Dividend income August 2024 — Documenting monthly dividend income and investment activity to chronicle the journey to financial independence.

I am not a licensed investment advisor, and the content of this post does not constitute professional investment advice. The information provided reflects my personal investment experiences and opinions, and should not be interpreted as a recommendation to buy or sell any stocks or other investments. Before making any investment decisions, please seek the advice of a qualified and licensed investment advisor. All opinions expressed are my own and are based on my personal perspective and experiences. This post may contain affiliate links to products/services I personally use and endorse.

The Dividend Income Investor blog is pleased to announce dividend income results for August 2024.

August 2024 was a standout month for my dividend income portfolio, marked not only by robust dividend earnings but also impressive gains in net worth and capital growth. A major highlight was Starbucks’ CEO transition announcement, which spiked the stock price by over 24% in just one day. Additionally, strong earnings reports from Royal Bank and CIBC bolstered my financial standing, while diligent savings contributed to an overall stellar performance.

Additionally, my strategic investments in REITs and utility stocks over the past year have continued to perform well, fuelled by expectations of further rate cuts this September. This rally has significantly contributed to my net worth and capital growth. However, it has also placed me in a bit of a dilemma—many of these positions have appreciated so much that I can no longer average down on them.

As a result, I chose to diversify my portfolio by initiating several new positions and selling a few existing ones, including taking profits on a prominent technology stock. Moving forward, I plan to be even more selective with my investments, focusing on companies with strong competitive advantages or “moats.” To prepare for potential market fluctuations, I’m also increasing my contributions to money market funds. On the emergency fund front, I’ve been actively seeking better returns and have secured a 6.25% interest rate through January.

In the sections below, I’ll provide detailed information on the bank offering the 6.25% interest rate and how you can take advantage of it, as well as the specifics of the stocks I sold and acquired in August. But first, let’s dive into the dividend income figures for August 2024.

Dividend Income August 2024 Highlights

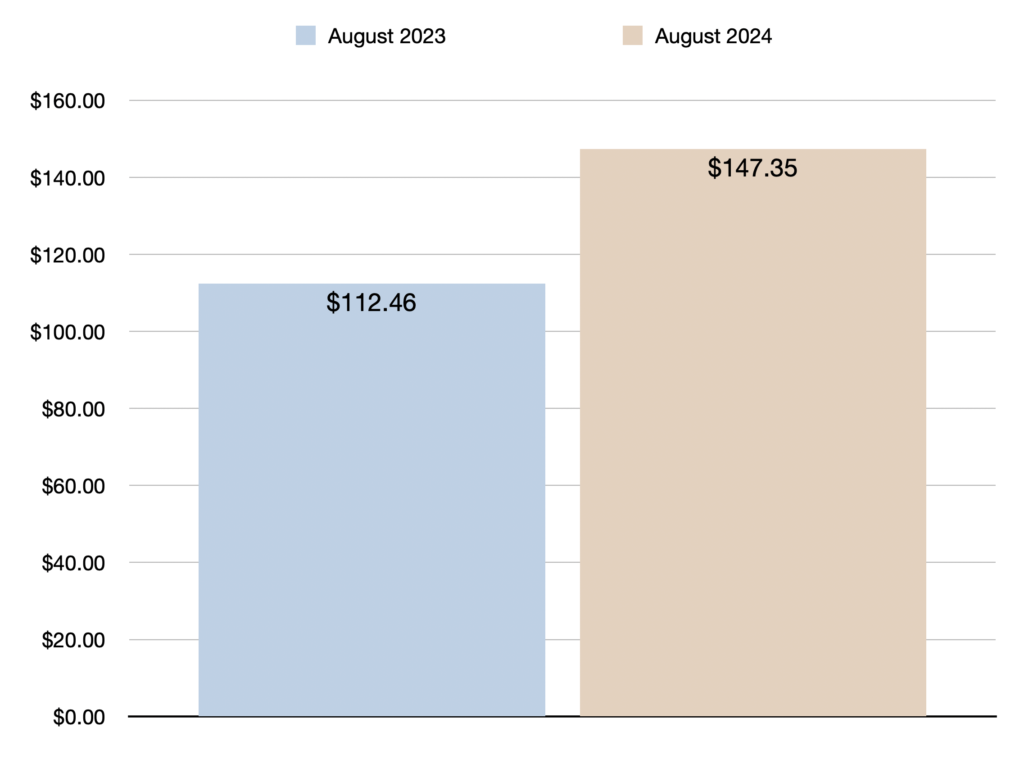

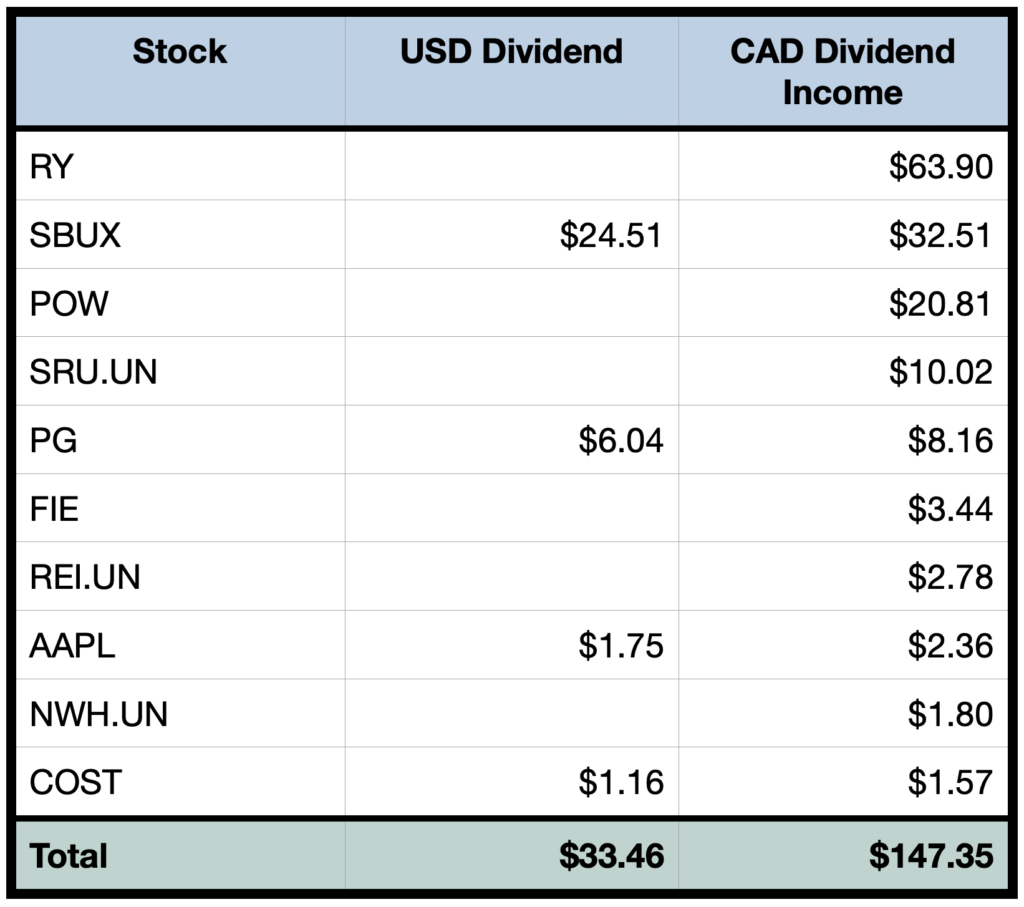

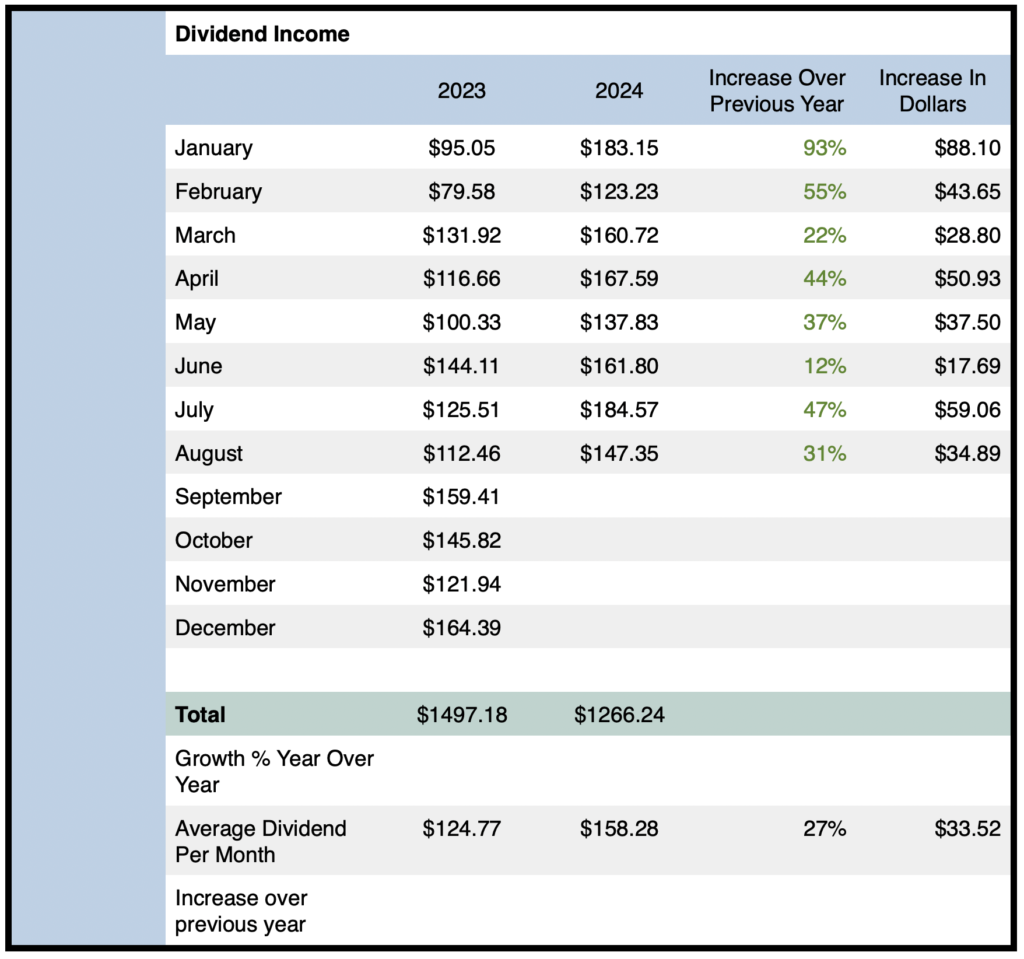

- Total dividend income earned in August 2024 was $147.35

- Year-over-year (YOY) dividend income increased by 31% or $34.89 compared to August 2023

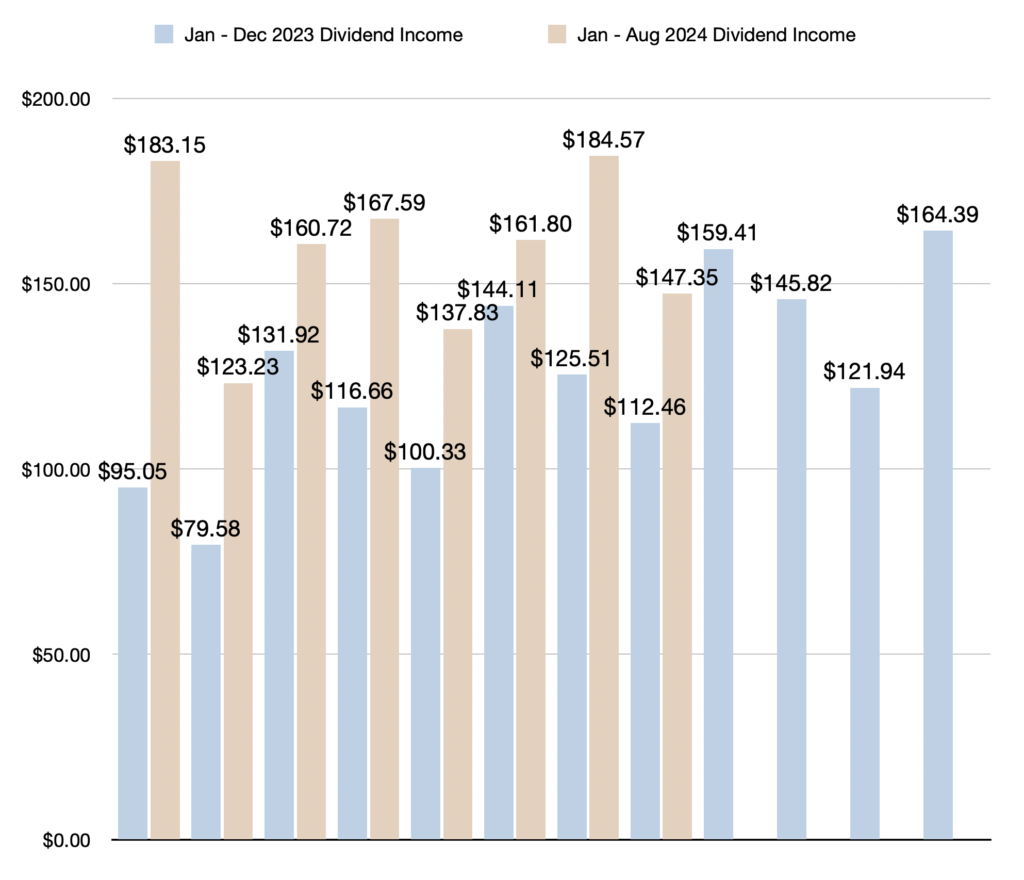

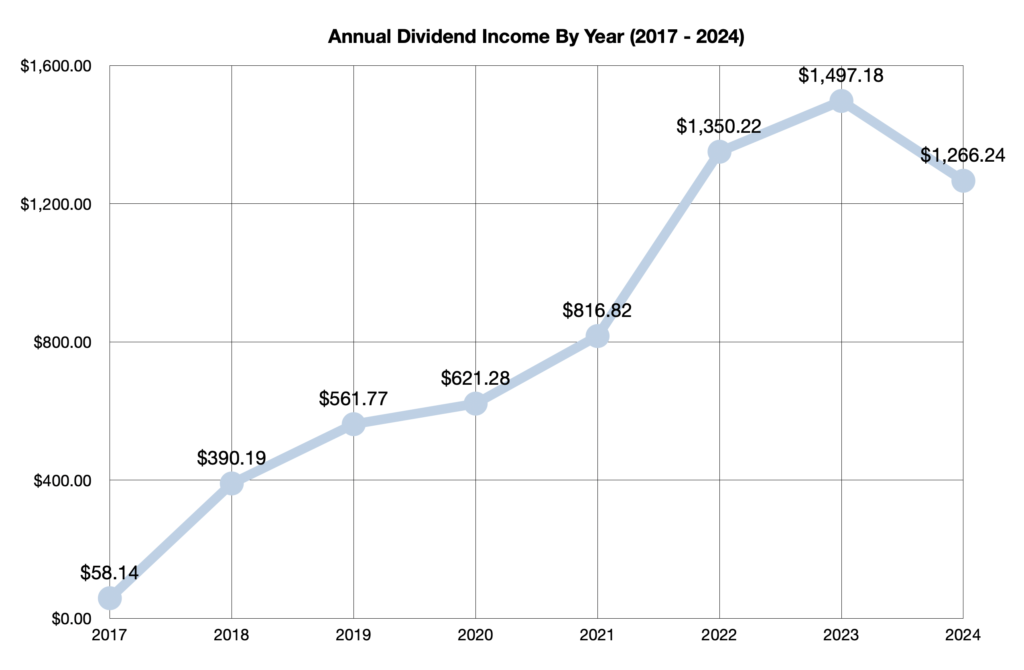

- Year-to-date (YTD) dividend income (January – August 2024) is up to $1266.24

- YTD dividend income is up by 39% or $360.62 compared to the first eight months of 2023

- Quarter-over-quarter (QOQ) dividend income increased by 7% or $9.52 compared to May 2024

- Average monthly dividend income in 2024 is $158.28 (up 27% or $33.52 per month compared to 2023)

- All-time dividend income since June 2017 reached $6561.74

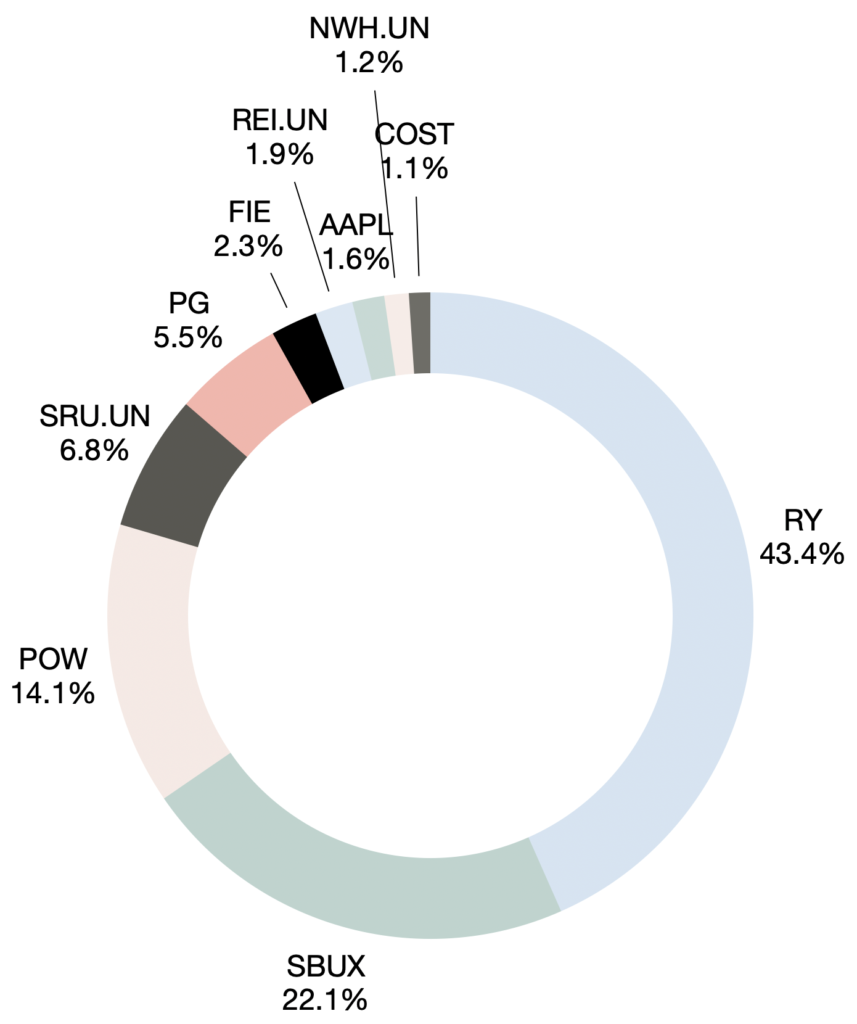

- 10 holdings paid dividends in August 2024

Dividend Income August 2024 Earnings — $147.35

Before diving into the dividend income numbers, I want to reiterate that total return is what truly matters, but tracking dividend income offers a measurable way to gauge progress and serves as a helpful proxy. Furthermore, tracking dividend income provides motivation to keep saving and investing and is helpful for investors to stick to a strategy.

Of course, I also monitor my total investment returns and compare performance to the S&P 500.

That said, these blog posts concentrate specifically on dividend income rather than total returns. Dividend income provides a clear and measurable way to track progress and serves as a useful indicator of my portfolio’s overall growth. It allows me to assess my journey toward financial independence and document the incremental increases on a monthly basis. For blogging purposes, focusing on incremental dividend income progress offers more actionable insights than simply reporting the monthly fluctuations of the S&P 500 or my investment portfolio overall.

Continuing from that focus, let’s delve into the specifics of the dividend income for August 2024. Total dividend income reached $147.35, marking an impressive 31% year-over-year increase. This translates to a $34.89 rise from the $112.46 received in August of the previous year.

Year-to-date dividend income reached $1,266.24, nearing the totals from 2022 and 2023. That’s a remarkable 39% increase—$360.62 more than the first eight months of 2023!

Quarter-over-quarter (QOQ) dividend income increased by 7% or $9.52 compared to May 2024. This increase is largely due to recent additions to existing positions over the past quarter, including $SBUX, $POW, $SRU.UN, and $REI.UN.

After factoring in August’s dividend income, all-time dividend income since June 2017 reached $6561.74.

Wealthsimple: Open an investment account with Wealthsimple and receive a $25 bonus when you fund your account. Wealthsimple is an excellent brokerage that offers zero commission on Canadian trades, making it a top choice for cost-effective investing. To get your $25 bonus and start investing with Wealthsimple, click here.

Operational Highlights — August 2024

Reminder: I am not a licensed investment advisor, and the content of this post does not constitute professional investment advice. The information provided reflects my personal investment experiences and opinions, and should not be interpreted as a recommendation to buy or sell any stocks or other investments. Before making any investment decisions, please seek the advice of a qualified and licensed investment advisor. All opinions expressed are my own and are based on my personal perspective and experiences.

In August 2024, I received dividend payments from 10 holdings, a decrease of one from the previous year. I sold two positions for a profit—$BMO and $SIS—but added $COST, which has since yielded over 77% in gains, including dividends. This adjustment results in a net reduction of just one holding.

See the spreadsheet below for a full breakdown of which stocks paid dividends in August 2024:

New Holdings In August 2024

In August 2024, I initiated four new positions: $GOOGL, $CNR, $PRL, and $ZMMK. However, in practice, this amounts to two new positions. I use $ZMMK as a temporary parking spot for cash when the stock market peaks and I’m awaiting new opportunities. Additionally, while I mentioned a planned investment in $PRL in last month’s update, this position was actually established on August 1st.

I’m not going to go into a deep dive on why I invested in these positions but I’ll just briefly comment on each of them.

$GOOGL —I initiated a position in $GOOGL because it’s currently the most undervalued among the MAG 7 stocks. Despite long-term concerns about competition from AI rivals like ChatGPT, I believe Google’s core business remains strong, bolstered by its significant competitive advantages and ownership of YouTube. The stock has faced recent declines due to issues surrounding its AI strategy and discussions about potential breakups. However, I view this as a buying opportunity and plan to increase my holdings if the stock price drops further.

$CNR — I’ve been eyeing $CNR for a while and finally decided to invest. $CNR is a crucial business with strong competitive advantages—after all, who’s going to launch a new railway company? A recent strike highlighted just how essential it is. I’ve started with a few shares and plan to add more in the coming months.

$PRL — I touched on my investment in $PRL, a small-cap stock with promising lending and AI focus, in last month’s blog. Since then, I’ve added more shares in mid-August and am up 13.78% in just one month. I wish I’d invested more, but I’ll keep an eye on the company and look to buy more if the price dips.

$ZMMK — I use this money market ETF to park cash while waiting for market dips. With anticipated rate cuts in September possibly already priced in and Warren Buffett recently offloading stocks, it’s prudent to reduce risk after recent market gains. Plus, I earn a 5% yield while I wait.

I’ve opened a new high-interest savings account with Simplii Financial, offering 6.25% until January 2025. I’m moving my emergency fund there to make the most of this rate.

Simplii Financial: Simplii Financial offers no-fee bank accounts and is a fantastic choice for holding your emergency fund. I recently opened an account and secured a 6.25% interest rate until January 2025. Right now, they have a great referral offer where you can earn between $50 and $600 just for becoming a Simplii Financial client. To learn more about this offer, claim your referral bonus, and find an excellent option for your emergency fund, click here.

Positions Sold In August 2024

$TSLA — The biggest move I made in August was selling $TSLA for a solid gain. I bought shares earlier this year below $180 and sold at $216.28. I might regret it if the stock soars, but my decision was based on sound reasoning.

Here are the reasons I sold $TSLA:

- Locked in a profit

- Rising competition

- Price cuts impacting margins

- Reasons to hold (FSD, Robotaxi) feel speculative

- Better opportunities elsewhere

- Doesn’t meet my usual investment metrics

- Recent run-up and overly optimistic sentiment

- Recession predicted for 2025

$CU — I sold my small stake in $CU after holding it for a very short period of time. I essentially traded it on expectation of further rate cuts and it worked out. I will get a small dividend in September for holding it as well. But ultimately, I prefer holding $FTS in the utilities sector and see less risk and similar yield in $ZMMK, so I decided to sell $CU.

$VFV — I did the unthinkable and sold a portion of my S&P 500 ETF. However, there’s no need to panic—I only sold 1 share from a position I’d been building through fractional purchases. I realized a gain of over 22% and still retain a small fractional stake. With the S&P 500’s remarkable run this year and its increasingly top-heavy composition, I decided it was prudent to reduce some risk and lock in those gains.

Otherwise, I’ve been considering selling a few other positions to lock in gains and reallocate to more promising opportunities. However, I haven’t acted on these decisions yet, as I’ve been swamped with work and haven’t had the time to fully evaluate my options.

Outlook/Guidance

I expect full-year dividend income to be in the range of $2000, unchanged from my 2024 financial goals.

Reaching $2000 would represent a 34% year-over-year dividend growth rate compared to the $1497.18 received in 2023.

Based on the $1266.24 received so far in 2024, I must earn at least $733.76 more by the end of the year. Broken down monthly, I must earn at least $183.44 per month for the remainder of the year.

Based on this year’s average monthly dividend income ($158.28), I am still trending slightly behind. If I continue to average $158.28 per month, the portfolio will end up generating $1899.36.

Despite being slightly behind, I am still confident that I will be able to achieve my $2000 target dividend income. The reason for my confidence is because my PADI (projected annual dividend income) is already well above $2000, and $200+ months are likely in the very near future.

To grow dividend income, I will continue to rely on the three dividend growth levers: reinvesting dividends | dividend raises | investing new capital.

Final Thoughts — Dividend Income August 2024

In summary, dividend income in August 2024 was $147.35, which represents an impressive 31% year-over-year increase compared to August 2023.

Year-to-date dividend income is now $1266.24, which is up by an impressive 39% or $360.62 compared to the first eight months of 2023.

Moreover, all-time dividend income since June 2017 reached $6561.74.

For the second consecutive month, I enjoyed exceptional capital growth alongside strong dividend results. However, this success has presented a challenge: I can no longer average down on many of my holdings, particularly in the REIT and utility sectors, due to the recent decline in rates.

Also worth noting, I initiated four new positions in August 2024: $GOOGL, $CNR, $PRL, and $ZMMK. Additionally, I sold shares of $TSLA, $CU, and $VFV.

Stay tuned for more exciting dividend income updates in 2024 as the snowball grows!

Related Dividend Income Updates

Dividend Income August 2024 — $112.46

Dividend Income May 2024 — $137.83

All Dividend Income Updates Since 2017

You may have noticed that I’ve recently removed display ads from the blog. Running this site involves ongoing costs, including web hosting and domain renewal, and your support is greatly appreciated. By opening an account with the companies listed below, which I personally use for investing and saving, you can help support the blog while also benefiting from their services. It’s a win-win—these companies offer great incentives for signing up. See below for more details and how you can get started.

Wealthsimple: Open an investment account with Wealthsimple and receive a $25 bonus when you fund your account. Wealthsimple is an excellent brokerage that offers zero commission on Canadian trades, making it a top choice for cost-effective investing. To get your $25 bonus and start investing with Wealthsimple, click here.

Simplii Financial: Simplii Financial offers no-fee bank accounts and is a fantastic choice for holding your emergency fund. I recently opened an account and secured a 6.25% interest rate until January 2025. Right now, they have a great referral offer where you can earn between $50 and $600 just for becoming a Simplii Financial client. To learn more about this offer, claim your referral bonus, and find an excellent option for your emergency fund, click here.

Connect With Dividend Income Investor

Instagram: @dividendincomeinvestor_

Threads: @dividendincomeinvestor_

Pinterest: @dividendincomeinvestor

Facebook: @Reversethecrushblog

Dividend Income July 2024 — Dividend Income Investor Reports Record Results; $184.57 (47% YOY Increase)

Dividend Income July 2024 — Dividend Income Investor Reports Record Results; $184.57 (47% YOY Increase)