Dividend income August 2023 — Documenting monthly dividend income to chronicle the journey to financial independence. I am not a licensed investment advisor and this post is not investment advice. All opinions are my own.

Hey dividend income investors.

Another month has passed, so it’s time to document my dividend income numbers and reflect on the year-to-date performance.

Although it was a slower month for year-over-year dividend growth, August was a strong month for growing the dividend business. My PADI (projected annual dividend income) increased by $157.10 in August alone. In turn, this will mark the end of the slower year-over-year growth. I expect to see the pace of growth pick up in September, October, November, and December.

But for the time being, let’s focus on August’s dividend income results. In this post, I will reveal how much dividend income I earned in August 2023 and provide insights on which stocks paid dividends.

Let’s dive into the August 2023 highlights.

Dividend Income August 2023 Highlights

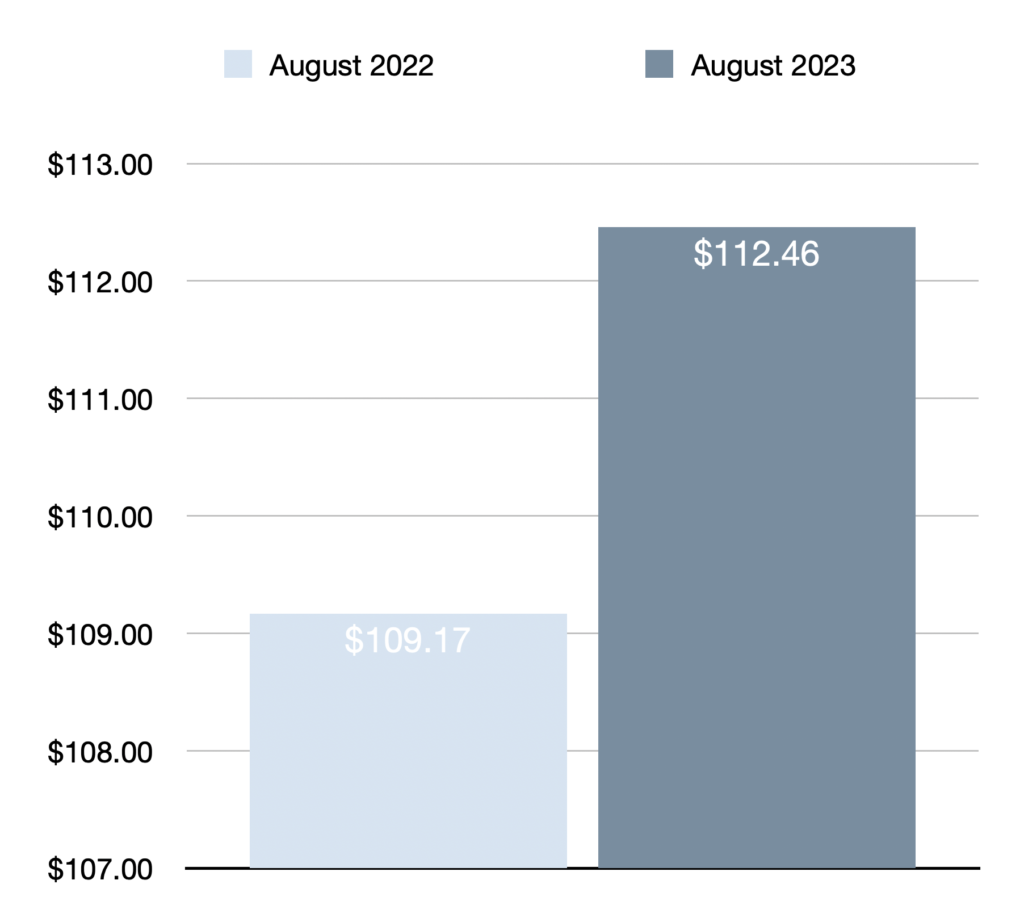

- Total dividend income earned in August 2023 was $112.46

- Year-over-year (YOY) dividend income increased by 3% or $3.29 compared to August 2022

- Year-to-date dividend income is $905.62 (January to August 2023)

- Quarter-over-quarter (QOQ) dividend income increased by 12% or $12.13 compared to May 2023

- 11 stocks/ETFs/REITs paid dividends in August 2023 (no change since last year)

- All-time dividend income since June 2017 is up to $4703.94

- Average monthly dividend income in 2023 is $113.20

- Dividend income per day in August 2023 was $3.63

Dividend Income August Earnings — $112.46

My investment portfolio generated $112.46 CAD in dividend income between August 1, 2023 to August 31, 2023. This represents a modest 3% year-over-year growth rate compared to August 2022. It’s actually the lowest rate of YOY growth so far this year.

On a positive note, I’m celebrating an impressive streak of six consecutive months with dividend income surpassing the $100 mark. What’s even more exciting is the anticipation of accelerated year-over-year growth heading into the remainder of the year and the start of 2024, where income is poised to soar to new heights. Signs of this accelerated growth are beginning to appear in the quarterly results. For example, quarter-over-quarter growth was 12% compared to May 2023.

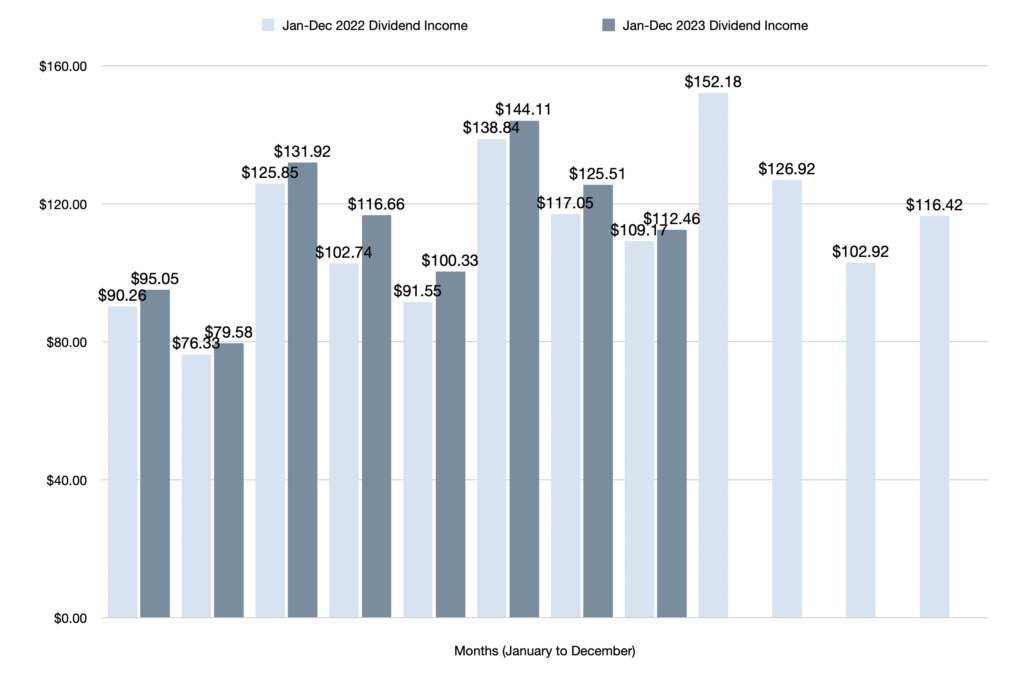

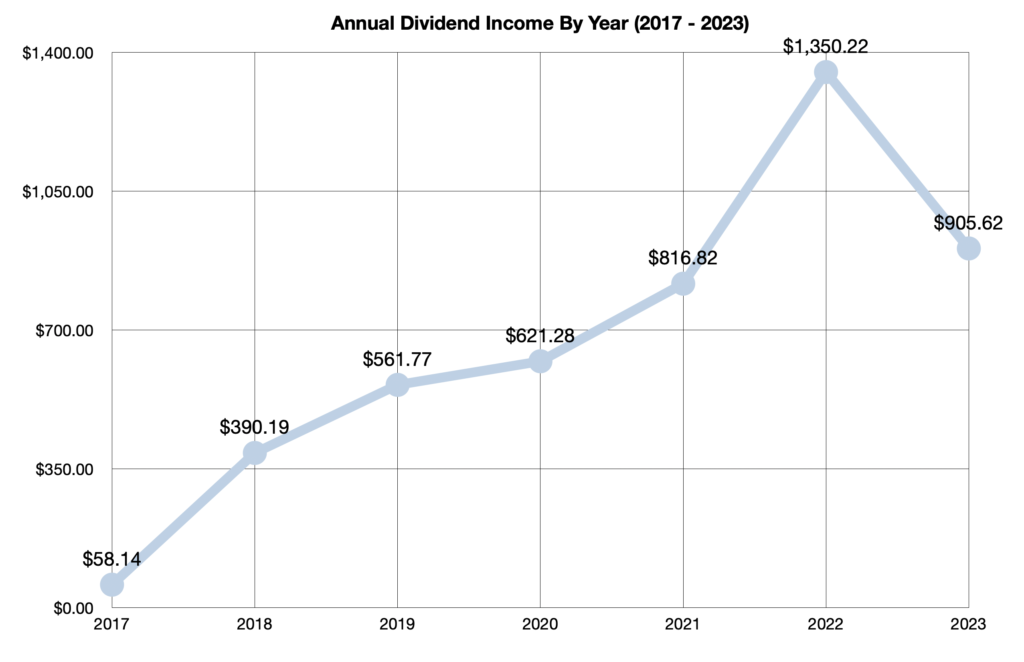

Furthermore, year-to-date dividend income reached $905.62, which is ahead of January to August 2022 by 6% or $53.83. Therefore, total 2023 dividend income has officially surpassed the 2021 total of $816.82. I have 4 months to go to surpass last year’s total of $1350.22.

After factoring in August, my all-time dividend income reached $4703.94 since June 2017. I’m literally months away from $5000 all-time in dividends received.

Stocks/REITs/ETFs That Paid Dividends In August 2023

Eleven positions paid dividend income in August 2023.

Below is a breakdown from highest to lowest payer (USD has been converted to CAD for reporting purposes):

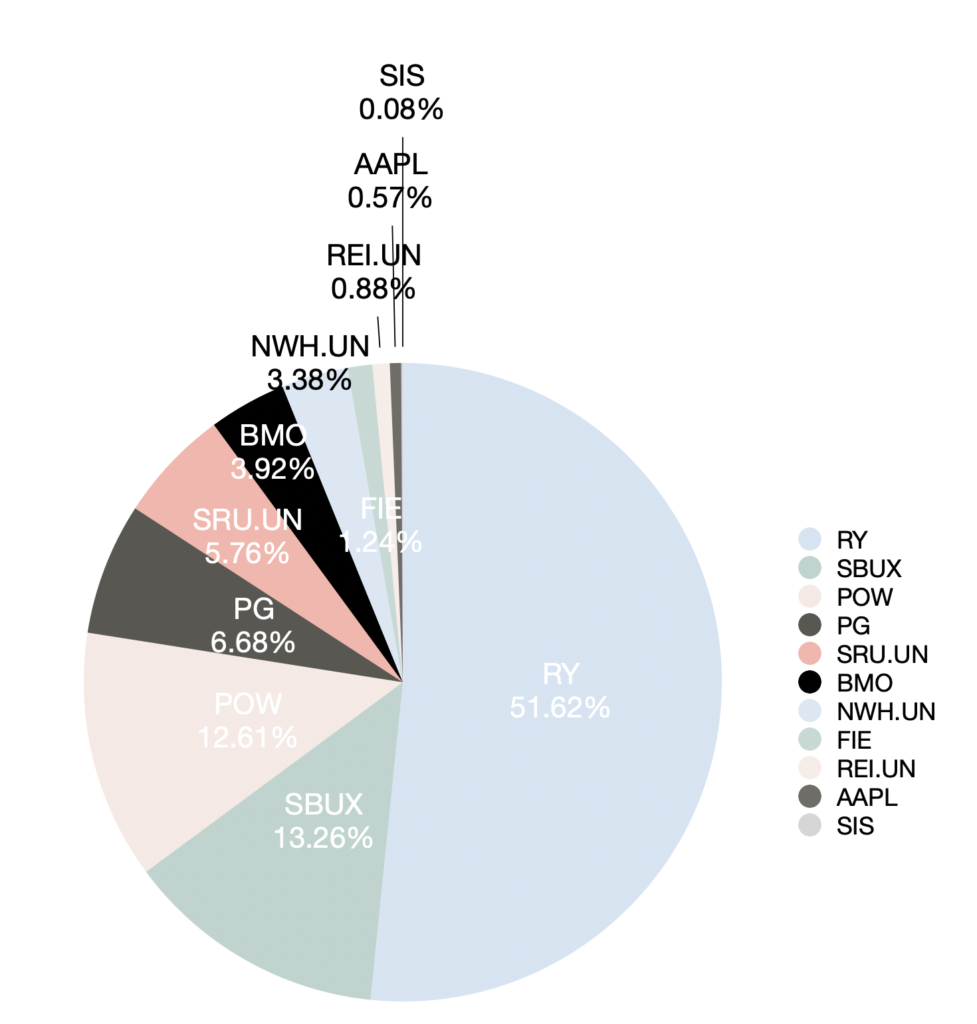

As mentioned above, 11 positions paid dividends in August 2023 — 7 stocks, 3 REITs, and 1 ETF.

This is down by one position since the previous quarter due to Costco’s payment date falling in September, instead of August. Otherwise, there is one new position ($BMO) and one less ($ABBV). As I discussed in previous income updates, I hold the $SCHD ETF instead of $ABBV now.

As per usual during the February-May-August-November months, Royal Bank ($RY) led the way. The company accounted for an overwhelming 51.62% of this month’s dividend income. Starbucks ($SBUX) was the second highest contributor at 13.26%. Power Corporation of Canada ($POW) contributed 12.61% as well, and Proctor & Gamble ($PG) accounted for 6.68% of this month’s dividends. Overall, not a lot changed since last quarter for the core positions.

Otherwise, SmartCentres REIT ($SRU.UN) and NorthWest Healthcare REIT ($NWH.UN) contributed 5.76% and 3.38%, respectively. Apple ($AAPL), RioCan ($REI.UN), FIE ($FIE), and Savaria ($SIS) each accounted for less than 1%. Meanwhile, the newly acquired Bank of Montreal ($BMO) contributed 3.92%.

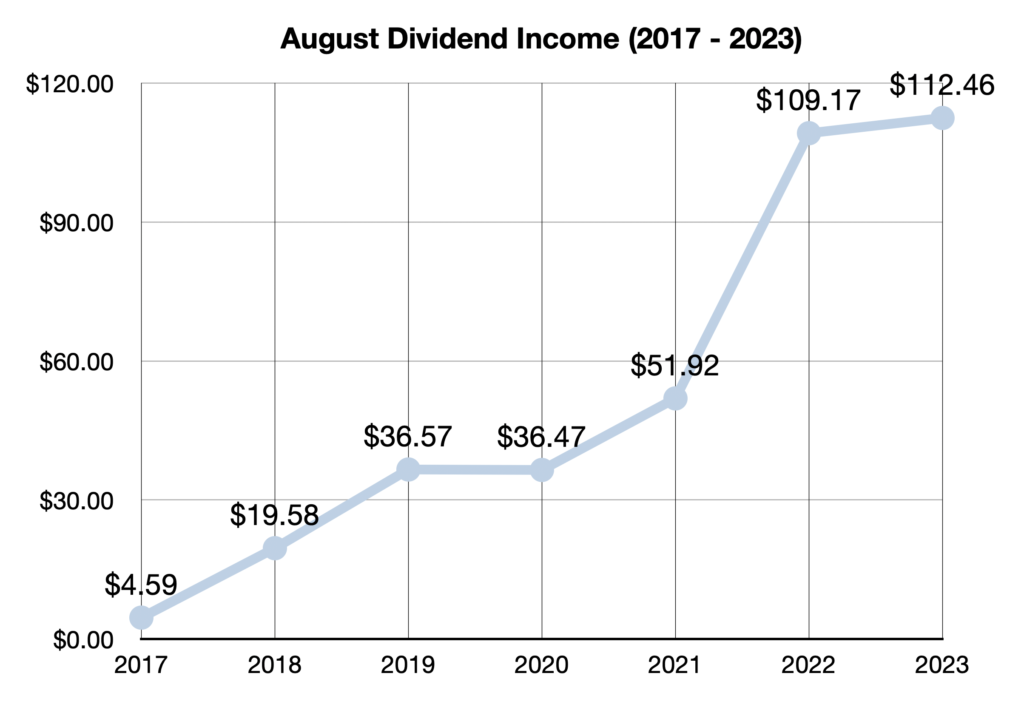

August Dividend Income Growth Since 2017

The month of August has seen steady dividend growth since 2017.

There was only one instance where dividend income was lower than the previous year. It was only a 10 cent decline and it was due to a career change.

Otherwise, dividend income has increased from a mere $4.49 in August 2017 to $112.46 in August 2023. That’s a 2350% increase overall.

Although $100 doesn’t seem like a lot anymore, it’s still incredible to reflect on the progress I’ve made since beginning this journey. $100+ months would have been a dream back in 2017. But that goal post is moving towards $250 to $500 months now to seem impressive. Nevertheless, it’s still nice to acknowledge the progress.

Here is a breakdown of each report from August 2017 to August 2023:

$4.59 — August 2017 Dividend Income

$19.58 — August 2018 Dividend Income

$36.57 — August 2019 Dividend Income

$36.47 — August 2020 Dividend Income

$51.92 — August 2021 Dividend Income

$109.17 — August 2022 Dividend Income

$112.46 — August 2023 Dividend Income

You can view all dividend income updates since June 2017 here.

Looking Ahead — $494.38 To Reach My 2023 Dividend Income Target

I set a modest goal to earn at least $1400 in dividend income in 2023. I consider it modest because it’s only 3.7% higher than the $1350.22 in dividends received in 2022.

With only 4 months remaining to collect dividends, I will need to earn at least $494.38 more to achieve this target.

Broken down monthly, I must earn at least $123.60 per month to reach my goal.

Frankly, this will be easy work.

Based on the 6% year-over-year growth rate thus far in 2023, and considering that dividend growth is expecting to accelerate from here on out, I expect to easily exceed $1400 by the end of the year.

I’m very excited for the results from September to December. All the money I’ve been putting to work recently will begin to show up in the reports over the next few months.

Final Thoughts

In summary, my investment portfolio generated $112.46 in dividend income in August 2023. This represents a 3% year-over-year increase compared to August 2022.

After factoring in August’s dividend income, year-to-date dividend income reached $905.62, which is also ahead of last year by 6%.

Moreover, my all-time dividend income continues to move closer to the $5000 mark. All-time dividend income reached $4703.94, including August’s dividend earnings.

In conclusion, I’m eagerly anticipating a strong year-end finish. With the anticipated acceleration in year-over-year growth, it’s highly likely that I’ll achieve a significant milestone by surpassing $5,000 in all-time dividends within the next two months.

Stay tuned for more exciting dividend income updates as the snowball grows!

Related Dividend Income Updates

All Dividend Income Updates Since 2017

I am not a licensed investment or tax adviser. All opinions are my own. This post may contain advertisements by Monumetric and Google Adsense. This post may also contain internal links, affiliate links to BizBudding, Amazon, Bluehost, and Questrade, links to trusted external sites, and links to RTC social media accounts.

Connect With Dividend Income Investor

Instagram: @dividendincomeinvestor_

Threads: @dividendincomeinvestor_

Pinterest: @dividendincomeinvestor

Facebook: @Reversethecrushblog

Dividend Income July 2023 — $125.51

Dividend Income July 2023 — $125.51