Dividend income February 2024 — Documenting monthly dividend income to chronicle the journey to financial independence. I am not a licensed investment advisor and this post is not investment advice. All opinions are my own. This post contains one link to Wealthsimple and display ads from Monumetric.

Welcome to the Dividend Income Investor blog.

Now that the second month of 2024 is officially over, it’s time to document February’s dividend income and reflect on this month’s performance.

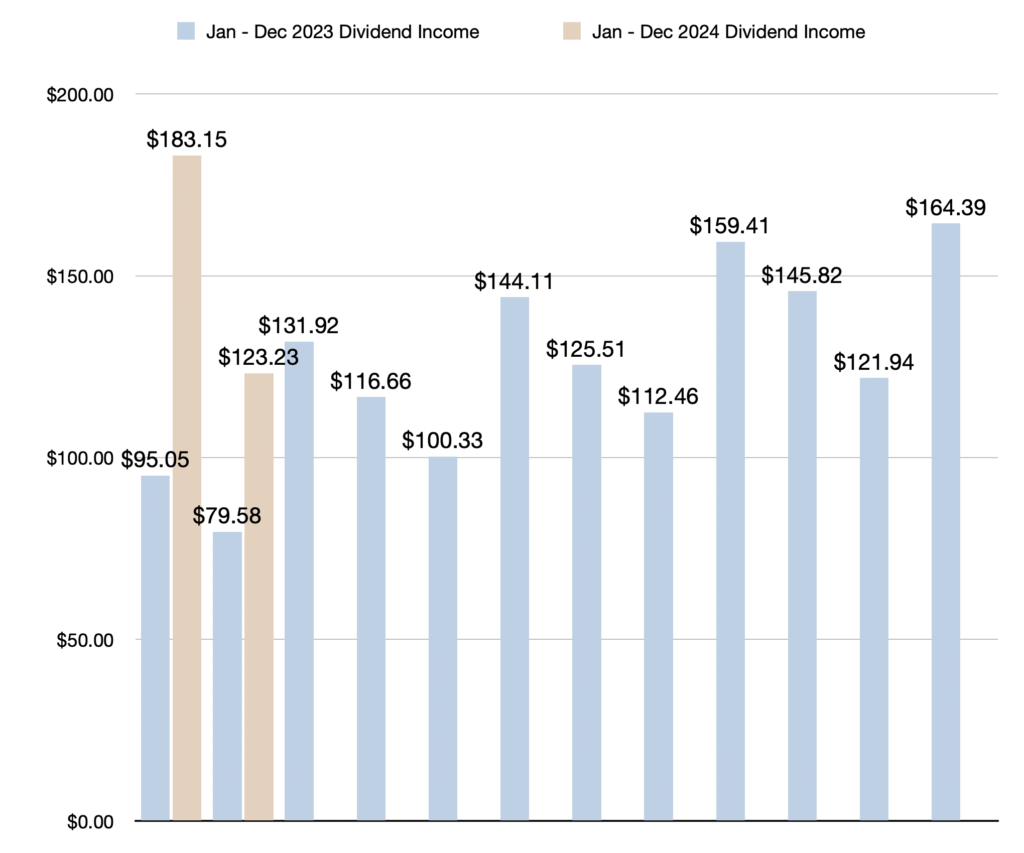

Fortunately, my investment portfolio had another fantastic month, as dividend income continued its torrid pace of year-over-year growth. Although it was not a record-setting month like January 2024 was, February’s year-over-year growth rate was higher than any month in 2023.

Also worth mentioning is that I made quite a few changes to the portfolio during the month. Of course, I did not change any of the core stock positions. I am a long-term investor that prioritizes dividend income, risk management, and remaining competitive with the S&P 500. However, I’m also a contrarian who will make trades depending on the enthusiasm of market participants and valuation of stocks. Frankly, the market is getting far too exciting right now, so I took some risk off the table. I also wanted to reduce the number of positions to concentrate on my best investments, after realizing 19 positions paid income in January. I’ll share more on these changes in the operational highlights section of the post.

For now, let’s take a look at how much dividend income was earned in February 2024, review which stocks paid dividends, and compare this month’s results to the same month last year.

Let’s begin by jumping into February’s dividend income highlights.

Dividend Income February 2024 Highlights

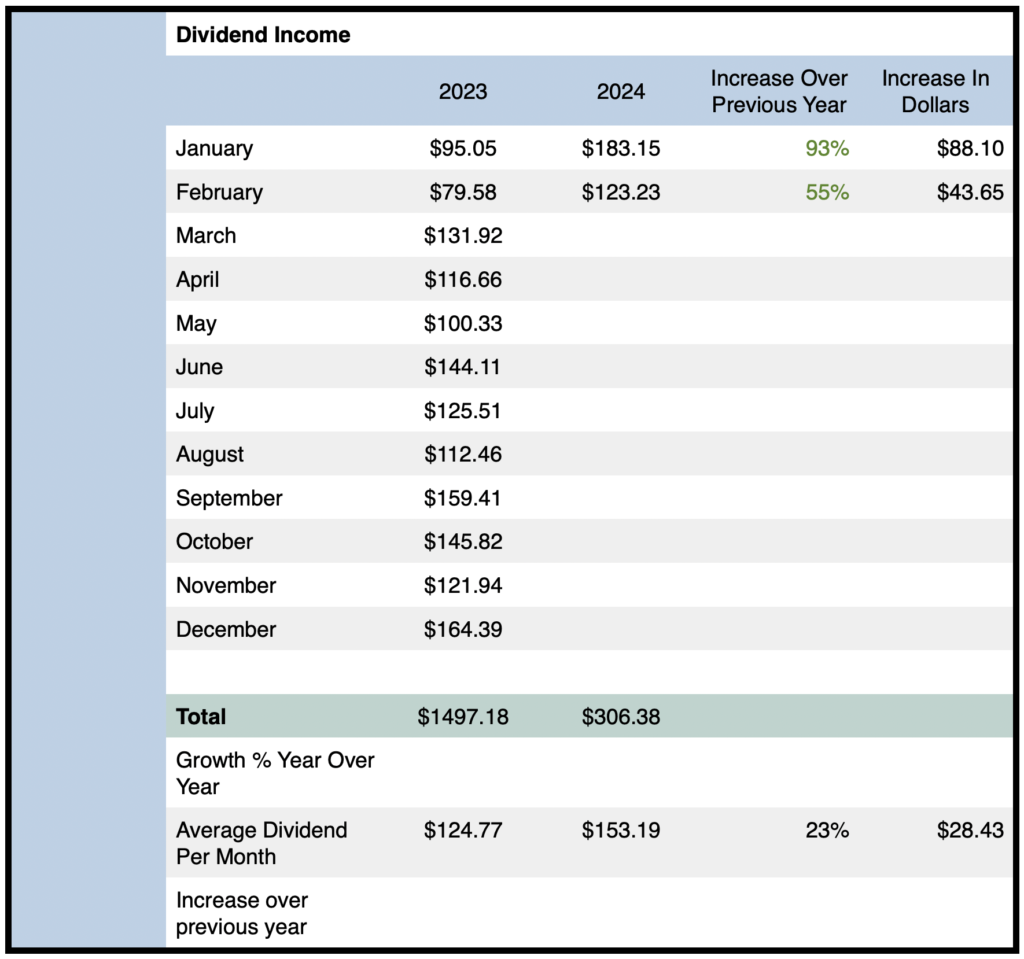

- Dividend income in February 2024 — Total dividend income in February 2024 was $123.23

- Year-over-year (YOY) dividend income increase — YOY dividend income increased by 55%

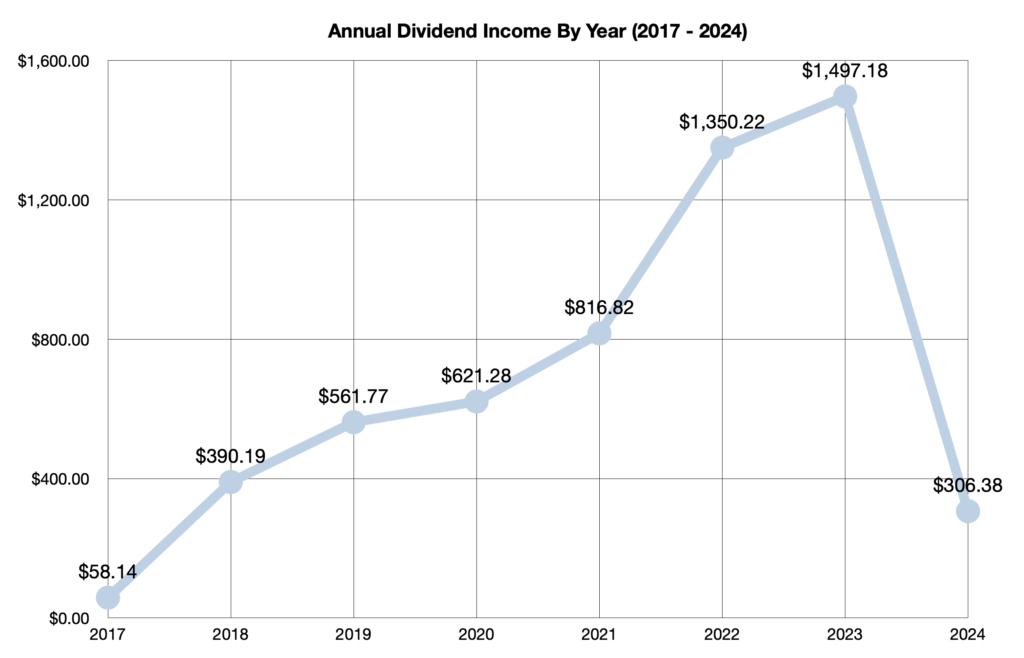

- Year-to-date (YTD) dividend income (Jan to Feb 2024) — YTD dividend income is $306.38

- YTD dividend income compared to Jan to Feb 2023 — YTD dividend income is up by 75% or $131.75 compared to the first two months of 2023

- Quarter-over-quarter (QOQ) dividend income increase — QOQ dividend income increased by 1%

- Average monthly dividend income 2024 — Average monthly dividend income in 2024 is $153.19 (Up 23% or $28.43 per month compared to 2023)

- All-time dividend income since June 2017 — All-time dividend income reached $5601.88

- Dividend income per day in February 2024 — Dividend income per day was $4.25

- Dividend Raises — 3 dividend raises were announced from BCE, REI.UN, CNQ, and META initiated a dividend

- Holdings — A total of 17 stocks/ETFs/REITs paid dividends

Dividend Income February 2024 Earnings — $123.23

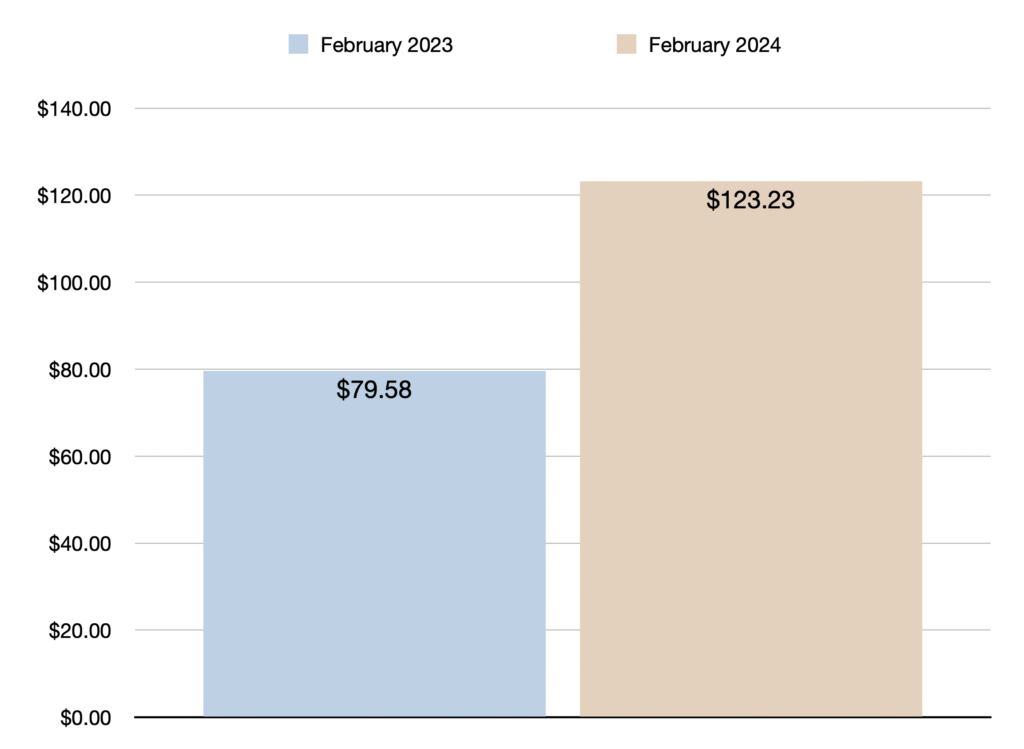

Dividend income in February 2024 was $123.23, which represents a 55% year-over-year increase compared to February 2023. In dollars, it’s an increase of $43.65 compared to the $79.58 received during the same month last year.

To put this month’s numbers in perspective, the highest rate of dividend growth in 2023 was 41% in December. This year’s low month is higher than last year’s best month. Of course, we’re only two months into the year. But I am thrilled to see dividend income growth off to such a strong start.

Also worth noting is that last February was the last time I received less than $100 in dividends. It’s now been a full year of receiving $100+ per month.

Year-to-date dividend income is now $306.36, which is up by an impressive 75% or $131.75 compared to the first two months of 2023. It took the first three months of last year to earn at least $306 in dividend income. Furthermore, the pace of dividend growth over the first two months of 2024 is well ahead of my 34% YOY growth goal for the year.

However, I still have a long way to go to meet my target of $2000 in dividends this year. My average dividend income over the first two months of 2024 is $153.19, which is up 23% or $28.43 per month compared to last year. But to reach my target, I must average $167 per month in dividends.

One other less favourable point to mention is that QOQ growth slowed. Quarter-over-quarter dividend income increased by just 1% or $1.29 compared to November 2023. This is likely due to saving more cash instead of investing.

Otherwise, my all-time dividend income since June 2017 reached $5601.88.

Operational Highlights

Reminder: I am not a licensed investment advisor and this post is not investment advice. You should always seek professional investment advice from a licensed investment advisor before investing. I am only sharing what I am doing with investing. None of the stocks mentioned are recommendations to purchase investments. All opinions are my own.

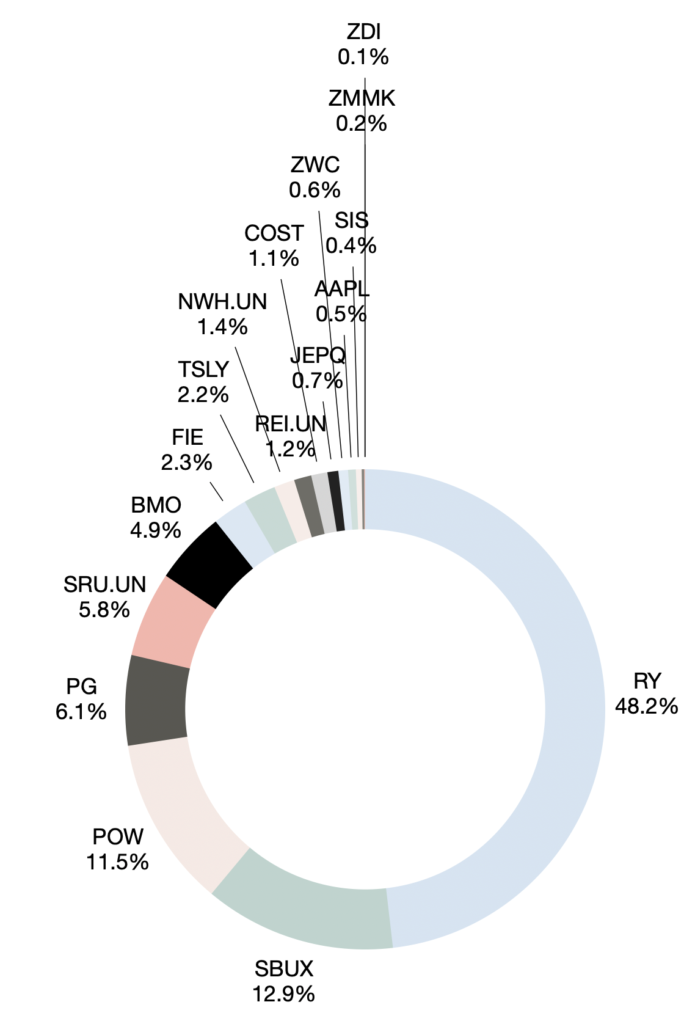

A total of seventeen positions paid dividend income in February 2024. This is up by one since the previous quarter.

As per usual during the February-May-August-November months, Royal Bank (RY) led the way, as it accounted for 48% of this month’s dividend income. Starbucks (SBUX) accounted for nearly 13%, Power Corp (POW) contributed 11.5%, Proctor & Gamble (PG) contributed 6%, SmartCentres (SRU.UN) contributed 5.8%, and BMO (BMO) added 4.9%, respectively. The remaining eleven positions accounted for 2.5% or less of February’s dividend income. A few of the other noteworthy stocks that paid were Apple (AAPL) and Costco (COST).

Trades

As I alluded to last month, I hold too many positions. I am overly diversified and not concentrated enough on my best positions. Hence why I made a few changes that I will discuss below.

To be clear, though, I am not a paper-hands trader that moves in and out of the market because of fear or FOMO. My core positions remain the same. I will rarely sell a core position unless there is a considerable change in the company, the dividend is cut, or the management is straying from its original plans.

Considering that the S&P 500 recently hit an all-time high, cryptocurrency is soaring, and the effect AI is having on technology stocks, I figured it was not a bad time to make some trades. Fortunately, I was able to earn capital gains overall on these trades. For the record, a few of these sales occurred in the first week of March.

In total, I sold 8 positions. A more detailed breakdown of what I sold and why is included below.

All Covered Call ETFs Sold

To begin, I completely sold out of all covered call ETFs. I sold ZWC, JEPQ, and TSLY.

Fortunately, I was able to earn a small profit from selling ZWC and JEPQ. However, I took a small loss on TSLY, even with dividends factored in. Although I only had 5 units as a test position, I am very glad I sold before the reverse split occurred. TSLY has continued to lose value.

In retrospect, I prefer to own quality businesses that appreciate in value and grow dividends rather than high-paying covered call ETFs that mostly depreciate. In my opinion, it’s not the time to own covered call ETFs when high-dividend stocks such as BCE and ENB are paying 7% to 8% yields. There are plenty of Canadian dividend stocks with high yields right now thanks to higher interest rates. As such, I don’t see the point in paying management fees to own covered call ETFs that depreciate over time. Perhaps there will be a time later on in my investment career when it will make sense.

Sold Ethereum (ETH)

I sold a small Ethereum position that I had been holding for a few years. Fortunately, I was able to earn a small profit.

The main reason I sold was contrarianism. Cryptocurrency has been on a tremendous bull run as of late. Bitcoin hit a new all-time high, and crypto investors have been in a frenzy. I’ve been noticing more and more mentions of Bitcoin and cryptocurrency on my X timeline. So I thought, why not take a profit? After all, it’s complete speculation anyways.

Otherwise, I have limited my crypto position to around 0.5% of my total portfolio value over the past few years. This percentage was creeping up a lot higher in this bull run, so I decided to sell.

For the record, I am still holding Bitcoin and I don’t plan on selling it. It’s the crypto I understand the most anyways. I wouldn’t hesitate to reinvest the ETH proceeds into BTC on a pullback. Maybe I’m a Bitcoin maximalist.

ETFs

Other than selling the covered call ETFs, there was one additional ETF that I sold — XEI.

Despite writing that it’s a position that could be built up to 5% of my portfolio’s value just last month, I decided to sell it.

The reason I decided to sell it is simply because its holdings overlap my Canadian holdings. After reviewing it further, it didn’t make much sense to pay a management fee to invest in the same stocks I’m already holding. As such, I sold my small position for a small profit.

For the record, I still think XEI is an excellent ETF with a low management fee that pays a monthly dividend.

Following the sale, I am only holding five ETFs: SCHD, ZDI, FIE, HMMJ, and ZMMK. These are all ETFs that complement my portfolio rather than overlap.

Stocks

I sold three more stocks recently that may surprise you: BMO, PLC, and PLTR.

BMO

I sold BMO for the same reason as I sold XEI — overlap. I am already invested in RY, CM, and FIE, so the financial services sector is already a very large portion of my portfolio. Especially considering RY is my largest position. Fortunately, I got lucky and sold BMO right before the post-earnings sell off. I was able to make a decent capital gain on the relatively small position. I also still received the dividend this month. But unfortunately I will not be getting the dividend in May now.

PLC

As for Park Lawn (PLC), I sold it recently post earnings because I didn’t like the earnings report. Mainly, I did not like the financial outlook and comment about no longer believing they can meet their previously announced five-year plan targets. Here is the comment from Park Lawn’s latest results:

“Given the recent completion of the transformational disposition of certain legacy businesses at the end of December, as well as the current macroeconomic environment, we no longer believe that our previously announced five-year long-term aspirational financial targets are achievable by the conclusion of 2026”

As I stated earlier, I will sell if management strays from its plans. I do not trust a management team that makes a commitment that they can’t meet. Furthermore, the revenue growth was relatively weak. For now, I will watch from the sidelines and see if management can continue their growth by acquisition strategy. Fortunately, I was able to make a small capital gain on this stock as well.

PLTR

Lastly, I sold my beloved PLTR. I have to admit I feel a little bittersweet about this sale. I have grown to enjoy hearing from their quirky CEO, Alex Karp, and the company has actually been growing since I was holding it. Frankly, it’s one of the more exciting stocks to invest in. I eagerly anticipated each earnings report over the past few years, and I’ll probably continue to do so. However, it’s important to remember that there’s no place for emotion and excitement in investing. The recent AI bull run and Palantir’s recent earnings report provided an opportunity to sell and take a profit.

The main reasons for selling were contrarianism, valuation, risk management, and because my cost was too high in the first place.

Frankly, the enthusiasm surrounding the company is getting a little bit crazy. It’s trading close to 300 times earnings and too many people view it as a sure thing. Although I do think it has the chance to have a similar trajectory as CRM over the next decade, there are other stocks in the AI space with more reasonable valuations. Furthermore, the products/services are easier to analyze and understand.

Admittedly, I might regret selling this stock. I could easily see it running up to an all-time high if this AI bull run continues. But at the end of the day, nobody knows what will happen. Ultimately, I decided it was a good time to do the opposite of the crowd and take risk off the table. With that said, I am going to keep a very close eye on Palantir and look for a lower entry point. I am not opposed to buying this stock again in the future.

Outlook

I expect full-year dividend income to be in the range of $2000, unchanged from my 2024 financial goals.

Reaching $2000 would represent a 34% year-over-year dividend growth rate compared to the $1497.18 received in 2023. This guidance means I am expecting the dividend growth rate to triple compared to the 11% YOY growth in 2023.

Based on the $306.36 received so far in 2024, I must earn at least $1693.62 more. Broken down monthly, I must earn at least $169.36 per month for the remainder of the year.

Based on this year’s average monthly dividend income ($153.19), I am falling slightly behind. If I continue to average $153.19 per month, the portfolio will end up generating $1838.28.

Of course, I will continue to rely on the three dividend growth levers (reinvesting dividends | dividend raises | investing new capital).

Three raises were announced this past month from BCE, REI.UN, and CNQ.

I also reinvested the capital gains from the positions that were sold. Furthermore, February’s dividend income was reinvested.

If any of the dividend growth levers have been lacking, it’s investing new capital. I have been executing well on my plan to build up cash this year. As a result, I have not been able to put as much new capital into my investment portfolio. I’ve made a lot of progress with saving cash this year, so it may be time to start allocating more of my savings towards investing.

Either way, I will continue to monitor my total investment returns and compare performance to the S&P 500. My goal is to maintain an income-centric portfolio with a low-risk profile that is competitive with the S&P 500. Ideally, my portfolio will stay competitive in the good years and outperform in the down years.

Final Thoughts

In summary, dividend income in February 2024 was $123.23. This represents a 55% year-over-year increase compared to February 2023. This year-over-year dividend growth rate is higher than any month in 2023.

Year-to-date dividend income is now $306.36, which is up by an impressive 75% or $131.75 compared to the first two months of 2023.

Moreover, my target dividend income for 2024 remains unchanged, as I still expect to receive at least $2000 in dividends by the end of the year.

Otherwise, it was an unusually high month for operational highlights, as eight trades were made. I was able to earn capital gains, take risk off the table, and reduce the number of positions in my portfolio.

Overall, it was another excellent month for the investment portfolio, as the momentum carried over from January’s record results.

Stay tuned for more exciting dividend income updates in 2024 as the snowball grows!

Related Dividend Income Updates

Dividend Income January 2024 — $183.15

Dividend Income February 2023 — $79.53

All Dividend Income Updates Since 2017

I am not a licensed investment or tax adviser. All opinions are my own. This post may contain advertisements by Monumetric and Google Adsense. This post may also contain internal links, affiliate links to BizBudding, Amazon, Bluehost, and Questrade, links to trusted external sites, and links to RTC social media accounts.

Connect With Dividend Income Investor

Instagram: @dividendincomeinvestor_

Threads: @dividendincomeinvestor_

Pinterest: @dividendincomeinvestor

Facebook: @Reversethecrushblog

Dividend Income January 2024 — Dividend Income Investor Reports Record Results; $183.15 (93% YOY Increase)

Dividend Income January 2024 — Dividend Income Investor Reports Record Results; $183.15 (93% YOY Increase)