Dividend stock portfolio for monthly income. Covering stocks and sectors in my portfolio to show what a dividend stock portfolio looks like.

A dividend stock portfolio is a portfolio of stocks that pay dividend income.

The goal of a dividend stock portfolio is to build your own basic income that will outpace inflation. And ideally, you also grow your initial investment through capital appreciation.

Once your dividend income exceeds your expenses, you reach the dividend crossover point.

If you invest $1,000,000 into a portfolio of dividend stocks with an average dividend yield of 5%, you will receive $50,000 in annual dividends and your wealth will grow as the stocks appreciate in value.

Since dividend investing is such a predictable way to build wealth, it is my main investment strategy to reach financial independence.

As such, I publish monthly dividend income updates to chronicle the journey and show how much income I earn from dividend stocks.

To provide you with a better overview of what a dividend stock portfolio looks like, this post will detail my entire dividend stock portfolio for monthly income.

In this post, I will show you how many stocks are in my portfolio, which stocks I own, my investment account types, and my total annual dividend income.

Let’s jump right into how many stocks are in my portfolio.

Dividend Stocks For Monthly Income

Total Stocks in My Dividend Stock Portfolio: 20 Stocks

As of February 9, 2021, my dividend stock portfolio consists of 20 stocks.

For the record, I also own three growth stocks that do not pay a dividend and I own Bitcoin. I allocate 10% or less of my portfolio’s value to growth stocks. The rest is all dividend growth stocks.

As for the stocks in my portfolio, they are all North American stocks that trade on either the TSX, TSXV, Nasdaq, or NYSE.

Because of the exchange rate over the last few years, the majority of my portfolio is invested in Canadian stocks.

Below I will show you the breakdown between Canadian and USD stocks.

Canadian Stocks: 15 Stocks/REITS

My Canadian dividend stock portfolio consists of 15 stocks or real estate investment trusts.

Here is a list of the positions in descending order by market value:

- ENB

- RY

- CM

- FTS

- REI.UN

- PLC

- SU

- BNS

- CHP.UN

- T

- RCI.B

- SRU.UN

- VCI

- NWH.UN

- SIS

Canada is known for its banks and its resources, and my portfolio reflects that.

My largest position, Enbridge (ENB), accounts for 27% of my Canadian portfolio’s value. As such, it provides a large chunk of my annual dividend income at the moment.

The second largest position in my Canadian portfolio is Royal Bank (RY), which accounts for 23% of my Canadian portfolio.

Overall, I have four main Canadian positions— ENB, RY, CM, and FTS. These are my core positions and they provide the majority of my Canadian dividend income.

I have purposely designed my portfolio to have a core position to carry each month. Over time, I use that income to reinvest back into dividend stocks to grow income.

Hence why my positions are a lot smaller beyond my core four.

The smaller positions are purchased in a zero commission account to avoid fees. Slowly but surely consistent investment acquisition will shrink the position size of my top four holdings.

Ideally, in the long term, my largest positions should account for 5 to 10% of my portfolio maximum.

USD Stocks

My USD dividend stock portfolio consists of 5 positions in the following order:

- AAPL

- MO

- T

- SBUX

- KO

As of now, my USD dividend stock portfolio is smaller than my Canadian positions.

I’ll admit that my USD portfolio lacks diversification and a few must-have dividend stocks.

As such, I plan to add JNJ, O, WMT, ABBV, and MSFT. Possibly more.

Since I will be building this dividend stock portfolio for the next 20 years, I still have time to add these positions.

Regarding my current positions, Altria Group (MO) is the main source of dividend income, similar to my larger Canadian stocks.

Meanwhile, Apple has carried my portfolio by growing more than 200% over the last few years.

As for AT&T (T), I am waiting for an opportunity to sell it because I’m tired of the underperformance. Now that the company decided not to raise its dividend, I no longer want to own an underperforming asset.

I am considering selling it and moving the funds into a high growth stock with a smaller market capitalization. Either that or I will allocate the funds to JNJ, O, WMT, ABBV, or MSFT.

Sector Breakdown

My dividend stock portfolio is overwhelmingly represented by financial services and utilities.

I am 36% invested in financial services, and 34% invested into utilities.

The rest of my dividend stock portfolio is invested in various sectors that account for 7% or less of the total portfolio’s value.

Keep in mind, I have growth stocks and Bitcoin that are not included in this sector breakdown. This is only counting my dividend stocks.

Account Types

To hold my dividend stocks, I have three account types:

- Tax Free Savings Account (TFSA)

- Registered Retirement Savings Plan (RRSP)

- Non-registered investment account

I hold all of my Canadian dividend stocks in a TFSA, since there is no tax on the dividends or capital gains.

As for my USD stocks, I hold them in my RRSP, because there is no tax on dividends. If I was to hold USD stocks in a TFSA, there is a non-resident withholding tax on dividend income. By holding USD stocks in my RRSP, I also get tax-deferred growth on the gains.

Regarding my non-registered investment account, it is a small account to hold and invest blog income. Any income that does not get reinvested back into the blog is invested in my non-registered account. It acts like a holding account for my blog income.

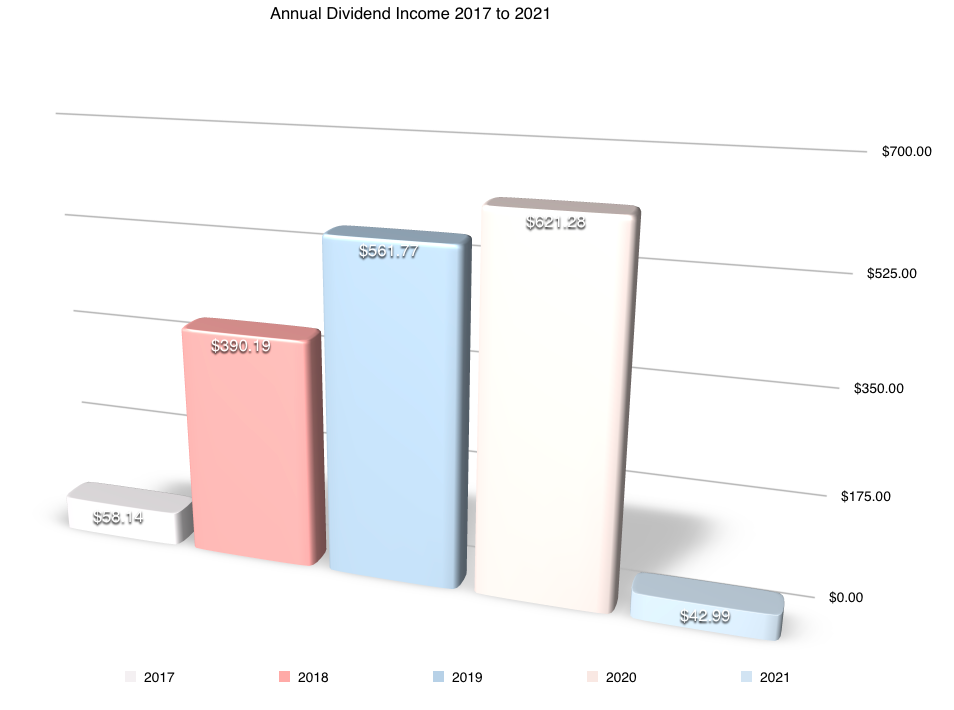

Annual Income From Dividends

Based on the most recent dividend income projection, the portfolio is expected to earn $691.60 annually.

Last year I earned $621.28 in total.

I update my annual projections quarterly. So, the next one will be live in March 2021.

Monthly Income

The portfolio is projected to generate $57.63 per month on average over the next 12 months.

To earn monthly dividend income from stocks, you can purchase stocks that pay quarterly in different months, or you can buy REITS that pay monthly.

Related: Monthly Dividend REITS – 5 Reliable REITs That Pay Every Month

Annual Growth Targets

After earning $621.28 in 2020, I set a modest goal to earn $750 from dividends in 2021.

This means I must earn $128.72 more than I did in 2020.

Based on last year’s increase of $51.77 during a pandemic, I am confident I can achieve this goal.

If I add the same as last year, $51.77, I will earn at least $673.75.

And if I factor in increased savings, dividend raises, and a more stable year, I should have no problem achieving this goal.

Long Term Goals

I recently wrote about how much money I need to invest to live off dividends.

If you missed the post, it is somewhere around $400,000.

If I have a portfolio worth $400,000 invested in dividend stocks, I can easily earn $20,000 annually.

Then, I will live off the combination of dividend income and blog income.

Obviously, I’m a long way off from living off dividends at this point.

However, by consistently investing more each year, and by reinvesting dividend income, I will realize my goal over the next 10 to 20 years.

I expect my dividend income to slowly increase over the next few years. This year I expect to start seeing some $100 months.

Within five years, I expect that the snowball will begin to take off.

Stay tuned for monthly dividend income updates every single month.

Dividend Stock Portfolio for Monthly Income – Final Thoughts

I wrote this post to show the stocks and sectors in my portfolio.

Along with monthly dividend income updates, I hope this post shows you what a small-size dividend stock portfolio for monthly income looks like.

In the future, I plan to update this post as the portfolio increases or if any significant changes occur.

As a recap, I have 20 stock positions held across three investment accounts. 70% of my dividend stock portfolio is invested in Canadian banks and utilities. Otherwise, it consists of positions worth 7% or less.

Moreover, the stocks I own are expected to generate $691.60 every twelve months.

Related Content on Documenting Dividend Income:

All Dividend Income Updates Since June 2017

Why Dividend Investing Is My Main Investment Strategy

How Much Do I Need To Invest To Luce Off Dividends?

I am not a licensed investment or tax adviser. All opinions are my own. This post may contain advertisements by Monumetric. This post may also contain internal links, affiliate links to BizBudding, Amazon, Bluehost, and Questrade, links to trusted external sites, and links to RTC social media accounts.

Connect with RTC

Twitter: @Reversethecrush

Pinterest: @reversethecrushblog

Instagram: @reversethecrush_

Facebook: @reversethecrushblog

Frugal Valentine’s Day Ideas: 13 Cost-Effective Ideas To Show You Care

Frugal Valentine’s Day Ideas: 13 Cost-Effective Ideas To Show You Care