Dividend income October 2023 — Documenting monthly dividend income to chronicle the journey to financial independence. I am not a licensed investment advisor and this post is not investment advice. All opinions are my own.

Hey dividend income investors.

Another month has passed, so it’s time to document my dividend income numbers and reflect on my year-to-date performance.

Exciting news: The long-awaited acceleration of dividend growth, that I have been predicting, has finally materialized!

After a modest start to the year for dividend growth, I am thrilled to announce that October 2023 produced the highest year-over-year dividend growth rate so far in 2023. Surely this is a sign that accelerated dividend growth is on the horizon.

Also worth noting, it was the third-highest month ever for dividend income and a new milestone was reached.

Of course, there are plenty of highlights to cover. First, let’s dive into the monthly highlights. Then I’ll take a closer look at October’s dividend earnings and which stocks paid dividends.

Dividend Income October 2023 Highlights

- $145.82 — Total dividend income earned in October 2023 was $145.82 (3rd highest month ever)

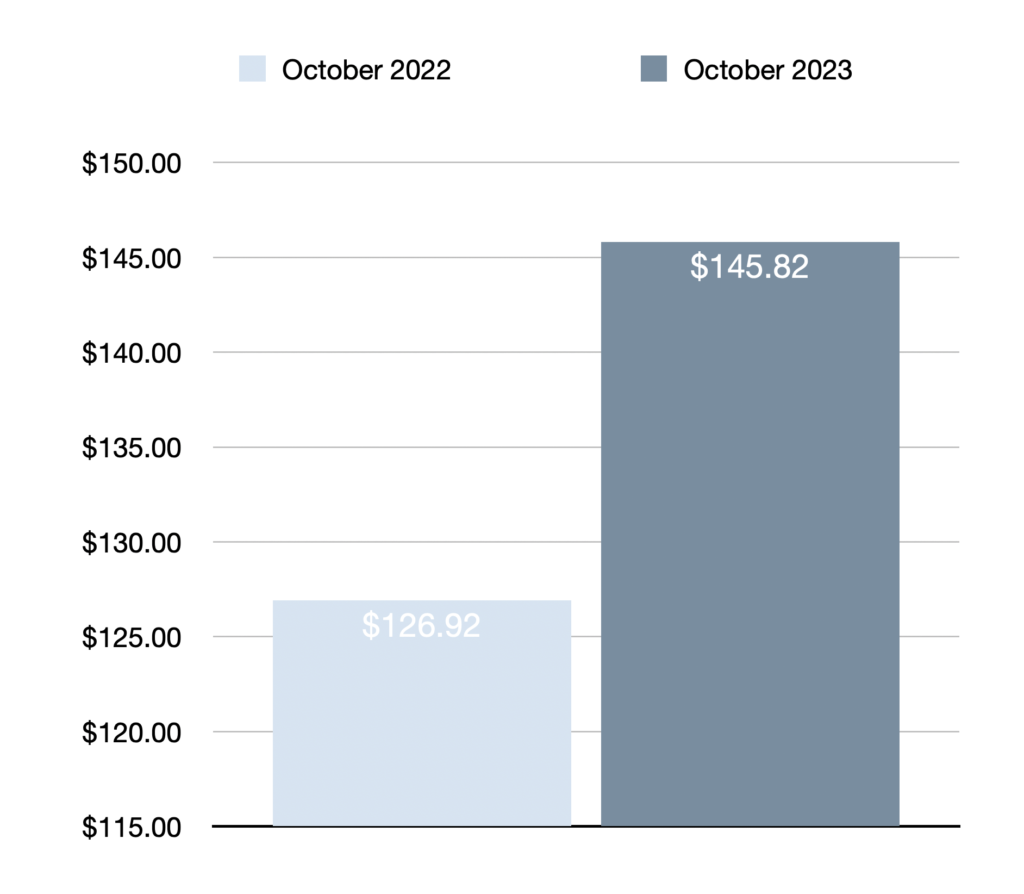

- 15% | $18.90 — Year-over-year (YOY) dividend income increased by 15% or $18.90 compared to October 2022 (Highest YOY growth rate this year)

- $1210.85 — Year-to-date (YTD) dividend income is $1210.85

- $5009.17 — Crossed $5000 in all-time dividend income. All-time dividend income since June 2017 is up to $5009.17

- 16% | $20.31 — Quarter-over-quarter (QOQ) dividend income increased by 16% or $20.31 compared to July 2023

- 16 — 16 stocks/ETFs/REITs paid dividend in October 2023

- $121.09 — Average monthly dividend income in 2023 is 121.09

- $4.70 — Dividend income per day in October 2023 was $4.70

Dividend Income October 2023 Earnings — $145.82

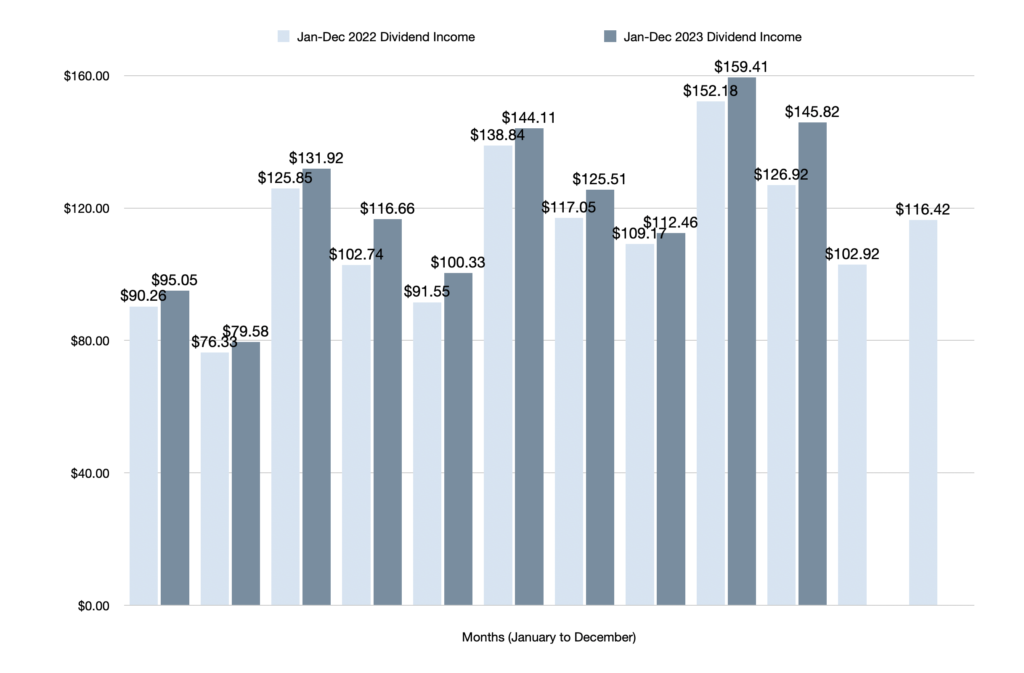

My investment portfolio generated $145.82 in dividend income between October 1, 2023 to October 31, 2023. This represents a 15% year-over-year growth rate compared to October 2022. It’s the highest year-over-growth rate achieved this year. At last, the accelerated dividend growth I have been anticipating has finally arrived.

Furthermore, this is the 3rd highest month ever for dividend earnings. September 2023 currently holds the record at $159.41 earned within a one month time span.

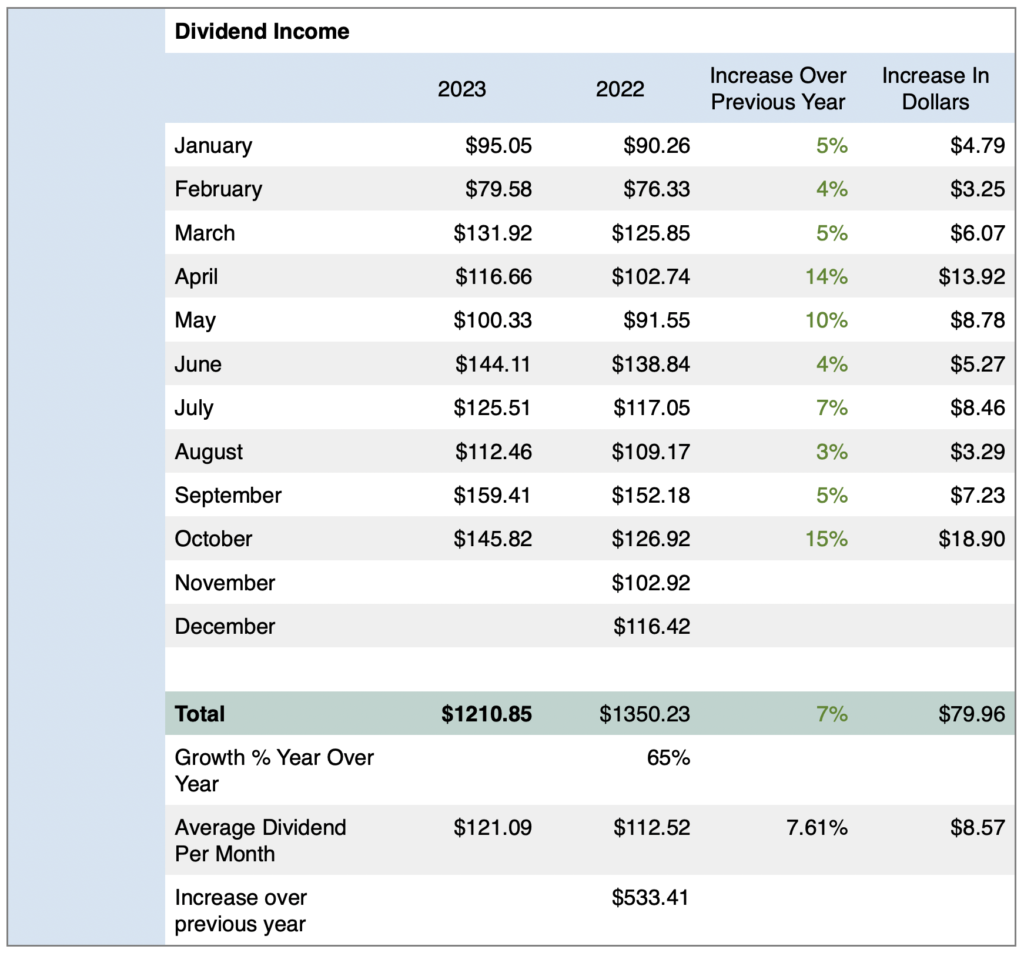

After factoring in October’s income, year-to-date dividend income reached $1210.85. This is ahead of January to October 2022 by 7% or $79.96. I’m only $139.38 away from surpassing last year’s total dividend income.

Also worth mentioning, I reached a fairly significant milestone in October 2023. My all-time dividend income surpassed $5000 since June 2017. I have officially earned $5009.17 in dividends since I started this journey.

Otherwise, I always like to compare quarter-over-quarter growth as a way to monitor the pace of dividend income growth. Compared to July 2023, dividend income increased by 16% or $20.31, which is even outpacing YOY growth. Clearly, income growth is beginning to accelerate.

Stocks/REITs/ETFs That Paid Dividends In October 2023

Reminder: I am not a licensed investment advisor and this post is not investment advice. You should always seek professional investment advice from a licensed investment advisor before investing. I am only sharing what I am doing with investing. None of the stocks mentioned are recommendations to purchase investments. All opinions are my own.

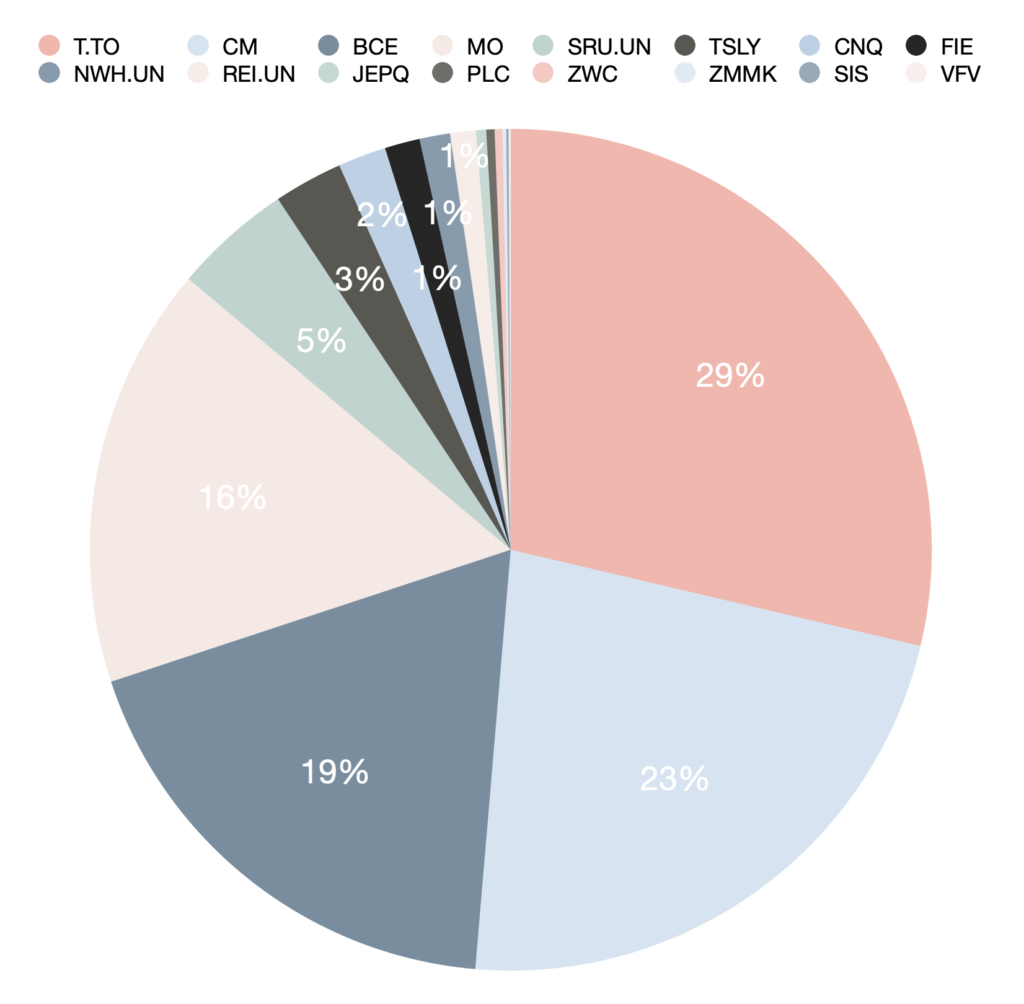

Sixteen positions paid dividend income in October 2023. This is up by two since October 2022.

The bulk of this month’s dividend income was from the four largest positions — T.TO, CM, BCE, and MO. Combined, they accounted for 87% of this month’s dividend earnings.

Below is a breakdown from highest to lowest dividend payment (USD has been converted to CAD for reporting purposes):

October Dividend Growth Since 2017

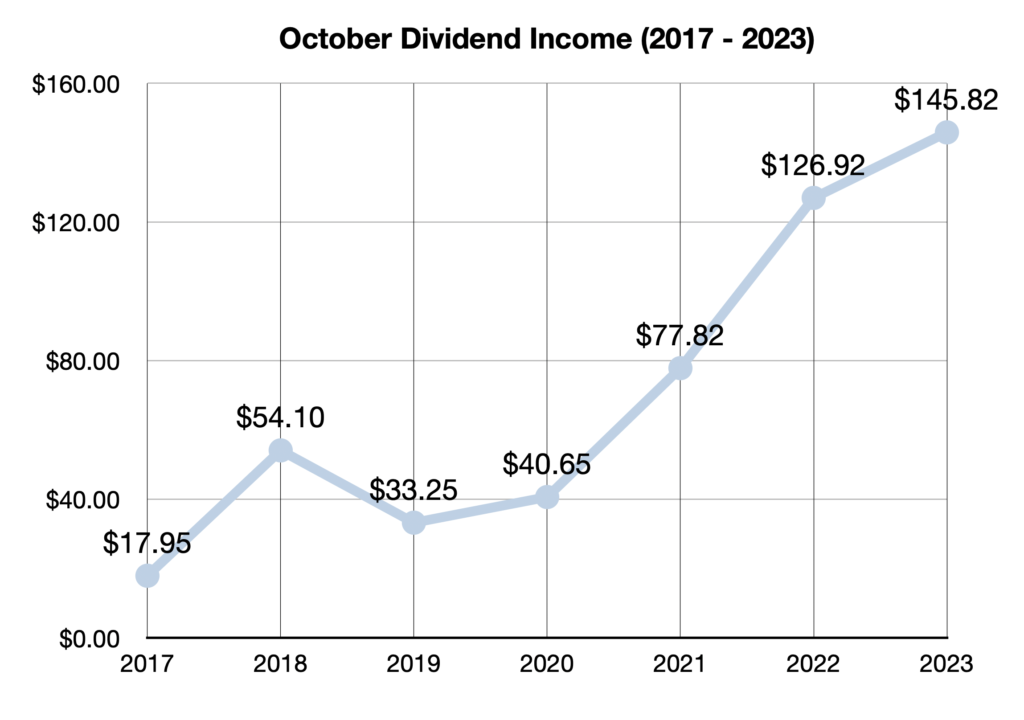

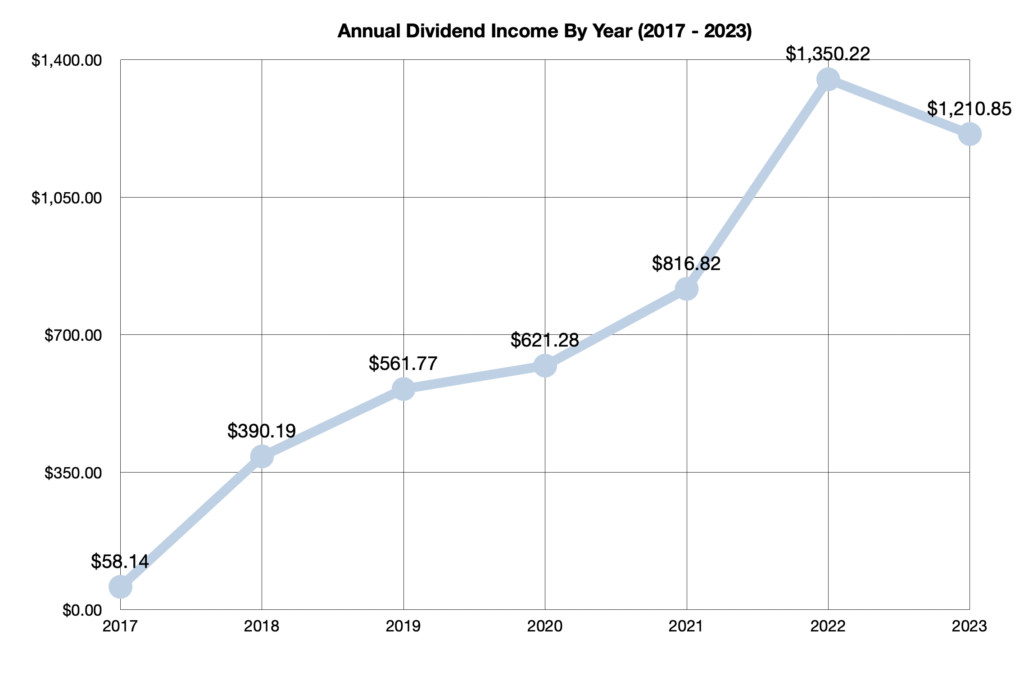

October has seen mostly steady dividend income growth since 2017.

Overall, dividend income has increased from $17.95 in October 2017 to $145.82 in October 2023.

Obviously, this is not enough to be financially independent yet, but $145.82 is enough to make a difference. It means I have cash to invest every month even if I don’t save money now.

Here is a breakdown of each report from September 2017 to September 2023:

$17.95 — October 2017 Dividend Income

$54.10 — October 2018 Dividend Income

$33.25 — October 2019 Dividend Income

$40.65 — October 2020 Dividend Income

$77.82 — October 2021 Dividend Income

$126.92 — October 2022 Dividend Income

$145.82 — October 2023 Dividend Income

Looking Ahead — $189.15 To Reach 2023 Target

I set a modest financial goal to earn at least $1400 in dividends in 2023.

Now with only two months remaining to collect dividends, I only need to earn at least $189.15 more to achieve my 2023 target dividend income.

Broken down monthly, I must earn $94.58 per month to reach my goal.

Considering that the average monthly dividend income in 2023 has been $121.09, I expect to easily surpass my target.

Furthermore, the pace of dividend growth is finally beginning to speed up.

After a year of slower growth, due to the bulk of last year’s savings being put towards a downpayment, this year’s savings have finally put my PADI (projected annual dividend income) back on track.

I am anticipating that November’s dividend income growth rate will be up slightly, compared to this month. However, December’s growth rate will be up significantly and that growth is expected to carry over into the new year.

Final Thoughts

My investment portfolio generated $145.82 in dividend income in October 2023. This represents a 15% year-over-year growth rate compared to October 2022. Furthermore, it’s the highest YOY growth rate so far this year. Also worth noting, it was the 3rd highest month ever for dividend income received since I began this journey in 2017.

After factoring in October dividend income, year-to-date dividend income reached $1210.85, which is ahead of January to October 2022 by 7% or $79.96.

Moreover, a significant milestone was achieved in October 2023 — I surpassed $5000 in dividends received. All-time dividend income reached $5009.17, including October’s earnings.

Most importantly, I was glad to see the pace of dividend income growth trending in the right direction.

Stay tuned for more exciting dividend income updates as the snowball grows!

Related Dividend Income Updates

Connect With Dividend Income Investor

Instagram: @dividendincomeinvestor_

Threads: @dividendincomeinvestor_

Pinterest: @dividendincomeinvestor

Facebook: @Reversethecrushblog

Dividend Income September 2023 — $159.41

Dividend Income September 2023 — $159.41