Dividend income February 2023 — Chronicling monthly dividend income to document my journey to financial independence. I am not a licensed investment advisor and this post is not investment advice. All opinions are my own.

The month of February is over, so it’s time to reflect on my dividend income performance.

In reflecting on the past month, I must admit that the growth I experienced was relatively modest when compared to the previous year. While the numbers may not have been particularly eye-opening, there is a silver lining to be found in the fact that dividend income continues to steadily increase when compared to the same period last year.

In this post, I will share insights on my February dividend earnings, as well as provide details about which stocks paid dividends.

Let’s begin by taking a look at this month’s highlights:

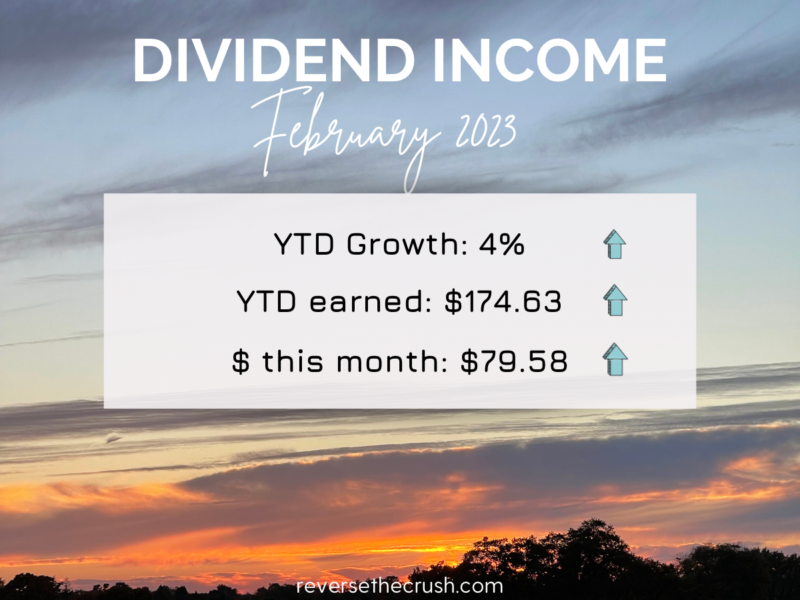

Dividend Income February 2023 Highlights

- Total dividend income received in February 2023 was $79.58

- Year-over-year (YOY) dividend income grew by 4% or $3.25 compared to February 2022

- Year-to-date (YTD) dividend income in 2023 is $174.63

- YTD dividend income is up by 5% or $8.04 compared to the first two months of 2022

- 5 positions paid dividend/distributions in February 2023

- All-time dividend income since June 2017 is $3,972.95

- Monthly average dividend income in 2023 is $87.32

- Dividend income per day in February 2023 is $2.84

Dividend Income February 2023 Earnings — $79.58

My investment portfolio generated $79.58 in dividend earnings in February 2023.

This represents a modest 4% year-over-year increase compared to February 2022.

As I have previously mentioned in my blog, I anticipated a relatively conservative rate of dividend income growth for the first half of this year. However, I am optimistic that the pace of growth will begin to accelerate by the middle of the year.

Year-to-date dividend income is up to $174.63, which is slightly ahead of the first two months of 2022. I’m ahead by a modest 5% or $8.04.

Otherwise, my all-time dividend income reached $3,972.95 after factoring in February’s earnings. I am inching closer and closer to reaching $4,000 all-time in dividend income since June 2017. When I began this journey, I only made $4.27 my first month. It’s surreal to see how far the portfolio has come in this short period of time.

Stocks/REITs That Paid In February 2023

Five positions paid income in February 2023.

Below is a breakdown of which positions paid:

- Royal Bank (Ticker: RY)

- Starbucks (Ticker: SBUX)

- SmartCentres REIT (Ticker: SRU.UN)

- NorthWest Healthcare REIT (Ticker: NWH.UN)

- Apple (Ticker: AAPL)

A total of five positions paid dividends or distributions in February 2023. Broken down further, three stocks and two REITs paid.

This is actually the lowest number of positions that have paid in a month in over a year. I have been in the process of reorganizing my portfolio since last year. The process has involved taking a few capital gains. In turn, only five positions paid in February.

As per usual, the bulk of my dividend income was from Royal Bank. A staggering 70% of this month’s income was earned from the Canadian bank. Although I am very comfortable having Royal Bank as my largest position, I must admit that this amount of reliance is too high. But I’m not worried about it, as that percentage will become lower naturally as I purchase other equities.

Otherwise, Starbucks accounted for 18% of February’s dividend income, SmartCentres REIT accounted for 7%, NorthWest Healthcare REIT contributed 5%, and Apple added 1%.

February Dividend Income Growth Since 2018

The month of February has seen a slow but steady increase in dividend income over the years.

Since February 2018, dividend income has increased from $10.86 to $79.58 in February 2023.

Back in February 2018, my portfolio generated $10.86.

In February 2019, my dividend income doubled to $22.37.

Then in February 2020, dividend income nearly doubled again, as $38.98 was generated.

In February 2021, growth slowed down as $41.54 was generated.

In February 2022, dividend income jumped to $76.33.

Finally, in February 2023, a modest increase was realized as $79.58 was generated.

Outlook — $1,225.37 To Reach My 2023 Target Income

As an investor, my dividend income target for 2023 is to earn a minimum of $1,400 in dividends. I’ve broken down this goal and calculated that I will need to receive $1,225.37 more in dividends by the end of the year. To achieve this, I must maintain an average of $122.54 in monthly dividends over the remaining ten months.

Admittedly, this target may appear challenging since I’ve only been averaging $87.32 per month in dividends for the first two months of 2022. However, I’ve been consistently investing 35% of my income in dividend stocks so far this year, and I’m optimistic that the impact of these investments will reflect in future reports.

Dividend Income February 2023 — Final Thoughts

In summary, my dividend income portfolio generated $79.58 in February 2023.

This represents a modest 4% year-over-year increase compared to February 2022.

Moreover, my year-to-date dividend income is up to $174.63. This represents a 5% increase over the first two months of 2022.

Furthermore, my all-time dividend income reached $3,972.95 after factoring in February’s earnings. I expect to cross $4,000 all time by the end of March.

In closing, I’m pleased to report that February 2023 was another prosperous month for my investment portfolio. As I anticipated, my portfolio has been generating consistent but moderate growth since the start of the year. Nevertheless, I remain optimistic that I can boost year-over-year growth by mid-year through a combination of reinvesting dividends and saving a substantial portion of my income.

Related Dividend Income Updates

I am not a licensed investment or tax adviser. All opinions are my own. This post may contain advertisements by Monumetric and Google Adsense. This post may also contains internal links, affiliate links to BizBudding, Amazon, Bluehost, and Questrade, links to trusted external sites, and links to RTC social media accounts.

Connect with RTC

Twitter: @Reversethecrush

Pinterest: @reversethecrushblog

Instagram: @reversethecrush_

Facebook: @reversethecrushblog

Dividend Income January 2023

Dividend Income January 2023