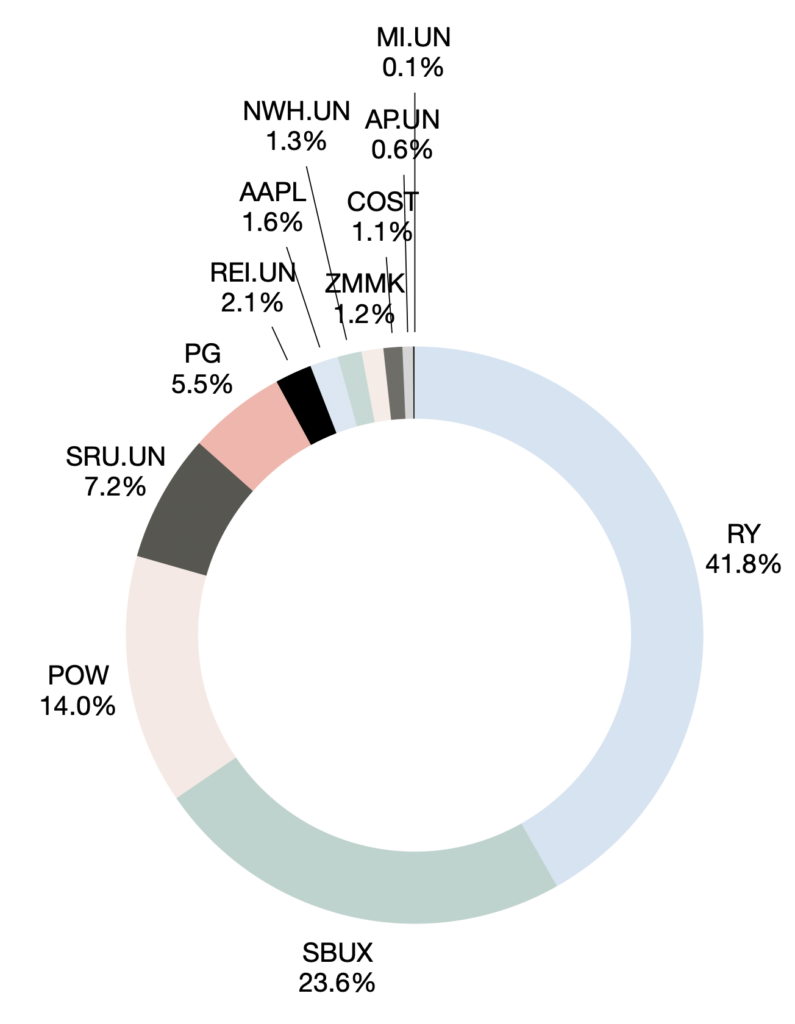

Quarter-over-quarter (QOQ) dividend income increased by 4% or $5.55 compared to August 2024. This increase can be attributed mainly to a dividend raise from $SBUX and a few new small REIT positions in $AP.UN and $MI.UN.

After factoring in November’s dividend income, all-time dividend income since June 2017 crossed the $7,000 mark, as it currently sits at $7,099.88. Hopefully all-time dividend income can surpass 5 figures in 2025.

Operational Highlights — November 2024

Reminder: I am not a licensed investment advisor, and the content of this post does not constitute professional investment advice. The information provided reflects my personal investment experiences and opinions, and should not be interpreted as a recommendation to buy or sell any stocks or other investments. Before making any investment decisions, please seek the advice of a qualified and licensed investment advisor. All opinions expressed are my own and are based on my personal perspective and experiences.

In November 2024, I received dividend payments from 12 holdings, down from 16 last year. Since last November, I sold $TSLY, $JEPQ, $BMO, $ZWC, and $SIS. Aside from adding to existing positions, I initiated new positions in two REITs: $AP.UN and $MI.UN. In short, I initiated positions to diversify my REIT holdings and in anticipation of further rate cuts.

See the spreadsheet below for a full breakdown of which stocks paid dividends in November 2024:

Outlook/Guidance

I expect full-year dividend income to be in the range of $2000, unchanged from my 2024 financial goals.

Reaching $2000 would represent a 34% year-over-year dividend growth rate compared to the $1497.18 received in 2023.

Fortunately, this month’s solid performance keeps my $2,000 dividend income goal within reach. With $1,804.38 received so far, I’m already $307.20—or 21%—ahead of last year’s total.

However, I’ll need to earn at least $195.62 in December 2024 to realize my target dividend income. As I mentioned last month, it’s going to be a close call.

Realistically, there are only two stocks that I can add to that still have an ex-dividend date in December: $CNR and $GOOGL. I will probably add to $CNR and I am possibly considering selling another big position that is overvalued to acquire more $GOOGL.

Either way, I’m still confident I’ll achieve my $2,000 dividend income goal for 2024. As always, I’ll continue to leverage three key strategies: reinvesting dividends, benefiting from dividend raises, and investing new capital.

Final Thoughts — November 2024 Dividend Income

In summary, dividend income in November 2024 was $152.90, which represents a 25% year-over-year increase compared to November 2023.

Year-to-date dividend income is now $1804.38, which is up by an impressive 21% or $307.20 compared last year’s total dividend income.

Moreover, all-time dividend income since June 2017 reached $7099.88. The quest to surpass $10,000 in total dividend income has begun.

Stay tuned for more exciting dividend income updates in 2024 as the snowball grows!

Related Dividend Income Updates

All Dividend Income Updates Since 2017

Connect With Dividend Income Investor

Instagram: @dividendincomeinvestor_

Threads: @dividendincomeinvestor_

Pinterest: @dividendincomeinvestor

Facebook: @Reversethecrushblog

October 2024 Dividend Income Report: Dividend Income Investor Reports Record-Breaking Income And Achieves A New Milestone; $209.94 (44% YOY Increase)

October 2024 Dividend Income Report: Dividend Income Investor Reports Record-Breaking Income And Achieves A New Milestone; $209.94 (44% YOY Increase)