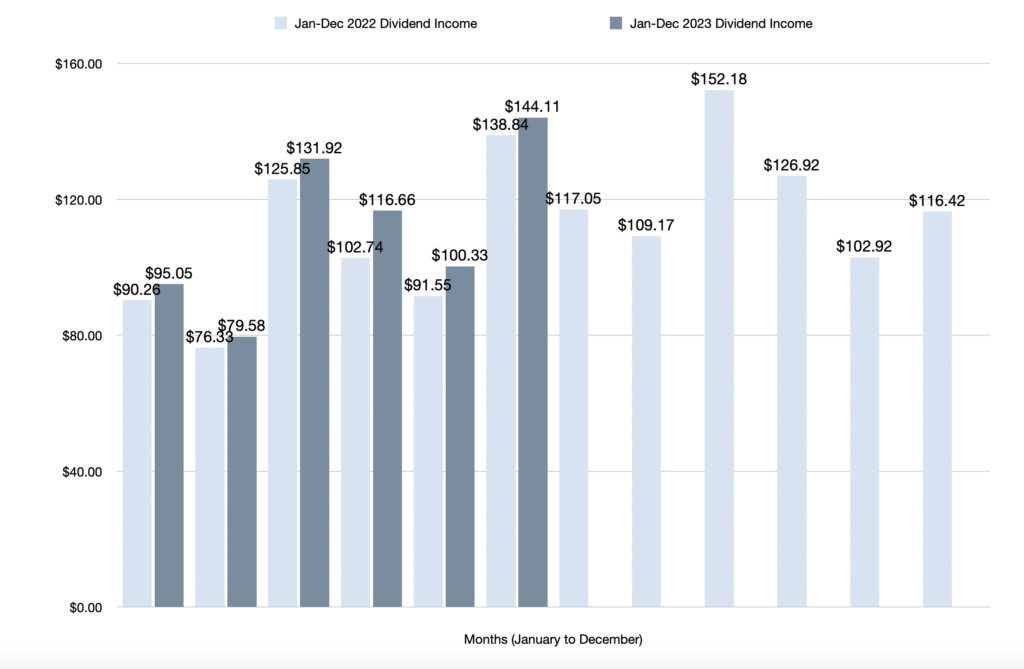

Dividend Income June 2023 — Chronicling monthly dividend income to document the journey to financial independence. I am not a licensed investment advisor and this post is not investment advice. All opinions are my own.

The month of June has come and gone, so it’s time to reflect on my dividend income performance.

Although year-over-year dividend growth slowed down, I’m happy to report that June 2023 was another profitable month. In fact, it turned out to be my second highest month for dividend income ever.

Since I am publishing this report later than usual, let’s dive straight into the details. This post will cover my June 2023 dividend income and provide insights on which stocks paid dividends.

Dividend Income June 2023 Highlights

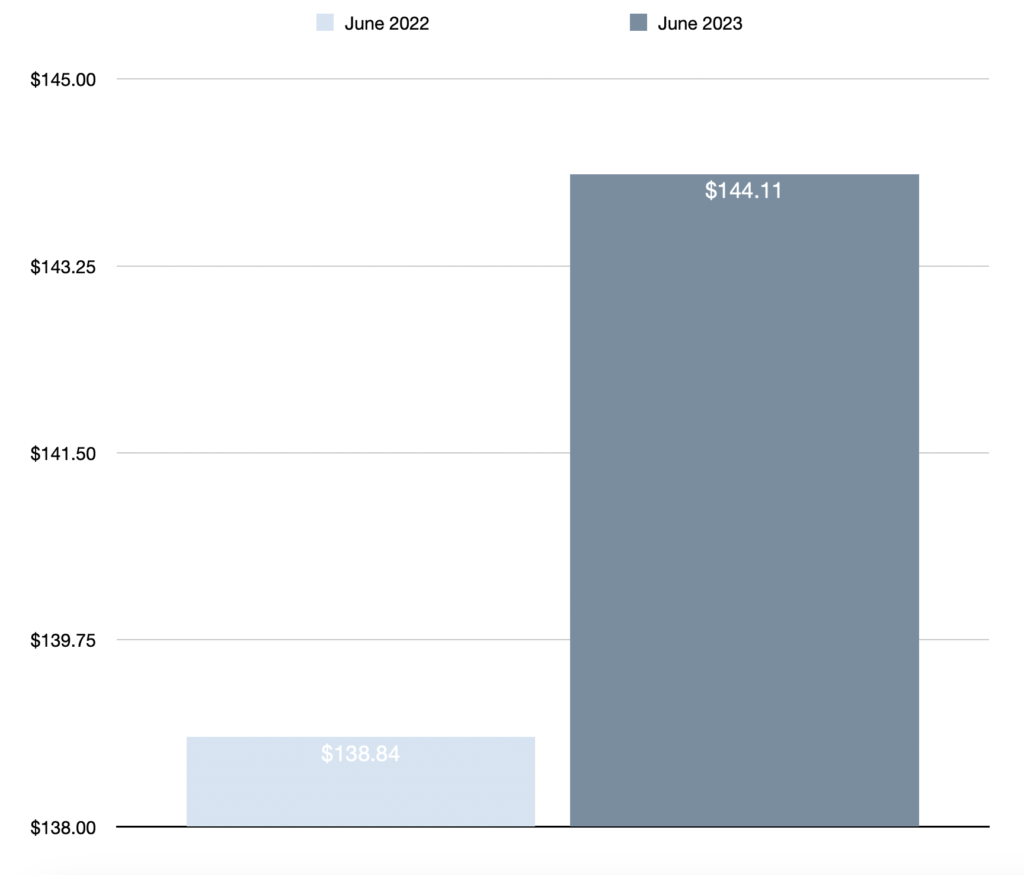

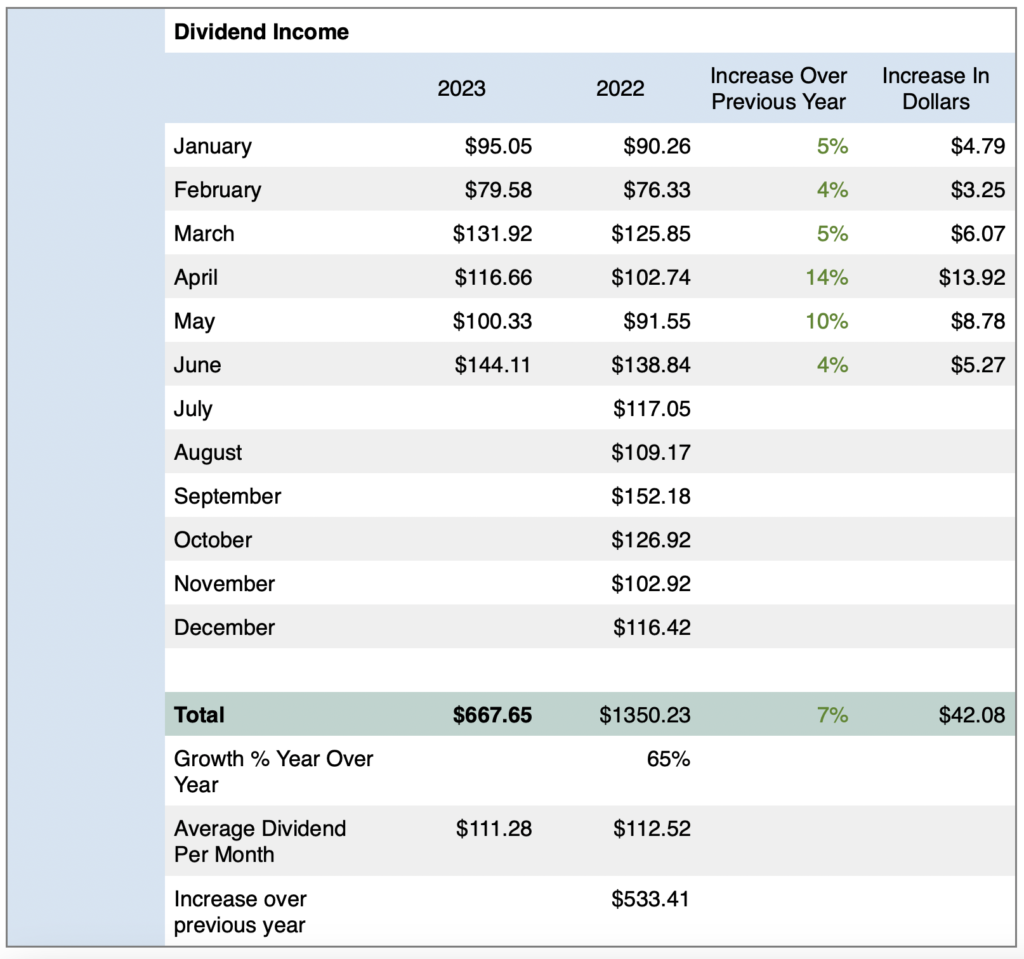

- Total dividend income earned in June 2023 was $144.11

- 2nd highest month ever for dividend income.

- Year-over-year (YOY) dividend income grew by 4% or $5.27 compared to June 2022

- Year-to-date (YTD) dividend income is $667.65 (January to June 2023)

- YTD dividend income is up by 7% or $42.08 compared to the same period in 2022

- YTD dividend income is already $46.37 higher than the 2020 total amount received

- 12 positions paid dividend income in June 2023

- Quarter-over-quarter (QOQ) dividend income increased by 9% or $12.19 compared to March 2023

- 4 months in a row of $100 or more in dividends

- All-time dividend income since June 1017 is $4465.97

- Average monthly dividend income in 2023 is $111.28

- Dividend income per day in June 2023 was $4.80

- This post is the 6-year anniversary since I began this dividend investing journey

Dividend Income June 2023 Earnings — $144.11

My investment portfolio generated $144.11 in dividend income between June 1, 2023 to June 30, 2023. This represents a modest 4% year-over-year growth rate compared to June 2022.

But on the bright side, it’s the second highest amount of dividend income I’ve ever received within one month. The top month ever is still September 2022. Of course, I’m hoping to set a new record in September 2023.

Otherwise, year-to-date dividend income in 2023 reached $667.65, which is ahead of January to June 2022 by 7% or $42.08. Also worth noting is that 2023 year-to-date dividend income is already higher than the total amount received in 2020. I will likely surpass the 2021 total within two months.

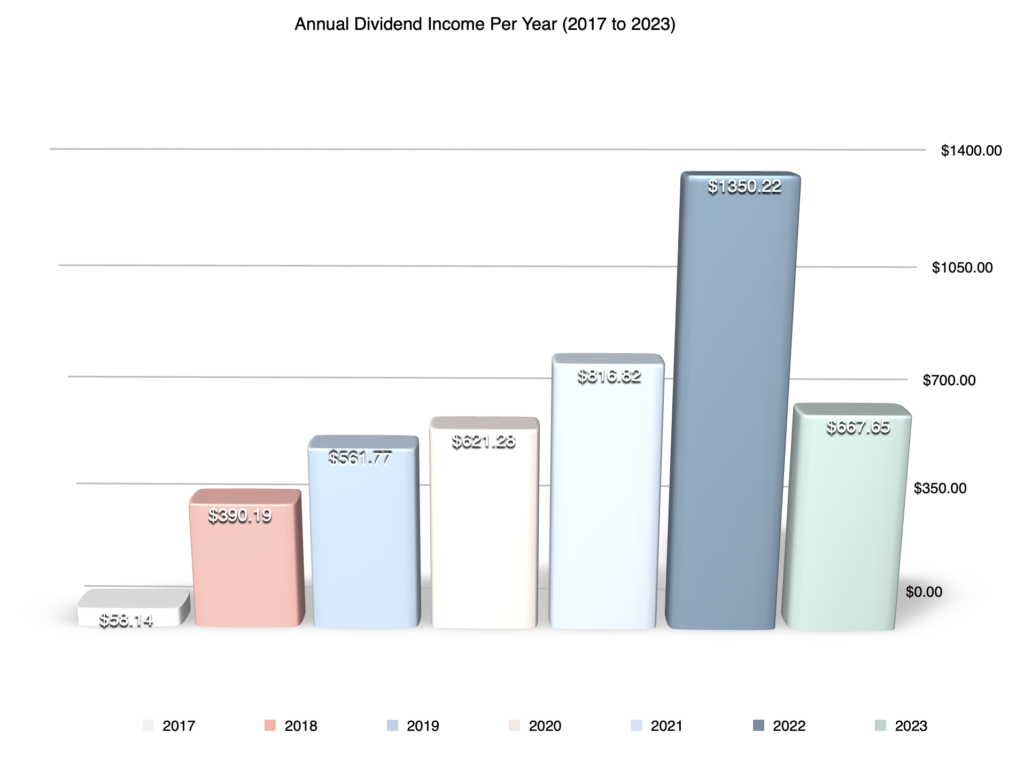

After factoring in June’s dividend earnings, my all-time dividend income reached $4465.97 since June 2017. I am slowly but surely approaching $5,000 in dividends received. Frankly, this dividend investing journey is only just beginning to get interesting. The snow ball is rolling on its own and the pace of growth should begin to pick up by the year’s end.

Stocks/REITs/ETFs That Paid Dividends In June 2023

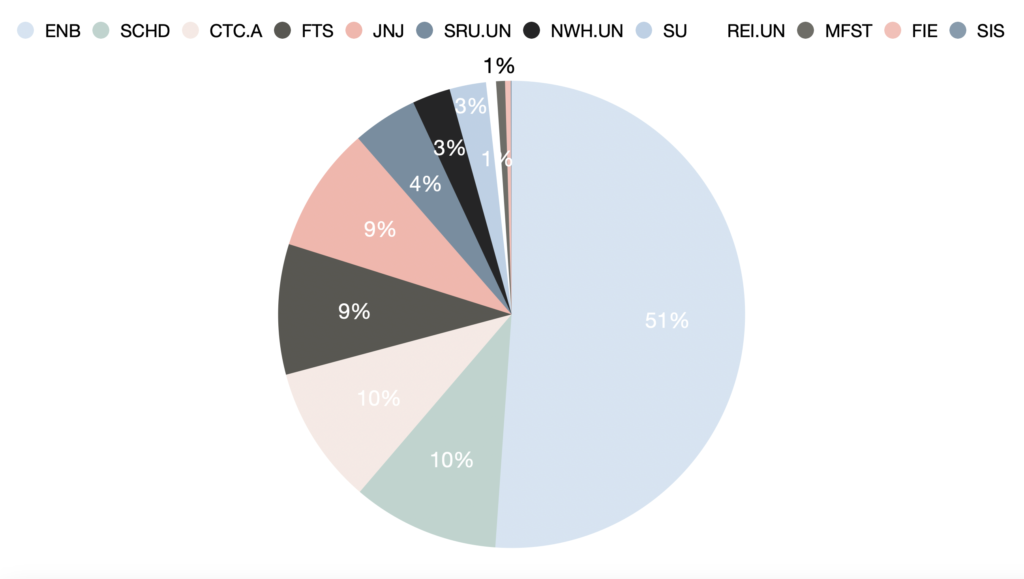

Below is a breakdown of the positions that paid dividends in June 2023:

In total, twelve positions paid dividend income in June 2023. Surprisingly, this is up by three positions since the March 2023 quarter. And this is in spite of selling out of Intel following the dividend cut, so it’s actually four new positions.

The four new positions that paid are SCHD, FIE, MSFT, and SU. In my opinion, I strengthened my portfolio by adding SCHD and MSFT during the quarter. At the time I am writing this post, I am already up over 12% on MSFT and 2% on SCHD, respectively.

To reiterate my thoughts on incorporating ETFs from last month’s post, I have resisted the urge to invest in ETFs over the past few years to avoid fees. However, I decided to add ETFs for diversification and to stop researching companies I am less interested in. For example, rather than hold ABBV directly, I just own SCHD. Furthermore, instead of adding HD, KO, PEP, and CSCO, I can just own SCHD. Plus, it’s a extremely low-cost ETF.

Otherwise, FIE is an income ETF that adds a bond component to my portfolio. I like it for the high monthly income and low cost per unit. Candidly, I dollar cost average into it every time I have enough dividends or savings to buy a unit. As for SU, I have a long history of trading in and out of the Canada-based energy company.

As per usual, ENB was the highest payer of the month, as it accounted for 51% of June’s dividend income. However, I am hoping to lower my reliance on it by the September quarter.

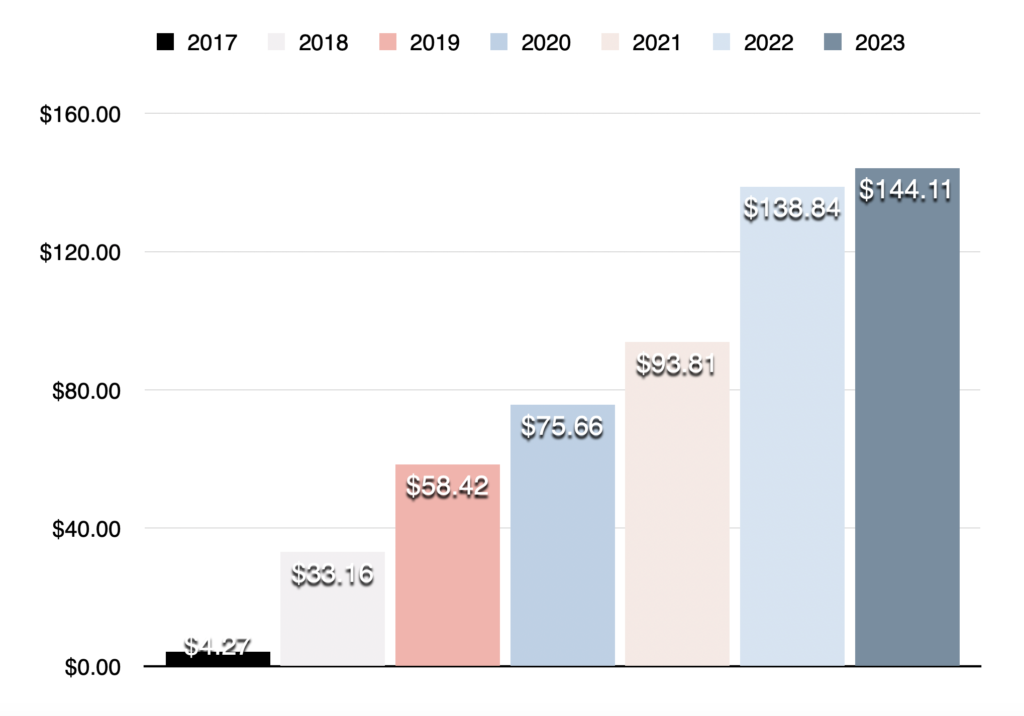

June Dividend Growth Since 2017

June 2023 commemorates six years of publishing dividend income updates on this blog.

In truth, I am slightly behind where I expected to be by now. Sometimes I worry I am not doing dividend investing enough justice.

Honestly, I never expected to buy a house and I did not anticipate switching careers. Originally, I liked the idea of renting and investing as much as possible. But then the pandemic came along and higher interest rates forced rent prices up. I also realized how much I appreciate the stability and autonomy of ownership. In short, I would’ve had more invested in stocks if not for a downpayment. But I have to admit, it’s nice having a tangible asset alongside my stock portfolio. Regarding my career change, I took a chance and opted out of a full-time job in favour of a part-time job. It resulted in a low income year and therefore a lower saving year or two. Fortunately, my career change worked out and now I’m making considerably more than I ever was.

Although there have been some ups and downs along the way, the month of June has seen steady dividend income growth.

Here is a breakdown of my June dividend income growth since I started this journey:

You can view all dividend income updates since June 2017 here.

Looking Ahead — $732.35 To Reach My 2023 Dividend Income Target

At the beginning of 2023, I set a modest financial goal to earn at least $1400 in dividends. This was only slightly higher than the $1350.22 I received in 2022. It’s only a 3.7% year-over-year increase.

At the mid year point, I am happy to claim that I am well on my way to achieve this target. Considering that I am 7% ahead of last year by the same point, I fully expect to meet and exceed my $1400 target.

Looking forward, I expect modest growth in July, August, September, and October. After that, I expect November and December to see significant growth.

I look forward to closing out the year strong.

Final Thoughts

In summary, my investment portfolio generated $144.11 in dividend income in June 2023.

This represents a modest 4% year-over-year increase. However, it’s my second highest total ever in one month.

After factoring in June’s dividend earnings, year-to-date dividend income reached $667.65, which is ahead of last year by 7%.

Moreover, my all-time dividend income received reached $4465.97 since June 2017. I am closing in on $5000 in dividends and expect to surpass it by the end of the year.

Despite the slower year-over-year growth, I am continuing to make steady progress towards my goal of earning $1400 in dividends this year. As always, I will continue to focus on the three main levers to grow dividend income: save a high percentage of my income, reinvest dividends, and focus on high-quality stocks that grow dividends.

Related Dividend Income Updates

All Dividend Income Updates Since June 2017

I am not a licensed investment or tax adviser. All opinions are my own. This post may contain advertisements by Monumetric and Google Adsense. This post may also contain internal links, affiliate links to BizBudding, Amazon, Bluehost, and Questrade, links to trusted external sites, and links to RTC social media accounts.

Connect With RTC

Twitter: @Reversethecrush

Instagram: @reversethecrush_

Threads: @reversethecrush_

Facebook: @reversethecrushblog

Pinterest: @reversethecrushblog

Dividend Income May 2023

Dividend Income May 2023