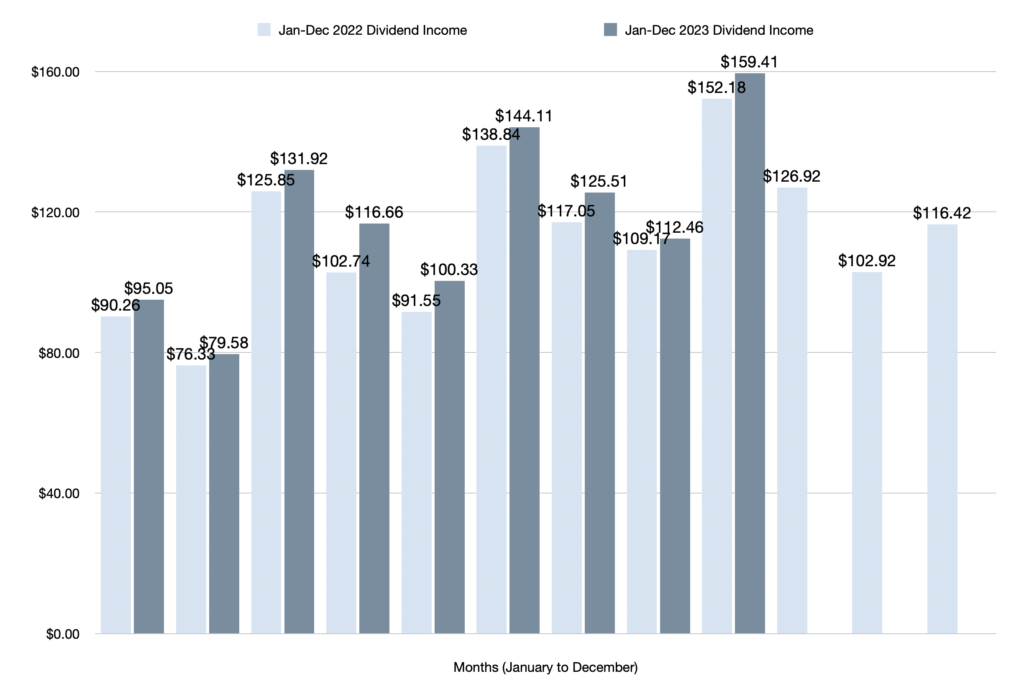

Dividend income September 2023 — Documenting monthly dividend income to chronicle the journey to financial independence. I am not a licensed investment advisor and this post is not investment advice. All opinions are my own.

Hey dividend income investors.

Another month has passed, so it’s time to document my dividend income numbers and reflect on year-to-date performance.

Fortunately, I get to share that September was an exceptionally strong month for dividend income. In fact, I reached a new all-time record for dividends received within one month.

Of course, there are plenty more highlights to cover.

But before I share how much dividend income I earned in September 2023 and compare the results to last September’s performance, I want to share why I discuss my dividend income publicly.

Why Share My Dividend Income?

I share my dividend income for several clear reasons:

Documentation: The primary purpose is to document my financial journey. It serves as a detailed record of my progress and milestones in building a dividend income portfolio.

Enjoyment: I genuinely enjoy the act of documenting and blogging about my dividend income. It’s a favourite pastime, combining my passion for finance and blogging.

Reflection: The documentation enables me to reflect on my portfolio’s performance over different timeframes. It offers insights into my investment decisions, helping me refine my strategies.

Financial Independence: My ultimate goal is to achieve financial independence through dividend income. By sharing this journey, the blog also represents my future aspirations, such as dedicating more time to personal finance, investing, trading, and full-time blogging once financial independence is attained.

In summary, sharing my dividend income is a means of tracking progress, enjoying a beloved hobby, facilitating reflection, and aligning with my long-term goal of financial independence.

Again, I want to mention that I am not a licensed investment advisor and this post is not investment advice. All opinions are my own.

Now let’s dive into the numbers.

Dividend Income September 2023 Highlights

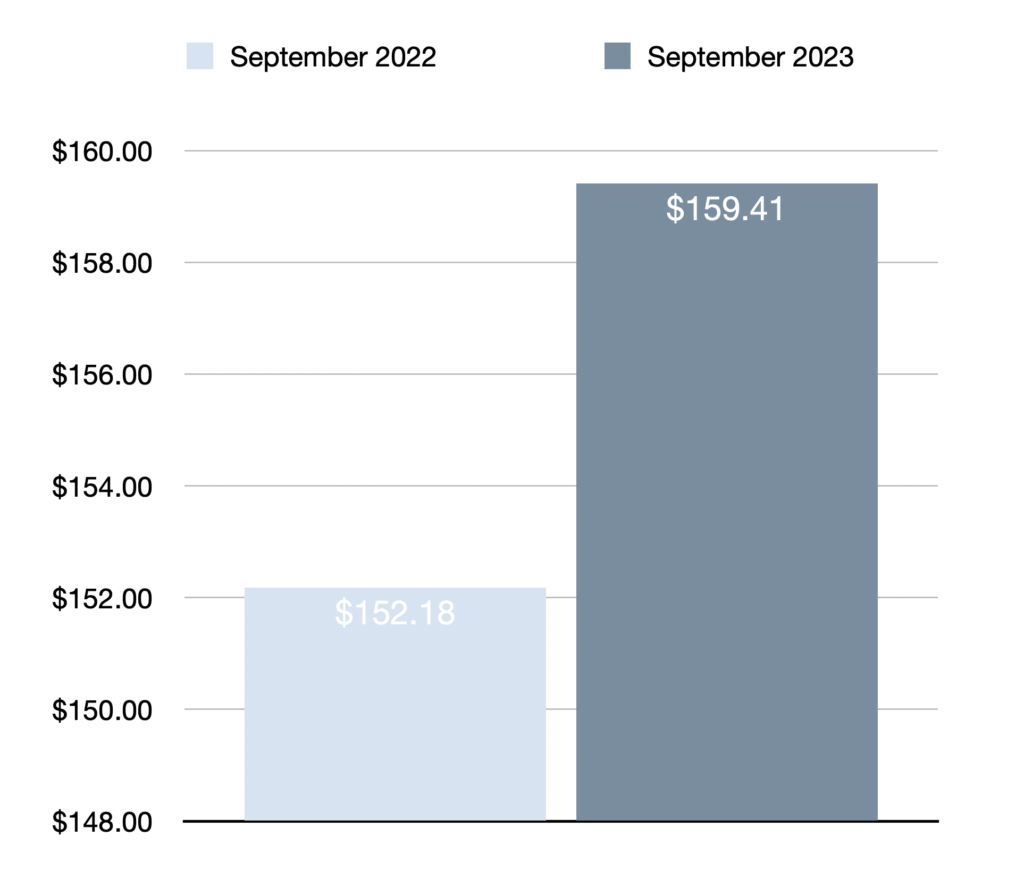

- Total dividend income earned in September 2023 was $159.41 CAD (a new record)

- Year-over-year (YOY) dividend income increased by 5% or $7.23 compared to September 2022

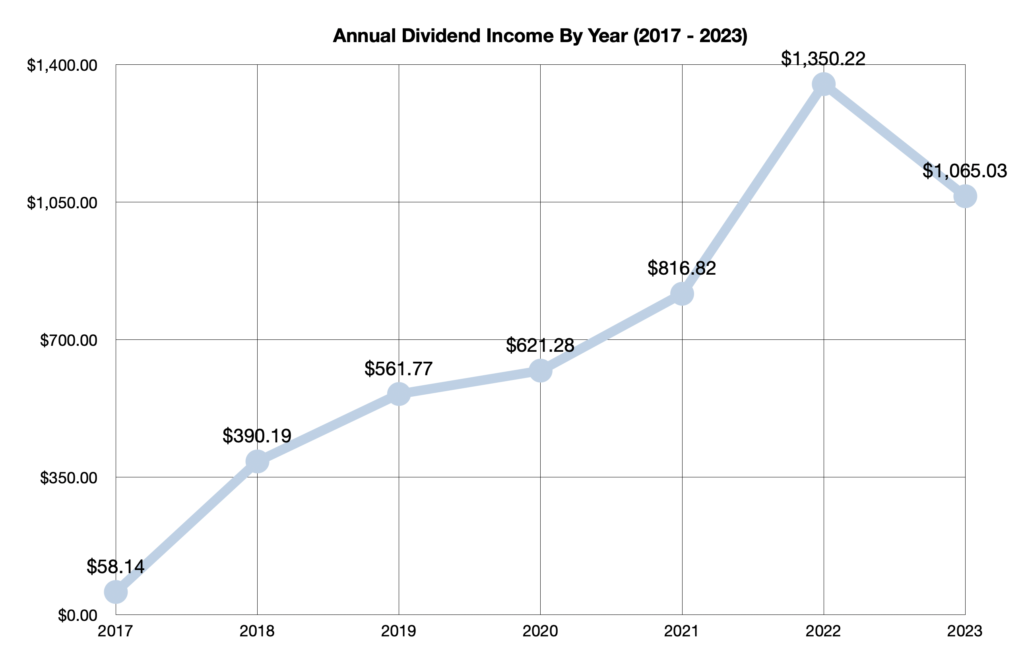

- Year-to-date dividend income is $1065.03 (January to September 2023)

- 2nd year in a row reaching at least $1000 in dividends

- Quarter-over-quarter (QOQ) dividend income increased by 11% or $15.30 compared to June 2023

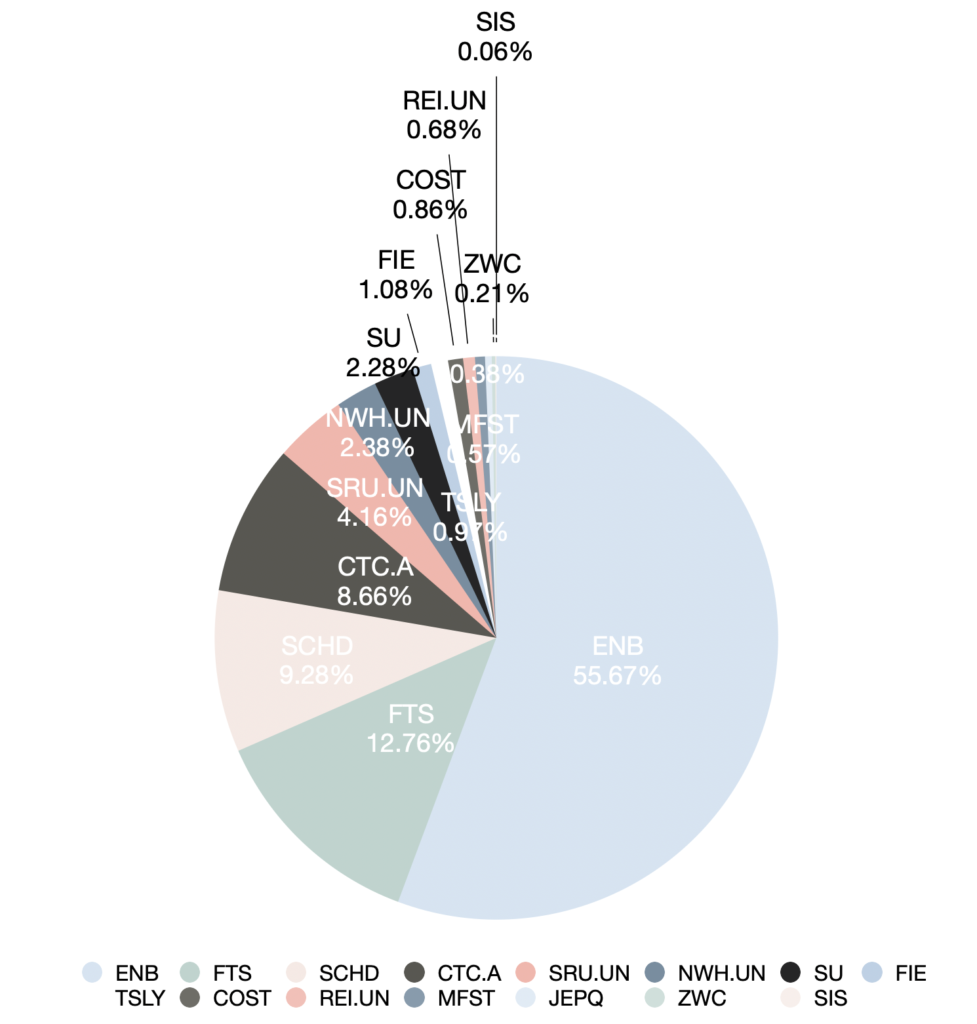

- 15 stocks/ETFs/REITs paid dividends in September 2023 (Up 3 since last year)

- All-time dividend income since June 2017 is up to $4863.35

- Average monthly dividend income in 2023 is $118.34

- Dividend income per day in September 2023 was $5.31

Dividend Income September 2023 Earnings — $159.41

My investment portfolio generated $159.41 in dividend income between September 1, 2023 to September 30, 2023. This is a new record for one month! The previous record was $152.18 in September 2022.

Of course, the 5% year-over-year growth rate compared to September 2022 was not as memorable.

But the stronger year-over-year growth I have been anticipating is about to show up in the final three months of the year. Stay tuned for higher dividend growth in the next three reports.

Furthermore, quarter-over-quarter growth remained strong; coming in at 11% compared to June 2023.

Otherwise, year-to-date dividend income reached $1065.03, which means it’s my second year in a row of earning at least $1000 in dividends. Furthermore, this is ahead of January to September 2022 by 6% or $61.06.

After factoring in September 2023, my all-time dividend income reached $4863.35 since June 2017. I’m literally a month away from $5000 all-time in dividends received.

Stocks/REITs/ETFs That Paid Dividends In September 2023

Reminder: I am not a licensed investment advisor and this post is not investment advice. You should always seek professional investment advice from a licensed investment advisor before investing. I am only sharing what I am doing with investing. None of the stocks mentioned are recommendations to purchase investments. All opinions are my own.

Fifteen positions paid dividend income in September 2023.

This month I decided to share the exact amounts in addition to the percentage breakdown. I have been hesitant to share the numbers because some of the positions are still small. This portfolio is far from complete. But I like the chart I created a lot and want to document the building process so I decided to share the numbers in spite of my hesitations.

Below is a breakdown from highest to lowest dividend payment (USD has been converted to CAD for reporting purposes):

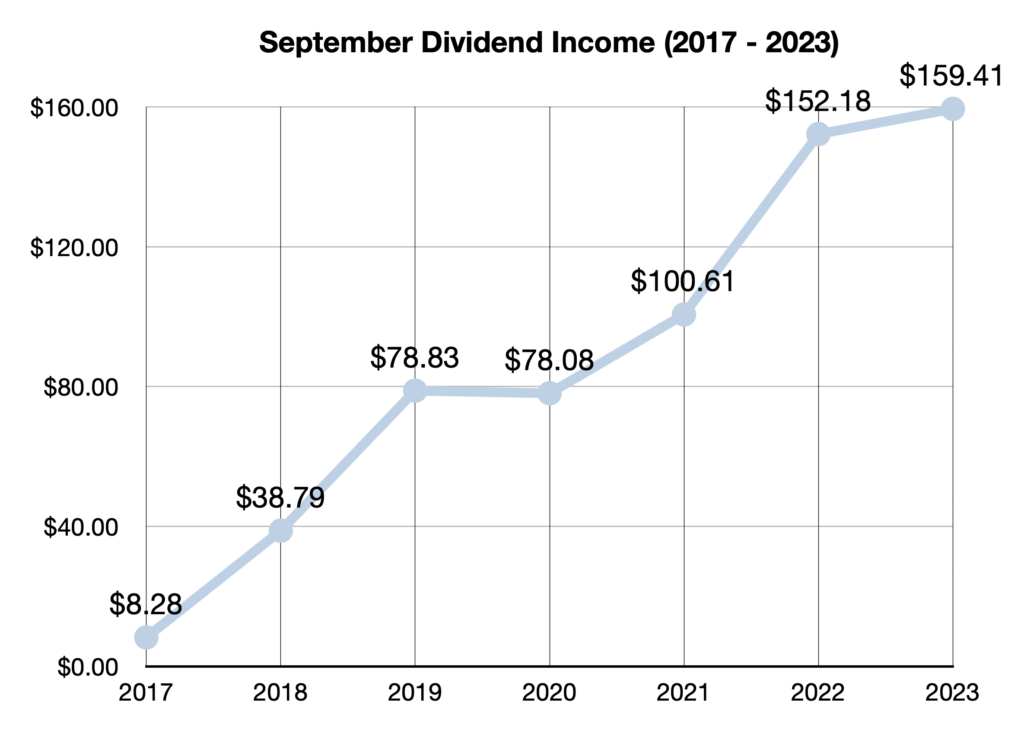

September Dividend Growth Since 2017

September has seen steady dividend income growth since 2017.

Dividend income has increased from a mere $8.28 in September 2017 to $159.41 in August 2023.

When I began my investing journey, there were months where I could only set aside $100. Today, my investment portfolio generates $159.41 per month.

Simply put, my dividend income compounding machine is growing.

Here is a breakdown of each report from September 2017 to September 2023:

$8.28 — September 2017 Dividend Income

$38.79 — September 2018 Dividend Income

$78.83 — September 2019 Dividend Income

$78.08 — September 2020 Dividend Income

$100.61 — September 2021 Dividend Income

$152.18 — September 2022 Dividend Income

$159.41 — September 2023 Dividend Income

Looking Ahead — $334.97 To Reach 2023 Target

I set a modest financial goal to earn at least $1400 in dividend income in 2023. I consider it modest because it’s only 3.7% higher than the $1350.22 in dividends received in 2022.

Now with only three months remaining to collect dividends, I must earn at least $334.97 to achieve my 2023 target dividend income.

Broken down monthly, I must earn $111.66 per month to reach my goal.

Based on my PADI (projected annual dividend income), achieving $1400 won’t be a problem. In fact, I expect to easily exceed it. The target should’ve been $1500.

Either way, I am looking forward to seeing how the year closes out. The stronger year-over-over growth I have been anticipating will finally begin to show up in the next three dividend income updates.

Final Thoughts

In summary, my investment portfolio generated a new record-setting $159.41 in dividend income in September 2023. This represents a 5% year-over-year increase compared to September 2022.

After factoring in September’s dividend income, year-to-date dividend income reached $1065.03, which is also ahead of last year by 6%. It’s the second year in a row of earning at least $1000 worth of dividends.

Moreover, my all-time dividend income continues to move closer to the $5000 mark. All-time dividend income reached $4863.35, including September’s dividend earnings.

To close, it was an exceptional month for dividend income, despite the stock market being down significantly. I hit a new all-time high and have now earned $1000 in dividends for two years in a row. I’m looking forward to closing out the year strong and achieving a few more milestones along the way.

Stay tuned for more exciting dividend income updates as the snowball grows!

Related Dividend Income Updates

Dividend Income September 2022

Connect With Dividend Income Investor

Instagram: @dividendincomeinvestor_

Threads: @dividendincomeinvestor_

Pinterest: @dividendincomeinvestor

Facebook: @Reversethecrushblog

Dividend Income August 2023 — $112.46

Dividend Income August 2023 — $112.46