Dividend income July 2023 — Documenting monthly dividend income to chronicle the journey to financial independence. I am not a licensed investment advisor and this post is not investment advice. All opinions are my own.

July 2023 is officially over, so it’s time to reflect on my dividend income performance.

This past month has been an eventful one, not only in terms of dividend income investing, but also as a defining moment in the evolution of this blog. After seven years of writing on reversethecrush.com, I decided to rebrand this blog as dividendincomeinvestor.com. Of course, I was hesitant to make the change. But the more I thought about it, the more it became clear that it was the right decision. To put it bluntly, I only want to write about dividend income investing. I want to focus on dividend investing as if it is a business. Instead of conveying that I am trying to escape work to reach financial independence, I want the blog to display my passion for investing and personal finance. Furthermore, I want to clearly categorize what this blog is about.

Going forward, the main focus of dividend income investor is documenting my monthly dividend income. In the future, I am considering PADI (projected annual dividend income) reports as well. Otherwise, the only other posts I plan on publishing are my annual financial goals.

Before I delve into July’s dividend income numbers, I want to take this opportunity to express my gratitude to each and every reader of reversethecrush.com over the past seven years.

But now, let’s begin this new chapter by documenting my monthly dividend income.

In this post, I will discuss how much dividend income I earned in July 2023 and provide insights on which stocks paid dividends.

Dividend Income July 2023 Highlights

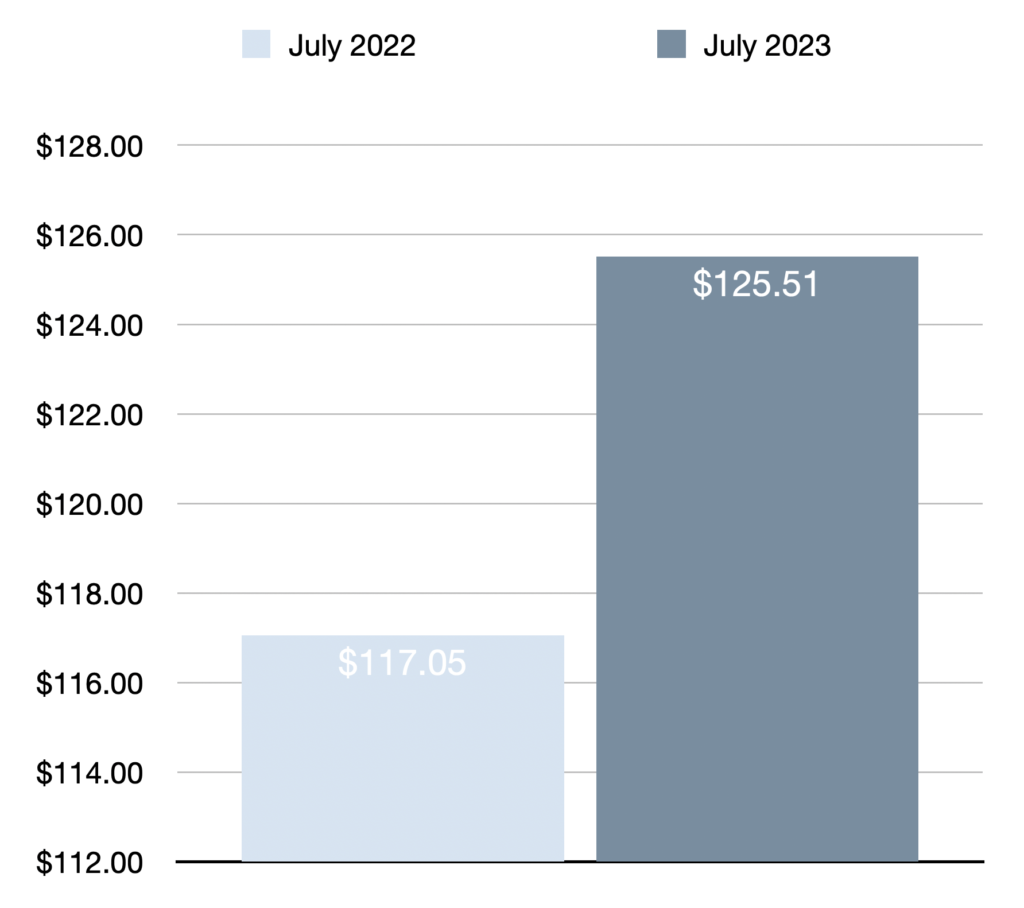

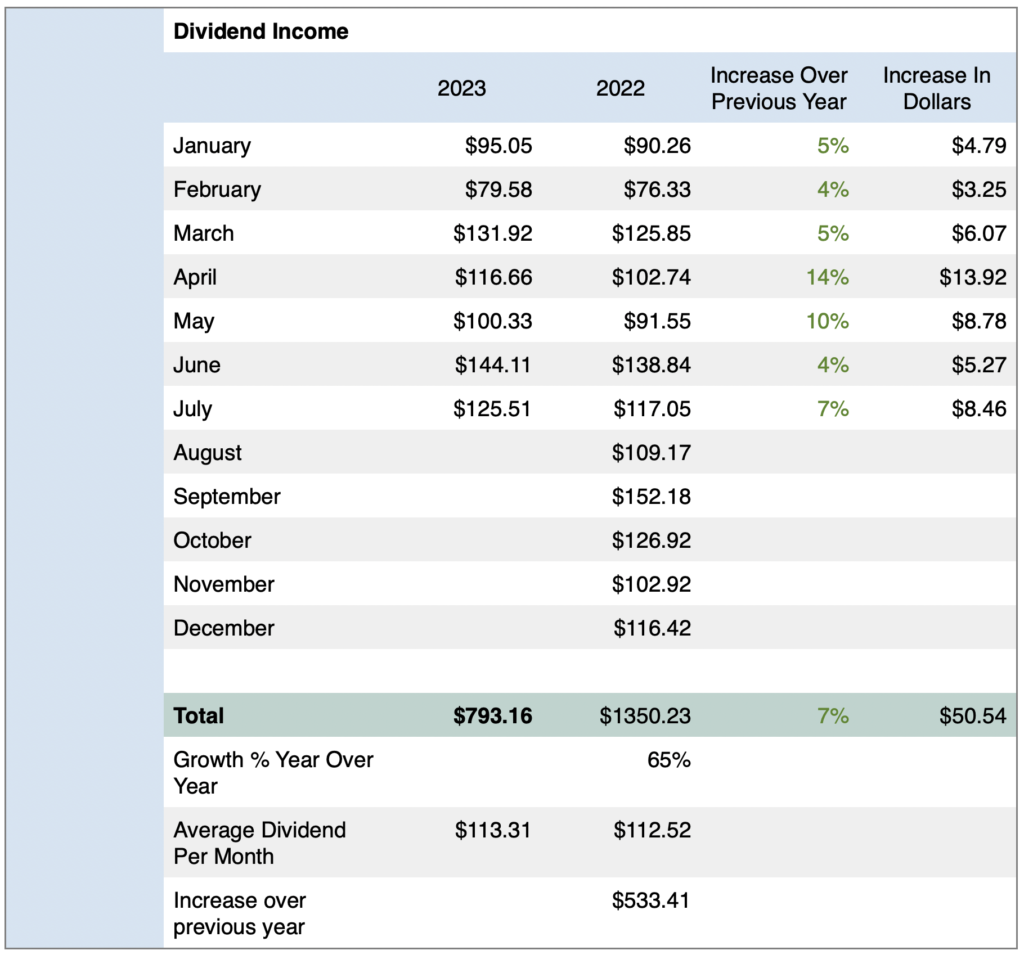

- Total dividend income earned in July 2023 was $125.51

- Year-over-year (YOY) dividend income increased by 7% or $8.46 compared to July 2022

- Year-to-date (YTD) dividend income is $793.16 (January to July 2023)

- Quarter-over-quarter (QOQ) dividend income increased by 8% or $8.85 compared to April 2023

- 11 positions paid dividends in July 2023 (Up 1 since last quarter)

- All-time dividend income since June 2017 is $4591.48

- Average monthly dividend income 2023 is $113.31

- Dividend income per day in July 2023 was $4.05

Dividend Income July 2023 Earnings — $125.51

My investment portfolio generated $125.51 in dividend income between July 1, 2023 to July 31, 2023. This represents a modest 7% year-over-year growth rate compared to July 2022.

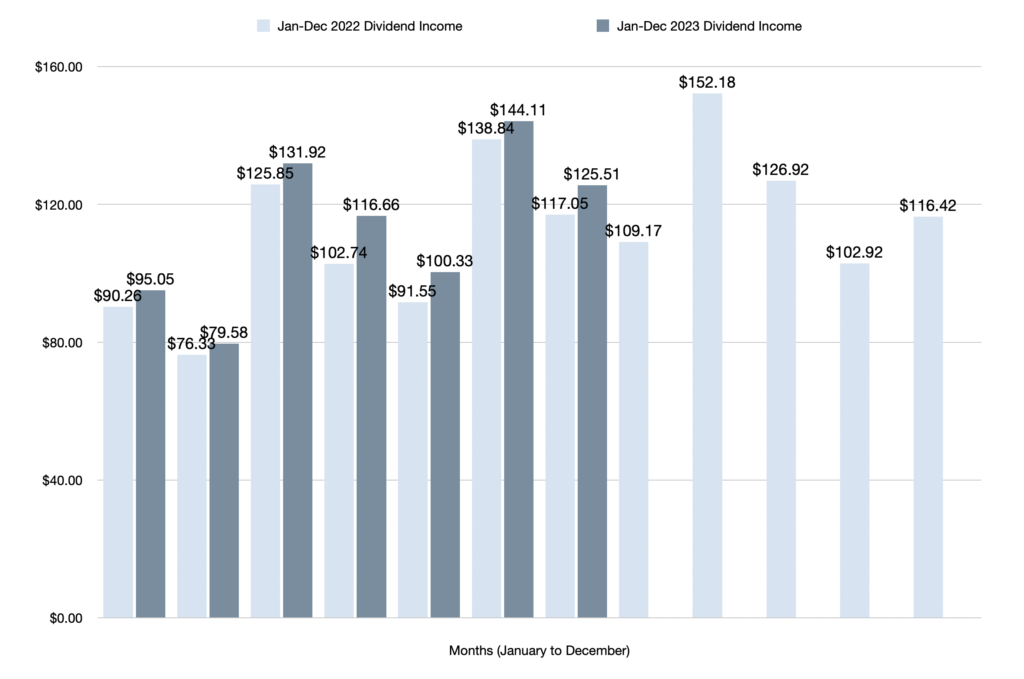

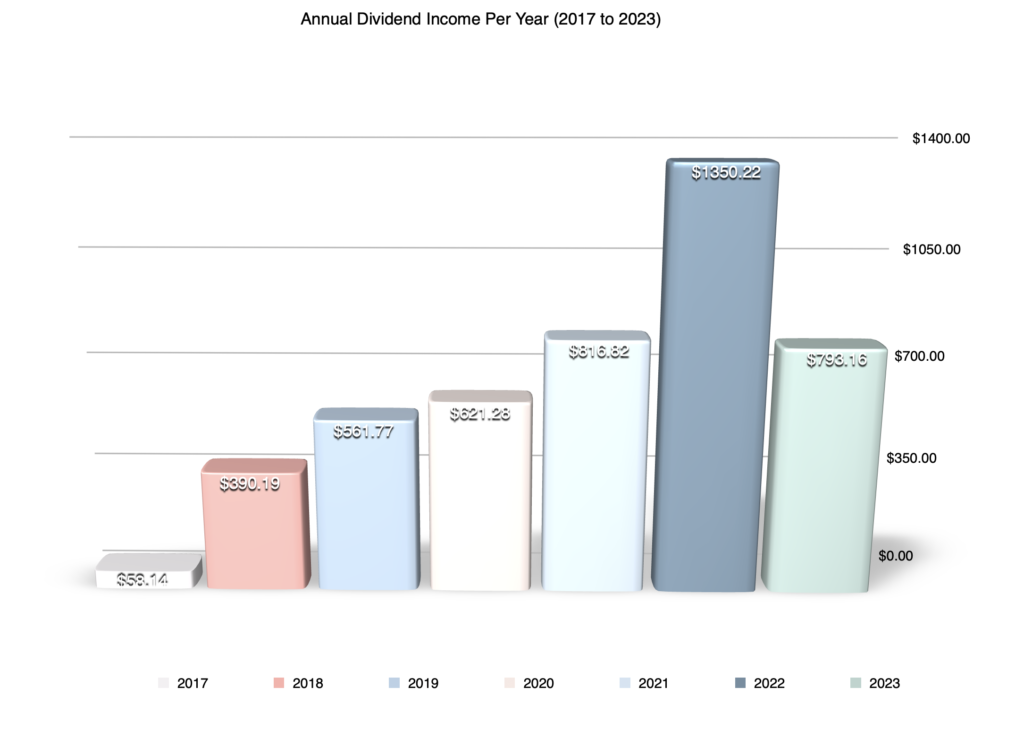

As of July 31, 2023, year-to-date dividend income reached $793.16, which is ahead of January to July 2022 by 7% or $50.54. By the end of August 2023, I expect to have exceeded the 2021 total of $816.82.

After factoring in July’s dividend income, my all-time dividend income reached $4591.48 since June 2017. That’s nearly $5000 worth of dividends and this dividend snowball is just getting started.

Overall, I am satisfied with the steady progress so far this year. Better yet, I’m only a few months away from seeing dividend income growth begin to accelerate. I’m expecting YOY growth to get back to double digits in November and December.

Stocks/REITs/ETFs That Paid Dividends In July 2023

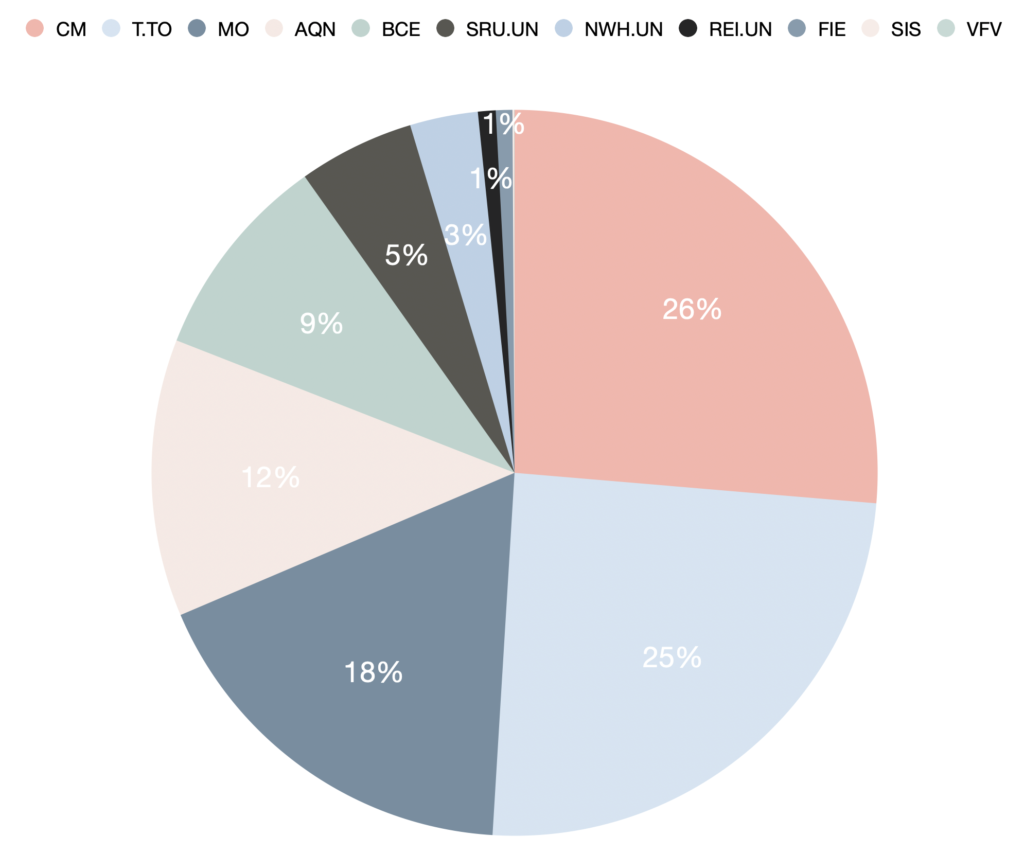

11 positions paid dividends over the course of July 2023.

Below is a breakdown from highest payer to lowest (USD has been converted to CAD for reporting purposes):

As mentioned above, 11 positions paid dividends in July 2023 — 6 stocks, 3 REITs, and 2 ETFs.

This is up by 1 position since last quarter. However, if you take a closer look, I made quite a few changes. Firstly, I was not holding the 2 ETFs (FIE and VFV) last quarter. Secondly, I am no longer holding CSCO or NKE. Otherwise, I added SIS, which is a very small position at this point.

Another change that will show up in the next quarter is that I finally sold AQN. Although I am usually fine with waiting for things to turn around, ultimately, there were better opportunities available. I lost confidence in the management after the dividend was slashed, and it’s basically speculation waiting for this management to turn the stock around. Of course, interest rates could be lower soon and the stock might turn around. But I made my decision and I am ok with whatever happens. I reallocated the funds, mostly into T.TO.

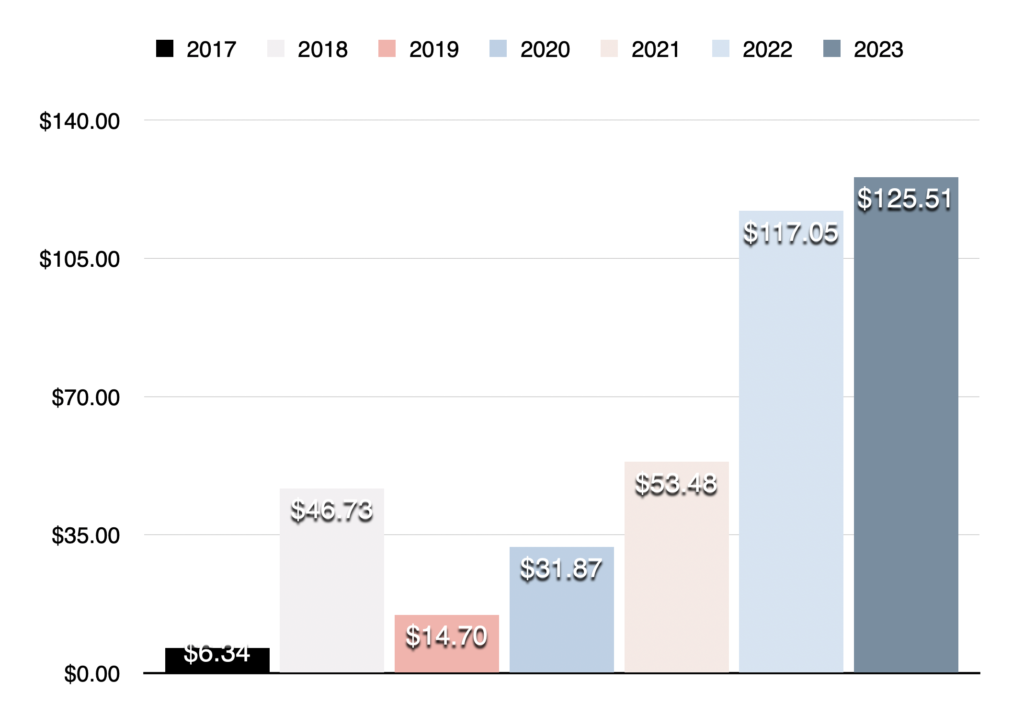

July Dividend Income Growth Since 2017

The month of July has seen steady dividend income growth since July 2017.

Of course, there was a bit of a drop in July 2019 after I resigned from my employer and stopped contributing to their stock-sharing plan. But otherwise growth has been steady.

In total, dividend income increased from $6.34 in July 2017 to $125.51 in July 2023. That’s a 1880% increase! It’s amazing to see how far my portfolio has come since its humble beginnings. July 2017 was only my second month on this journey.

Here is a breakdown of each report from July 2017 to July 2023:

$125.51 — July 2023

You can view all dividend income updates since June 2017 here.

Looking Ahead — $606.84 To Reach My 2023 Dividend Income Target

I set a modest financial goal to earn at least $1400 in dividends at the beginning of 2023. I consider it modest because it’s only 3.7% higher than the $1350.22 in dividends received in 2022.

With only 5 months remaining to collect dividends, I will need to earn at least $606.84 more to achieve this target.

Broken down monthly, I must earn at least $121.37 per month to reach my goal.

Based on the 7% year-over-year growth average so far this year, I am quite certain that I will meet and exceed my $1400 target.

Furthermore, I expect that September and December will be record-setting months for dividend income. As such, it’s likely that I end up a lot higher than $1400.

Final Thoughts

In summary, my investment portfolio generated $125.51 in dividend income in July 2023. This represents a 7% year-over-year increase compared to July 2022.

After factoring in July’s dividend income, year-to-date dividend income reached $793.16, which is also ahead of last year by 7%.

Moreover, my all-time dividend income continues to inch closer to the $5000 mark. All-time dividend income reached $4591.48, including July’s dividend earnings.

Otherwise, it was an eventful month for this blog, as the website domain was rebranded to Dividend Income Investor. The Reverse The Crush chapter has come to a close. In my view, the new domain name better reflects what this blog is about and satisfies my desire to clearly categorize it. Additionally, this transformation turns the blog into a personal portfolio and extension of my investment activities. I’d feel more confident about sharing this blog in real life now. In short, it’s a better fit all around and I am very excited about the change.

I look forward to documenting my monthly dividend income for years to come.

Related Dividend Income Updates

I am not a licensed investment or tax adviser. All opinions are my own. This post may contain advertisements by Monumetric and Google Adsense. This post may also contain internal links, affiliate links to BizBudding, Amazon, Bluehost, and Questrade, links to trusted external sites, and links to RTC social media accounts.

Connect With Dividend Income Investor

Instagram: @dividendincomeinvestor_

Threads: @dividendincomeinvestor_

Pinterest: @dividendincomeinvestor

Facebook: @Reversethecrushblog

Dividend Income June 2023

Dividend Income June 2023