September 2024 Dividend Income Report — Documenting monthly dividend income and investment activity to chronicle the journey to financial independence.

I am not a licensed investment advisor, and the content of this post does not constitute professional investment advice. The information provided reflects my personal investment experiences and opinions, and should not be interpreted as a recommendation to buy or sell any stocks or other investments. Before making any investment decisions, please seek the advice of a qualified and licensed investment advisor. All opinions expressed are my own and are based on my personal perspective and experiences. This post may contain affiliate links to products/services I personally use and endorse.

The Dividend Income Investor blog is pleased to announce dividend income results for September 2024.

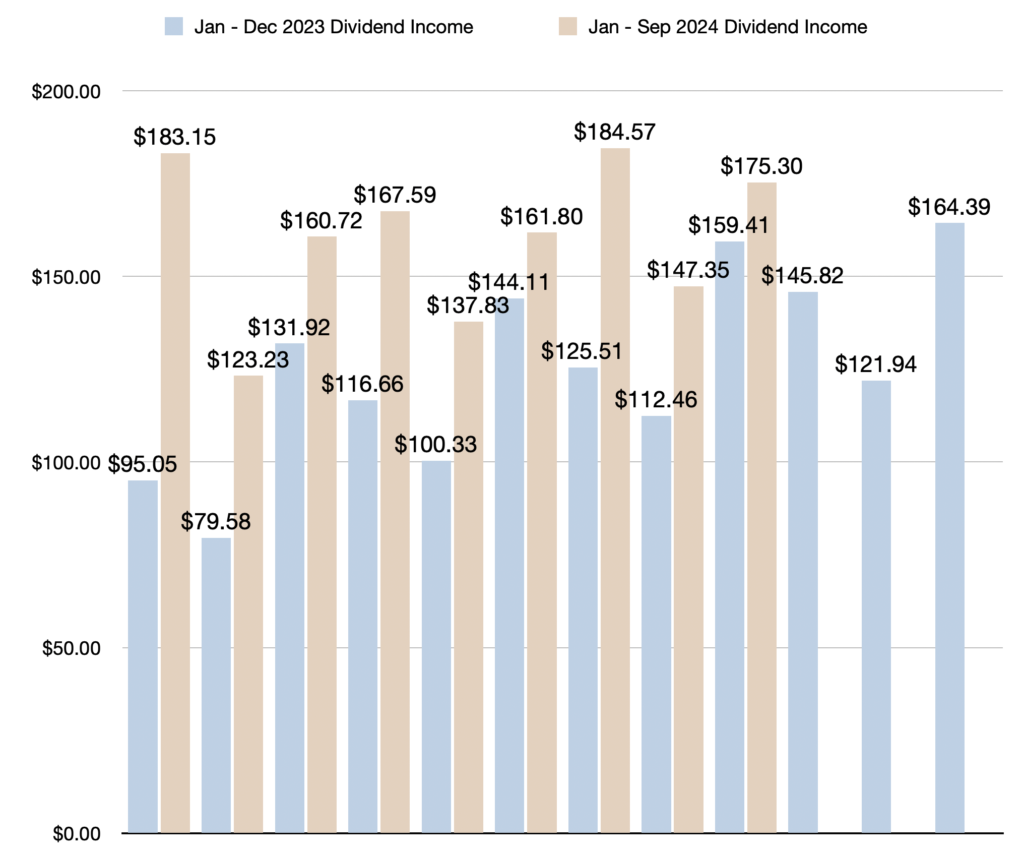

September 2024 proved to be another impressive month for dividend income, marking it as the third highest month of the year and the third highest ever in my dividend investing journey. That said, the month experienced a slowdown in year-over-year dividend growth.

In September, both the Bank of Canada and the Federal Reserve made notable moves, with the former cutting interest rates by another 25 basis points and the latter launching its rate-cutting cycle with a surprising 50 basis point reduction. While these cuts have positively impacted my portfolio, finding compelling stock buys has become increasingly challenging.

On the portfolio management front, September was a quieter month compared to August. Unlike the previous month, I didn’t initiate any new positions. However, I did manage to add to some existing positions, and I’ll delve into those details in the operational highlights section of this post. In terms of total returns, I’m still modestly outperforming my benchmark, the S&P 500, by a few basis points. Worth mentioning is that two dividend raises were announced by Fortis and Microsoft.

I also took the opportunity this month to refine my investment strategy. Over the past few years, my portfolio has grown significantly. With that growth comes a heightened sense of responsibility to manage my investments effectively and mitigate risk. To that end, I started crafting a one-page summary of my investment strategy, which outlines my objectives, investment philosophy, competitive edge, asset allocation, selection criteria, and risk management approaches, along with monitoring and time horizon targets. Additionally, I’m developing individual investment analysis worksheets to aid in decision-making. I believe these steps will enhance my skills as an investor and prepare me for the next chapter of my investing journey, all while continuing to track my dividend income.

Now, let’s explore the dividend income highlights for September 2024.

Dividend Income September 2024 Highlights

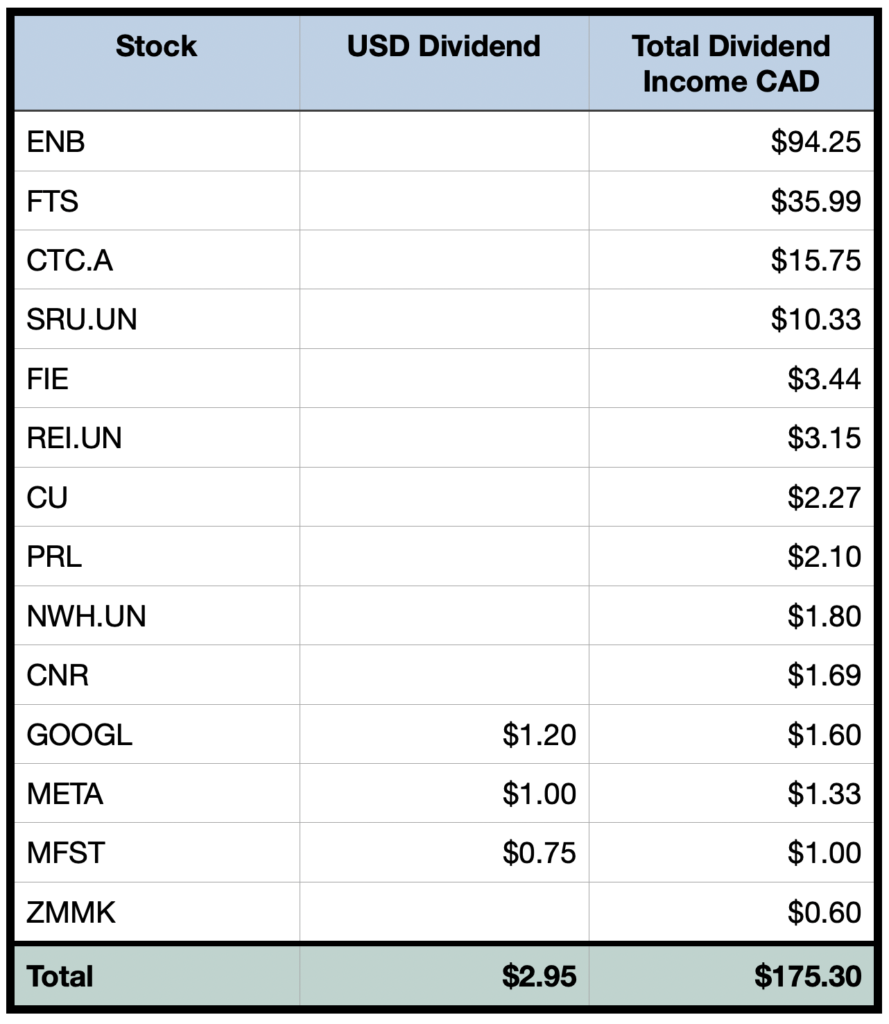

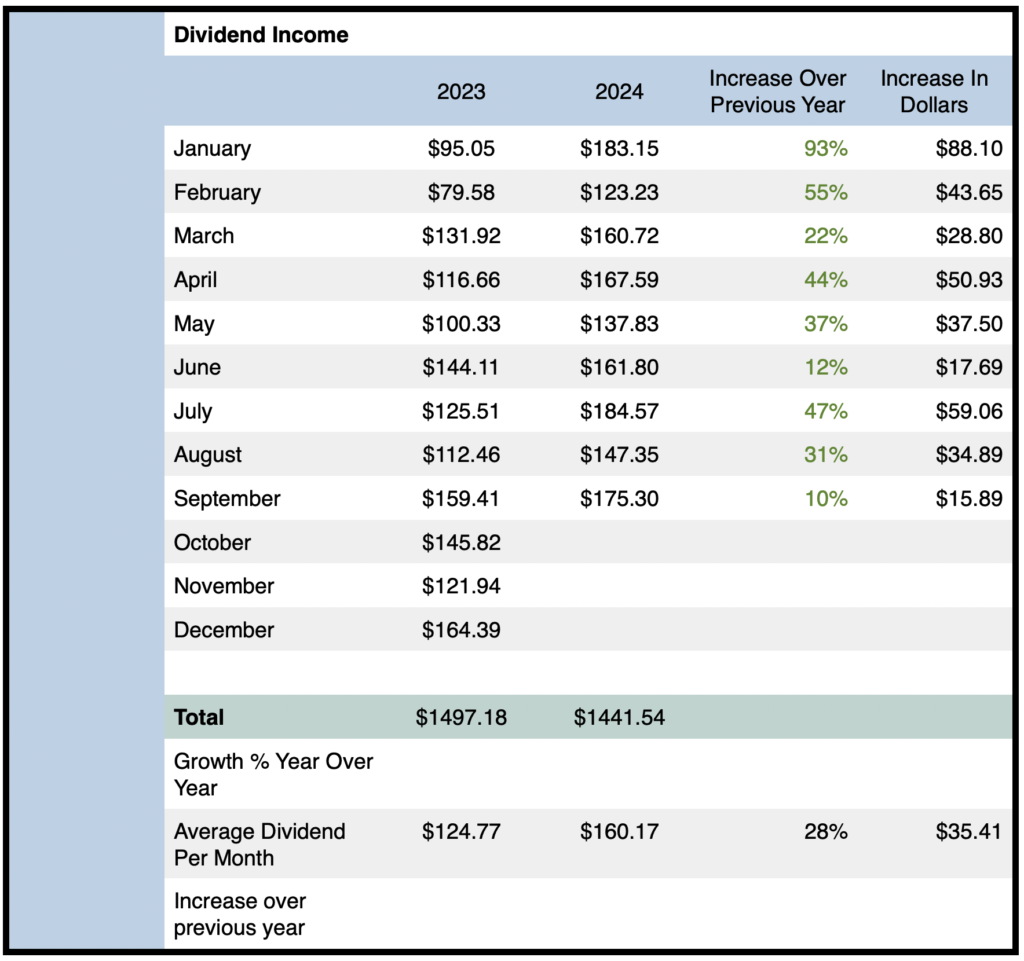

- Total dividend income earned in September 2024 was $175.30

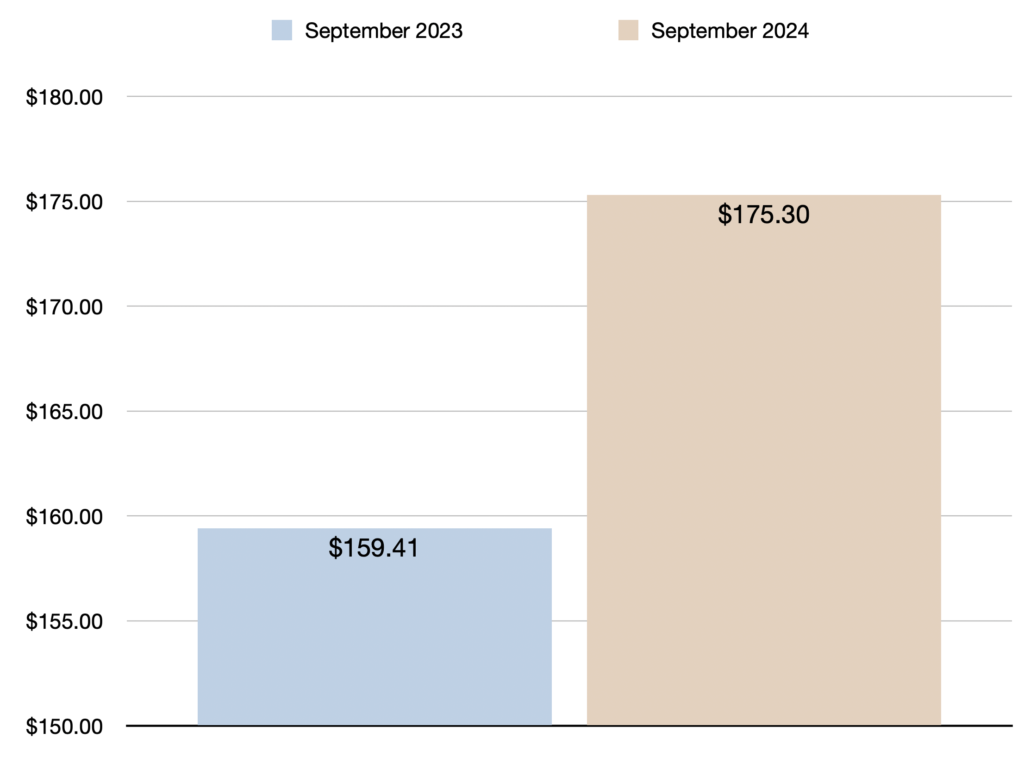

- Year-over-year (YOY) dividend income increased by 10% or $15.89 compared to September 2023

- Year-to-date (YTD) dividend income (January – September 2024) is up to $1441.54

- YTD dividend income is up by 35% or $376.51 compared to the first nine months of 2023

- Quarter-over-quarter (QOQ) dividend income increased by 8% or $13.50 compared to June 2024

- Average monthly dividend income in 2024 is $160.17 (up 28% or $35.41 per month compared to 2023)

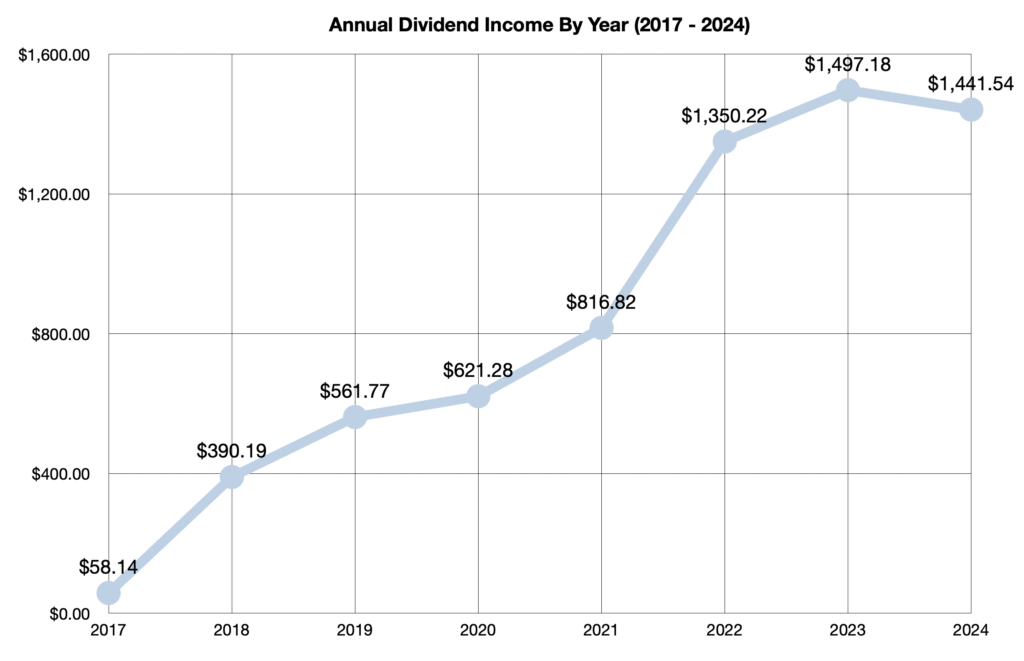

- All-time dividend income since June 2017 reached $6737.04

- 14 holdings paid dividends in August 2024

- 2 dividend raises were announced by $FTS and $MSFT

September 2024 Dividend Income Earnings — $175.30

I’ll start this section as I did last month, so feel free to skip ahead to the specifics if you’ve already read that.

Before diving into the dividend income numbers, I want to reiterate that total return is what truly matters, but tracking dividend income offers a measurable way to gauge progress and serves as a helpful proxy. Furthermore, tracking dividend income provides motivation to keep saving and investing and is helpful for investors to stick to a strategy.

Of course, I also monitor my total investment returns and compare performance to the S&P 500. As I alluded to in the introduction, I’m still modestly outperforming this benchmark by a few basis points year to date.

That said, these blog posts concentrate specifically on dividend income rather than total returns. Dividend income provides a clear and measurable way to track progress and serves as a useful indicator of my portfolio’s overall growth. It allows me to assess my journey toward financial independence and document the incremental increases on a monthly basis. For blogging purposes, focusing on incremental dividend income progress offers more actionable insights than simply reporting the monthly fluctuations of the S&P 500 or my investment portfolio overall.

Continuing from that focus, let’s delve into the specifics of the dividend income for September 2024.

Total dividend income for September reached $175.30, representing a 10% year-over-year increase—a rise of $15.89 from the $159.41 received in September of last year. This marks the third highest month of 2024 and the third highest overall in my dividend investing journey. However, it’s worth noting that this month saw the slowest year-over-year dividend growth of the year.

Year-to-date dividend income reached $1,441.54, nearing the total from 2023. That’s a remarkable 35% increase—$376.51 more than the first nine months of 2023!

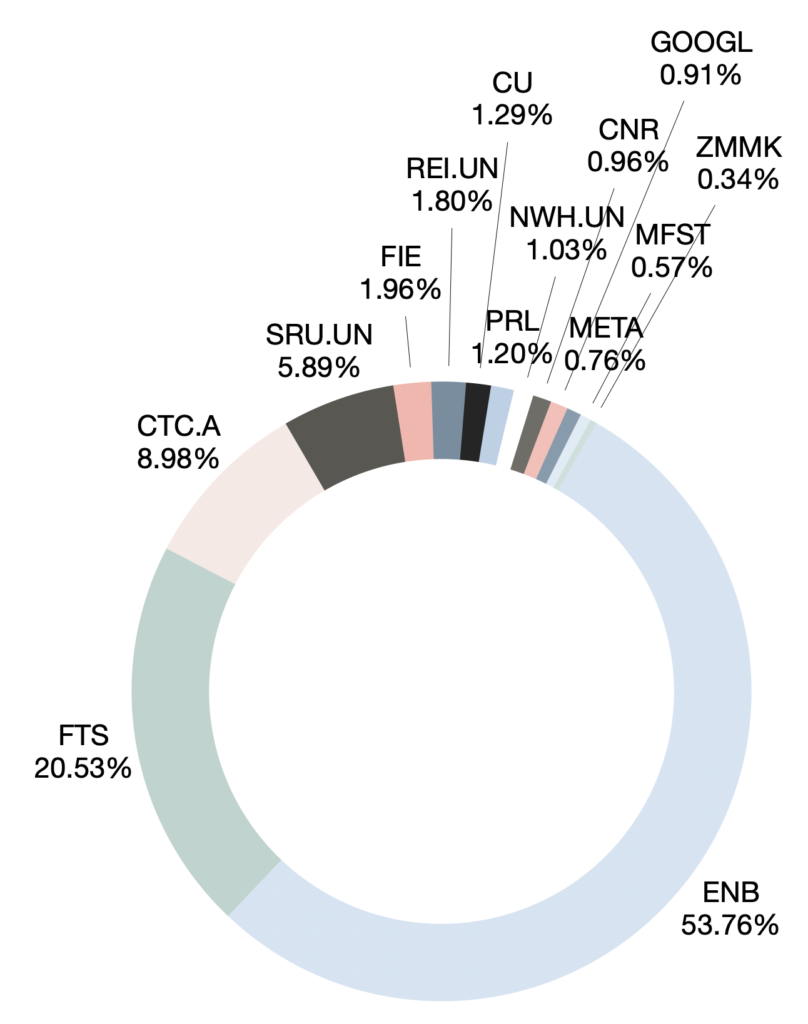

Quarter-over-quarter (QOQ) dividend income increased by 8% or $13.50 compared to June 2024. This increase can be attributed primarily to new positions in $GOOGL, $PRL, $CU, $CNR, and $ZMMK. Additionally, I bolstered my existing holdings in $SRU.UN, $REI.UN, $NWH.UN, and $FTS during the quarter.

After factoring in September’s dividend income, all-time dividend income since June 2017 reached $6737.04.

Wealthsimple: Open an investment account with Wealthsimple and receive a $25 bonus when you fund your account. Wealthsimple is an excellent brokerage that offers zero commission on Canadian trades, making it a top choice for cost-effective investing. To get your $25 bonus and start investing with Wealthsimple, click here.

Operational Highlights — September 2024

Reminder: I am not a licensed investment advisor, and the content of this post does not constitute professional investment advice. The information provided reflects my personal investment experiences and opinions, and should not be interpreted as a recommendation to buy or sell any stocks or other investments. Before making any investment decisions, please seek the advice of a qualified and licensed investment advisor. All opinions expressed are my own and are based on my personal perspective and experiences.

In September 2024, I received dividend payments from 14 holdings, down one from the previous year. Since last September, I made several changes to my portfolio: I sold $SCHD, $SU, $TSLY, $JEPQ, $ZWC, and $SIS, while adding $GOOGL, $PRL, and $CNR, and I also bought and sold $CU. These adjustments were driven by a focus on total returns rather than just dividend income. As reflected in my sales, I eliminated all covered call ETFs, and most of my new positions come with lower yields.

I opted to sell $SCHD to concentrate on individual stocks, allowing me to choose the best options and achieve more predictable dividend income. $SU has been a frequent trade for me, but I currently prefer $CNQ for energy sector exposure, as I find its management more appealing. However, I wouldn’t rule out reintroducing $SU to my portfolio in the future. Additionally, I appreciate $SIS for its unique exposure and diversification; it has performed well recently, and I’d be open to owning it again down the line.

See the spreadsheet below for a full breakdown of which stocks paid dividends in September 2024:

Activity In September 2024

As I mentioned in the introduction, I didn’t initiate any new positions this month, nor did I sell any like I did last month. However, I did manage to add to some existing holdings.

Before diving into those details, I’d like to share my thoughts on the current market landscape. I don’t consider myself an expert or someone making predictions; rather, this is simply me clarifying my thoughts through writing. My investing experience, coupled with my ongoing engagement with market analysts and research, provides a solid framework for anticipating potential market movements, even though we can never predict exactly what will happen or when.

This month, I’ve found it increasingly challenging to identify clear buying opportunities. While I still view it as a standout target, even $GOOGL has experienced somewhat of a run lately. There seems to be a prevailing optimism in the market due to recent rate cuts and expectations of further reductions. With the markets hitting all-time highs and many of my positions performing strongly this year, my contrarian instincts urge caution. At the same time, savings account rates and money market rates are declining, leaving me feeling that the market is in a precarious position—balancing on the edge of uncertainty. Simultaneously, some economists are forecasting a recession in 2025, but many seem to think a “soft landing” is possible. Consumer spending is beginning to slow, a trend that is evident in the earnings reports of major companies.

In light of this, I’ve been gradually building up my cash reserves and investing in money market funds as a precaution. Nevertheless, I’m still selectively adding to positions where I see value. I will continue to nibble away but it is certainly an interesting time in the markets.

Simplii Financial: Simplii Financial offers no-fee bank accounts and is a fantastic choice for holding your emergency fund. I recently opened an account and secured a 6.25% interest rate until January 2025. Right now, they have a great referral offer where you can earn between $50 and $600 just for becoming a Simplii Financial client. To learn more about this offer, claim your referral bonus, and find an excellent option for your emergency fund, click here.

Buys In September

$GOOGL

In September, $GOOGL was the only USD stock I added to. After initiating my position in August, I purchased an additional four shares—two on September 9, 2024, at $149.62 per share, and another two on September 12, 2024, at $153.91 each. I’m already seeing gains on those shares based on the current market price. Ideally, I’d like to see a pullback below $150 to make another purchase, but if that doesn’t happen, I’d still consider buying at the current price of $165.82 as I write this.

$T.TO

I’m continuing to gradually add to my position in $T.TO, recently picking up 3 more shares in the $22.70 range and below. I believe it’s a solid dividend growth stock with significant upside potential, especially given how beaten up the telecommunications sector is.

$CNQ

I capitalized on the dip in $CNQ and added to my position several times throughout the month. On September 5, 2024, I purchased 1 share for $44.42, followed by 8 shares at $44.69 on September 12, 2024. Thankfully, the stock has since rallied to $47.69. However, it’s worth noting that this uptick is tied to some unfortunate circumstances.

$ZMMK

As mentioned earlier, I’ve been investing in money market funds to earn some interest while I wait for clear buying opportunities to emerge. In September 2024, I added a few more units of $ZMMK for this purpose.

$NWH.UN

I recently picked up 4 shares of this struggling REIT using some spare change from my brokerage account. To be honest, I’m not particularly fond of this REIT, especially after its dividend was slashed, and I plan to sell it eventually. However, I see an opportunity to average down, and I believe that potential rate cuts and some recent management decisions could drive future upside. So, for now, I’m holding and making small additions as I go.

$BTC

On September 7, 2024, I added a small amount to my Bitcoin holdings at a price of $73,176.05 CAD. Just to clarify, I maintain a very modest position in Bitcoin, keeping it below 0.50% of my overall portfolio value. Occasionally, when Bitcoin dips, I use a bit of spare change from my checking account to make these small purchases.

Dividend Raises

Two dividend raises were announced in September 2024, which added $6.42 to my PADI (projected annual dividend income).

$FTS — Fortis Inc. recently announced a 4.2% dividend increase, marking an impressive 51 years of consecutive dividend growth. They also extended their annual dividend growth guidance of 4-6% through 2029. The December 2024 dividend will rise to $0.615 per share, up from $0.59. With my ownership of 61 shares, this increase adds an additional $6.10 to my projected annual dividend income.

$MSFT — Microsoft recently announced a 10% increase in its quarterly dividend, bringing it up to $0.83 per share. Since I only own 1 share, the impact on my portfolio is minimal. That said, I’m pleased to report that I’m up 41% on that single share!

Outlook/Guidance

I expect full-year dividend income to be in the range of $2000, unchanged from my 2024 financial goals.

Reaching $2000 would represent a 34% year-over-year dividend growth rate compared to the $1497.18 received in 2023.

Based on the $1441.54 received so far in 2024, I must earn at least $558.46 more by the end of the year. Broken down monthly, I must earn at least $186.15 per month for the remainder of the year.

Based on this year’s average monthly dividend income ($160.17), I am still trending slightly behind. If I continue to average $160.17 per month, the portfolio will end up generating $1922.05.

Despite being slightly behind, I am still confident that I will be able to achieve my $2000 target dividend income. The reason for my confidence is because my PADI (projected annual dividend income) is already well above $2000, and October 2024 will likely generate more than $200.

To grow dividend income, I will continue to rely on the three dividend growth levers: reinvesting dividends | dividend raises | investing new capital.

Final Thoughts — September 2024 Dividend Income

In summary, dividend income in September 2024 was $175.30, which represents a 10% year-over-year increase compared to September 2023.

Year-to-date dividend income is now $1441.54, which is up by an impressive 35% or $376.51 compared to the first nine months of 2023.

Moreover, all-time dividend income since June 2017 reached $6737.04.

It’s also worth mentioning that $FTS and $MSFT both announced dividend raises, resulting in an increase of $6.42 to my projected annual dividend income.

Regarding portfolio activity, I didn’t initiate any new positions this month and didn’t sell any holdings like I did last month. However, I did add to some existing positions. In terms of total returns—the primary focus of my strategy—I’m still modestly outperforming my benchmark, the S&P 500, by a few points.

Stay tuned for more exciting dividend income updates in 2024 as the snowball grows!

Related Dividend Income Updates

September 2023 Dividend Income

All Dividend Income Updates Since June 2017

You may have noticed that I’ve recently removed display ads from the blog. Running this site involves ongoing costs, including web hosting and domain renewal, and your support is greatly appreciated. By opening an account with the companies listed below, which I personally use for investing and saving, you can help support the blog while also benefiting from their services. It’s a win-win—these companies offer great incentives for signing up. See below for more details and how you can get started.

Wealthsimple: Open an investment account with Wealthsimple and receive a $25 bonus when you fund your account. Wealthsimple is an excellent brokerage that offers zero commission on Canadian trades, making it a top choice for cost-effective investing. To get your $25 bonus and start investing with Wealthsimple, click here.

Simplii Financial: Simplii Financial offers no-fee bank accounts and is a fantastic choice for holding your emergency fund. I recently opened an account and secured a 6.25% interest rate until January 2025. Right now, they have a great referral offer where you can earn between $50 and $600 just for becoming a Simplii Financial client. To learn more about this offer, claim your referral bonus, and find an excellent option for your emergency fund, click here.

Connect With Dividend Income Investor

Instagram: @dividendincomeinvestor_

Threads: @dividendincomeinvestor_

Pinterest: @dividendincomeinvestor

Facebook: @Reversethecrushblog

Dividend Income August 2024 — Dividend Income Investor Sees An Impressive $147.35 In Dividends: 31% YOY Dividend Growth and Robust Capital Gains

Dividend Income August 2024 — Dividend Income Investor Sees An Impressive $147.35 In Dividends: 31% YOY Dividend Growth and Robust Capital Gains