January 2025 Dividend Update — Documenting monthly dividend income and investment activity to chronicle the journey to financial independence.

I am not a licensed investment advisor, and the content of this post does not constitute professional investment advice. The information provided reflects my personal investment experiences and opinions, and should not be interpreted as a recommendation to buy or sell any stocks or other investments. Before making any investment decisions, please seek the advice of a qualified and licensed investment advisor. All opinions expressed are my own and are based on my personal perspective and experiences. This post may contain affiliate links to products/services I personally use and endorse.

The Dividend Income Investor Blog is excited to share the dividend income results for January 2025.

January 2025 proved to be a record-setting month for my dividend income portfolio. I achieved a new personal best in monthly dividend payouts, demonstrating the power of long-term dividend investing.

As part of my ongoing risk management strategy and focus on growing my USD positions through growth stocks and boosting dividend income from my Canadian holdings, I decided to sell one of my larger positions in January. This move allows me to reinvest in the best available opportunities. I’ll provide a detailed analysis of these adjustments later in this post.

For now, let’s jump into the January 2025 dividend update highlights and examine the impressive dividend income figures.

January 2025 Dividend Update Highlights

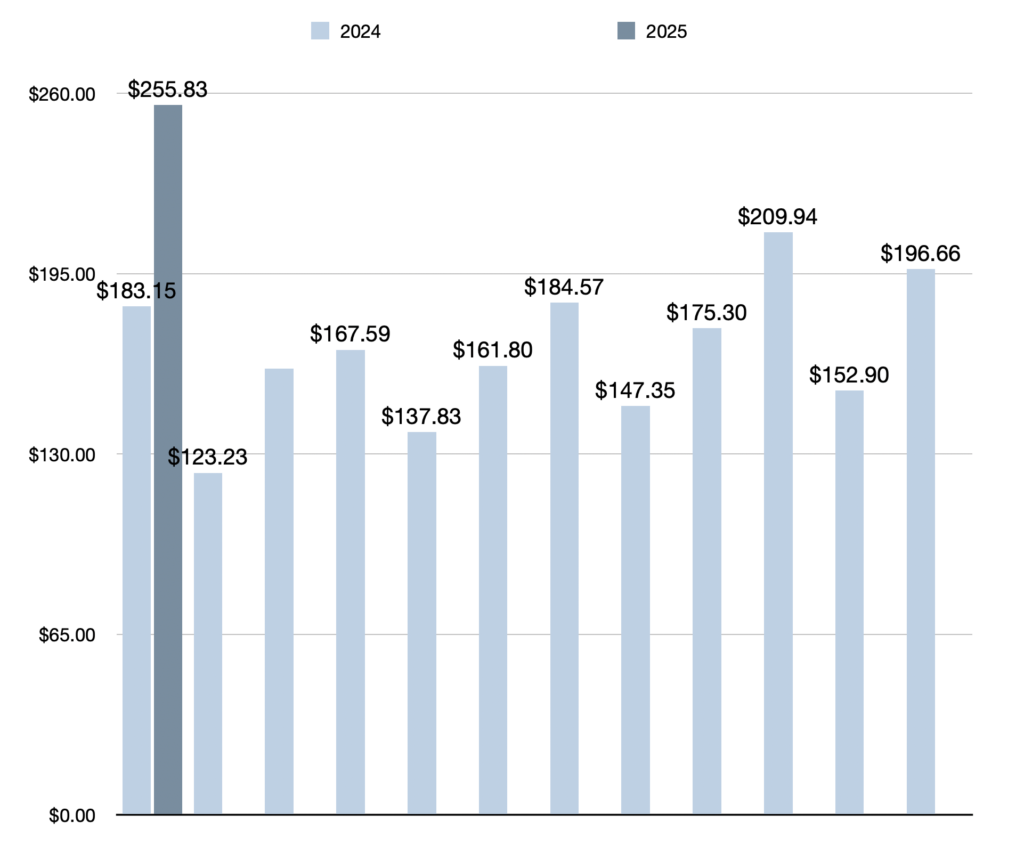

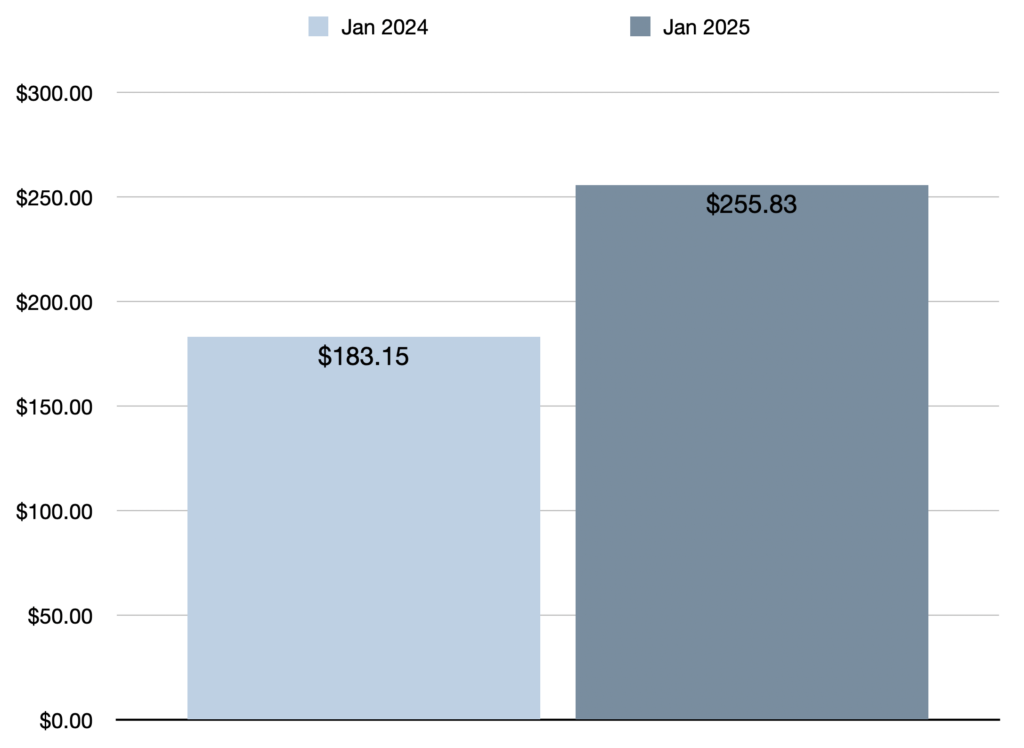

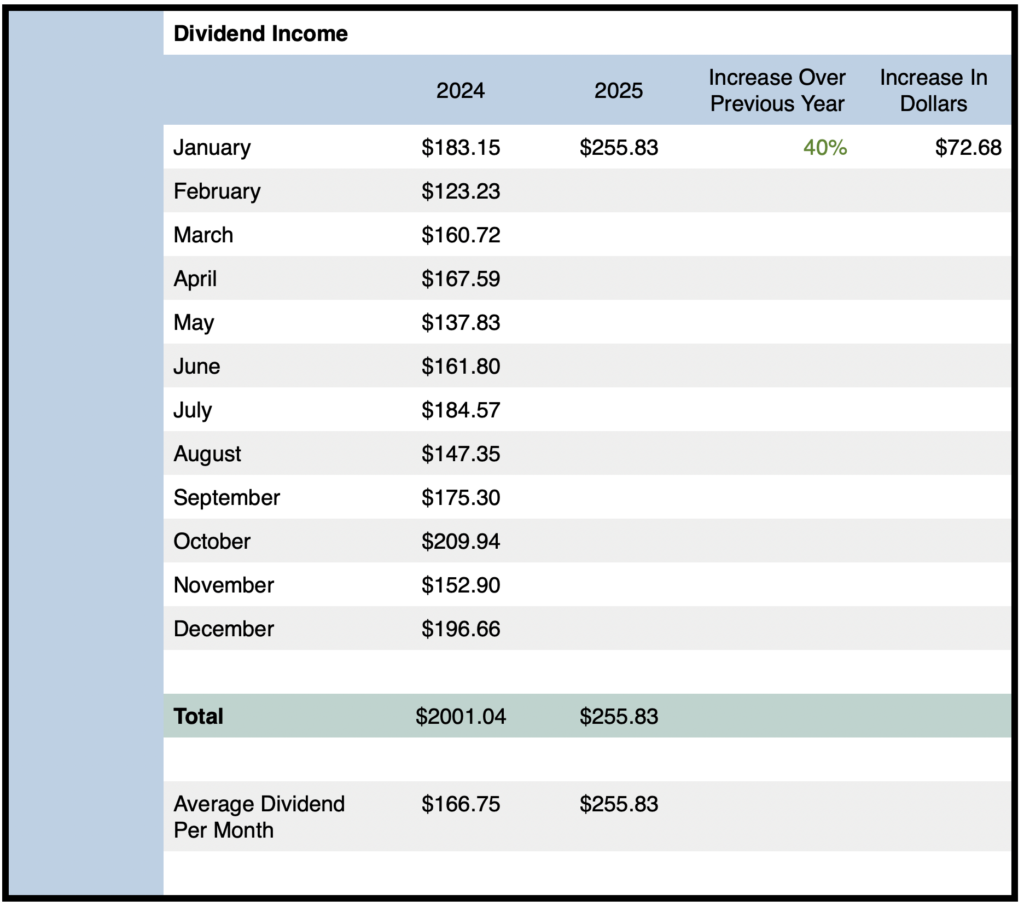

- Total dividend income earned in January 2025 was $255.83 (new record)

- Year-over-year (YOY) dividend income increased by 40% or $72.68 compared to January 2024

- Quarter-over-quarter (QOQ) dividend income increased by 22% or $45.89 compared to October 2024

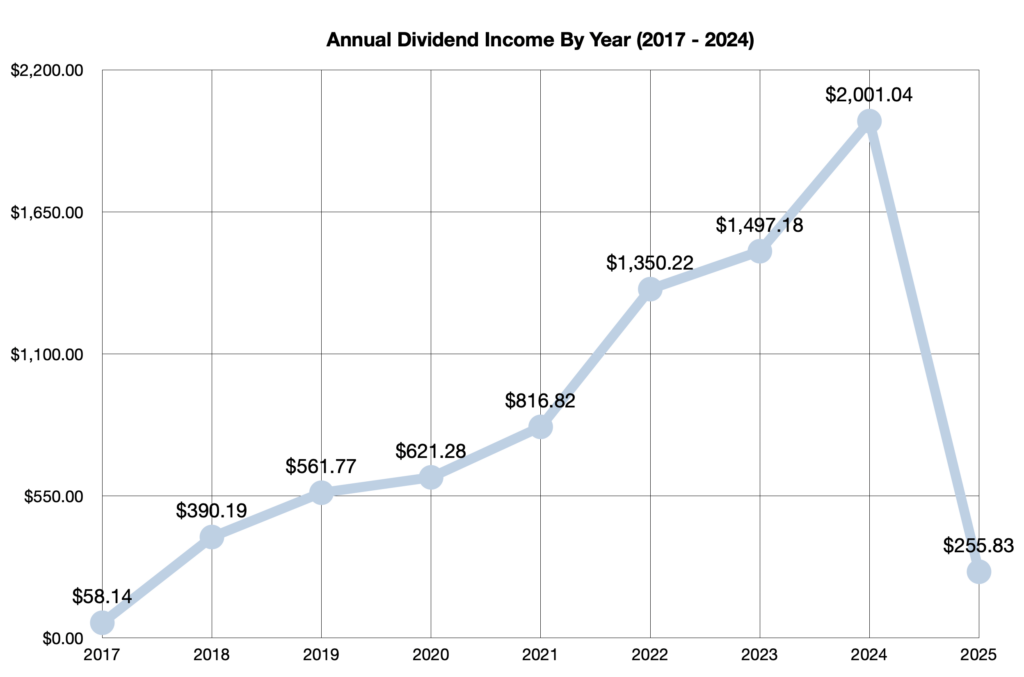

- All-time dividend income since June 2017 reached $7,552.37

- Dividend raise announced by $CNR

January 2025 Dividend Update

Total dividend income for January reached $255.83, representing a 40% year-over-year increase—a rise of $72.68 from the $183.15 received in January 2024. It’s certainly worth noting that this month delivered my highest dividend income ever.

This month also saw me reach a new milestone: my first $250+ dividend payout! It’s a quarter of the way to $1,000/month.

Quarter-over-quarter (QOQ) dividend income increased by an impressive 22% or $45.89 compared to October 2024. This strong quarterly growth suggests my dividend income is poised for even faster acceleration.

After factoring in January’s dividend income, all-time dividend income since June 2017 reached $7,552.37. And since I reinvest all dividends, $7,552.37 of my portfolio’s value can be directly attributed to the consistent reinvestment of dividends.

Overall, January proved to be an exceptional month for dividend income. Not only did I achieve a new monthly record, but the rapid pace of growth sets a promising precedent for the rest of 2025.

January 2025 Operational Highlights

Reminder: I am not a licensed investment advisor, and the content of this post does not constitute professional investment advice. The information provided reflects my personal investment experiences and opinions, and should not be interpreted as a recommendation to buy or sell any stocks or other investments. Before making any investment decisions, please seek the advice of a qualified and licensed investment advisor. All opinions expressed are my own and are based on my personal perspective and experiences.

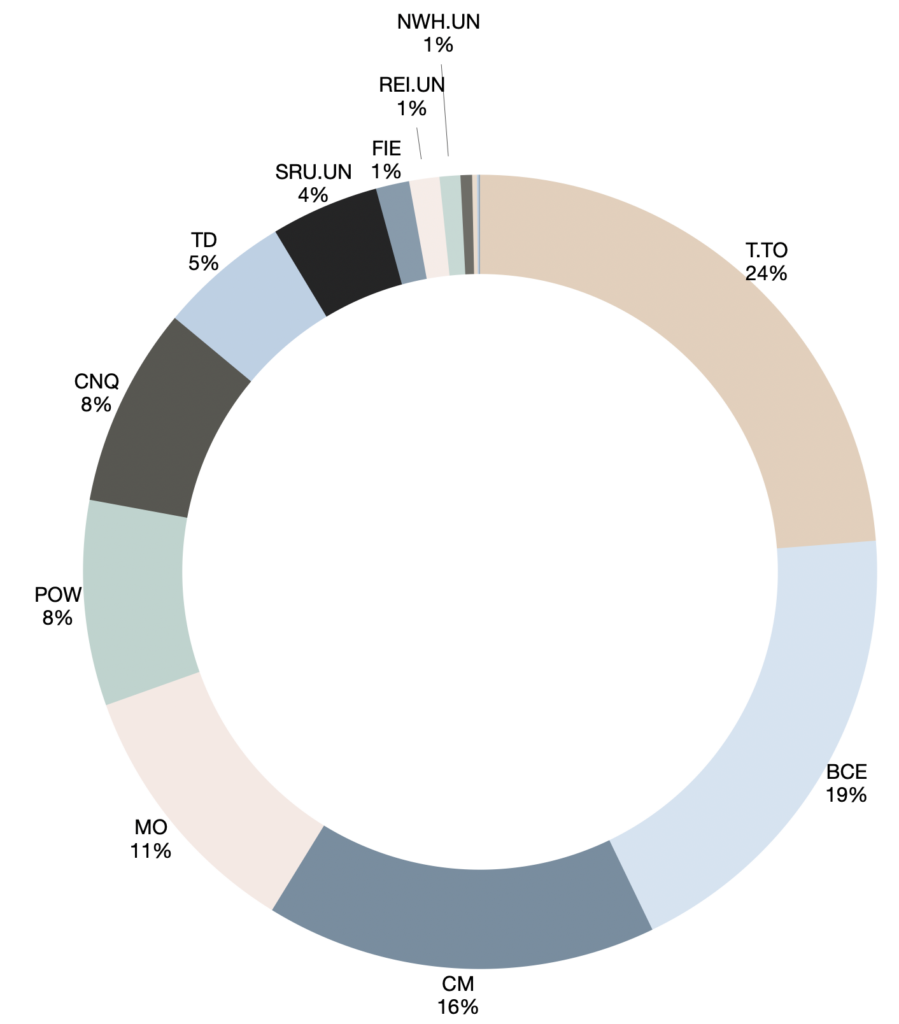

This January, I received dividend income from 15 holdings, a decrease of 4 companies compared to last year.

On the portfolio management front, I followed up last month’s sale of $PG with another significant sale. This has left me with a larger-than-usual cash position in the USD portion of my portfolio, which I’m now focusing on deploying into growth-oriented opportunities rather than dividend-paying stocks. On the Canadian side, I’ve continued to funnel capital into dividend-paying stocks, staying aligned with my goal of building steady income streams.

See the spreadsheet below for a full breakdown of which stocks paid dividends in January 2025:

January 2025 Portfolio Activity

I made a significant portfolio change in January, selling one of my larger holdings. This decision was driven by several factors: my ongoing risk management strategy, a focus on growth on the USD side of my portfolio( the Canadian stock side will prioritize dividend income), and, ultimately, deploying capital where I see the strongest potential.

Sold $SBUX

The position I decided to sell was $SBUX. As I mentioned earlier, there were several factors that led me to sell my Starbucks position, and I’d like to dive into a few more of them. For one, I’m no longer as enthusiastic about the business as I once was as a customer. There’s no guarantee that their turnaround strategy will pan out, and competition in China is becoming more intense. On top of that, the current macroeconomic environment isn’t particularly favorable for high-priced coffee, and with a P/E ratio over 30, I see opportunities to invest in faster-growing companies at a more attractive price. But ultimately, the decision to sell was driven by my desire to lock in profits and reduce downside risk.

Of course, it’s easy to say in hindsight that this decision didn’t work out as planned, especially since the stock spiked after earnings. However, one important lesson I’ve taken from investing—likely from Howard Marks—is that the outcome doesn’t matter as much as the reasoning behind the decision. If the rationale for the decision was solid, then it was a good move, regardless of short-term results.

I will admit, I’m impressed with the new CEO’s turnaround strategy, and I’m starting to see some signs of positive change. But given Starbucks’ current price, I decided to take some risk off the table for now. That said, I’d be open to buying Starbucks back at the right price when the time comes.

Selling $SBUX does mean taking a hit to my PADI (Projected Annual Dividend Income).

Buys In January 2025

It’s been a strong month for my personal finances, as I was able to save a substantial amount of money to allocate towards investing. On top of that, I had a record month for dividend income, which I’ve reinvested into various positions.

On the USD side, I initiated two new positions in $UBER and $NVDA. While these aren’t your typical dividend stocks, they still align with my core investment strategy. I always aim to take a contrarian approach when I invest, looking to buy assets when they’re out of favor with the market.

Take $UBER, for example—it’s been somewhat out of favor lately due to fears around autonomous vehicles potentially disrupting their business model. But after diving deep into their results, numbers, and listening to the CEO’s interviews, I came away more convinced that the business has long-term potential. As for $NVDA, my decision was more of a reactive move. I bought in after the stock dropped 17% due to concerns over DeepSeek. It’s a small position for now, and while I could end up treating it more as a trade, time will tell how it plays out.

On the Canadian side, I added to a number of positions, including $CNQ, $ZMMK, $REI.UN, $T.TO, $TD, $MI.UN, and $SU. One notable move was initiating a position in $RCI.B, given that the Canadian telecommunications sector is still facing significant headwinds. I’ve always been drawn to buying into broad industry selloffs because, while there might be legitimate risks in the space, sentiment can often oversell these stocks. I’m not sure when exactly, but I believe sentiment toward the sector will eventually shift, and when it does, I’ll be positioned to benefit.

Otherwise, I contributed a bit of spare change to Bitcoin on the DeepSeek fear as well.

Dividend Raises In January 2025

In January 2025, I received a dividend increase from $CNR. With 10 shares in my portfolio, the 5% raise added an additional $1.70 to my PADI.

It’s always rewarding to see dividend growth, no matter how small—it’s a nice boost to my overall income.

Outlook For 2025

Each year, I usually set an annual dividend income target—last year, for example, I aimed for $2,000. However, this year, I’ve decided not to set a specific target, even though I’m still focused on growing my dividend income.

The main reason for this shift is to prioritize making the best investment decisions. I don’t want to buy a stock just to hit a dividend target—I want to buy stocks that offer the best opportunities available.

That said, based on last year’s dividend income of $2,001.04, I’m anticipating a range of $2,600 to $2,700 for this year. I’m comfortable with not hitting that target if it means higher total returns in the long run.

As I mentioned earlier, selling $SBUX has impacted my PADI in the short term, particularly in February 2025. It could end up being one of my lowest dividend income months for a while, as I also sold $PG and $POW, with the latter paying out in January.

Due to these moves, I’m sitting on a higher-than-usual cash position and actively looking for opportunities to deploy this capital. I’ve got a short list of four stocks, three of which I already own. Ideally, I’m hoping for a market pullback so I can acquire these shares at a discount. While there is an opportunity cost to holding cash, risk management is a key part of my strategy. I want to be ready to make bigger moves when the right opportunities arise.

Final Thoughts: January 2025 Dividend Update

In summary, dividend income in January 2025 was $255.83, which represents a 40% year-over-year increase compared to January 2024.

January 2025 was a record-setting month for dividend income, and the year is off to a blazing start! 🚀

That said, February may see a dip in income, primarily due to the sale of $SBUX and the fact that $POW paid out in January. However, I’ve been aggressively adding to dividend stocks in my Canadian portfolio and reinvesting a growing amount of monthly dividend income.

As a result, I’m confident that total dividend income for 2025 will significantly surpass the $2,001.04 I received in 2024—despite not setting a specific target for dividend income this year. The focus remains on making smart investment decisions and growing my portfolio over time.

Stay tuned for more exciting dividend income updates in 2025 as the snowball grows!

Related Dividend Income Updates

January 2024 Dividend Income — $183.15

December 2024 Dividend Income — $196.66

All Dividend Income Updates Since 2017

Connect With Dividend Income Investor

Instagram: @dividendincomeinvestor_

Threads: @dividendincomeinvestor_

Pinterest: @dividendincomeinvestor

Facebook: @Reversethecrushblog

December 2024 Dividend Income Update: $196.66 Earned in December, 20% YOY Growth, and Full Year Total Hits $2,001.04

December 2024 Dividend Income Update: $196.66 Earned in December, 20% YOY Growth, and Full Year Total Hits $2,001.04