Dividend income November 2023 — Documenting monthly dividend income to chronicle the journey to financial independence. I am not a licensed investment advisor and this post is not investment advice. All opinions are my own.

Hey dividend investors.

Another month has passed, so it’s time to document my dividend income numbers and reflect on year-to-date performance.

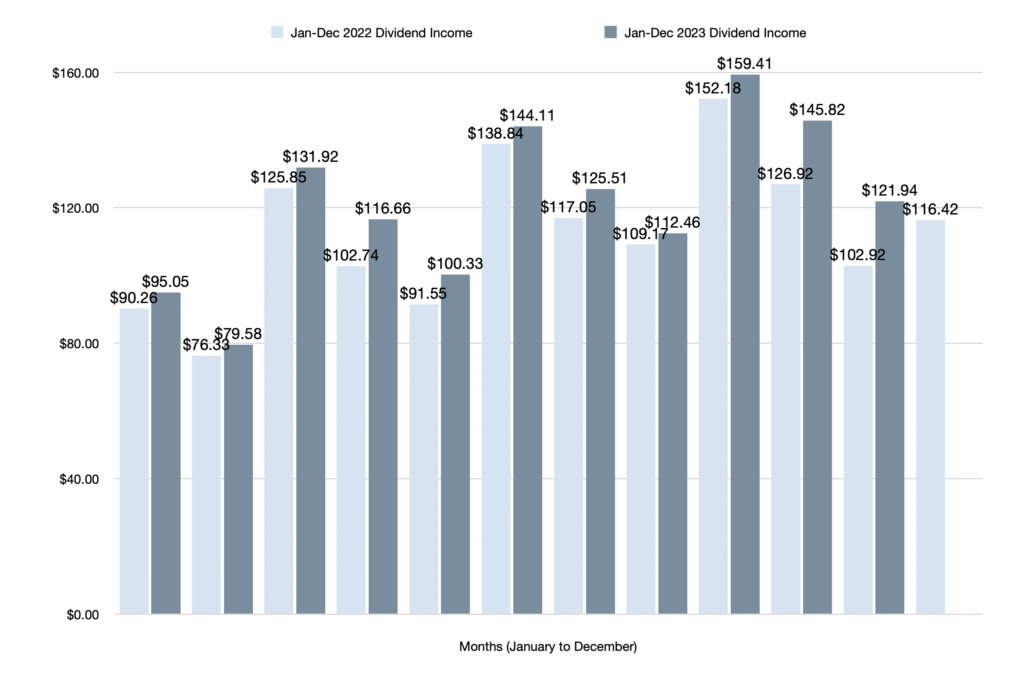

After posting the highest year-over-year (YOY) growth rate of 2023 just last month, I am thrilled to announce that November’s YOY growth rate was even higher.

It’s clear now that dividend income growth is accelerating after back-to-back months of higher year-over-year numbers.

Let’s take a closer look at this month’s numbers.

Dividend Income November 2023 Highlights

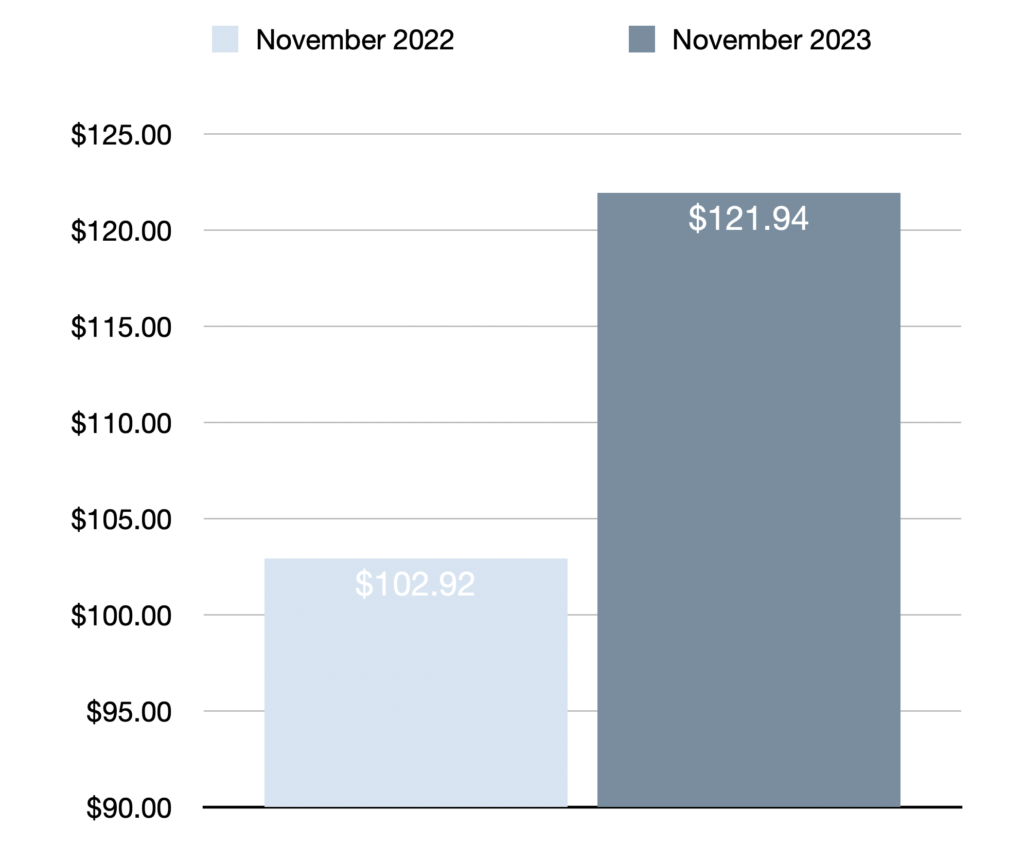

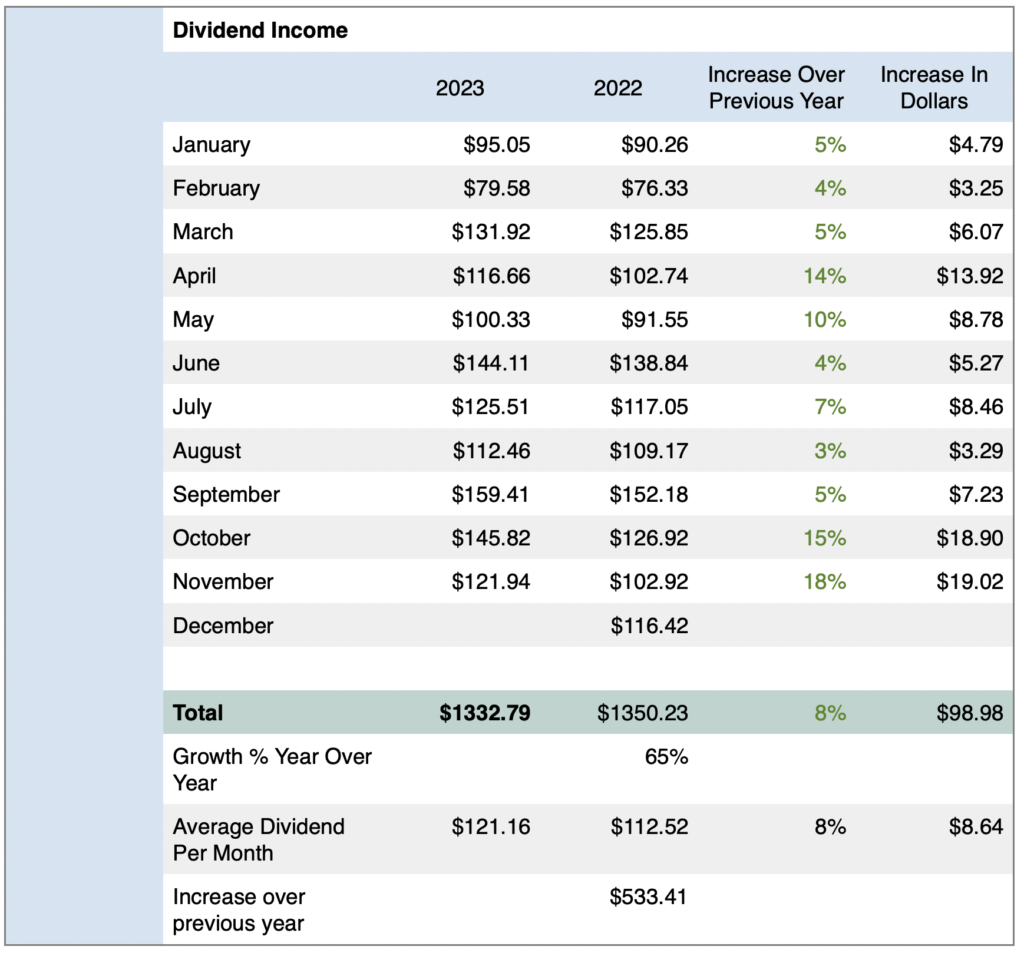

- $121.94 — Total dividend income earned in November 2023 was $121.94

- 18% | $19.02 — Year-over-year (YOY) dividend income increased by 18% or $19.02 compared to November 2022 (Highest YOY dividend growth rate this year)

- $1332.79 — Year-to-date (YTD) dividend income is $1332.79

- $5131.11 — All-time dividend income since June 2017 is $5131.11

- 8.4% | $9.48 — Quarter-over-quarter (QOQ) dividend growth increased by 8.4% or $9.48 compared to August 2023

- 16 — 16 stocks/ETFs/REITs paid dividends in November 2023 (Up 9 since November 2022)

- $121.16 — Average monthly dividend income in 2023 is $121.16

- $4.06 — Dividend income per day in November 2023

Dividend Income November 2023 Earnings — $121.94

My investment portfolio generated $121.94 in dividend income between November 1, 2023 to November 30, 2023. This represents an 18% year-over-year growth rate compared to November 2022. It’s the highest year-over-year growth rate achieved this year.

After factoring in November’s income, year-to-date dividend income reached $1332.79. This is ahead of January to November 2022 by 8% or $98.98. I’m only $17.44 away from surpassing last year’s total dividend income now.

Of course, I would’ve liked to surpass the previous year’s income total a few months earlier.

But after a slower start to the year, following the purchase of my first property, at least dividend income growth is officially accelerating. Furthermore, I’m expecting the trend of higher dividend growth to continue next month and into the new year.

Otherwise, quarter-over-quarter (QOQ) dividend income increased by 8.4% or $9.48 compared to August 2023. QOQ is another metric I like to track to predict future dividend growth.

Also worth mentioning is that my all-time dividend income since June 2017 reached $5131.11. This means over $5000 of my portfolio was built from dividend income. Every single dollar of dividends has been reinvested back into the portfolio.

Stocks/ETFs/REITs That Paid Dividends In November 2023

Reminder: I am not a licensed investment advisor and this post is not investment advice. You should always seek professional investment advice from a licensed investment advisor before investing. I am only sharing what I am doing with investing. None of the stocks mentioned are recommendations to purchase investments. All opinions are my own.

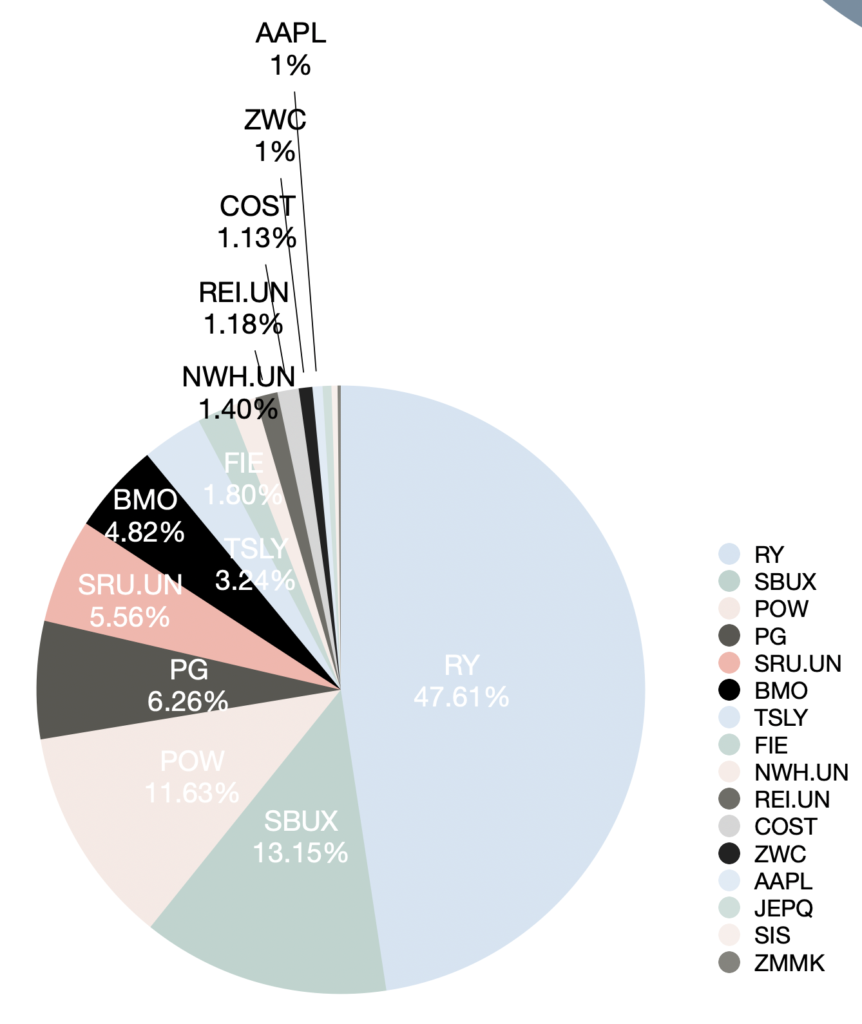

Sixteen positions paid dividends in November 2023. This is up by a surprisingly high 9 positions since last November.

As usual, the bulk of this month’s income was from Royal Bank (RY), as it accounted for over 47%. Although my portfolio is intentionally top heavy, this percentage is still higher than I would like it to be. Hence why I am glad to see it was down from 52% last November.

Otherwise, Starbucks (SBUX) was my second highest dividend payer. It contributed just over 13% of November’s dividends. Meanwhile, Power Corp (POW) accounted for over 11% and Proctor & Gamble chipped in over 6% of this month’s dividends.

The rest of the smaller positions contributed between 1% to 5%.

Heading into 2024, I may look at reducing the number of positions, as it is getting more challenging to manage. If I can take profits on some of the smaller positions I have less conviction in and double down on higher conviction names, I will likely take advantage of the opportunity.

Below is a breakdown from highest to lowest dividend payment (USD has been converted to CAD for reporting purposes):

November Dividend Growth Since 2017

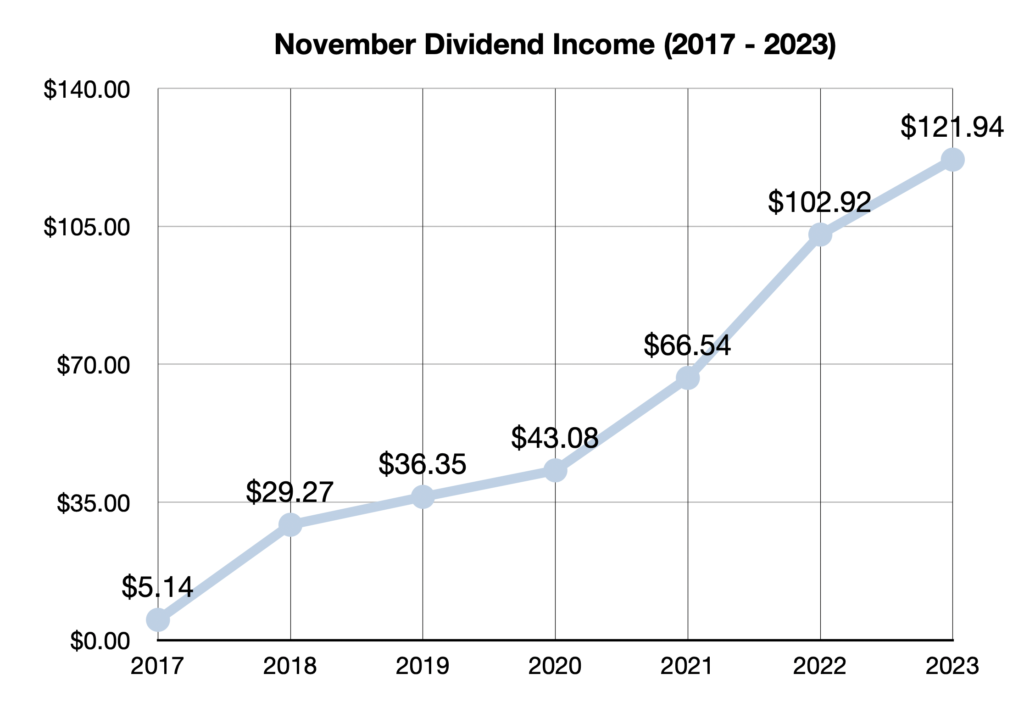

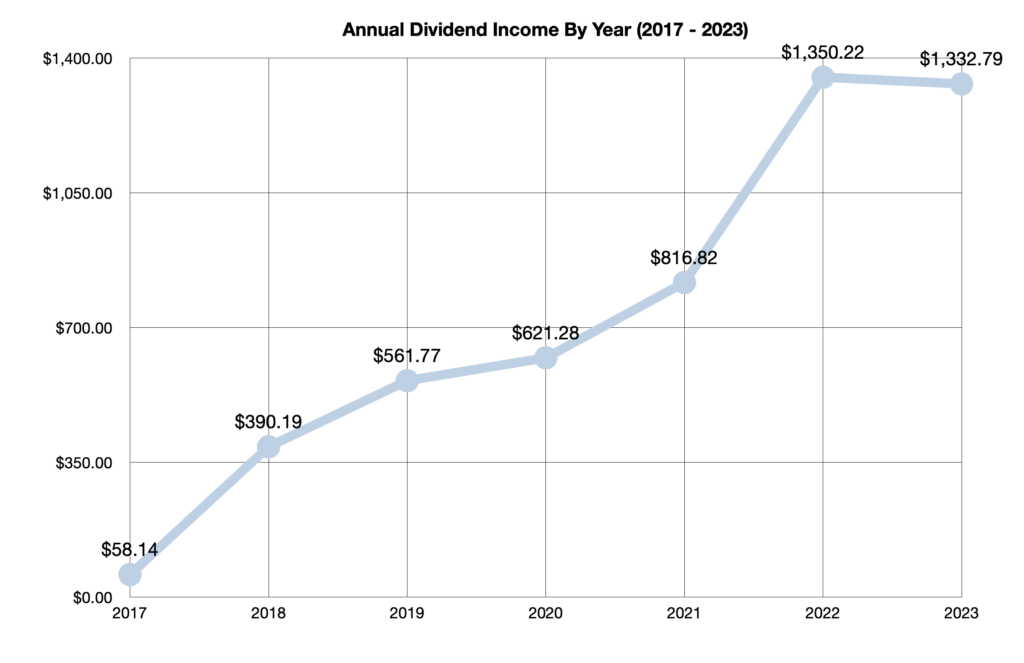

November has seen steady dividend income growth since 2017.

Overall, dividend income has increased from $5.14 in November 2017 to $121.94 in November 2023.

Here is a breakdown of each report from November 2017 to November 2023:

$5.14 — November 2017 Dividend Income

$29.27 — November 2018 Dividend Income

$36.35 — November 2019 Dividend Income

$43.08 — November 2020 Dividend Income

$66.54 — November 2021 Dividend Income

$102.92 — November 2022 Dividend Income

$121.94 — November 2023 Dividend Income

Countdown To FI

I decided to include a new segment in this month’s dividend income update that focuses on the countdown to financial independence.

After all, the main purpose of these reports is to document the journey to financial independence.

But I should also clarify that I no longer want to become financially independence to escape work. I’ve actually realized I like to work. I just want to reach FI because I want independence and autonomy.

“Like Warren, I had a considerable passion to get rich, not because I wanted Ferraris—I wanted the independence. I desperately wanted it.” — Charlie Munger (R.I.P. to the late, great investing legend, Charlie Munger)

Of course, I still have a long way to go until I reach financial independence. Obviously $121.94 is not enough to retire with yet. However, I’m earning enough dividend income now to feel its impact on my life.

For example, November’s dividend income is enough monthly to pay for my cell phone bill ($60), my portion of home insurance ($15.04), my portion of internet ($31.08), and my Apple iCloud subscription ($4.51), with some spending money leftover.

At this point, though, I don’t use dividend income to pay bills — I reinvest it into more dividend stocks. So, it’s assisting me with saving money. Even if I don’t save for a month now, I always have $120+ to invest. Simply put, dividend investing is already having a major impact on my life.

Now to the point of this new segment — the countdown to FI. Based on a $2,000 per month target income, I am approximately 6% of the way towards accomplishing FI.

But now that I have $120+ per month to reinvest from dividends, my pursuit of FI should begin to pick up speed.

Forward Guidance — $17.44 To Reach 2023 Target Dividend Income

I set a modest financial goal to earn at least $1400 in dividends in 2023.

Now with only one month remaining to collect dividends, I only need to earn at least $17.44 more to achieve my 2023 target dividend income.

Spoiler alert: I already surpassed the $1400 target on December 1st.

Now that I’ve reached that target, I’m more focused on the year-over-year growth rate, which I expect to be considerably higher than this month’s 18%.

Heading into the new year, I’m expecting to get back to much higher YOY growth rates. Look out for 40%+ growth rates to kick off the new year.

Final Thoughts

In summary, my investment portfolio generated $121.94 in dividend income in November 2023. This represents an 18% year-over-year growth rate compared to November 2022. Furthermore, it’s the highest YOY growth rate so far this year.

After factoring in November’s dividend income, year-to-date dividend income reached $1332.79, which is ahead of January to November 2022 by 8% or $98.98.

Also worth mentioning, I am over 6% of the way towards achieving financial independence based on the $121.16 average monthly dividend income achieved in 2023.

Moreover, year-over-year dividend growth is expected to accelerate next month and heading into 2024.

Stay tuned for more exciting dividend income updates as the snowball grows!

Related Dividend Income Updates

All Dividend Income Updates Since 2017

I am not a licensed investment or tax adviser. All opinions are my own. This post may contain advertisements by Monumetric and Google Adsense. This post may also contain internal links, affiliate links to BizBudding, Amazon, Bluehost, and Questrade, links to trusted external sites, and links to RTC social media accounts.

Connect With Dividend Income Investor

Instagram: @dividendincomeinvestor_

Threads: @dividendincomeinvestor_

Pinterest: @dividendincomeinvestor

Facebook: @Reversethecrushblog

Dividend Income October 2023 — $145.82

Dividend Income October 2023 — $145.82