Dividend Income May 2024 — Documenting monthly dividend income to chronicle the journey to financial independence. I am not a licensed investment advisor and this post is not investment advice. All opinions are my own. This post contains display ads from Monumetric.

The Dividend Income Investor blog is pleased to announce dividend income results for May 2024.

Dividend Income May 2024 Highlights

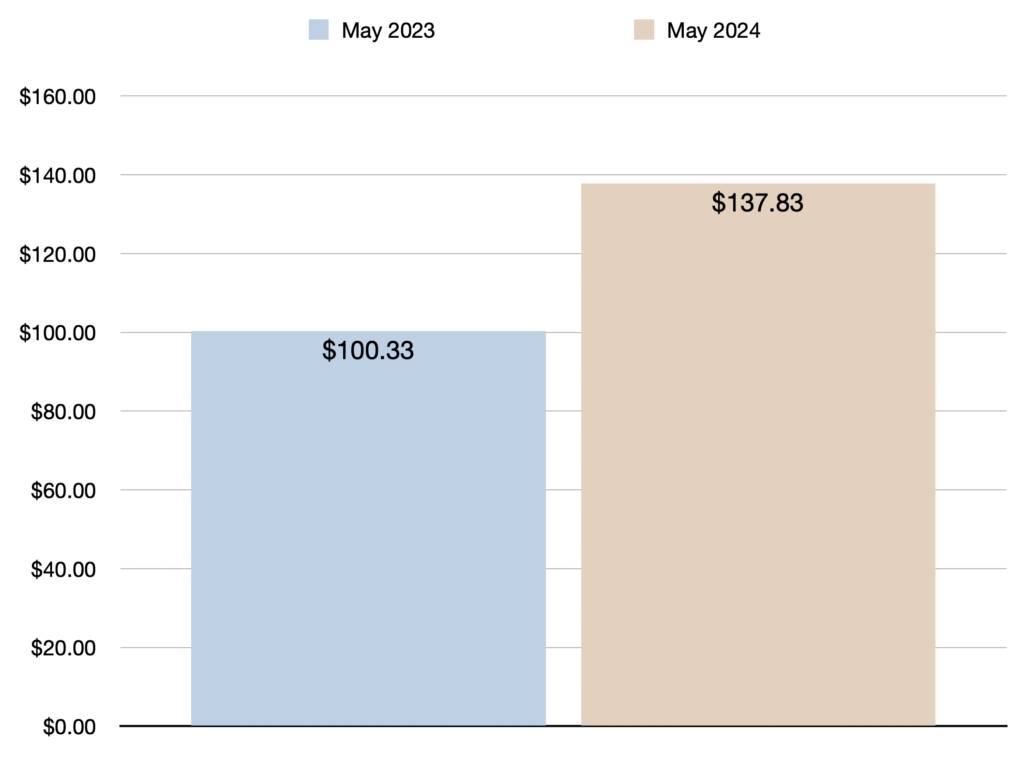

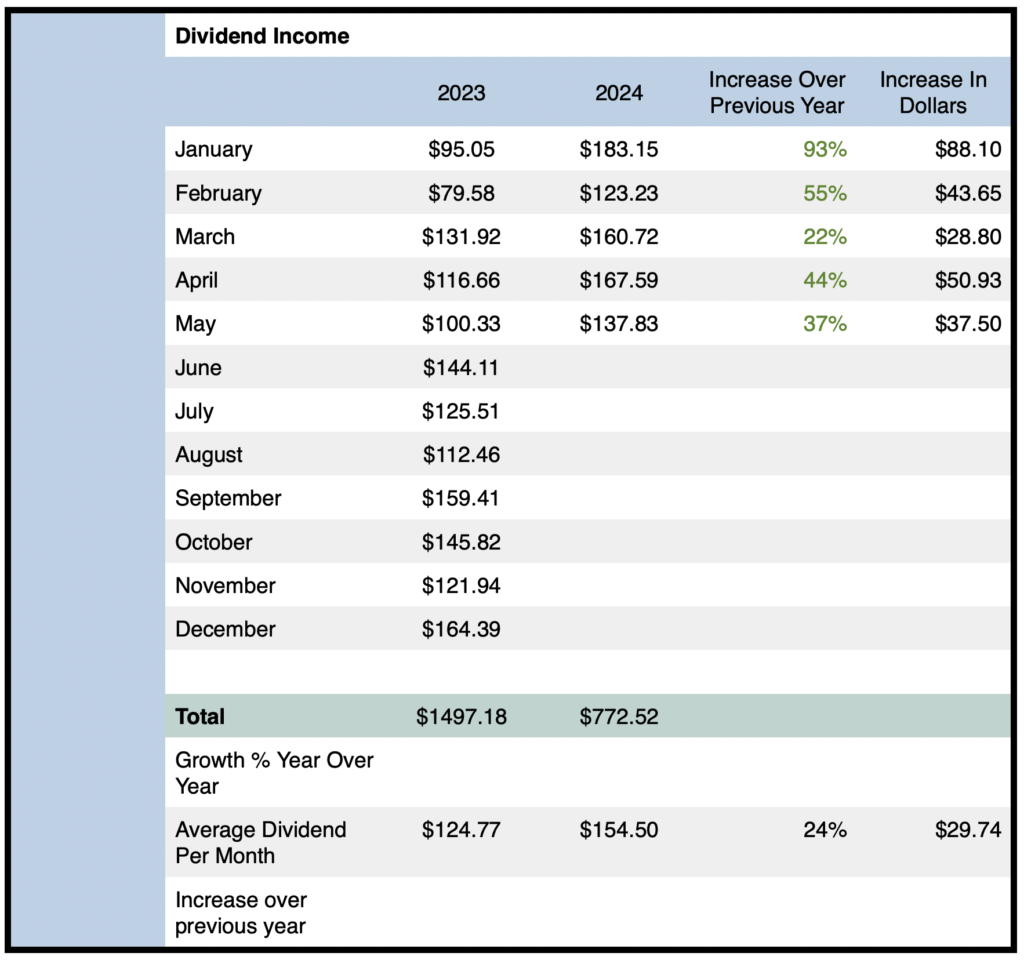

- Total dividend income earned in May 2024 was $137.83

- Year-over-year (YOY) dividend income increased by 37% or $37.50 compared to May 2023

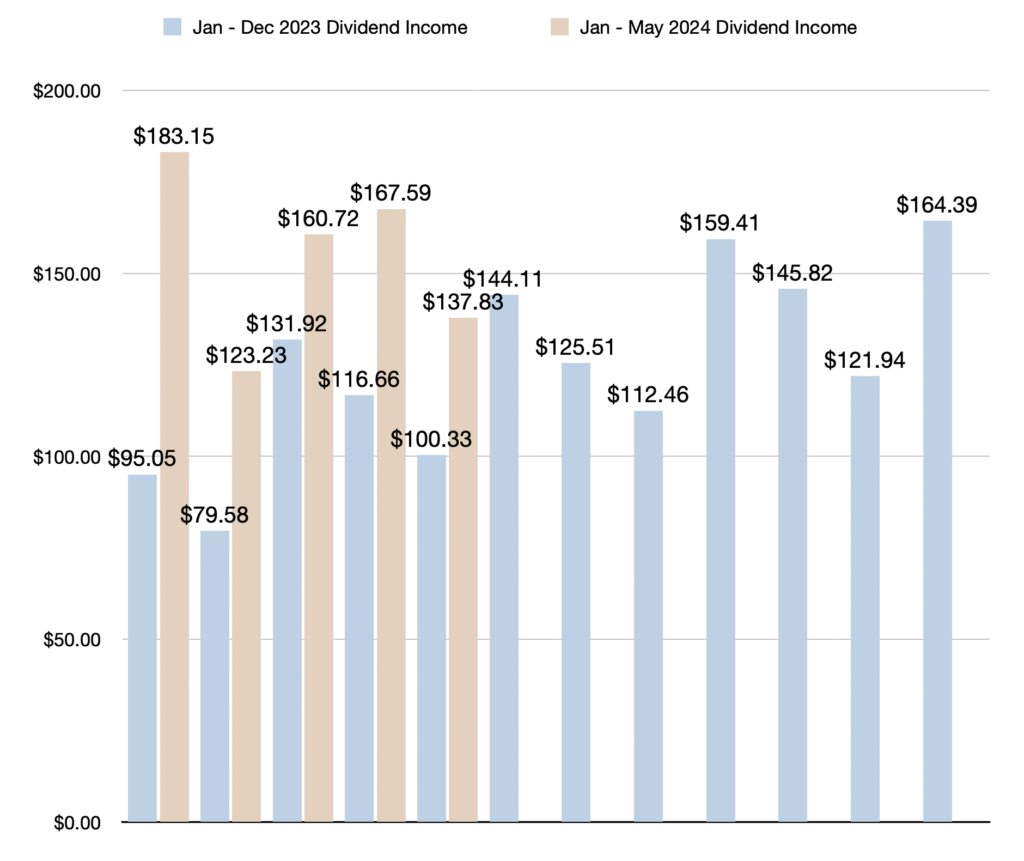

- Year-to-date (YTD) dividend income (January – May 2024) is up to $772.52

- YTD dividend income is up by 48% or $248.98 compared to the first five months of 2023

- Quarter-over-quarter (QOQ) dividend income increased by 12% or $14.60 compared to February 2024

- Average monthly dividend income in 2024 is $154.50 (up 24% or $29.74 per month compared to 2023)

- All-time dividend income since June 2017 reached $6068.02

- Dividend income per day in May 2024 reached $4.45

- 2 dividend raises were announced by Telus (T.TO) and Royal Bank (RY.TO)

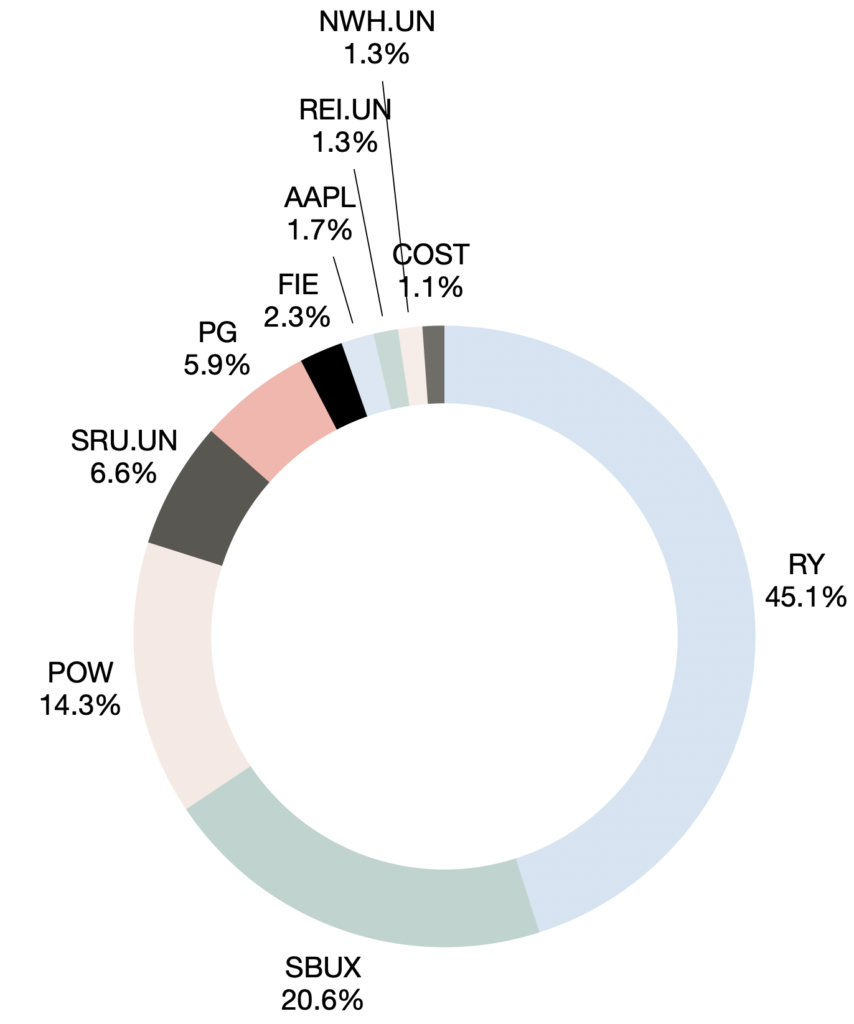

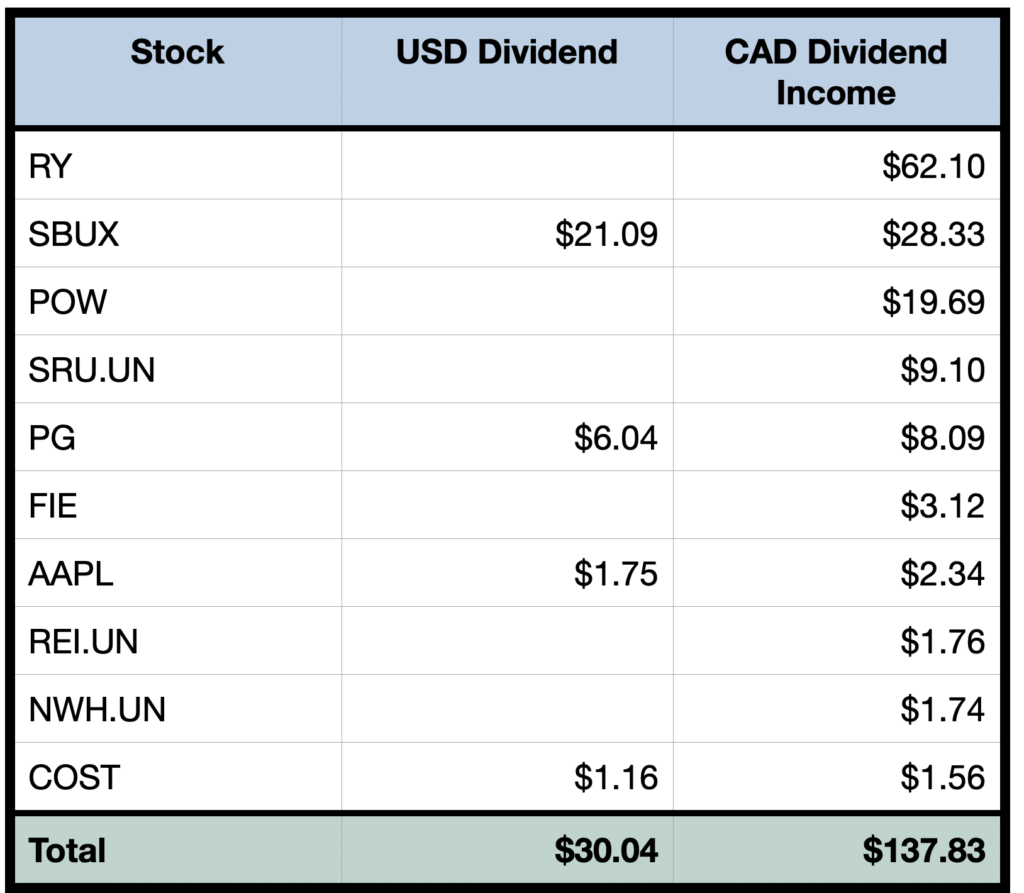

- 10 holdings paid dividends in May 2024

Dividend Income May 2024 Results — $137.83

Total dividend income in May 2024 was $137.83, which represents a 37% year-over-year increase compared to May 2023. In dollars, it’s an increase of $37.50 compared to the $100.33 received during the same month last year.

Also worth noting is that the year-over-year dividend growth rate jumped up substantially from 10% in May 2023 to 37% in May 2024.

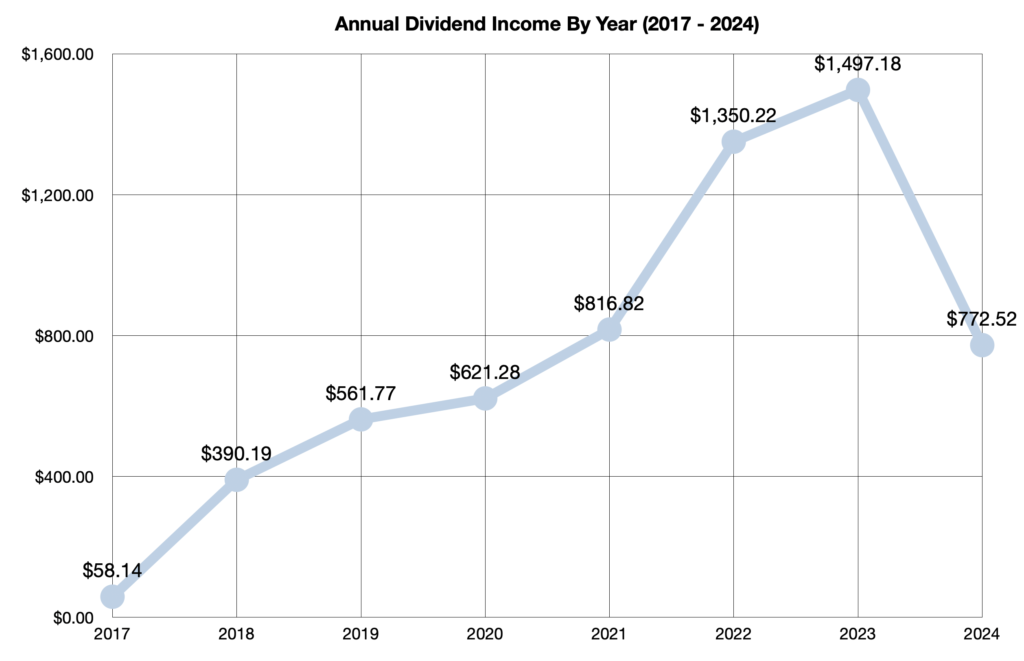

Year-to-date dividend income reached $772.52, which is up by an impressive 48% or $248.98 compared to the first five months of 2023. This year’s dividend income is already more than halfway to surpassing last year’s total of $1497.18. This year’s dividend income is already higher in the first five months than full year dividend income in 2020, 2019, 2018, and 2017. By the end of June 2024, this year’s dividend income will easily exceed full year dividend income in 2021 ($816.82).

Quarter-over-quarter dividend income increased by 12% or $14.60 compared to February 2024. This is despite having seven less holdings to collect dividends from. The increase can primarily be attributed to larger positions in POW and SBUX.

Lastly, another small milestone was reached in May — I surpassed $6000 in all-time dividends. After factoring in May’s dividend income, all-time dividend income since June 2017 reached $6068.02.

Operational Highlights — May 2024

Reminder: I am not a licensed investment advisor and this post is not investment advice. You should always seek professional investment advice from a licensed investment advisor before investing. I am only sharing what I am doing with investing. None of the stocks mentioned are recommendations to purchase investments. All opinions are my own.

A total of 10 holdings paid dividend income in May 2024. This is down substantially by 7 positions since the previous quarter. I intentionally sold stocks to take capital gains, decrease overlap, reduce the amount of positions, and concentrate on the best positions.

Below is a breakdown of which stocks paid dividends in May 2024:

Trades

On the USD side, I added to SBUX and reinitiated a position in a stock I recently traded — PLTR. After recently selling PLTR at $25.85 per share in March, I was able to initiate a new position at $20.69 in May.

For the record, I hold all my USD positions in my RRSP to avoid paying withholding tax on dividends. However, I am increasingly using my RRSP for non-paying growth stocks.

Meanwhile, my TFSA will continue to be centred around quality Canadian dividend paying stocks. I added to CM, T.TO, SRU.UN, REI.UN, CNQ, and BCE in May. I also added fractional shares of TOI, LMN, and VFV.

Outlook

I expect full-year dividend income to be in the range of $2000, unchanged from my 2024 financial goals.

Reaching $2000 would represent a 34% year-over-year dividend growth rate compared to the $1497.18 received in 2023.

Based on the $772.52 received so far in 2024, I must earn at least $1227.48 more by the end of the year. Broken down monthly, I must earn at least $175.35 per month for the remainder of the year.

Based on this year’s average monthly dividend income ($154.50), I am still slightly behind. If I continue to average $154.50 per month, the portfolio will end up generating $1854.02.

Despite being slightly behind, I am still confident that I will be able to achieve my $2000 target dividend income. But it’s definitely time to start being more aggressive at achieving this target.

As I alluded to last month, I have already started allocating a higher percentage of my savings towards investing.

Of course, I will continue to rely on the three dividend growth levers (reinvesting dividends | dividend raises | investing new capital).

In regards to dividend raises, two dividend raises from RY and T.TO contributed to my PADI (projected annual dividend income) in May. My PADI increased by $13.81 as a result of the dividend raises.

Final Thoughts

In summary, dividend income in May 2024 was $137.83. This represents a 37% year-over-year increase compared to May 2023.

Year-to-date dividend income is now $772.52, which is up by an impressive 48% or $248.98 compared to the first five months of 2023.

Furthermore, another milestone was reached as I surpassed $6000 in all-time dividend income. I have now received $6068.02 in dividends since June 2017.

Moreover, my target dividend income for 2024 remains unchanged, as I still expect to receive at least $2000 in dividends by the end of the year. However, I am trending slightly behind, so it’s time to become more aggressive.

Overall, it was a solid month for the investment portfolio. Although it wasn’t the highest month for dividend income this year, it was a very strong month for capital appreciation. My portfolio was up significantly in May and is continuing to remain competitive with the S&P 500. I’m not currently beating it YTD, but I’m not too far behind.

In addition to tracking the dividend income, I will continue to monitor my total investment returns and compare performance to the S&P 500. My goal is to maintain an income-centric portfolio with a low-risk profile that is competitive with the S&P 500. Ideally, my portfolio will stay competitive in the good years and outperform in the down years.

Stay tuned for more exciting dividend income updates in 2024 as the snowball grows!

Related Dividend Income Updates

Dividend Income May 2023 — $100.33

Dividend Income February 2024 — $123.23

I am not a licensed investment or tax adviser. All opinions are my own. This post may contain advertisements by Monumetric and Google Adsense. This post may also contain internal links, affiliate links to BizBudding, Amazon, Bluehost, and Questrade, links to trusted external sites, and links to RTC social media accounts.

Connect With Dividend Income Investor

Instagram: @dividendincomeinvestor_

Threads: @dividendincomeinvestor_

Pinterest: @dividendincomeinvestor

Facebook: @Reversethecrushblog

Dividend Income April 2024 — Dividend Income Investor Reports 2nd Highest Month Ever; $167.59 (44% YOY Increase)

Dividend Income April 2024 — Dividend Income Investor Reports 2nd Highest Month Ever; $167.59 (44% YOY Increase)