February 2025 Dividend Income Update — Documenting monthly dividend income and investment activity to chronicle the journey to financial independence.

I am not a licensed investment advisor, and the content of this post does not constitute professional investment advice. The information provided reflects my personal investment experiences and opinions, and should not be interpreted as a recommendation to buy or sell any stocks or other investments. Before making any investment decisions, please seek the advice of a qualified and licensed investment advisor. All opinions expressed are my own and are based on my personal perspective and experiences. This post may contain affiliate links to products/services I personally use and endorse.

Welcome to the February 2025 dividend income report for the Dividend Income Investor Blog.

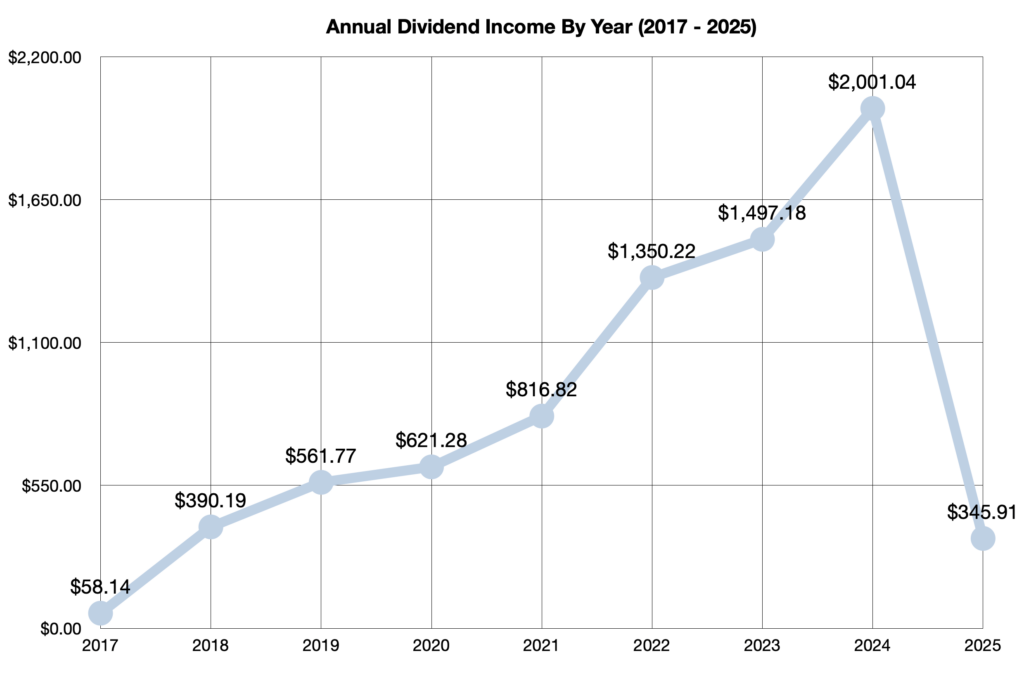

This month’s dividend income update reflects a shift from recent trends, resulting from ongoing portfolio optimization. For the first time in over four years, year-over-year dividend income growth has experienced a slight decrease. This is directly attributable to strategic sales of certain dividend-paying stocks in February. While this may appear as a deviation from previous performance, it is a necessary step to position the portfolio for greater long-term success. These changes are expected to ultimately lead to more robust returns.

Despite the lower year-over-year dividend growth, year-to-date dividend growth is still ahead compared to the first two months of 2024.

Now with that context provided, let’s turn our attention to the February 2025 dividend income figures.

February 2025 Dividend Income Numbers

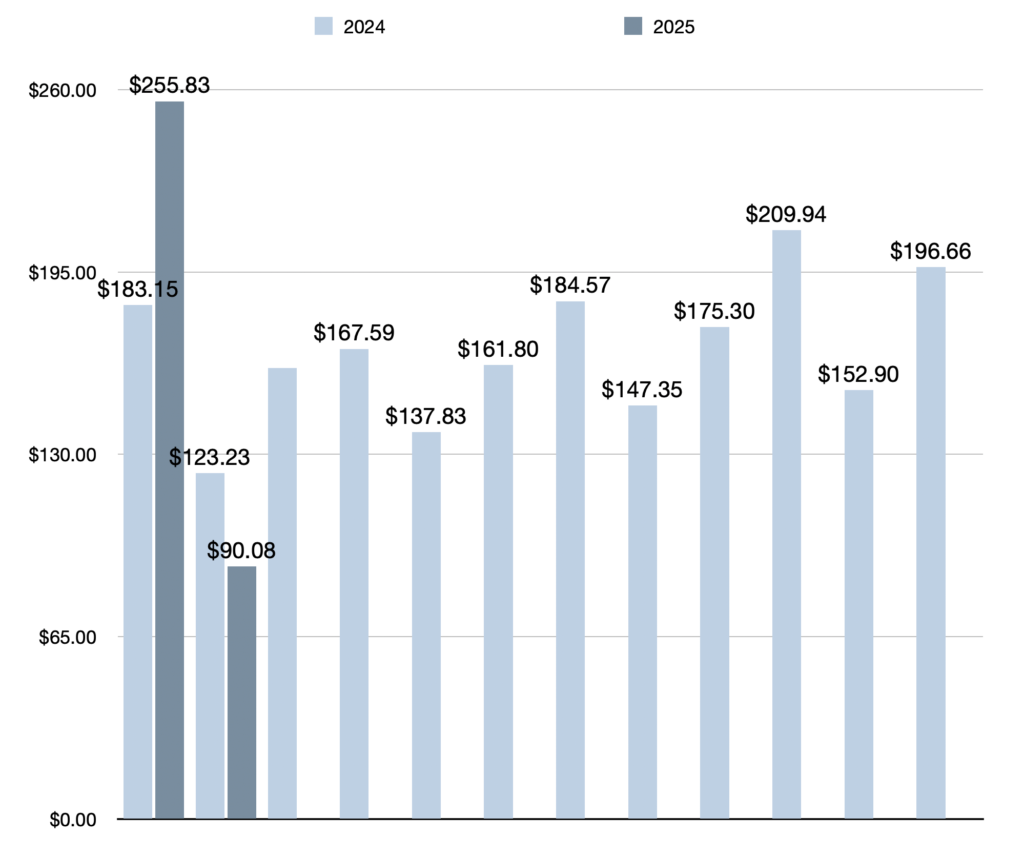

- Total dividend income earned in February 2025 was $90.08

- Year-over-year (YOY) dividend income declined by -27% or -$33.15 compared to February 2024

- YTD dividend income is $345.91 (Up by 13% or $39.53 compared to the first two months of 2024)

- Quarter-over-quarter (QOQ) dividend income declined by –41% or -$62.82 compared to November 2024

- All-time dividend income since June 2017 reached $7,642.45

- 3 dividend raises announced by: $META, $PRL, $REI.UN

Comments & Analysis

In February 2025, dividend income totaled $90.08, a 27% year-over-year decrease compared to February 2024. This represents the lowest monthly dividend income since February 2023.

This decline is directly attributable to strategic portfolio adjustments, specifically the sale of Starbucks (SBUX) and Procter & Gamble (PG) shares, with the capital reallocated to Alphabet (GOOGL) and Uber (UBER).

Despite the year-over-year decrease, year-to-date dividend income remains 13% ($39.53) ahead of the same period in 2024.

This month’s report focuses on key figures and analysis to streamline content delivery. Future updates will continue to emphasize core data points.

We anticipate higher dividend growth in the months ahead and look forward to sharing further updates throughout 2025.

January 2025 Dividend Update: $255.83 Earned & 40% Year-Over-Year Growth (New Monthly Record)

January 2025 Dividend Update: $255.83 Earned & 40% Year-Over-Year Growth (New Monthly Record)