Dividend Income July 2024 — Documenting monthly dividend income to chronicle the journey to financial independence. I am not a licensed investment advisor and this post is not investment advice. All opinions are my own. This post contains display ads from Monumetric.

The Dividend Income Investor blog is pleased to announce dividend income results for July 2024.

July 2024 turned out to be an exceptional month for both dividend income and capital growth, marking a new milestone in my investment journey. Not only did I achieve my highest ever monthly dividend income, but the overall value of my portfolio also saw impressive gains.

The standout factor was the record-breaking dividend income. The total amount received this month surpassed any previous highs, showcasing the reliability of my investment strategy focused on high-quality, income-generating stocks.

Additionally, the portfolio’s value experienced significant growth, driven by strategic investments in interest rate-sensitive stocks over the past year. This uptick followed a favourable 25 basis point rate cut, which bolstered the performance of my Canadian investments.

Let’s dive into this month’s highlights.

Dividend Income July 2024 Highlights

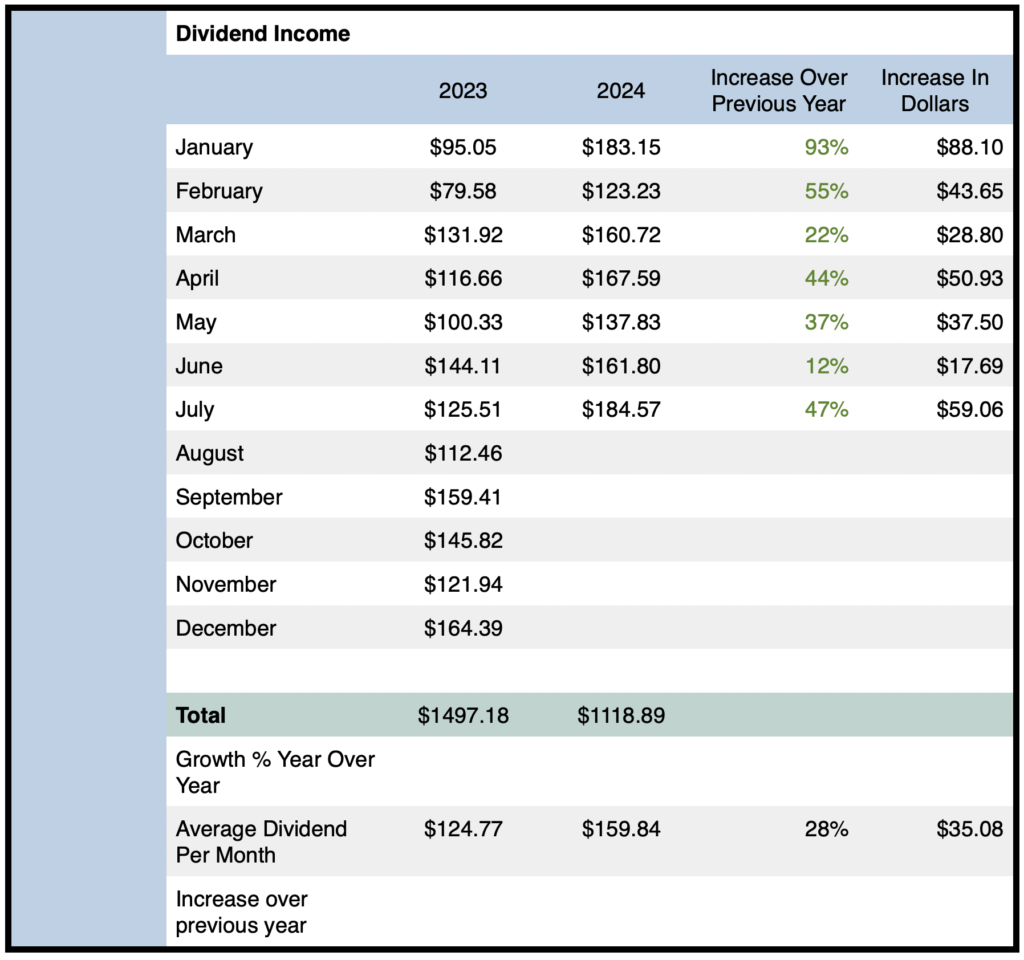

- Total dividend income earned in July 2024 was $184.57 (New Record)

- Year-over-year (YOY) dividend income increased by 47% or $59.06 compared to July 2023

- Year-to-date (YTD) dividend income (January – July 2024) is up to $1118.89

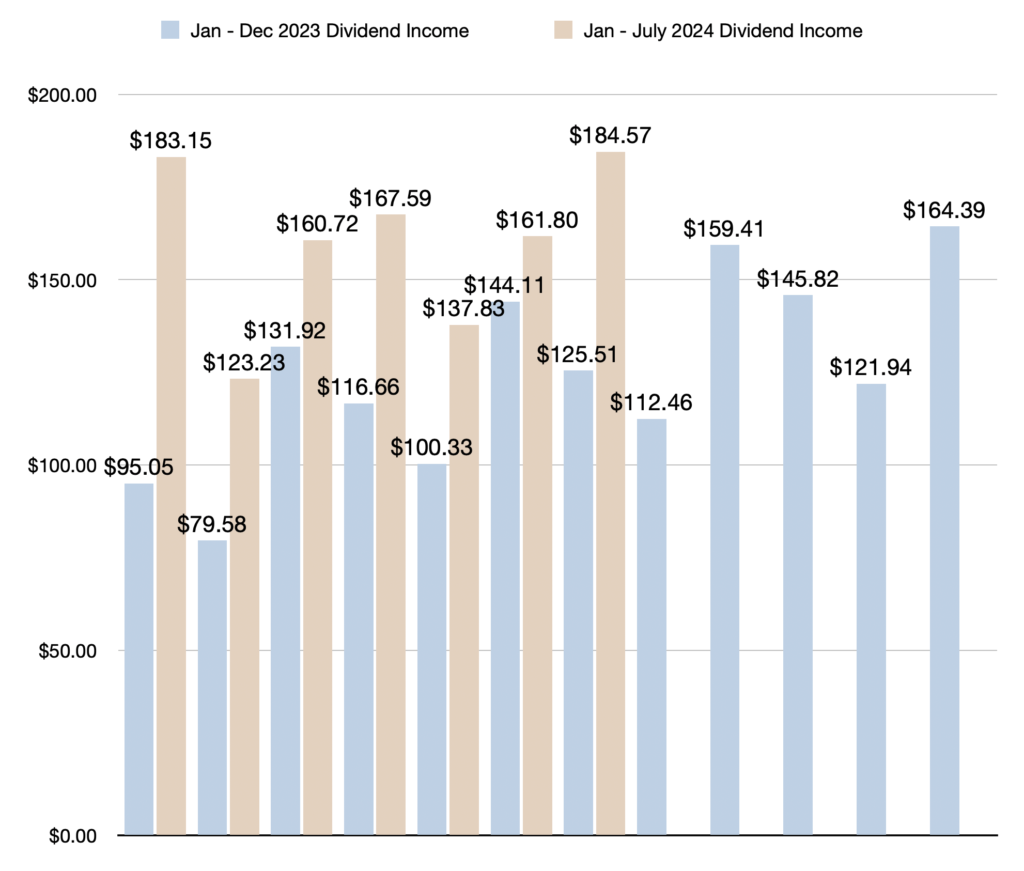

- YTD dividend income is up by 41% or $325.73 compared to the first seven months of 2023

- Quarter-over-quarter (QOQ) dividend income increased by 10% or $16.98 compared to April 2024

- Average monthly dividend income in 2024 is $159.84 (up 28% or $35.08 per month compared to 2023)

- All-time dividend income since June 2017 reached $6414.39

- Dividend income per day in June 2024 reached $5.95

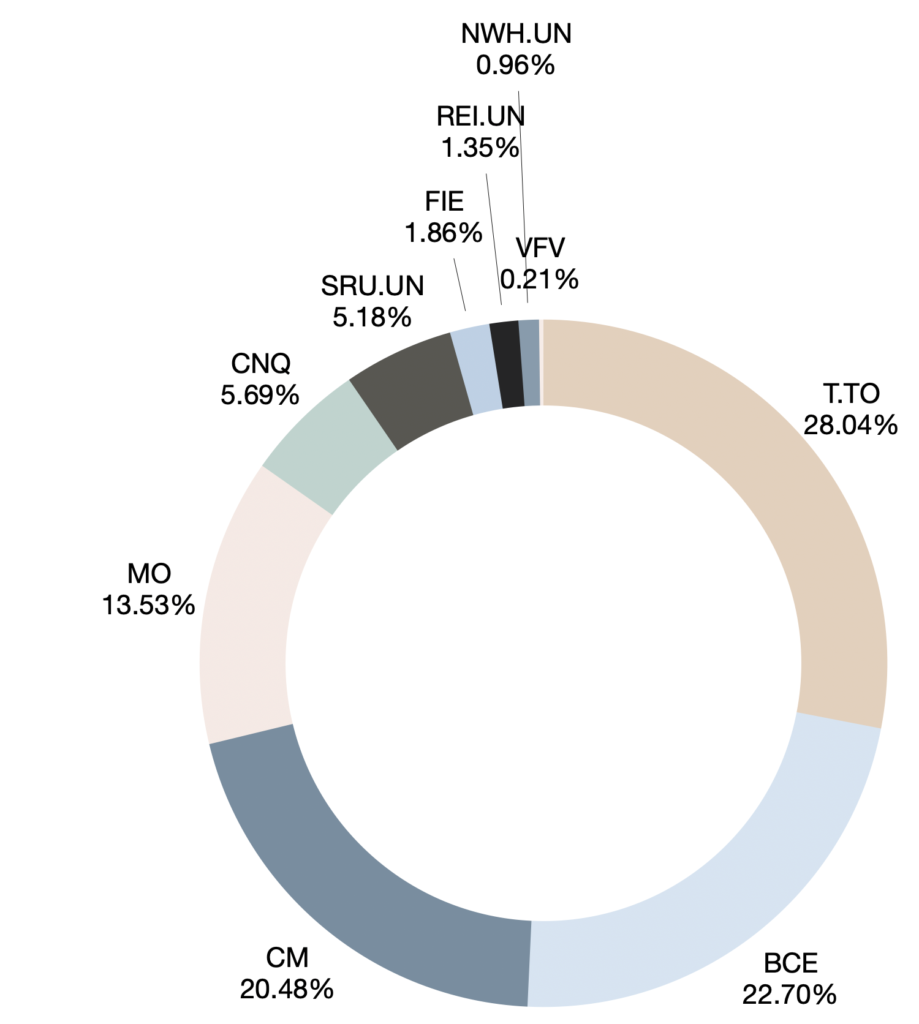

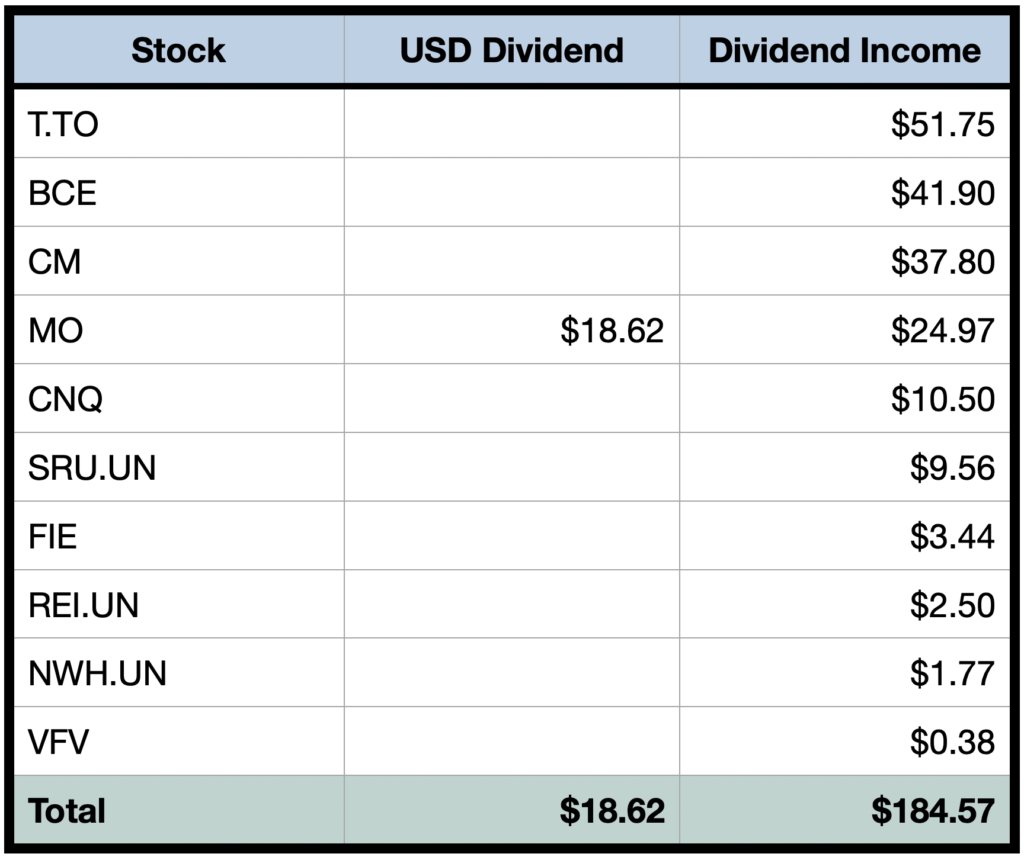

- 10 holdings paid dividends in July 2024

Dividend Income July 2024 Earnings — $184.57

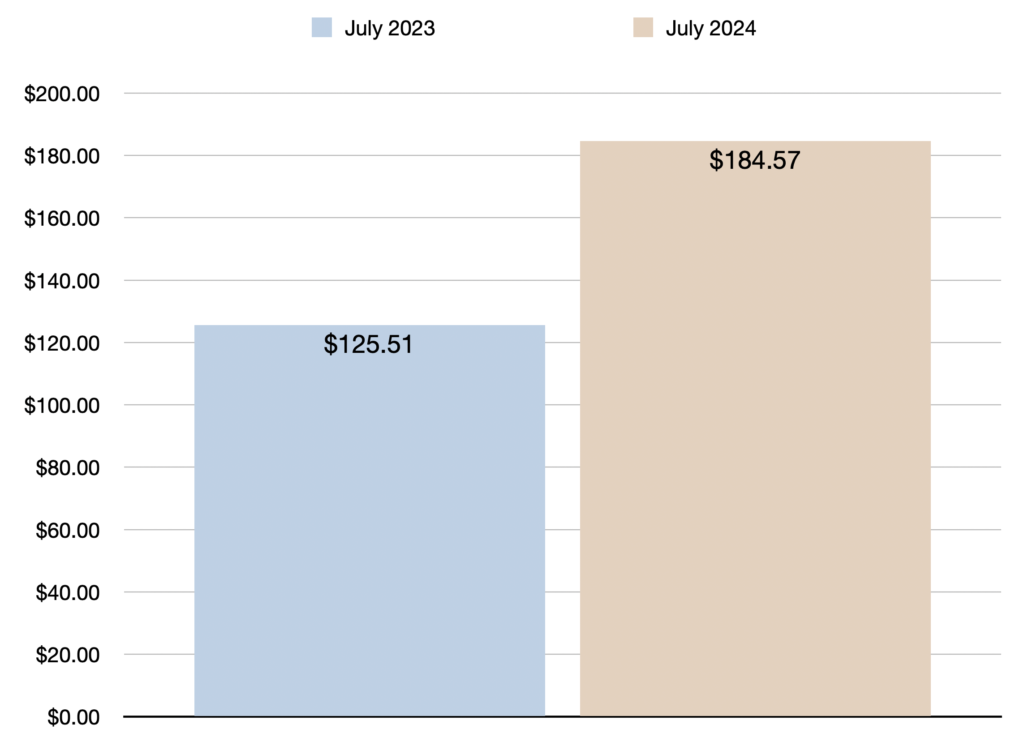

Total dividend income in July 2024 was $184.57, which represents a new record for dividends received within one month. The previous record occurred in January 2024, as $183.15 was earned.

This month’s dividend income represents a 47% year-over-year increase compared to July 2023. In dollars, it was an increase of $59.06 compared to the $125.51 received during the same month last year.

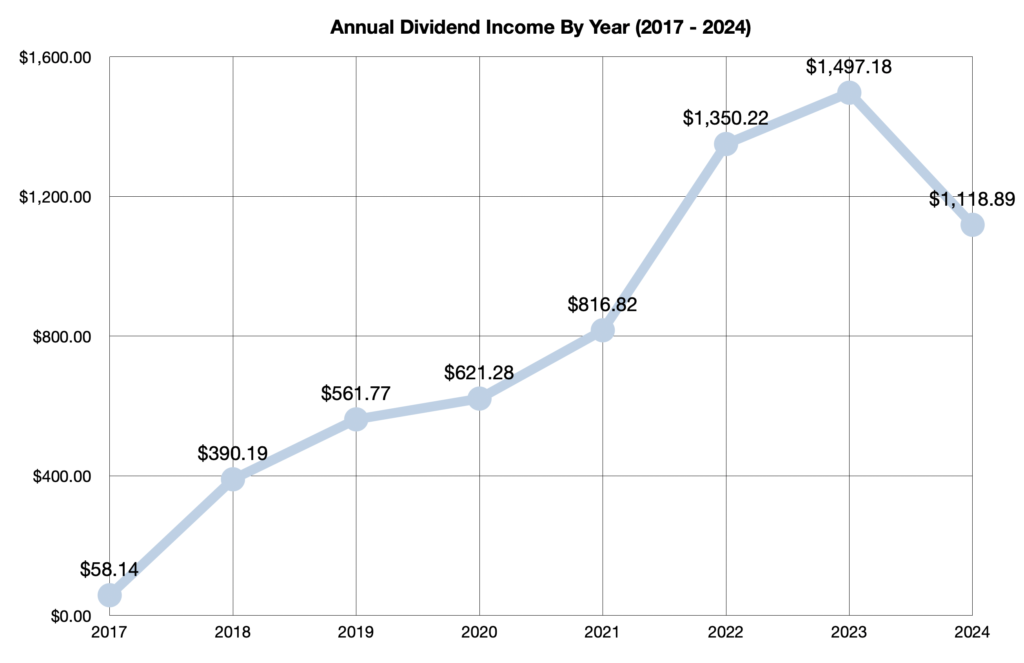

Year-to-date dividend income surpassed $1000, as I have now received $1118.89 from January to July 2024. This is up by an impressive 41% or $325.73 compared to the first seven months of 2023. This year’s dividend income is now within reach of surpassing last year’s total of $1497.18. Furthermore, this year’s dividend income is already higher in the first seven months than full year dividend income in 2021, 2020, 2019, 2018, and 2017.

Quarter-over-quarter (QOQ) dividend income increased by a solid 10% or $16.98 compared to April 2024. The increase can mostly be attributed to adding to existing positions: $T.TO, $BCE, $CM, and $CNQ.

After factoring in July’s dividend income, all-time dividend income since June 2017 reached $6414.39.

Overall, July 2024 turned out to be an exceptionally strong month for dividend income.

Operational Highlights — July 2024

Reminder: I am not a licensed investment advisor and this post is not investment advice. You should always seek professional investment advice from a licensed investment advisor before investing. I am only sharing what I am doing with investing. None of the stocks mentioned are recommendations to purchase investments. All opinions are my own.

In July 2024, I received dividend payments from 10 holdings, down by one from July 2023. Over the past year, I made a few notable changes that had an impact on July 2024: I sold $SIS and $AQN, and added $CNQ to my portfolio.

See the spreadsheet below for a full breakdown of which stocks paid dividends in July 2024:

Activity In July 2024

In July, I focused on several key adjustments to my portfolio. I continued to build my position in $CNQ and took advantage of opportunities in the telecommunications sector by increasing my stake in $T.TO. I also added to my existing REIT holdings, $SRU.UN and $REI.UN, and expanded my USD investments with $SBUX.

Additionally, I initiated two new positions: $CU and $PRL. Although I prefer $FTS over $CU, I’m optimistic about further gains in the utilities sector with additional rate cuts. For $PRL, a small-cap stock, I see potential due to its focus on lending and its AI component. The company’s impressive growth metrics make it an intriguing prospect, and I plan to increase my position if conditions are favourable.

July 2024: Transitioning to New Opportunities

July marked a transitional period for my portfolio. After accumulating significant cash reserves due to high interest rates, it’s time to explore higher returns. With my cash account rate dropping from 4% to 3.5%, I transferred funds to a new bank offering up to 5.7%—though this rate is temporary.

As interest rates decline, I plan to shift more of my savings back into equities. While a 4% risk-free return was attractive, a 3.5% cash rate pales compared to the potential 5% to 7% returns from dividend stocks. It’s time to balance risk and reward as market conditions evolve.

Outlook/Guidance

I expect full-year dividend income to be in the range of $2000, unchanged from my 2024 financial goals.

Reaching $2000 would represent a 34% year-over-year dividend growth rate compared to the $1497.18 received in 2023.

Based on the $1118.89 received so far in 2024, I must earn at least $881.11 more by the end of the year. Broken down monthly, I must earn at least $176.22 per month for the remainder of the year.

Based on this year’s average monthly dividend income ($159.84), I am still trending slightly behind. If I continue to average $159.84 per month, the portfolio will end up generating $1918.09.

Despite being slightly behind, I am still confident that I will be able to achieve my $2000 target dividend income. But it looks like it will be cutting it close.

Reaching my target would be straightforward if I solely focused on yields. For instance, instead of low-yield stocks like $PRL, I could invest in high-yielders like $BCE or consider selling non-dividend payers such as $TSLA and $PLTR. However, my priority is total returns and staying competitive with the S&P 500. I also prefer keeping a substantial cash reserve to handle market downturns and emergencies. It’s about owning top-tier companies while balancing risk and opportunity.

Of course, I will continue to rely on the three dividend growth levers to grow dividend income (reinvesting dividends | dividend raises | investing new capital).

Final Thoughts

In summary, dividend income in July 2024 was $184.57, which was a new monthly record. This represents an impressive 47% year-over-year increase compared to July 2023.

Year-to-date dividend income is now $1118.89, which is up by an impressive 41% or $325.73 compared to the first seven months of 2023.

Moreover, all-time dividend income since June 2017 reached $6414.39.

As mentioned in the introduction, July 2024 turned out to be an exceptional month for both dividend income and capital growth. I earned a record-setting amount of dividend income and the value of my portfolio saw impressive gains.

In addition to tracking the dividend income, I will continue to monitor my total investment returns and compare performance to the S&P 500. My goal is to maintain an income-centric portfolio with a low-risk profile that is competitive with the S&P 500. Ideally, my portfolio will stay competitive in the good years and outperform in the down years.

Stay tuned for more exciting dividend income updates in 2024 as the snowball grows!

Related Dividend Income Updates

Dividend Income July 2023 — $125.51

Dividend Income January 2024 — $183.15

I am not a licensed investment or tax adviser. All opinions are my own. This post may contain advertisements by Monumetric and Google Adsense. This post may also contain internal links, affiliate links to BizBudding, Amazon, Bluehost, and Questrade, links to trusted external sites, and links to RTC social media accounts.

Connect With Dividend Income Investor

Instagram: @dividendincomeinvestor_

Threads: @dividendincomeinvestor_

Pinterest: @dividendincomeinvestor

Facebook: @Reversethecrushblog

Dividend Income June 2024 — Dividend Income Investor Reports Solid Numbers; $161.80 (But Slowing YOY Dividend Growth At Only 12%, And Slowing QOQ Dividend Growth!)

Dividend Income June 2024 — Dividend Income Investor Reports Solid Numbers; $161.80 (But Slowing YOY Dividend Growth At Only 12%, And Slowing QOQ Dividend Growth!)