Dividend income December 2023 — Documenting monthly dividend income to chronicle the journey to financial independence. I am not a licensed investment advisor and this post is not investment advice. All opinions are my own.

Hey dividend investors.

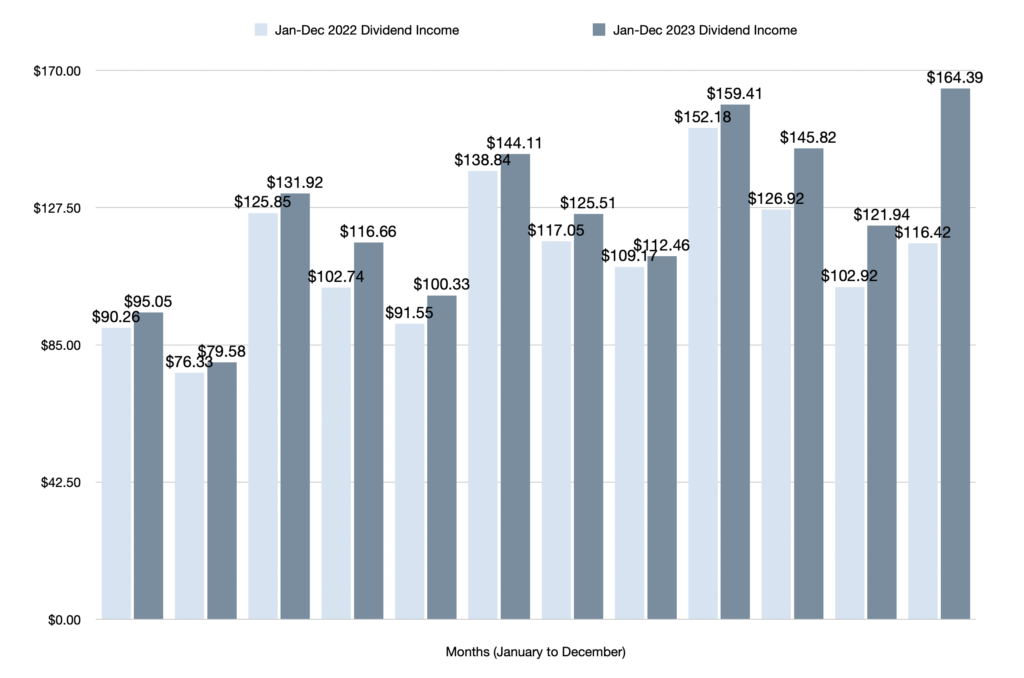

The final month of 2023 has passed, so it’s time to document my dividend income numbers and reflect on year-to-date performance.

On that note, I am thrilled to announce that December 2023 produced the highest year-over-year dividend growth rate of the year. Not only that — I set a new record for dividend income received in one month. Furthermore, year-over-year growth has increased for three consecutive months. Clearly dividend income growth is accelerating heading into the new year.

Let’s take a closer look at how much dividend income was earned in December 2023 and find out how much I earned in total during the year.

Dividend Income December 2023 Highlights

- $164.39 — Total dividend income earned in December 2023 was $164.39 (New record in one month)

- 41% | $47.97 — Year-over-year (YOY) dividend income increased by 41% or $47.97 compared to December 2022 (Highest YOY dividend growth rate this year)

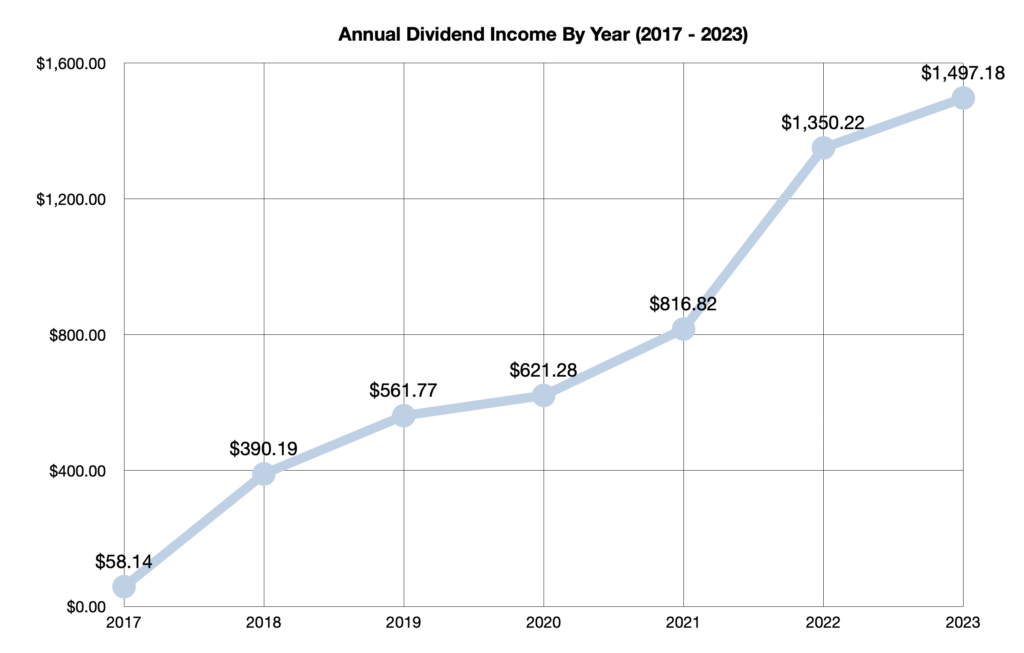

- $1497.18 — Full year dividend income reached $1497.18

- 11% | $146.95 — Total dividend income in 2023 increased by 11% or $146.95 compared to 2022

- $5295.50 — All-time dividend income since June 2017 is $5295.50

- 3% | $4.98 — Quarter-over-quarter (QOQ) dividend growth increased by 3% or $4.98 compared to September 2023

- 14 — 14 stocks/ETFs/REITs paid dividends in December 2023 (Up 5 since December 2022)

- $124.77 — Average monthly dividend income in 2023 was $124.77

- $5.30 — Dividend income per day in December 2023 was $5.30

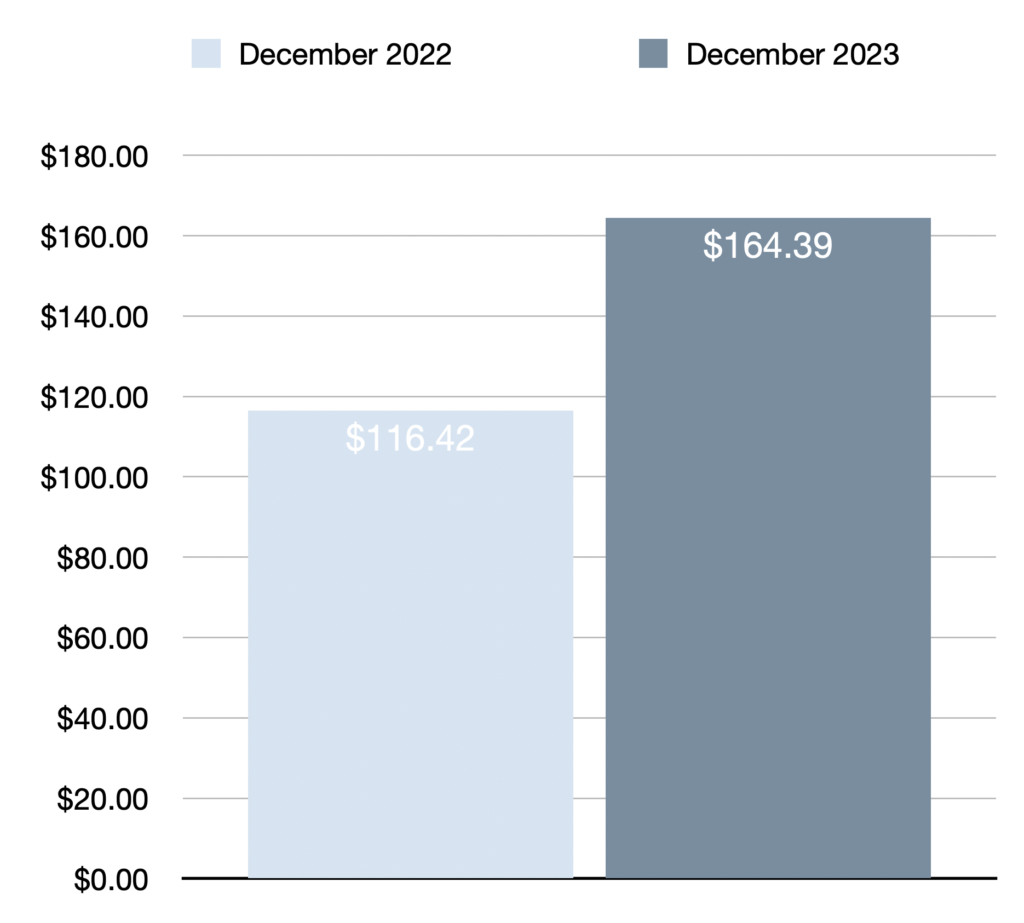

Dividend Income December 2023 Earnings — $164.39

My investment portfolio generated $164.39 in dividend income between December 1, 2023 to December 31, 2023. This represents a 41% year-over-year dividend growth rate compared to December 2022. It’s the highest year-over-year growth rate of 2023. The previous high occurred last month and was 23% lower.

Furthermore, December 2023 set a new all-time record for dividend income received in one month. The previous high occurred in September when $159.41 was generated.

After factoring in December’s income, year-to-date dividend income reached $1497.18. This is an increase of 11% or $146.95 compared to 2022. It’s a new record amount for dividend income earned in one year as well. Additionally, I surpassed my 2023 target dividend income goal of $1400.

Otherwise, quarter-over-quarter (QOQ) dividend income increased by 3% or $4.98 compared to September 2023.

In total, my all-time dividend income since June 2017 reached $5295.50. It’s hard to believe I started this journey earning $4.27 the first month. Fast forward six years later and I’m earning over $160 a month and have made more than $5000 in dividends.

Stocks/REITs/ETFs That Paid Dividends In December 2023

Reminder: I am not a licensed investment advisor and this post is not investment advice. You should always seek professional investment advice from a licensed investment advisor before investing. I am only sharing what I am doing with investing. None of the stocks mentioned are recommendations to purchase investments. All opinions are my own.

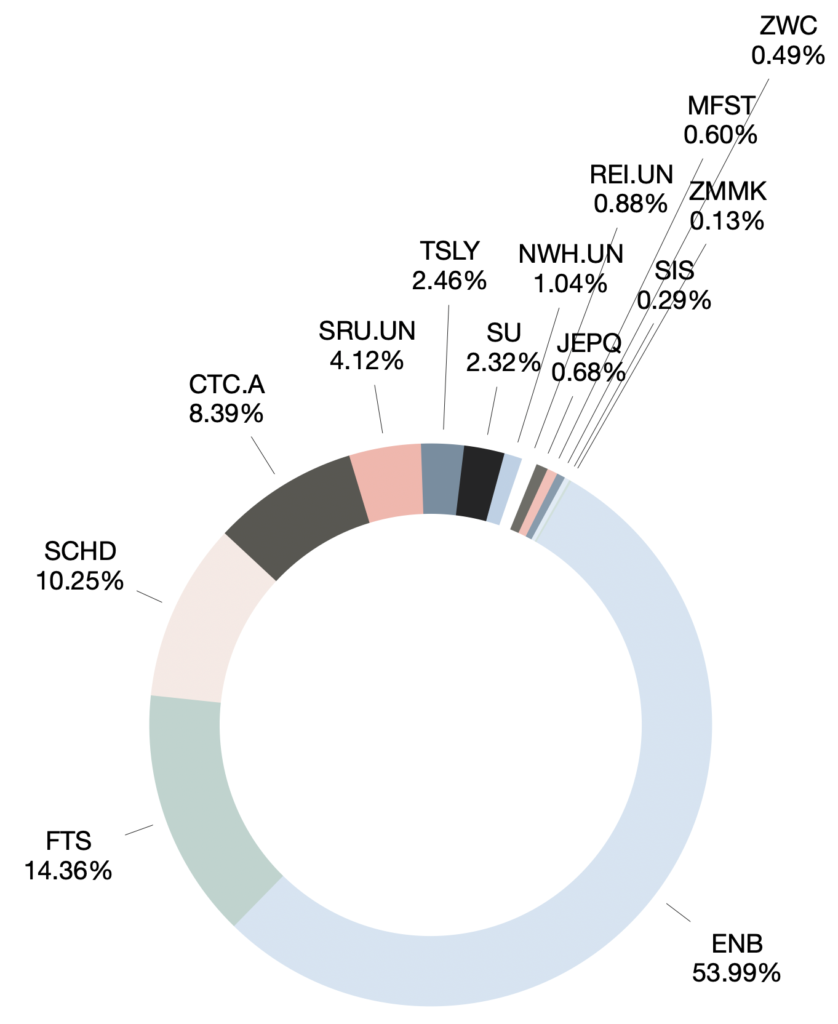

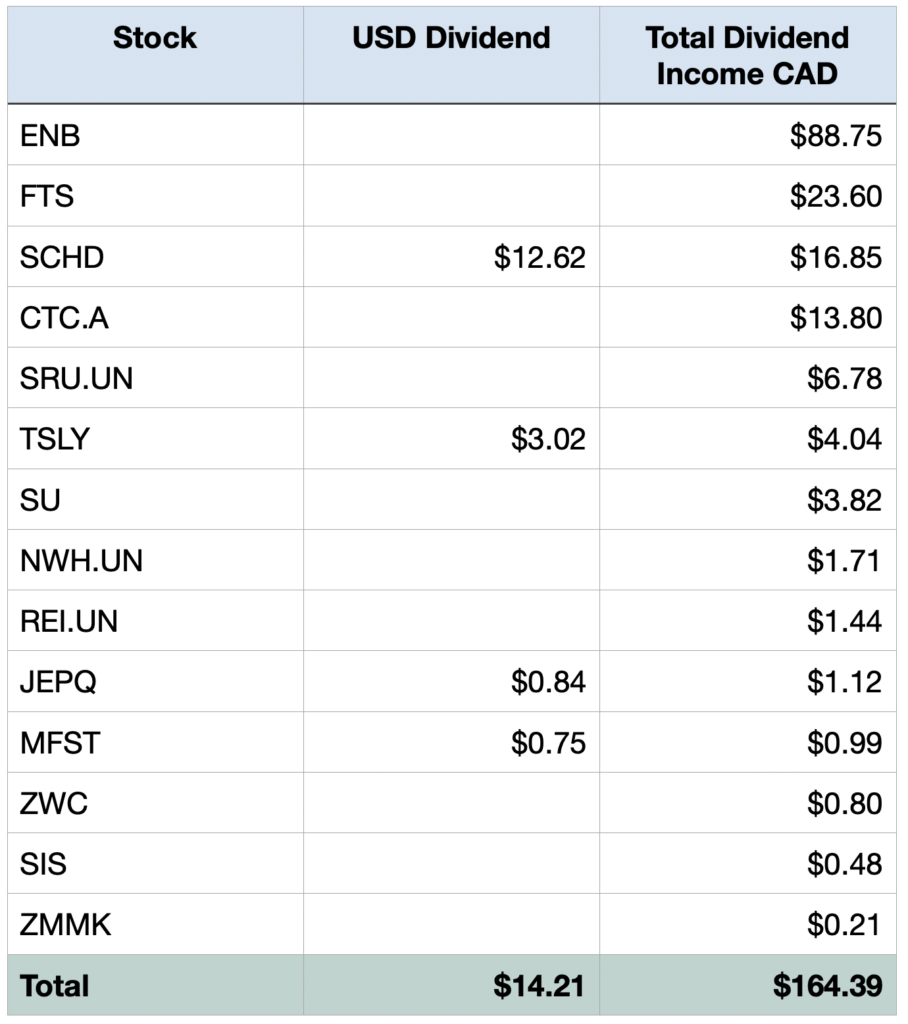

Fourteen positions paid dividends in December 2023. This is up by 5 positions since last December.

Of course, my main positions remained the same. As usual during the March-June-September-December months, the bulk of this month’s income was from Enbridge (ENB), as it accounted for 53.99%. But I’m glad to see that number is down compared to last quarter (55%). Compared to December 2022, it’s down from 59%.

Meanwhile, Fortis (FTS) accounted for 14%, SCHD accounted for 10%, Canadian Tire (CTC.A) accounted for 8%, and SmartCentres REIT accounted for 4% of this month’s dividend income. The remaining positions each accounted for 2% or less.

Below is a breakdown from highest to lowest dividend payment (USD has been converted to CAD for reporting purposes):

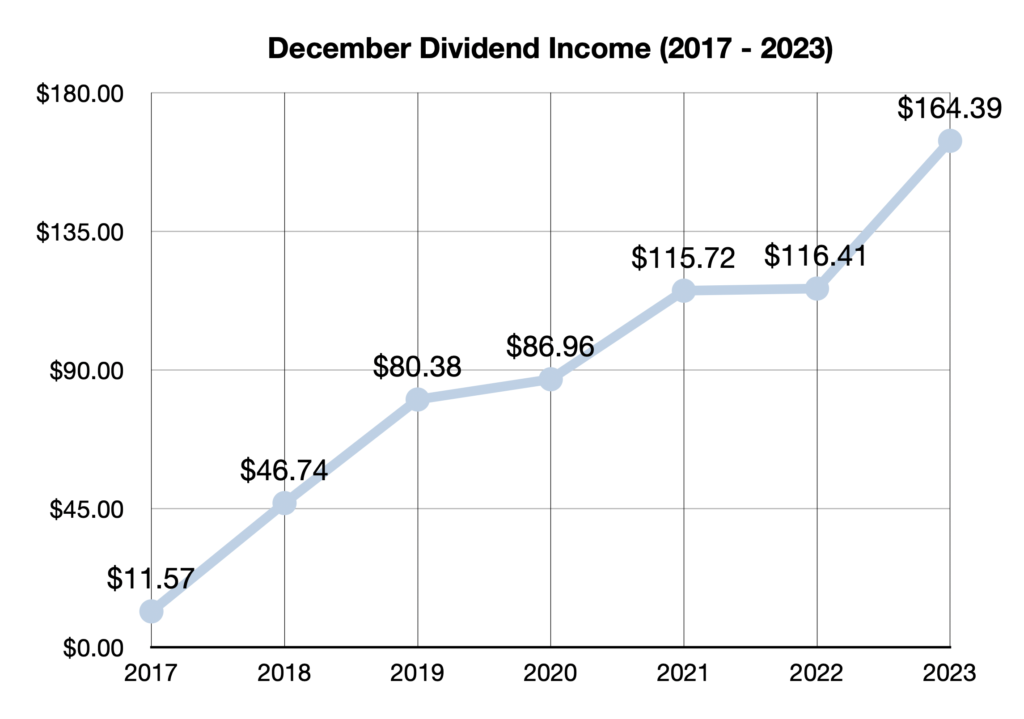

December Dividend Income Growth Since 2017

December has seen steady dividend income growth since 2017.

Overall, dividend income has increased from $11.57 in December 2017 to $164.39 in December 2023.

Here is a breakdown of each report from December 2017 to December 2023:

$11.57 — December 2017 Dividend Income

$46.74 — December 2018 Dividend Income

$80.38 — December 2019 Dividend Income

$86.96 — December 2020 Dividend Income

$115.72 — December 2021 Dividend Income

$116.41 — December 2022 Dividend Income

$164.39 — December 2023 Dividend Income

Outlook – Exceeded My $1400 Target By $97.18

I set a modest financial goal to earn at least $1400 in dividends in 2023.

This target was only 3.7% higher than the $1350.22 in dividends received in 2022.

Fortunately, despite purchasing my first home at the end of 2022, I was able to meet and exceed this target by $97.18. I ended up achieving an 11% year-over-year dividend growth rate.

Of course, I am satisfied and consider this year a success overall. But I’m excited to get back to a higher level of dividend growth in 2024.

In case you missed my financial goals for 2024, I am aiming to earn at least $2000 in dividends, which is 34% higher than the $1497.18 earned in 2023.

I’m looking forward to the challenge and expect to start off the year with an exceptionally strong month.

Final Thoughts

In summary, my investment portfolio generated $164.39 in dividend income in December 2023. This represents a 41% year-over-year dividend growth rate compared to December 2022. Furthermore, it’s the highest YOY dividend growth rate of 2023, and it’s a new record amount for one month.

After factoring in December’s income, year-to-date dividend income reached $1497.18, which was ahead of 2022 by 11% or $146.95. Moreover, I exceeded my target dividend income goal of $1400 this year.

After a slower start to the year, I am thrilled to see dividend income growth accelerating to close out the year.

Stay tuned for more exciting dividend income updates in 2024 as the snowball grows!

Related Blog Posts

I am not a licensed investment or tax adviser. All opinions are my own. This post may contain advertisements by Monumetric and Google Adsense. This post may also contain internal links, affiliate links to BizBudding, Amazon, Bluehost, and Questrade, links to trusted external sites, and links to RTC social media accounts.

Connect With Dividend Income Investor

Instagram: @dividendincomeinvestor_

Threads: @dividendincomeinvestor_

Pinterest: @dividendincomeinvestor

Facebook: @Reversethecrushblog

Financial Goals 2024: 11 Strategic Personal Finance & Investing Goals

Financial Goals 2024: 11 Strategic Personal Finance & Investing Goals