Dividend Income June 2024 — Documenting monthly dividend income to chronicle the journey to financial independence. I am not a licensed investment advisor and this post is not investment advice. All opinions are my own. This post contains display ads from Monumetric.

The Dividend Income Investor blog is pleased to announce dividend income results for June 2024.

Dividend Income June 2024 Highlights

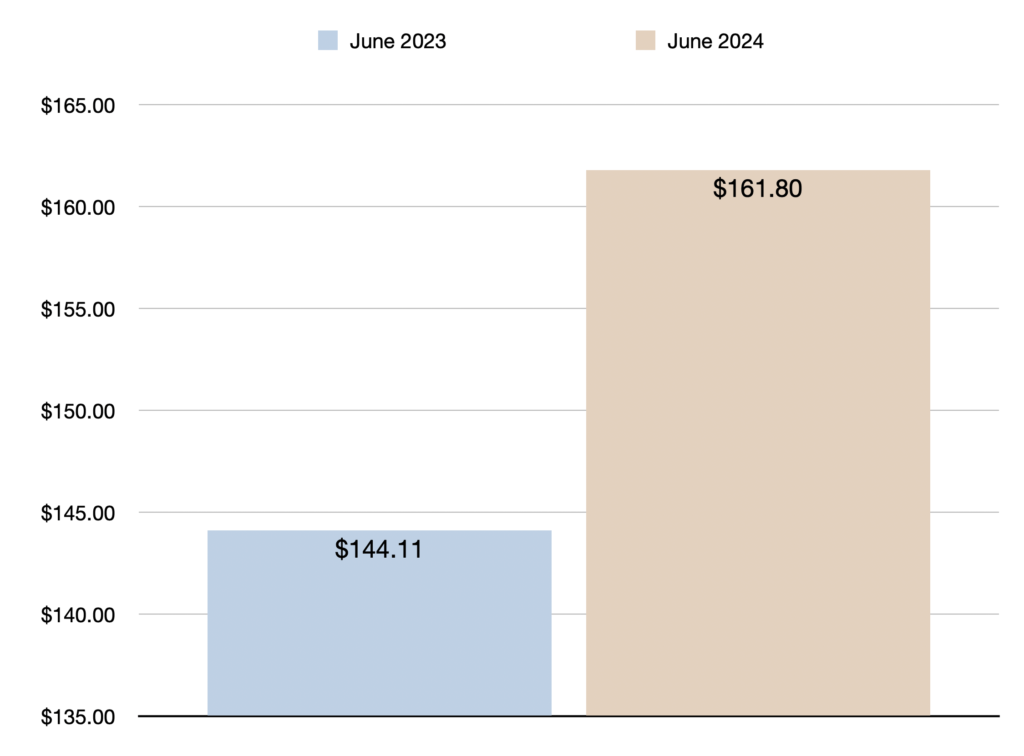

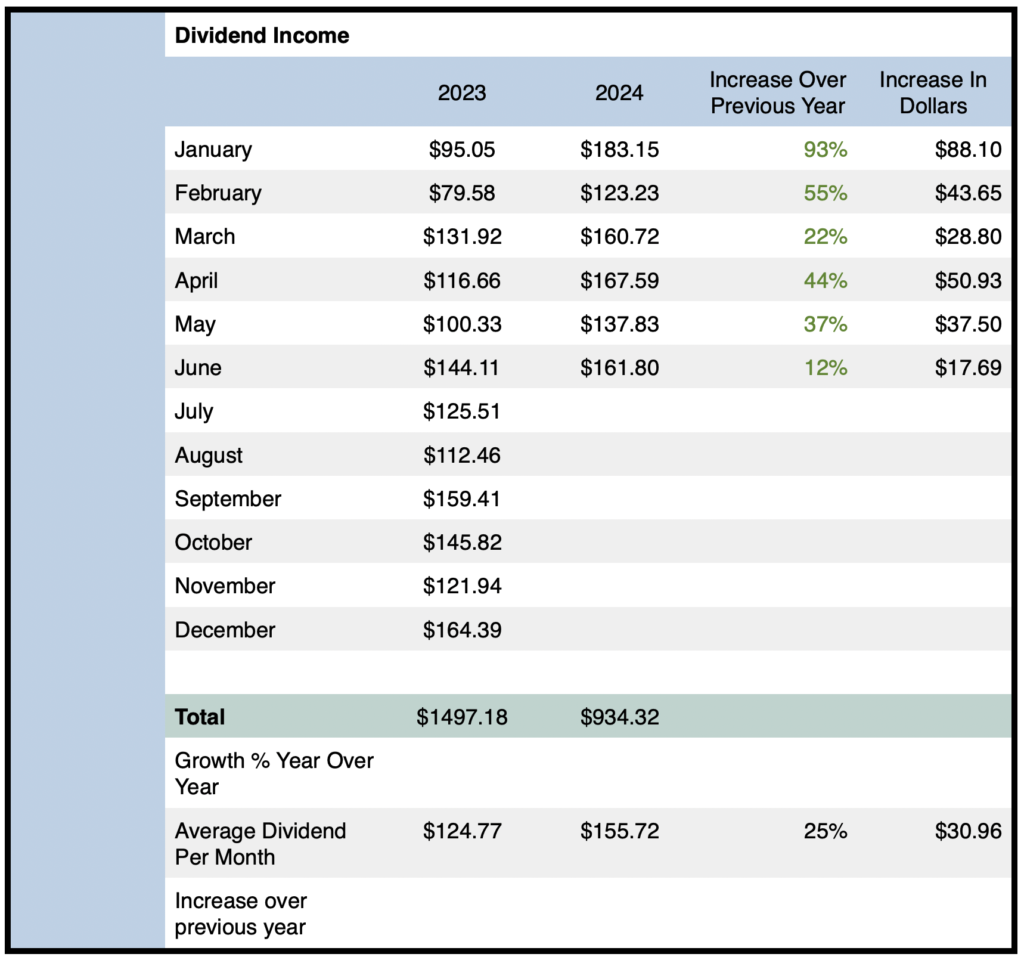

- Total dividend income earned in June 2024 was $161.80

- Year-over-year (YOY) dividend income increased by 12% or $17.69 compared to June 2023

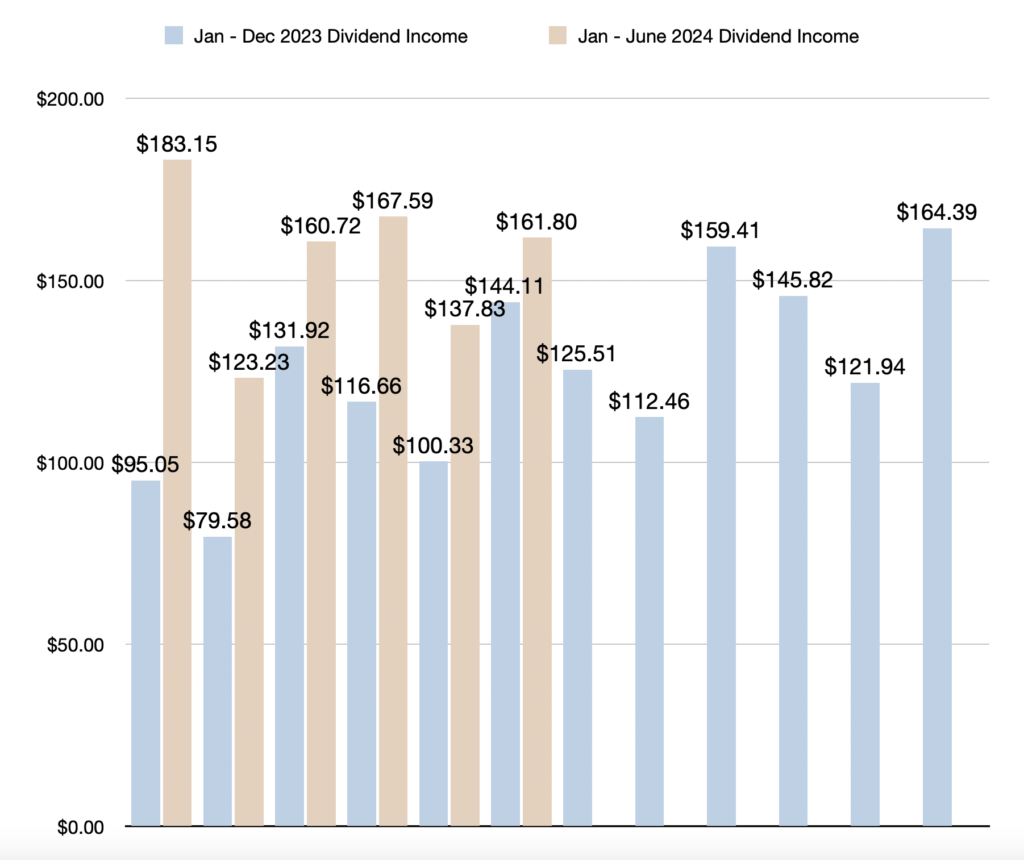

- Year-to-date (YTD) dividend income (January – June 2024) is up to $934.32

- YTD dividend income is up by 40% or $266.67 compared to the first six months of 2023

- Quarter-over-quarter (QOQ) dividend income increased by 1% or $1.08 compared to March 2024

- Average monthly dividend income in 2024 is $155.72 (up 25% or $30.96 per month compared to 2023)

- All-time dividend income since June 2017 reached $6229.82

- Dividend income per day in June 2024 reached $5.22

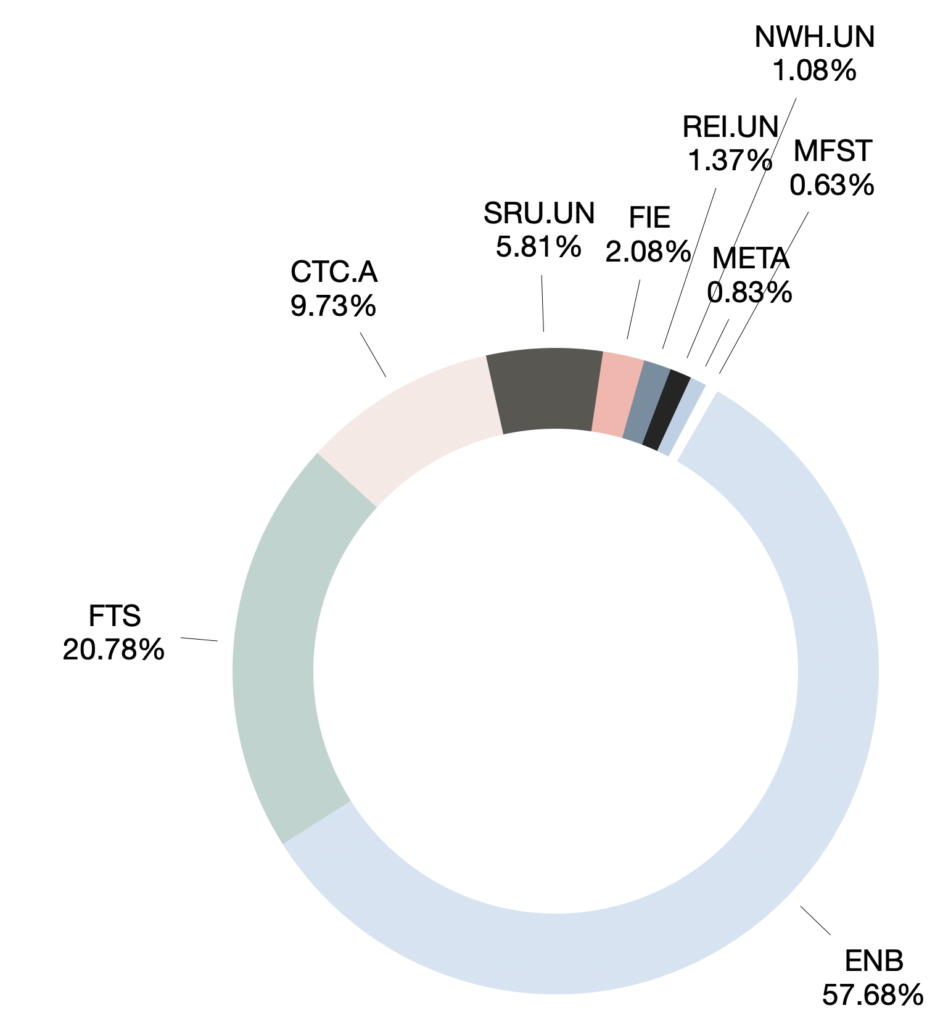

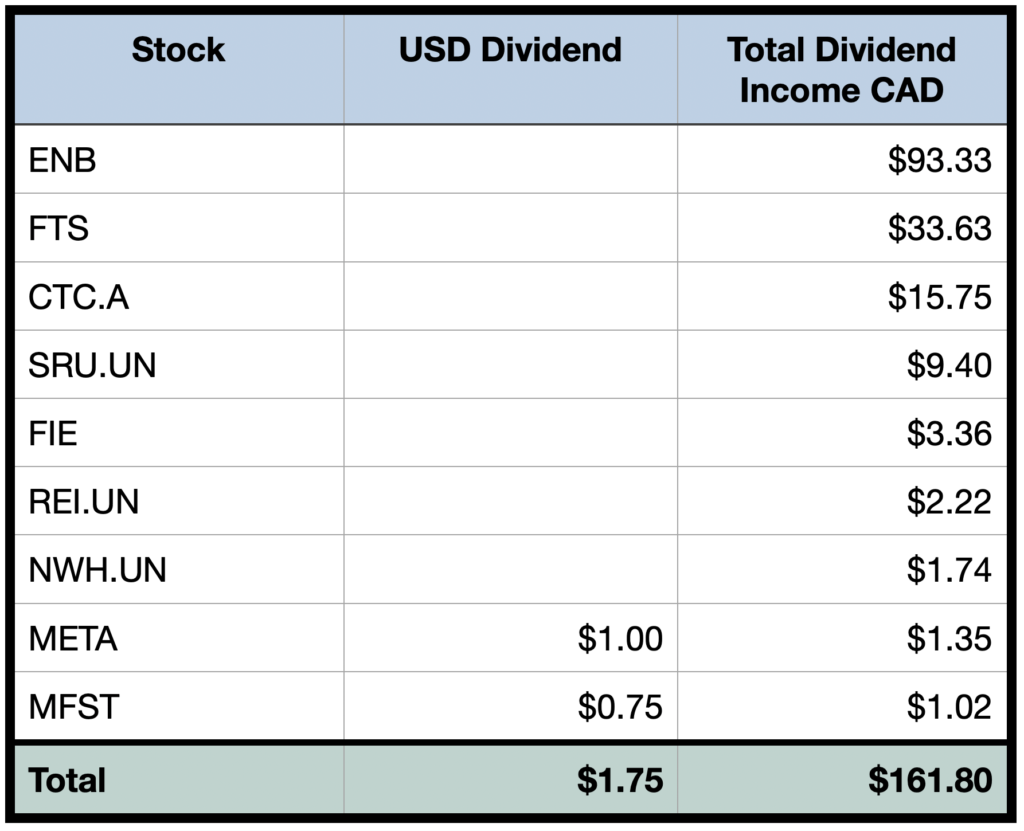

- 9 holdings paid dividends in June 2024

- This month marks the 7 year anniversary since I began documenting dividend income

Dividend Income June 2024 Earnings — $161.80

Total dividend income in June 2024 was $161.80, which represents a 12% year-over-year increase compared to June 2023. In dollars, it’s an increase of $17.69 compared to the $144.11 received during the same month last year.

Although it was the lowest month for year-over-year dividend growth in 2024 so far, it’s actually an increase compared to June 2023. YOY dividend growth in 2023 increased by just 4% compared to 2022.

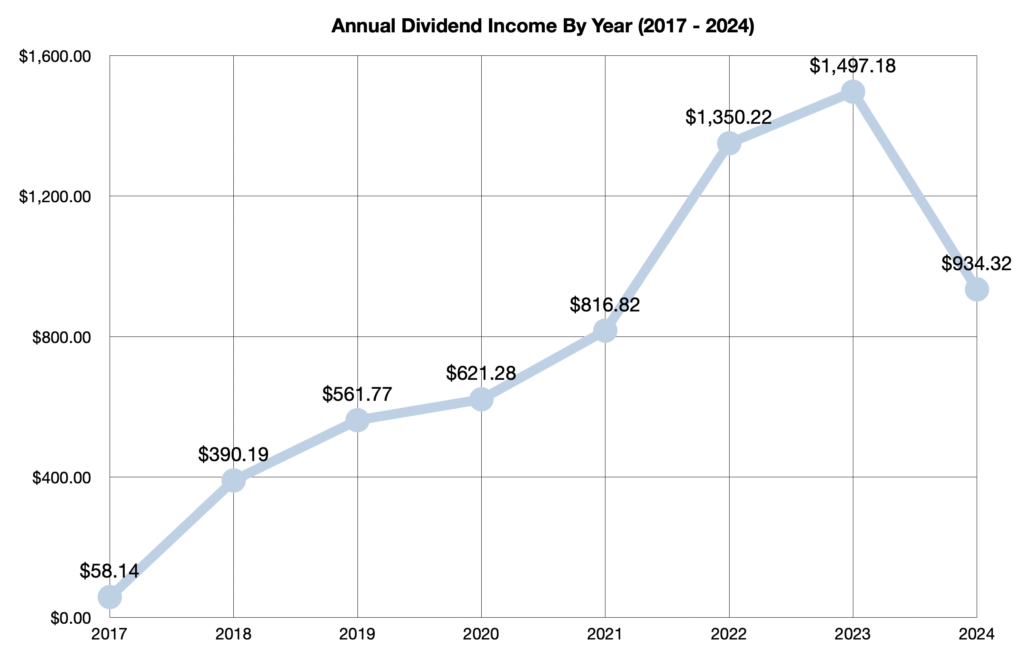

Year-to-date dividend income reached $934.32, which is up by an impressive 40% or $266.67 compared to the first six months of 2023. This year’s dividend income is already more than halfway to surpassing last year’s total of $1497.18. Furthermore, this year’s dividend income is already higher in the first six months than full year dividend income in 2021, 2020, 2019, 2018, and 2017.

Quarter-over-quarter dividend income increased by a very modest 1% or $1.08 compared to March 2024. The slowdown of QOQ dividend growth can primarily be attributed to selling SCHD and a few high-yielding covered call ETFs earlier this year. I took profits on those positions and reinvested into lower-yielding stocks such as AAPL and SBUX, and non-dividend paying stocks such as TSLA and PLTR. Fortunately, it turned out to be a excellent decision from a total return perspective. But it did slow down my dividend income growth slightly.

After factoring in June’s dividend income, all-time dividend income since June 2017 reached $6229.82.

Overall, it was solid month. But I would have liked to see year-over-year dividend growth come in a little higher.

Operational Highlights — June 2024

Reminder: I am not a licensed investment advisor and this post is not investment advice. You should always seek professional investment advice from a licensed investment advisor before investing. I am only sharing what I am doing with investing. None of the stocks mentioned are recommendations to purchase investments. All opinions are my own.

A total of 9 holdings paid dividend income in June 2024. This is down by 3 compared to June 2023. Actually, it’s down by 4 positions (SCHD, JNJ, SU, SIS) and up by 1 new position (META initiated a dividend). SU is a position that could be added again at some point, as my portfolio could use more exposure to the energy sector.

Otherwise, it was business as usual for my portfolio during the month.

On the USD side, holdings such as META, AAPL, TSLA, PLTR, COST, and MSFT have been soaring. I’m building up cash and waiting for an opportunity to add to a position or make a big new purchase. I am also considering adding to SBUX.

Meanwhile, on the Canadian side of my portfolio, utility and telecommunication stocks, and REITs continue to be beaten down. I am continuing to average in to stocks such as FTS, T.TO, and CNQ as of late. I have also been adding to REITs while they are down.

See the spreadsheet below for a full breakdown of which stocks paid dividends in June 2024:

Outlook

I expect full-year dividend income to be in the range of $2000, unchanged from my 2024 financial goals.

Reaching $2000 would represent a 34% year-over-year dividend growth rate compared to the $1497.18 received in 2023.

Based on the $934.32 received so far in 2024, I must earn at least $1065.68 more by the end of the year. Broken down monthly, I must earn at least $177.61 per month for the remainder of the year.

Based on this year’s average monthly dividend income ($155.72), I am still trending slightly behind. If I continue to average $155.72 per month, the portfolio will end up generating $1868.64.

Despite being slightly behind, I am still confident that I will be able to achieve my $2000 target dividend income. But it’s definitely time to start being more aggressive at achieving this target.

But at the same time, I am prioritizing total returns and I am very focused on remaining competitive with the S&P 500.

Of course, I will continue to rely on the three dividend growth levers to grow dividend income (reinvesting dividends | dividend raises | investing new capital).

Final Thoughts

In summary, dividend income in June 2024 was $161.80. This represents a modest 12% year-over-year increase compared to June 2023.

Year-to-date dividend income is now $934.32, which is up by an impressive 40% or $266.67 compared to the first six months of 2023.

Moreover, all-time dividend income since June 2017 reached $6229.82.

Overall, it was a solid month for the investment portfolio. Although it wasn’t the highest month for year-over-year dividend growth, it’s possible that July 2024 could be a record-setting month. The extra capital I have been allocating should begin to make an impact over the coming months.

In addition to tracking the dividend income, I will continue to monitor my total investment returns and compare performance to the S&P 500. My goal is to maintain an income-centric portfolio with a low-risk profile that is competitive with the S&P 500. Ideally, my portfolio will stay competitive in the good years and outperform in the down years.

Stay tuned for more exciting dividend income updates in 2024 as the snowball grows!

Related Dividend Income Updates

I am not a licensed investment or tax adviser. All opinions are my own. This post may contain advertisements by Monumetric and Google Adsense. This post may also contain internal links, affiliate links to BizBudding, Amazon, Bluehost, and Questrade, links to trusted external sites, and links to RTC social media accounts.

Connect With Dividend Income Investor

Instagram: @dividendincomeinvestor_

Threads: @dividendincomeinvestor_

Pinterest: @dividendincomeinvestor

Facebook: @Reversethecrushblog

Dividend Income May 2024 — Dividend Income Investor Reports Solid Results; $137.83 (37% YOY Dividend Growth)

Dividend Income May 2024 — Dividend Income Investor Reports Solid Results; $137.83 (37% YOY Dividend Growth)