December 2024 Dividend Income Update — Documenting monthly dividend income and investment activity to chronicle the journey to financial independence.

I am not a licensed investment advisor, and the content of this post does not constitute professional investment advice. The information provided reflects my personal investment experiences and opinions, and should not be interpreted as a recommendation to buy or sell any stocks or other investments. Before making any investment decisions, please seek the advice of a qualified and licensed investment advisor. All opinions expressed are my own and are based on my personal perspective and experiences. This post may contain affiliate links to products/services I personally use and endorse.

The Dividend Income Investor Blog is excited to share the dividend income results for December 2024, along with a recap of the full-year dividend performance for 2024.

December 2024 capped off a strong year, delivering just enough dividend income to help me hit a major milestone — surpassing my $2,000 dividend income target for the year.

Overall, 2024 was a spectacular year for the stock market, with my benchmark, the S&P 500, delivering an impressive 23%+ return. Fortunately, my dividend-focused portfolio outperformed, including the dividend income numbers I’m about to share.

I’m excited to dive into the details of my 2024 dividend income—there’s a lot to cover, so let’s jump right into the highlights!

December 2024 Dividend Income Highlights

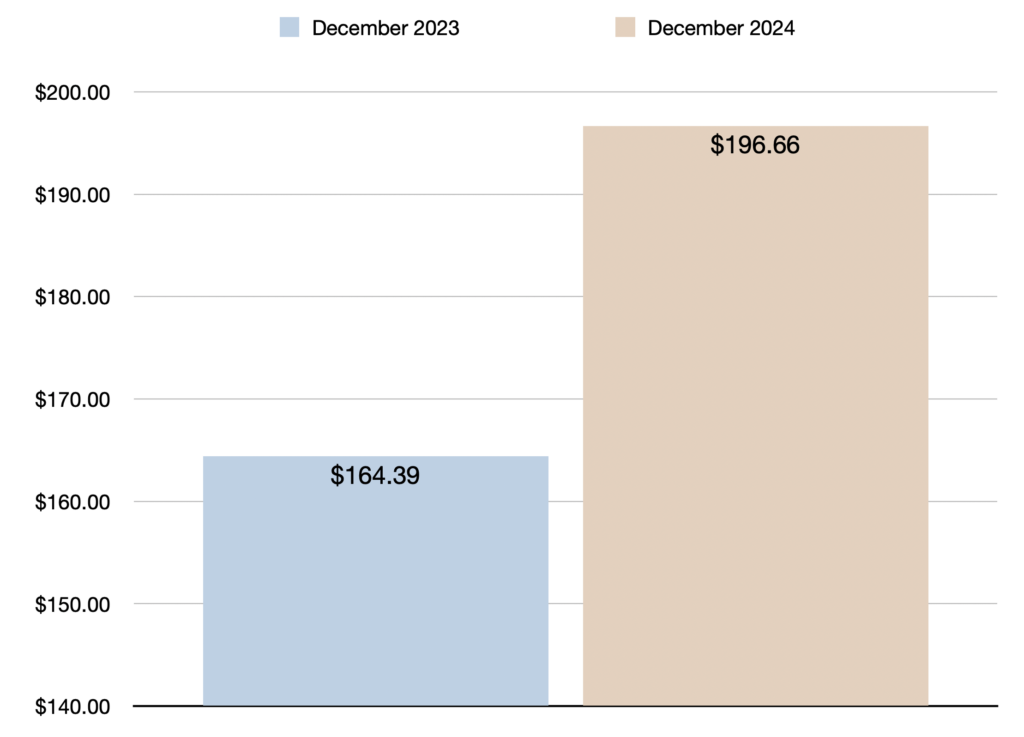

- Total dividend income earned in December 2024 was $196.66 (2nd highest month ever)

- Year-over-year (YOY) dividend income increased by 20% or $32.27 compared to December 2023

- Quarter-over-quarter (QOQ) dividend income increased by 12% or $21.36 compared to September 2024

- PADI increased by $34 as dividend raises were announced by 3 companies: $ENB, $RY, & $CM

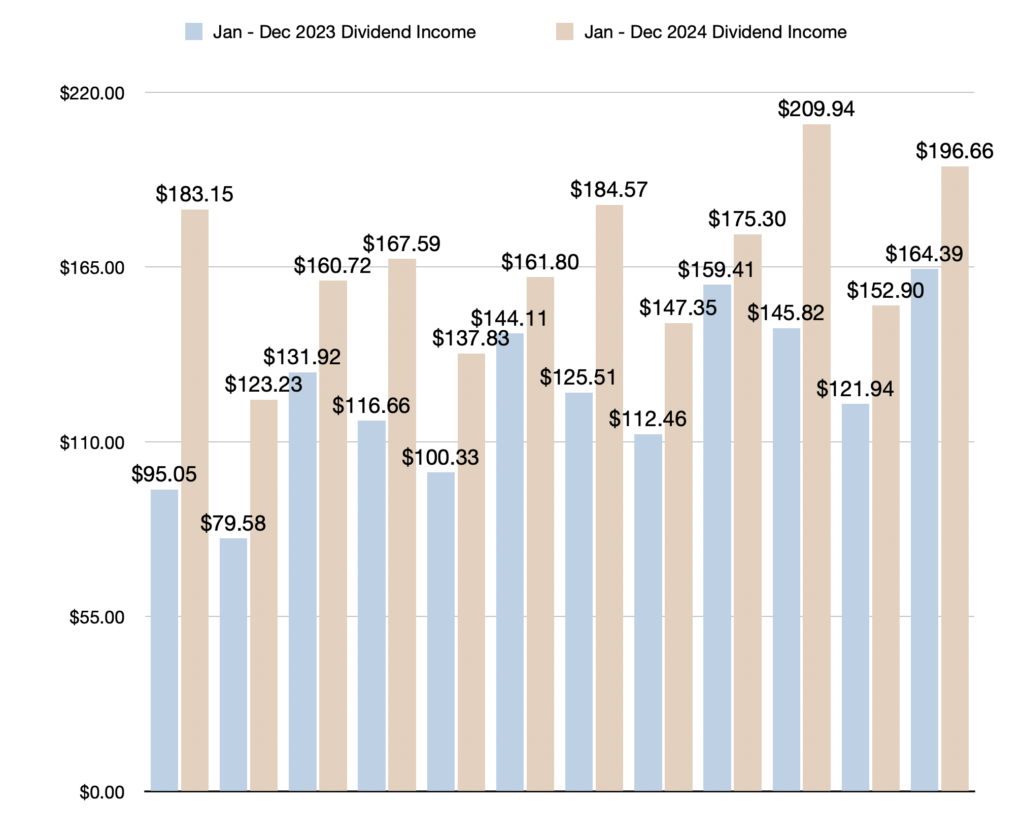

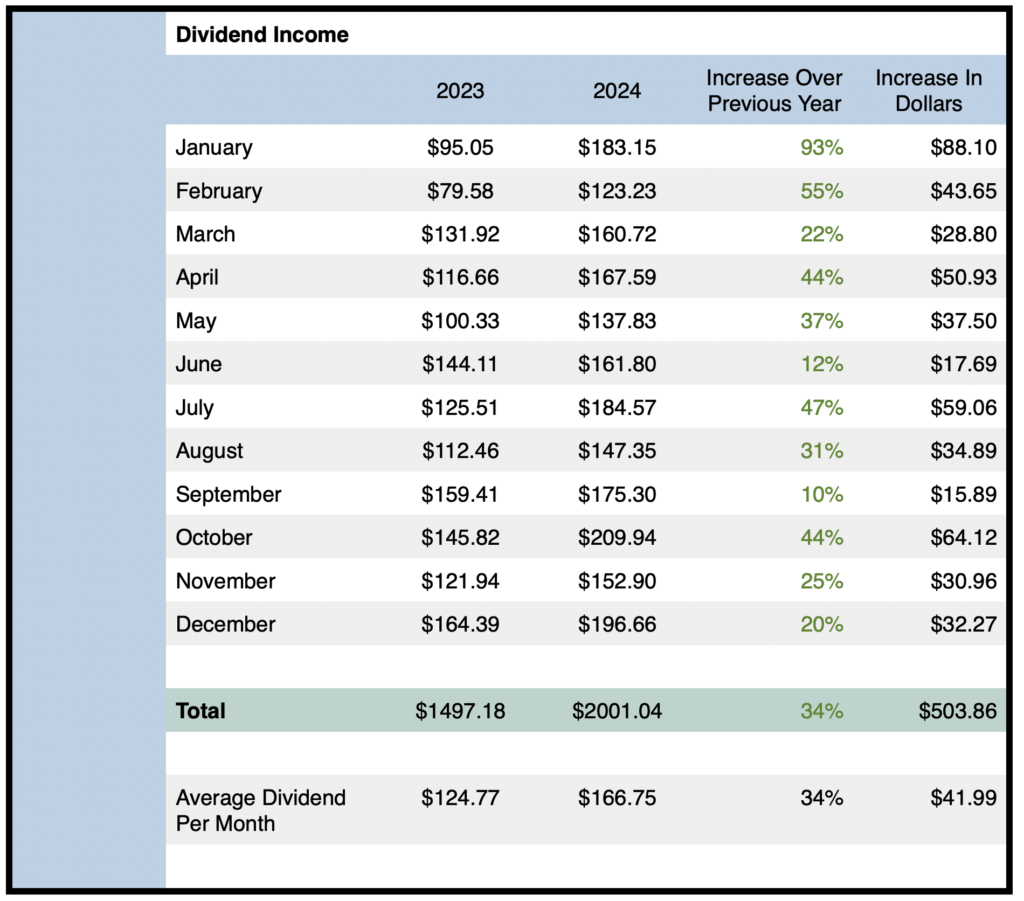

2024 Full Year Dividend Income Highlights

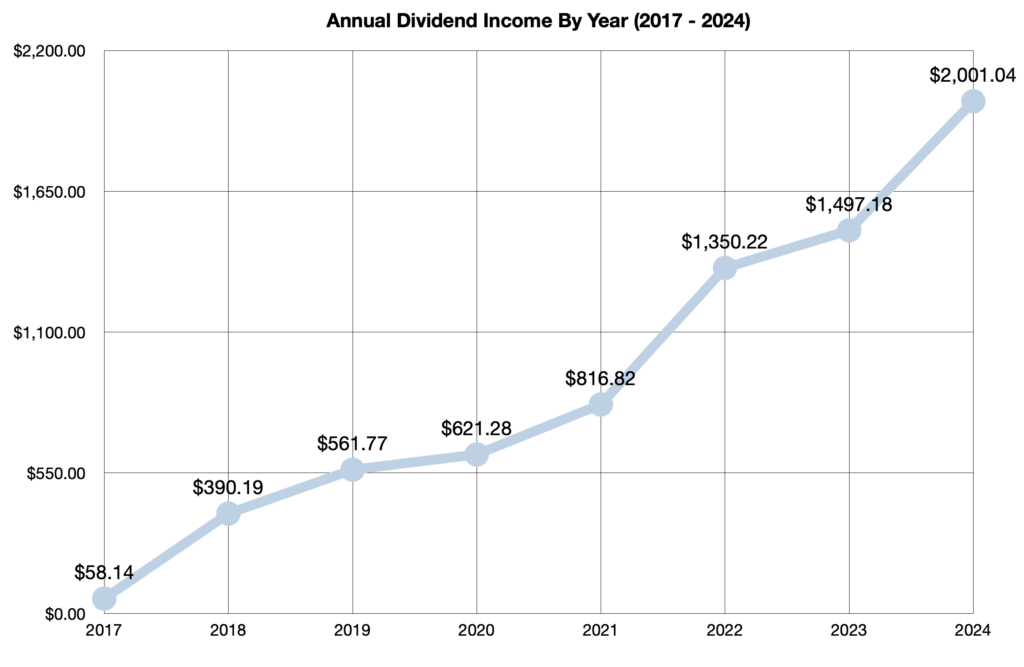

- Total dividend income received in 2024 was $2,001.04 (most ever)

- Total dividend income for 2024 increased by $503.86, marking a 34% year-over-year growth compared to 2023

- Average monthly dividend income in 2024 was $166.75 (Up 34% or $41.99 per month compared to 2023)

- All-time dividend income since June 2017 reached $7,286.54

- Dividend raises added $95.34 in PADI in 2024

- Reinvesting dividends added $88.22 to my PADI in 2024

- Beat the S&P 500

December 2024 Dividend Income Earnings — $196.66

Total dividend income for December reached $196.66, representing a 20% year-over-year increase—a rise of $32.27 from the $164.39 received in December 2023. It’s also worth noting that it was the second highest month ever for dividend income.

Total year-to-date dividend income reached $2,001.04, exceeding my $2,000 target. Overall, my dividend earnings saw an impressive growth of $503.86, marking a 34% increase over the $1,497.18 collected in 2023.

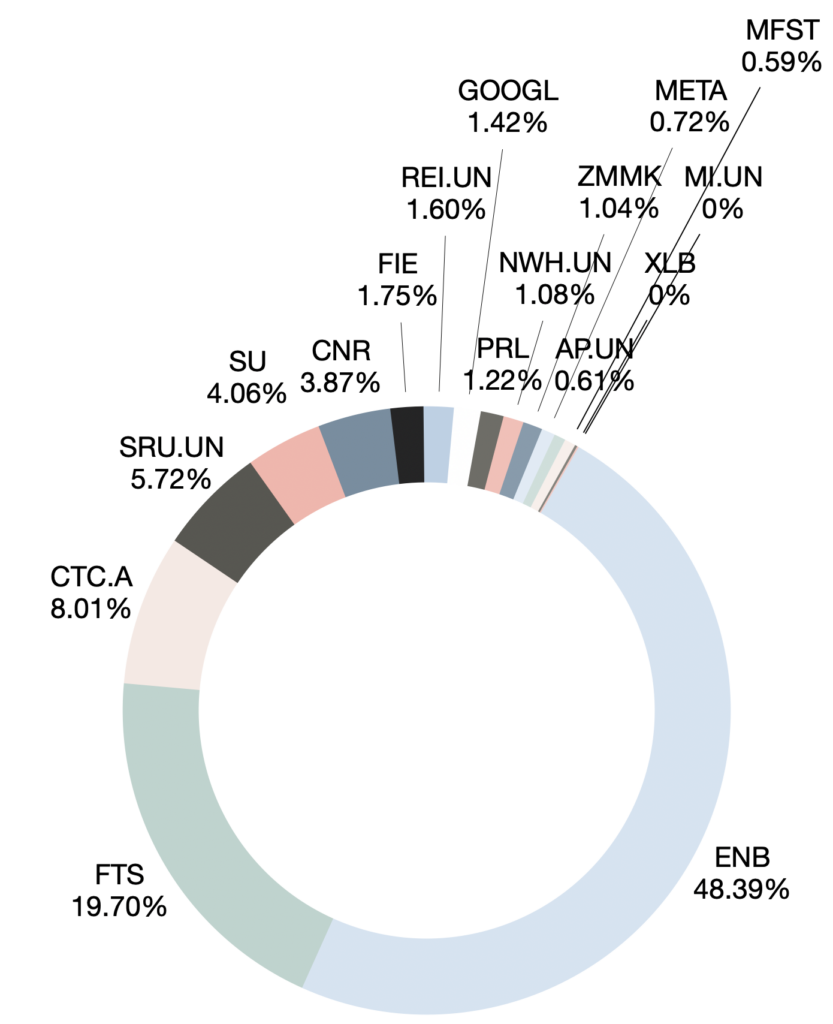

Quarter-over-quarter (QOQ) dividend income increased by an impressive 12% or $21.36 compared to September 2024. This rate of quarterly growth is a very positive sign going into 2025. This growth was driven by increased holdings in $FTS and $GOOGL, along with new positions in REITs, $SU, and $CNR.

After factoring in December’s dividend income, all-time dividend income since June 2017 reached $7,286.54. And since I reinvest all dividends, $7,286.54 of my portfolio’s value can be directly attributed to the consistent reinvestment of dividends.

As this is the final dividend income update for 2024, I wanted to highlight a few key contributors to my portfolio’s dividend growth. Dividend raises provided an additional $95.34 to my projected annual dividend income (PADI) this year, while dividend reinvestment contributed $88.22. Combined, these two powerful forces boosted my PADI by $183.56. This demonstrates the incredible power of dividend reinvestment. My portfolio has reached a stage where it’s not solely reliant on new capital infusions for growth—dividend raises and reinvestment are now significant drivers. The power of dividend reinvestment is on full display in my portfolio.

Operational Highlights — December 2024

Reminder: I am not a licensed investment advisor, and the content of this post does not constitute professional investment advice. The information provided reflects my personal investment experiences and opinions, and should not be interpreted as a recommendation to buy or sell any stocks or other investments. Before making any investment decisions, please seek the advice of a qualified and licensed investment advisor. All opinions expressed are my own and are based on my personal perspective and experiences.

This December, I received dividend income from 17 holdings, an increase of 3 companies compared to last year. My portfolio has undergone some notable changes since then. I exited positions in $SCHD, $TSLY, $JEPQ, $ZWC, and $SIS, while adding $CNR, $GOOGL, $PRL, $AP.UN, $XLB, and $MI.UN. It’s worth noting that $META appears as a new dividend payer, but I held $META last December; it simply began paying a dividend. Overall, I’m pleased with these portfolio shifts. I’ve largely transitioned away from high-income, fee-laden ETFs with limited upside potential, favouring higher-quality positions at more attractive valuations and eliminating management fees.

See the spreadsheet below for a full breakdown of which stocks paid dividends in December 2024:

Portfolio Activity In December 2024

In December, I shifted my focus to portfolio management for 2025, emphasizing risk management and identifying potential investment opportunities. This led to two key trades in my USD portfolio.

Firstly, I exited my entire position in $PG. While seemingly counterintuitive for a dividend investor, this decision aimed to reduce risk and free up capital for more promising opportunities. The sale, executed at $167.36 near the 52-week high and at a demanding 29 times earnings, yielded a 26% capital gain, including dividends.

While $PG is a high-quality dividend stock, its growth trajectory is relatively slow compared to other USD equities. Moreover, as a Canadian investor, I face the burden of U.S. withholding tax on dividends or the need to hold these investments within an RRSP, incurring taxes upon withdrawal.

Given these factors, I believe the USD market presents greater growth potential, particularly within the realm of fast-growing companies. Consequently, my USD portfolio will prioritize growth over dividends, while my Canadian portfolio will maintain its focus on dividend-generating stocks.

Secondly, I trimmed my $PLTR position, realizing a substantial 263% gain. I believe the current market euphoria surrounding AI has inflated $PLTR’s valuation. This presented an opportune moment to secure profits while mitigating risk. I will maintain a residual position, essentially holding the ‘house money’ generated from my initial investment.

These portfolio adjustments reflect my commitment to proactive risk management and the pursuit of attractive investment opportunities in both the Canadian and US markets.

Dividend Raises

December was a banner month for dividend increases! Three of my holdings, $ENB, $RY, and $CM, announced dividend raises, boosting my Projected Annual Dividend Income (PADI) by $34.

To put this into perspective, dividend raises contributed an impressive $95.34 to my PADI this year. It’s worth noting that generating an additional $100 in annual dividend income would typically require investing $2,000 at a 5% dividend yield. However, I achieved this significant increase organically through the strong performance of my existing holdings.

I’m optimistic that dividend raises will continue to contribute significantly to my portfolio’s growth in 2025, potentially exceeding $100.

Outlook For 2025

While I typically set an annual dividend income target, I’ve decided to forgo that practice this year. Although I’ll continue documenting my dividend income here, I believe focusing solely on a dividend income target can be counterproductive.

My primary objective is to maximize investment returns while minimizing risk. This involves acquiring high-quality assets at attractive valuations, not simply chasing high-yielding stocks to meet an arbitrary income goal.

Dividend investing remains a cornerstone of my strategy, providing a consistent income stream for reinvestment and contributing significantly to overall returns. I prioritize high-quality, undervalued companies, often employing a contrarian approach by investing when the market is pessimistic.

Rather than fixating on a dividend income target, I’ll focus on executing sound investment decisions and striving to outperform the S&P 500.

I anticipate my 2025 dividend income will likely fall within the $2,600 to $2,700 range, with my Projected Annual Dividend Income (PADI) approaching $3,000. However, these are not rigid targets. My primary focus remains on achieving the highest possible returns while managing risk effectively.

Final Thoughts — December 2024 Dividend Income

In summary, dividend income in December 2024 was $196.66, which represents a 20% year-over-year increase compared to December 2023.

Full-year dividend income finished at $2,001.04, which is up by an impressive 34% or $503.86 compared last year’s total dividend income. I officially reached my $2,000 dividend income target in 2024.

Furthermore, my all-time dividend income since June 2017 reached $7,286.54, which means $7,286.54 of my portfolio’s value can be directly attributed to dividends now.

Best of all, my portfolio outperformed the S&P 500 in 2024, demonstrating the effectiveness of my investment strategy.

It’s also worth highlighting again that dividend raises alone added $34 in December and a total of $95.34 to my PADI this year. Furthermore, the power of dividend reinvestment contributed an additional $88.22. Combined, these two powerful forces boosted my PADI by a substantial $183.56 – all without requiring me to invest any new capital.

Looking back on 2024, I’m incredibly pleased with the progress I made. Dividend income grew significantly, overall returns were strong, and I experienced substantial growth in my net worth. It was a year of significant progress on my investment journey.

Stay tuned for more exciting dividend income updates in 2025 as the snowball grows!

Related Dividend Income Updates

Dividend Income September 2024

Connect With Dividend Income Investor

Instagram: @dividendincomeinvestor_

Threads: @dividendincomeinvestor_

Pinterest: @dividendincomeinvestor

Facebook: @Reversethecrushblog

November 2024 Dividend Income Report — Dividend Income Investor Earns $152.90 on 25% Year-Over-Year Growth

November 2024 Dividend Income Report — Dividend Income Investor Earns $152.90 on 25% Year-Over-Year Growth