October 2024 Dividend Income Report — Documenting monthly dividend income and investment activity to chronicle the journey to financial independence.

I am not a licensed investment advisor, and the content of this post does not constitute professional investment advice. The information provided reflects my personal investment experiences and opinions, and should not be interpreted as a recommendation to buy or sell any stocks or other investments. Before making any investment decisions, please seek the advice of a qualified and licensed investment advisor. All opinions expressed are my own and are based on my personal perspective and experiences. This post may contain affiliate links to products/services I personally use and endorse.

The Dividend Income Investor blog is pleased to announce dividend income results for October 2024.

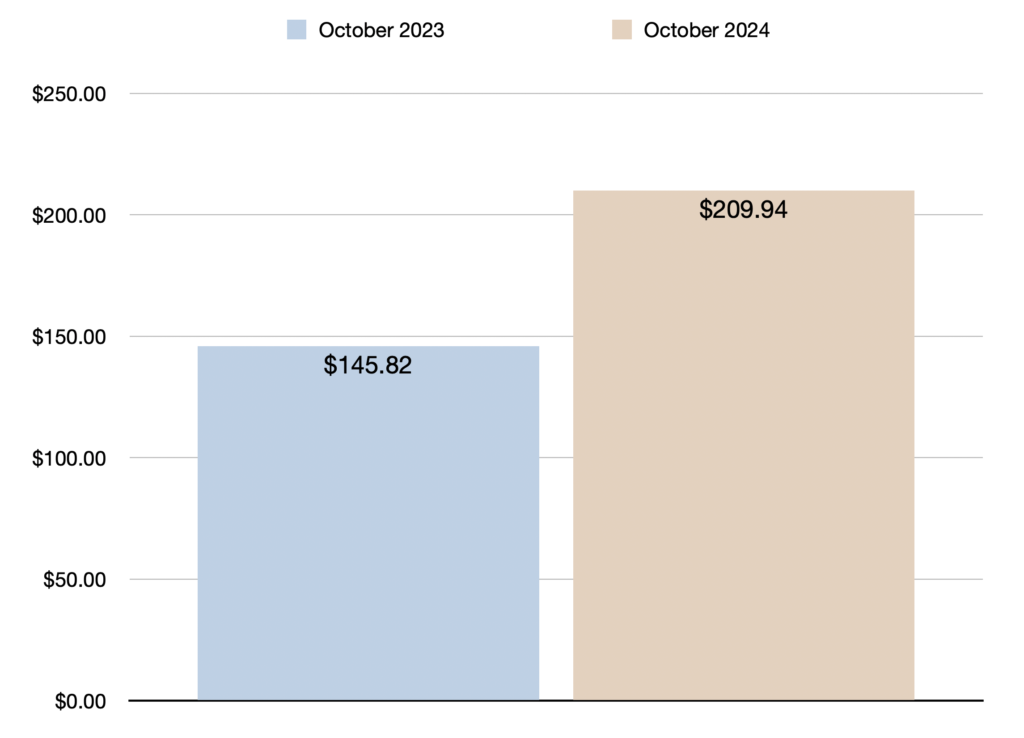

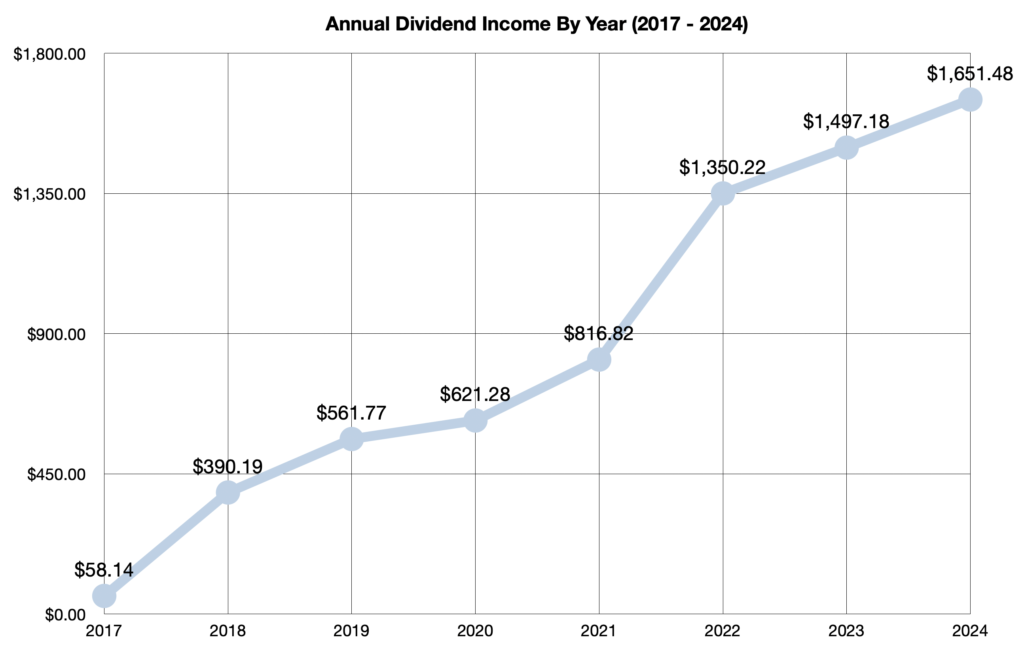

October 2024 was a landmark month for dividend income. I broke my personal record, earning the highest amount I’ve ever received in a single month. For the first time ever, my dividend income surpassed $200 in a single month, marking a significant milestone in my investing journey.

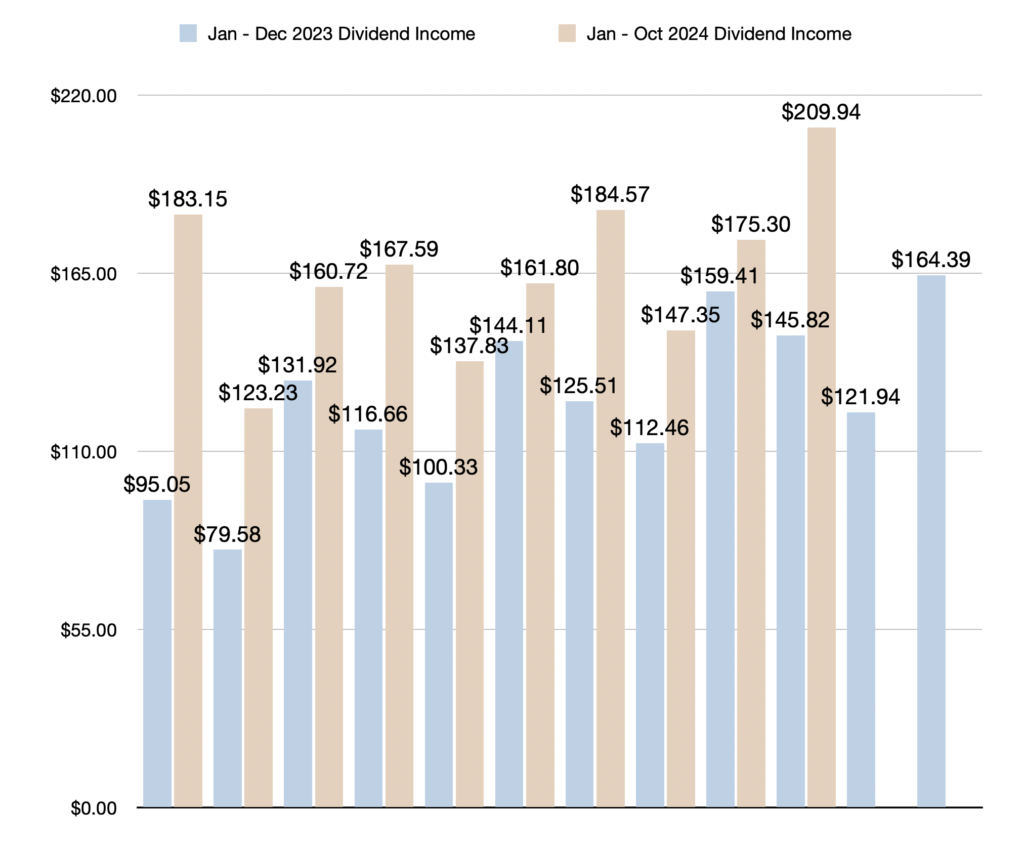

It’s also worth noting that I surpassed last year’s total dividend income. As of now, I’ve officially earned more dividend income in 2024 than I did throughout all of 2023, which totalled $1,497.18.

While I primarily focus on dividend income on this blog, I can’t help but share how outstanding my total investment returns have been this year. I’m currently outperforming the S&P 500 year-to-date, even accounting for the cash I have in high-yield savings accounts. To put it simply, my unrealized capital gains this year alone exceed my total dividend income since 2017. It’s been a fantastic year overall!

That said, there’s something uniquely rewarding about dividend income. It not only allows my investments to grow but also provides a consistent cash flow. In fact, the thrill of tracking my dividend income over the years is actually a key reason my total investment returns have surged this year. By staying committed and continuously counting my dividends, I was able to hold onto my investments just as the stock market experienced a significant rally. This approach has truly paid off!

On the portfolio management side, I initiated several new small positions, primarily funded by reinvested dividends. Additionally, I’ve been focusing on building my cash reserves and increasing my investment in a money market ETF.

There are many highlights to cover, so let’s dive into the details of my October 2024 performance!

October 2024 Dividend Income Highlights

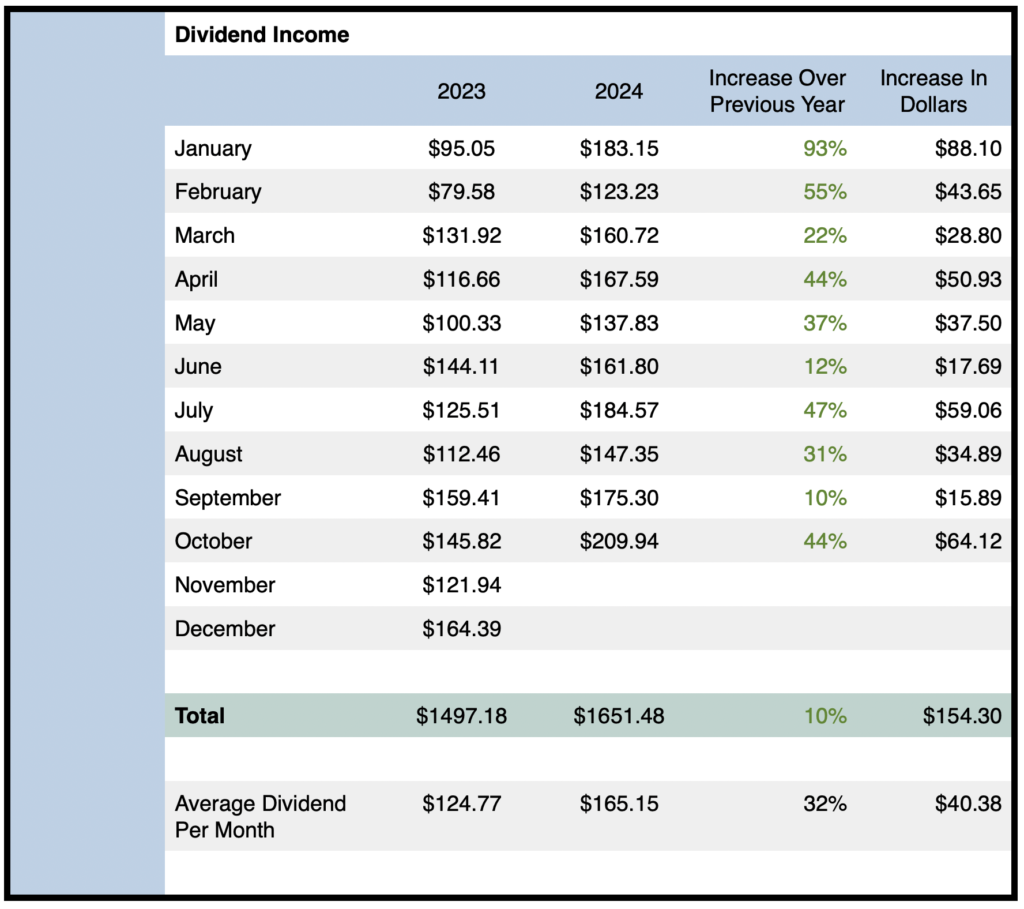

- Total dividend income earned in October 2024 was $209.94 (New Record)

- Year-over-year (YOY) dividend income increased by 44% or $64.12 compared to October 2023

- Year-to-date (YTD) dividend income (January – October 2024) is up to $1651.48 (Up 10% or $154.30 compared to Full Year Dividend Income In 2023)

- YTD dividend income is up by 36% or $440.63 compared to the first ten months of 2023

- Quarter-over-quarter (QOQ) dividend income increased by 14% or $25.37 compared to July 2024

- Surpassed $200 in dividend income within a single month for the first time ever

- Year-over-year dividend income growth in October is on the rise, jumping from 15% in 2023 to an impressive 44% in 2024

- Average monthly dividend income in 2024 is $165.15 (Up 32% or $40.38 per month compared to 2023)

- All-time dividend income since June 2017 reached $6946.98

- Dividend raises were announced by 2 companies: $SBUX & $CNQ

October 2024 Dividend Income Earnings — $209.94

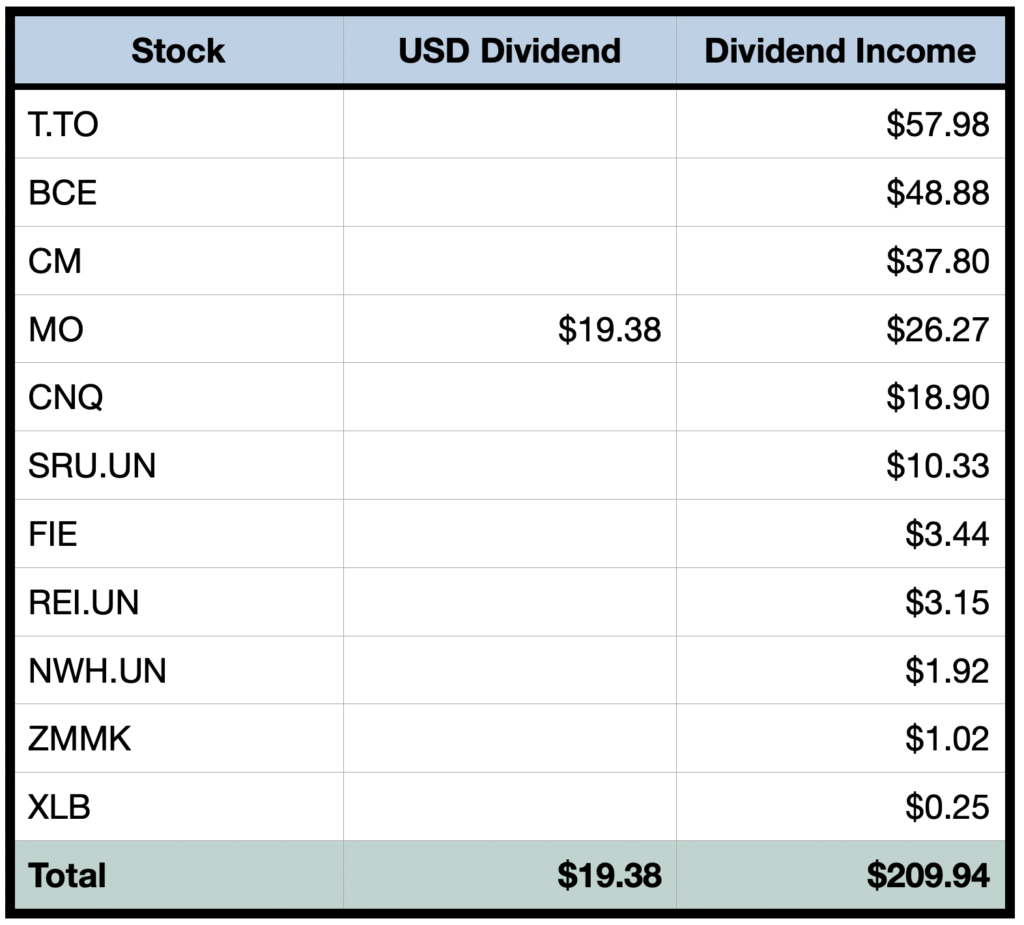

In October 2024, I achieved a new milestone by earning a total of $209.94 in dividend income, setting a record for the highest monthly dividends I’ve received. This marked the first time I surpassed the $200 mark in a single month. The previous record was in July 2024, when I earned $184.57.

This month’s dividend income represents a 44% year-over-year increase compared to October 2023. In dollars, it was an increase of $64.12 compared to the $145.82 received during the same month last year.

It’s also noteworthy that year-over-year dividend income growth in October is rising, despite the larger portfolio size. YOY growth soared from 15% in 2023 to an impressive 44% in 2024. This acceleration in dividend income is a very positive sign for my investment strategy.

Year-to-date dividend income reached $1,651.48, surpassing the total from 2023. With two months remaining, total dividend income for 2024 has increased by 10%, or $154.30, compared to the entire dividend income for 2023.

The numbers compared to this time last year are even more impressive. Dividend income for the first ten months of 2024 has surged by a remarkable 36%, or $440.63 more than in the same period of 2023.

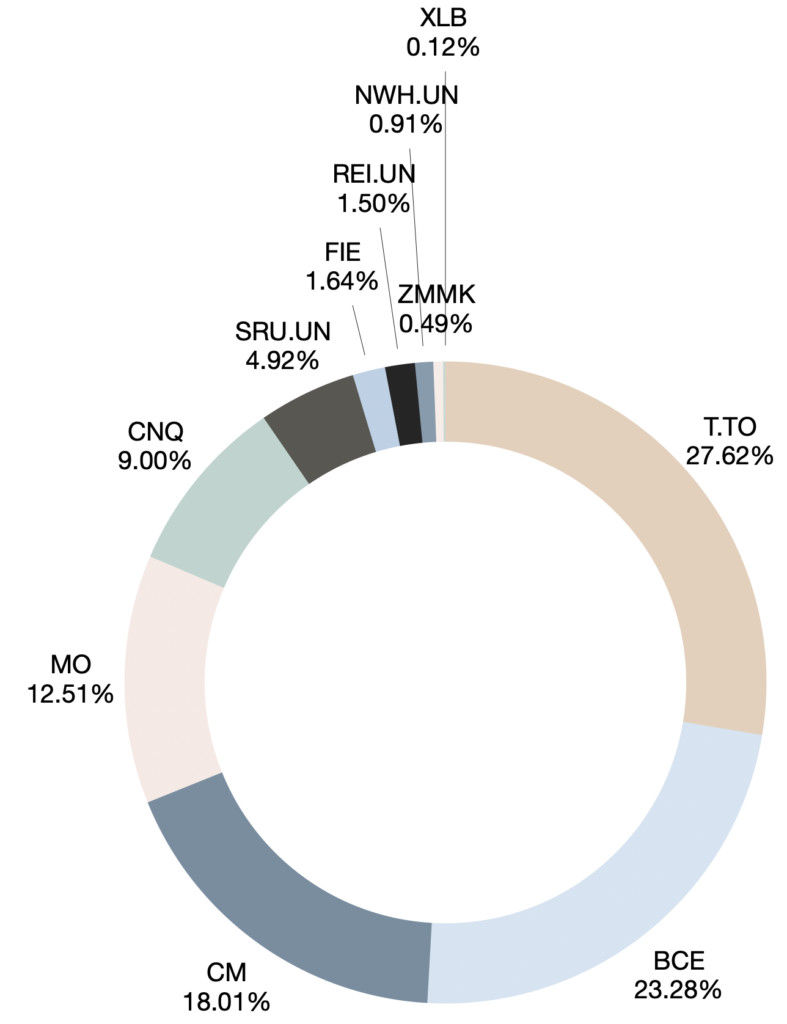

Quarter-over-quarter (QOQ) dividend income increased by a surprisingly high 14% or $25.37 compared to July 2024. This increase can be attributed mainly to larger payments received from $T.TO, $BCE, $CNQ, $SRU.UN, and $REI.UN. It’s a great sign to see quarterly dividend income growth accelerating!

After factoring in October’s dividend income, all-time dividend income since June 2017 reached $6946.98.

Wealthsimple: Open an investment account with Wealthsimple and receive a $25 bonus when you fund your account. Wealthsimple is an excellent brokerage that offers zero commission on Canadian trades, making it a top choice for cost-effective investing. To get your $25 bonus and start investing with Wealthsimple, click here.

Operational Highlights — October 2024

Reminder: I am not a licensed investment advisor, and the content of this post does not constitute professional investment advice. The information provided reflects my personal investment experiences and opinions, and should not be interpreted as a recommendation to buy or sell any stocks or other investments. Before making any investment decisions, please seek the advice of a qualified and licensed investment advisor. All opinions expressed are my own and are based on my personal perspective and experiences.

In October 2024, I received dividend payments from 11 holdings, down from 16 last year. Since last October, I sold $TSLY, $JEPQ, $PLC, $ZWC, $SIS, and $VFV. Aside from adding to existing positions, my only new investment was $XLB, a long-duration bond ETF that I recently introduced as a small position. This reflects a relatively high turnover compared to last year. As I mentioned earlier, I sold all my covered call ETF positions to focus on what I believe are the best total return opportunities. However, I still see a place for covered call ETFs in my portfolio for income, and I anticipate that $SIS will find its way back into my holdings in the future.

See the spreadsheet below for a full breakdown of which stocks paid dividends in October 2024:

Activity In October 2024

In October 2024, I initiated four new positions in $MI.UN, $AP.UN, $SU, and $XLB, while also adding to my existing holdings in $ZMMK, $SRU.UN, $T.TO, $NWH.UN, and $CNR.

The new positions are primarily funded by reinvested dividends and are still relatively small at this stage. The main reason I’m initiating them is that many of my existing holdings have grown significantly, prompting me to seek out new undervalued investment opportunities.

Without going into too much detail, I purchased the two new REITs, $MI.UN and $AP.UN, to diversify my REIT holdings. I appreciate $MI.UN for its focus on condos, attractive price-to-book ratio, and monthly income stream. Meanwhile, $AP.UN stands out for its exceptionally high dividend yield and serves as a contrarian pick due to its association with office real estate.

As for $XLB, I chose this long-duration bond ETF because interest rates are expected to decline, and long-duration bonds are particularly sensitive to rate changes. Lastly, I added $SU for increased exposure to the energy sector, a stock that has cycled in and out of my portfolio several times.

Regarding my existing positions, I’m actively adding to my money market fund, $ZMMK. This not only provides a monthly dividend but also ensures I have liquid assets on hand to seize potential opportunities. Otherwise, I just added to existing positions where I see value or have the opportunity to average down.

Dividend Raises

Two dividend raises were announced in October 2024, adding $12.28 to my PADI (projected annual dividend income).

$CNQ — Canadian Natural Resources Limited has announced a 7% dividend increase, raising the dividend from $0.525 to $0.5625. This boost adds $5.40 to my projected annual dividend income.

$SBUX — Starbucks has announced a 7% dividend increase, raising the dividend from $0.57 to $0.61 per share. This increase adds $6.88 to my projected annual dividend income.

Outlook/Guidance

I expect full-year dividend income to be in the range of $2000, unchanged from my 2024 financial goals.

Reaching $2000 would represent a 34% year-over-year dividend growth rate compared to the $1497.18 received in 2023.

Fortunately, this month’s strong performance keeps my $2,000 dividend income goal within reach. With $1,651.48 received so far, I’m already $154.30—or 10%—ahead of last year’s total.

However, I still need to earn at least $348.52 by year-end, which breaks down to a minimum of $174.26 per month for the remainder of the year.

It’s likely to come down to the final month. I expect to receive around $150 in November, so December will need to bring in another $200 to hit my target.

Given that it may be a close call, I might adopt a more aggressive and strategic approach to purchasing income stocks to reach my goal. However, I won’t compromise my investment strategy to hit this target. I’ll remain cautious and continue to build my cash reserves and money market fund.

That said, I’m confident I’ll achieve my $2,000 dividend income goal for 2024. I’ll continue to leverage three key strategies: reinvesting dividends, benefiting from dividend raises, and investing new capital.

Final Thoughts — October 2024 Dividend Income

In summary, October 2024 saw a record-breaking dividend income of $209.94, marking both an all-time high for monthly earnings and the first time I’ve surpassed $200 in a single month.

Additionally, it was a robust month for year-over-year growth, as the $209.94 received reflects a 44% increase compared to October 2023.

Year-to-date dividend income now stands at $1,651.48, reflecting an impressive 36% increase of $440.63 compared to the first ten months of 2023. Additionally, 2024’s dividend income has already exceeded last year’s total of $1,497.18 by 10%, or $154.30.

Overall, October was fantastic: I set a new monthly dividend record, surpassed $200 for the first time, achieved 44% YOY growth, and my total YTD dividend income already exceeded last year’s income with two months remaining.

I’m eager to finish the last two months strong and achieve my $2,000 dividend income target.

Stay tuned for more exciting dividend income updates in 2024 as the snowball grows!

Related Dividend Income Updates

You may have noticed that I’ve recently removed display ads from the blog. Running this site involves ongoing costs, including web hosting and domain renewal, and your support is greatly appreciated. By opening an account with the companies listed below, which I personally use for investing and saving, you can help support the blog while also benefiting from their services. It’s a win-win—these companies offer great incentives for signing up. See below for more details and how you can get started.

Wealthsimple: Open an investment account with Wealthsimple and receive a $25 bonus when you fund your account. Wealthsimple is an excellent brokerage that offers zero commission on Canadian trades, making it a top choice for cost-effective investing. To get your $25 bonus and start investing with Wealthsimple, click here.

Simplii Financial: Simplii Financial offers no-fee bank accounts and is a fantastic choice for holding your emergency fund. I recently opened an account and secured a 6.25% interest rate until January 2025. Right now, they have a great referral offer where you can earn between $50 and $600 just for becoming a Simplii Financial client. To learn more about this offer, claim your referral bonus, and find an excellent option for your emergency fund, click here.

Connect With Dividend Income Investor

Instagram: @dividendincomeinvestor_

Threads: @dividendincomeinvestor_

Pinterest: @dividendincomeinvestor

Facebook: @Reversethecrushblog

September 2024 Dividend Income Report: Dividend Income Investor Achieves $175.30, Highlights Year-Over-Year Growth, Portfolio Activity, and Year-to-Date Performance

September 2024 Dividend Income Report: Dividend Income Investor Achieves $175.30, Highlights Year-Over-Year Growth, Portfolio Activity, and Year-to-Date Performance