Dividend Income October 2021 — Chronicling monthly dividend income to document how much passive income was earned and which stocks paid dividends. For the record, I am not a licensed advisor and this post is not investment advice. Additionally, this article may contain affiliate links.

Another month has passed, so it’s time to report how much dividend income was earned in October 2021.

After hitting a new monthly record of more than $100 last month, I am excited to report that I achieved record year-over-year income growth this month.

Additionally, I surpassed last year’s total dividend income after factoring in this month’s numbers. Now I have November and December to push income even higher.

In this article, I will share how much dividend income was earned and I will detail which stocks paid dividends in October 2021.

Let’s dive right into the numbers.

Dividend Income October 2021 Highlights

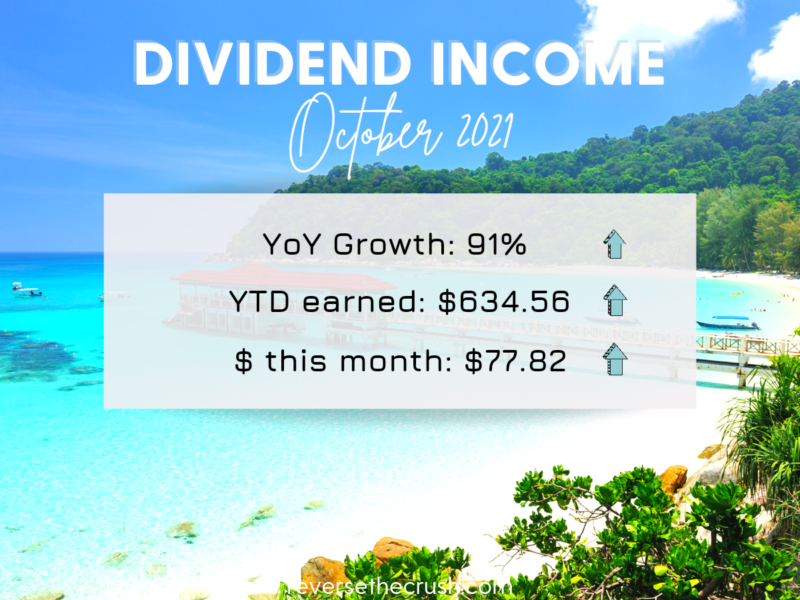

- Total dividend income in October 2021 was $77.82

- 91% year-over-year (YoY) increase compared to October 2020 (highest of the year)

- Year-to-date income from dividends is $634.56 (January 1, 2021 to October 31, 2021)

- Surpassed total dividend income earned in 2020 by October 2021

- All-time dividend income received is $2,265.74 (June 2017 to October 2021)

- Monthly average dividend income in 2021: $63.46

- $2.51 per day in dividends was earned in October 2021

- 10 months in a row of YoY growth

- Increased forward dividend income by $66.21 during the month

- 2 dividend raises were announced by Suncor and AbbVie

- Dividend raises added $23.64 in forward dividend income

- Forward dividend income is surpassed $1,000 annually

Dividend Income October 2021 Earnings — $77.82

In total, $77.82 was generated from dividend stocks in October 2021.

This represents a 91% year-over-year increase compared to the $40.65 that was earned last October. It was the highest YoY increase so far in 2021.

Compared to the previous quarter, dividend income was up by an impressive $23.34 or 45.5%. The growth can be attributed to a higher savings rate, and from continuing to add to AQN, MO, and Telus.

As of October 31, 2021, year-to-date dividend income is up to $634.46, which is already more than what was earned in during the entirety of 2020. Dividend income in 2021 is up by $13.28 or 2% over last year’s total dividend income.

By the same point last year (October 2020), only $491.24 was earned. This represents an increase of $143.22 or 29%.

In short, my passive income from dividend investing is beginning to take a dramatic leap forward.

Stocks That Paid Dividends In October 2021

Thirteen stocks paid dividends in October 2021. Here is a breakdown of the stocks that paid in order from highest payer to lowest:

- Altria Group (Ticker: MO)

- Telus (Ticker: T.TO)

- Algonquin Power & Utilities Corp (AQN)

- Bank Of Nova Scotia (Ticker: BNS)

- CIBC (Ticker: CM)

- Riocan REIT (Ticker: REI.UN)

- Cicso (Ticker: CSCO)

- SmartCentres REIT (Ticker: SRU.UN)

- NorthWest Healthcare Property REIT (Ticker: NWH.UN)

- Choice Properties Investment Trust (Ticker: CHP.UN)

- Park Lawn (Ticker: PLC)

- Rogers (Ticker: RCI.B.TO)

- Savaria Corporation (Ticker: SIS)

As I alluded to last quarter, January, April, July, and October are some of my more balanced months for income distributions.

Of the thirteen stocks that paid dividends, the bulk of dividend income was from MO, Telus, and AQN.

MO accounted for 26% of October’s dividend income, Telus accounted for 24%, and AQN accounted for 20%.

Additionally, the two banks that paid this month, BNS and CM, each chipped in 8% of this month’s income. CM was the not-so-new acquisition of the month. I’ve had an on again off again relationship with CM since I stopped for working the company back in 2019. This time I plan to hold for good and will likely continue adding to my position.

Otherwise, the other eight positions accounted for 4% or less of October’s income. As time goes on, I expect the percentage from PLC and SIS will increase, as I have been adding one share per pay to each position.

Outlook — $115.54 To Reach My 2021 Target

At the beginning of 2021, I set a modest goal to earn at least $750 in dividend income during the year.

Frankly, it’s starting to look like I lowballed the target to make sure I would be able to blow that target out of the water.

It’s basically a foregone conclusion that I was crush this target now.

To reach my target, I just need to earn $115.54 more by December 31, 2021.

This works out to an average of $57.77 over the next two months.

Based on my projections, I will most certainly eclipse that target by the end of the year.

In fact, I would likely be able to exceed it even if I only counted December’s dividend income, as it will likely exceed $115.

The only question left is how much I will exceed my $750 target by in 2021.

Portfolio Activity In October 2021

I increased my total forward dividend income by $66.21 in October 2021.

As I mentioned earlier, $23.64 of the increase was a result of dividend raises from Suncor and AbbVie Inc.

Suncor Energy increased its dividend by 100% back to 2019 levels, which was a welcome surprise. Meanwhile, AbbVie announced an 8.5% dividend raise during the month.

The other $42.57 was a result of investing another $1,738.48 into the market.

Here is a summary of my investment activity in October 2021:

- Increased position in AQN

- Added to FTS

- Added more SBUX

- Increased RY position

- Added to AAPL

- Added to T.TO

- Bought more PLTR

- Added to NWH.UN

- Bought more fractional shares of SHOP

- Added to SIS

- Added to PLC

- Increased position in BTC

- Increased position in ETH

Similar to last month, I was very active during the month.

All of the Canadian trades were completed in a zero-commission TFSA account with WealthSimple. The USD trades were processed in my RRSP, which does charge a commission fee. However, I typically use credit card points to trade for free, or I will only trade with larger amounts of money.

Altogether, my total investment fees for the year are substantially lower than any investment advisor or mutual fund would charge you.

Dividend Income October 2021 — Final Thoughts

In summary, I earned $77.82 from dividend investing in October 2021.

This represents a 91% year-over-year increase over October 2020. It was also the highest month for year-over-year growth this year. So, even though my portfolio is significantly larger, it is beginning to grow faster by reinvesting dividends and a higher savings rate.

Moreover, total dividend income in 2021 is up to $634.56, which is already more than the total amount earned in 2020.

After factoring in this month’s purchases and dividend raises, forward dividend income increased by $66.21 during the month.

More importantly, I finally crossed $1,000 in forward dividend! So, the minimum amount of dividend income I will receive next year is $1,000.

I look forward to closing out the next two months strong, as I expect to easily exceed my $750 target I set for 2021.

How was your dividend income in October 2021? Do you own any of the same stocks?

Related Posts On Dividend Investing

All Dividend Income Updates Since 2017

Dividend Income Update October 2020

Dividend Income July 2021 – 68% YoY Growth

I am not a licensed investment or tax adviser. All opinions are my own. This post may contain advertisements by Monumetric and Google Adsense. This post may also contains internal links, affiliate links to BizBudding, Amazon, Bluehost, and Questrade, links to trusted external sites, and links to RTC social media accounts.

Connect with RTC

Twitter: @Reversethecrush

Pinterest: @reversethecrushblog

Instagram: @reversethecrush_

Facebook: @reversethecrushblog

Email: graham@reversethecrush.com

Expensive Purchases That Are Worth It — 10 Times To Choose Quality Over Quantity

Expensive Purchases That Are Worth It — 10 Times To Choose Quality Over Quantity