Dividend income January 2024 — Documenting monthly dividend income to chronicle the journey to financial independence. I am not a licensed investment advisor and this post is not investment advice. All opinions are my own. This post contains one link to Wealthsimple and display ads from Monumetric.

Welcome to the Dividend Income Investor blog.

If you are a first time reader, this blog is focussed on documenting monthly dividend income.

Since the first month of 2024 is officially over, it’s time to document January’s dividend income and reflect on this month’s performance.

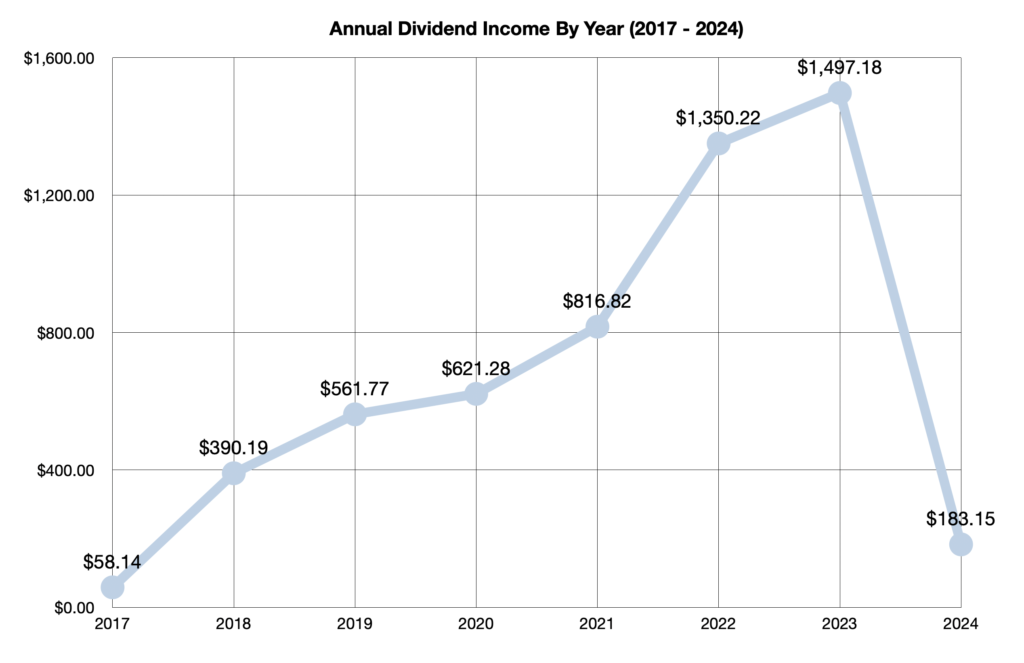

Fortunately, I had a great month, as the investment portfolio is off to a fantastic start. In fact, January 2024 set a new record for dividend income received in one month, and my portfolio achieved the highest year-over-year dividend growth rate since August 2022.

After a slower year for dividend growth in 2023 (11% overall), I am absolutely thrilled to see this year get off to such a strong start. My investment portfolio is in a completely different stratosphere than it was at the beginning of last year. Consequently, I am excited to continue to improve as a dividend income investor and fine-tune my investment and portfolio management skills overall.

In this blog post, I will discuss how much dividend income was earned in January 2024, review which stocks paid dividends, and compare this month’s results to the same month last year.

Since there is a lot of exciting details to cover, let’s jump right into the numbers.

Dividend Income January 2024 Highlights

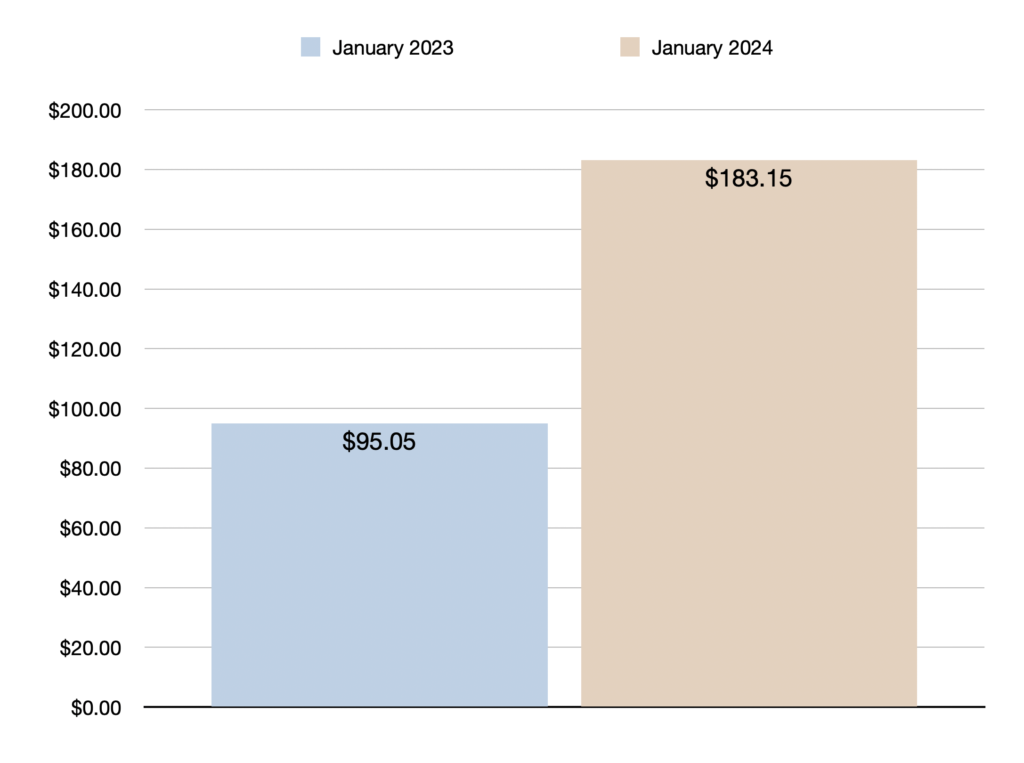

- Dividend Income in January 2024 — Total dividend income in January 2024 was $183.15

- Year-over-year dividend income increase (YOY) — YOY dividend income increased by 93%

- Quarter-over-quarter dividend income increase (QOQ) — QOQ increased by 26%

- All-time dividend income since June 2017 — All-time dividend income reached $5478.65

- Special dividend payment from Costco — A special dividend of $15 USD boosted income

- Holdings — 19 stocks/REITs/ETFs paid dividends

Dividend Income January 2024 Results

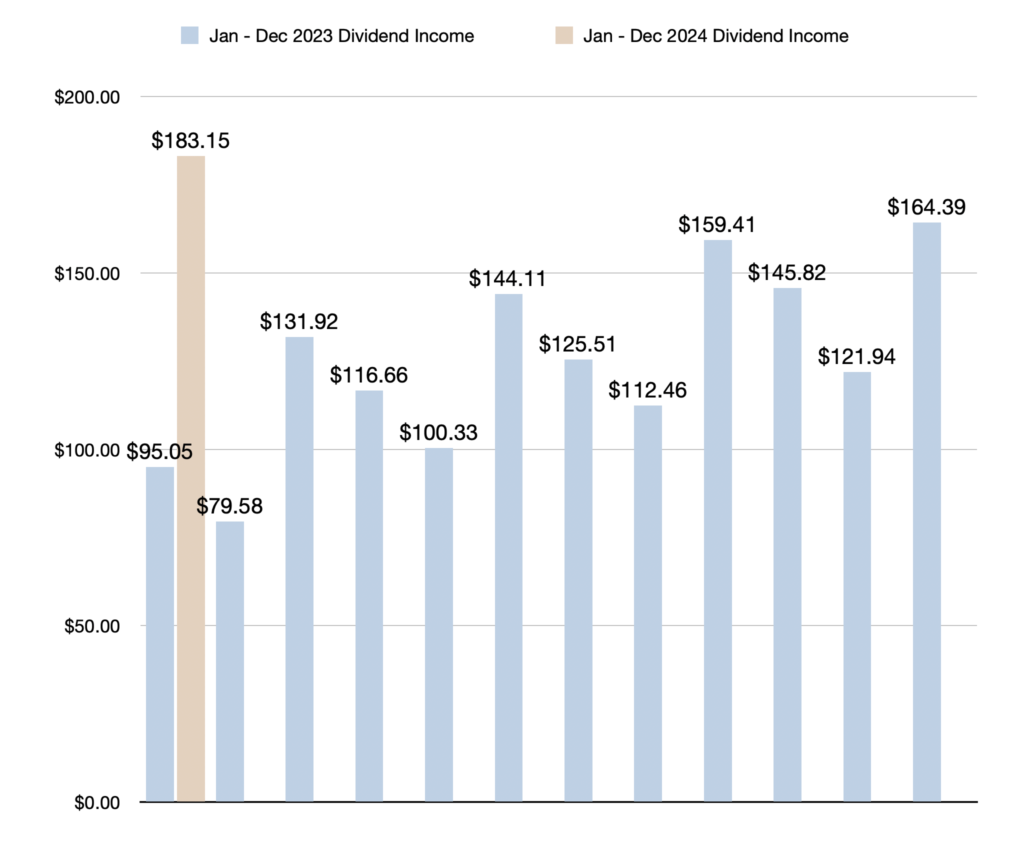

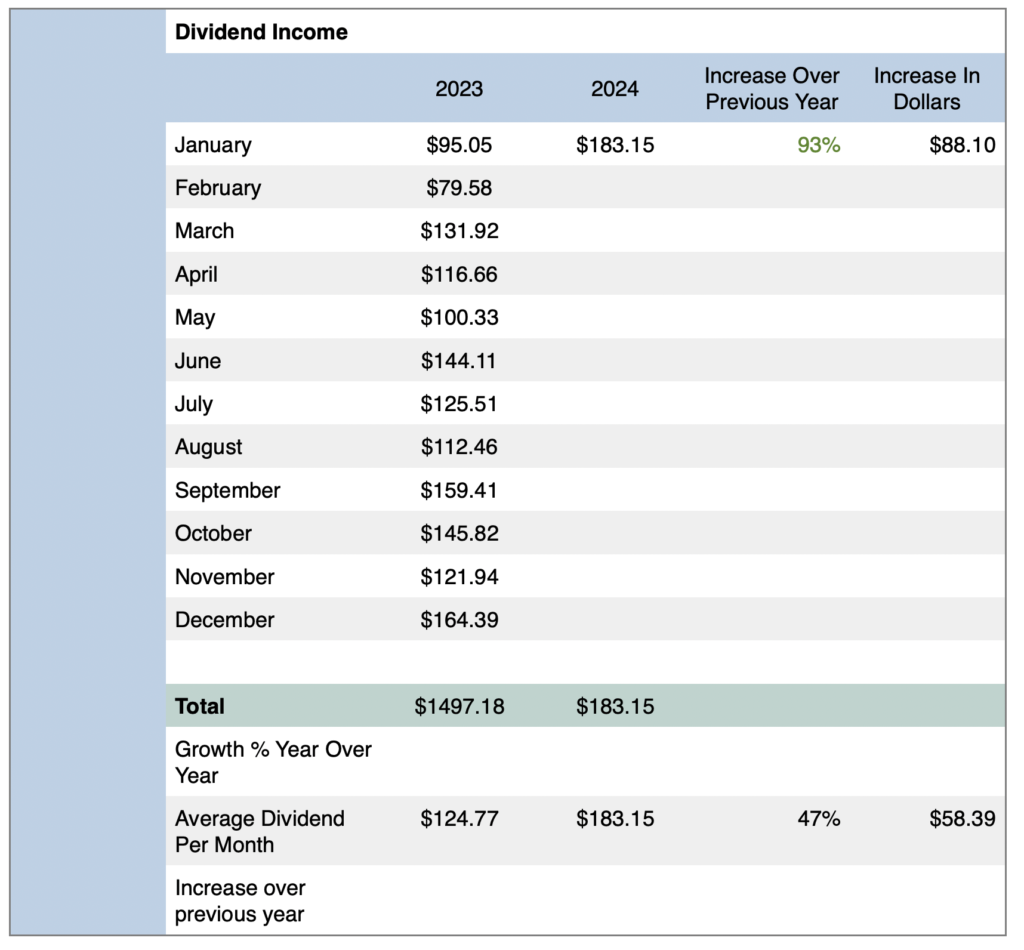

Dividend income in January 2024 was $183.15, which is a new all-time record within one month. The previous high occurred in December 2023, as $164.39 in dividends was earned.

This month’s dividend income represents an increase of 93% year-over-year compared to January 2023. In dollars, it’s an increase of $88.10. It’s the highest year-over-year increase in sixteen months (since August 2022). As mentioned earlier, I am absolutely thrilled to see dividend income off to such a strong start compared to the $95.05 that was earned last January.

Furthermore, year-over-year dividend income has been increasing for four consecutive months. After a slower year for dividend growth in 2023, it’s clear now that dividend income growth is accelerating.

Compared to the previous quarter (October 2023), quarter-over-quarter dividend income increased by 26% or $37.33. Although this increase was partially due to the special dividend from Costco, it’s another strong indication that dividend income growth is accelerating.

In total, my all-time dividend income since June 2017 reached $5478.65, which is incredible considering that I started this journey off by earning only $4.27.

Overall, it was a great month and a fantastic start to 2024.

Operational Highlights — Stocks | REITs | ETFs That Paid In January 2024

Reminder: I am not a licensed investment advisor and this post is not investment advice. You should always seek professional investment advice from a licensed investment advisor before investing. I am only sharing what I am doing with investing. None of the stocks mentioned are recommendations to purchase investments. All opinions are my own.

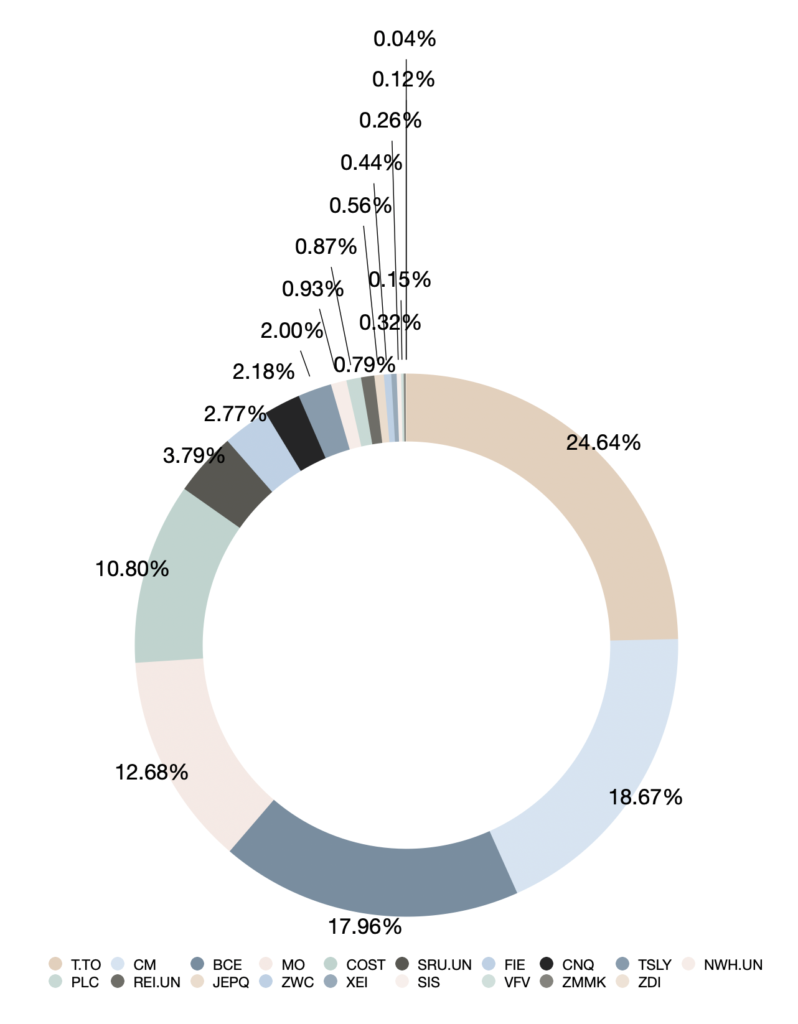

A record-high nineteen positions paid dividends in January 2024. Surprisingly, this is up by eleven since January 2023.

Of course, one of the payments was a special dividend from Costco, so it was really eighteen positions that paid.

ETFs

Frankly, I still think I hold too many positions. But at least the ETFs (FIE, VFV, XEI, ZDI, ZMMK, ZWC) don’t require the same level of research as the stocks I hold do. I am up on all these ETFs as they have been performing well. I will likely continue to average into them. In terms of portfolio allocation, FIE, VFV, and XEI will eventually represent 5% of my total portfolio. ZDI, which is an international dividend ETF that I hold for diversification, could eventually be as high as 3% of my total portfolio. And ZMMK is just a money market ETF that I plan to slowly add to. ZWC, which is a covered call ETF, is really the only question mark of these ETFs.

Holdings That Could Be Sold

As for TSLY and JEPQ, though, I am considering closing out these small positions. I hold these two positions in my RRSP and would prefer to reinvest the money into high quality USD stocks that offer more growth potential. Either that or SCHD.

Otherwise, two more holdings that I would consider selling are NWH.UN and REI.UN. In short, both REITs have slashed dividends at points, so I have less confidence in them than SRU.UN.

Exiting TSLY, JEPQ, NWH.UN, and REI.UN would lower this month’s holdings down to a more reasonable fourteen positions.

Stocks

Excluding the special dividend payment from Costco, the bulk of January’s income was from T.TO, CM, BCE, and MO.

The other three stocks (CNQ, PLC, SIS) are positions I’d like to add more to. Unfortunately, I didn’t invest enough when SIS and PLC were down. My cost basis on SIS and PLC is $13.85 and $17.81, respectively. As such, I plan to invest more on dips in the future.

Outlook

I expect full-year dividend income to be in the range of $2000, unchanged from my 2024 financial goals.

Reaching $2000 would represent a 34% year-over-year dividend growth rate compared to the $1497.18 received in 2023. This guidance means I am expecting the dividend growth rate to triple compared to the 11% YOY growth in 2023.

Based on the $183.15 of dividend income received in January 2024, I am on pace for a much higher target. To reach $2000, I must earn at least $167 per month in dividends. But after factoring in this month’s income, I only need to earn $1816.85 in total or $165.17 per month to achieve this target.

Although I am saving more cash than usual, I expect the three dividend growth levers (reinvesting dividends | dividend raises | investing new capital) to continue to be the main drivers to increase dividend income. So far, I received an unexpected boost from META, as the company announced its first dividend. It’s a small boost but definitely a welcome increase. Otherwise, to grow dividend income, I reinvested $183.15 of dividends and invested a small amount of new capital so far in 2024.

In addition, I still expect my full-year costs to be 0.08% or less, unchanged from my financial goals. To keep costs low, I utilize a zero-commission brokerage (Wealthsimple) and pay for USD trades with credit card points.

Also worth mentioning, I will continue to monitor my total investment returns and compare performance to the S&P 500. My goal is to maintain an income-centric portfolio with a low-risk profile that is competitive with the S&P 500. Ideally, my portfolio will stay competitive in the good years and outperform in the down years.

Final Thoughts

In summary, dividend income in January 2024 was $183.15. This represents a 93% year-over-year increase compared to January 2023. It’s the highest year-over-year growth rate in sixteen months, and it’s a new record amount for dividend income received within one month.

It was an excellent month as the investment portfolio is off to a fantastic start in 2024. It was a great start towards my full-year dividend goal to earn at least $2000 in dividend income.

Stay tuned for more exciting dividend income updates in 2024 as the snowball grows!

Related Blog Posts

Dividend Income December 2023 — $164.39

Dividend Income January 2023 — $95.05

I am not a licensed investment or tax adviser. All opinions are my own. This post may contain advertisements by Monumetric and Google Adsense. This post may also contain internal links, affiliate links to BizBudding, Amazon, Bluehost, and Questrade, links to trusted external sites, and links to RTC social media accounts.

Connect With Dividend Income Investor

Instagram: @dividendincomeinvestor_

Threads: @dividendincomeinvestor_

Pinterest: @dividendincomeinvestor

Facebook: @Reversethecrushblog

The Most Important Thing Book By Howard Marks (Top 25 Quotes)

The Most Important Thing Book By Howard Marks (Top 25 Quotes)