Forward Dividend Income Projection September 2020 – Projecting how much dividend income a 16-stock portfolio will generate in twelve months.

Dividend income investing is the main income stream I am utilizing to reach financial independence.

Over the next 15 to 20 years, my goal is to build a dividend income stream that covers my basic expenses.

To chronicle how much dividend income I earn, I publish monthly dividend income updates.

To document how much dividend income the portfolio is projected to earn annually, I publish quarterly dividend income projections.

In this post, I will review how much dividend income I expect to earn in a 1 year time frame from the 16 dividend stocks I own.

Let’s dive into the numbers.

Projected income or forward dividend income refers to how much dividend income is expected to be paid over 12 months from January to December.

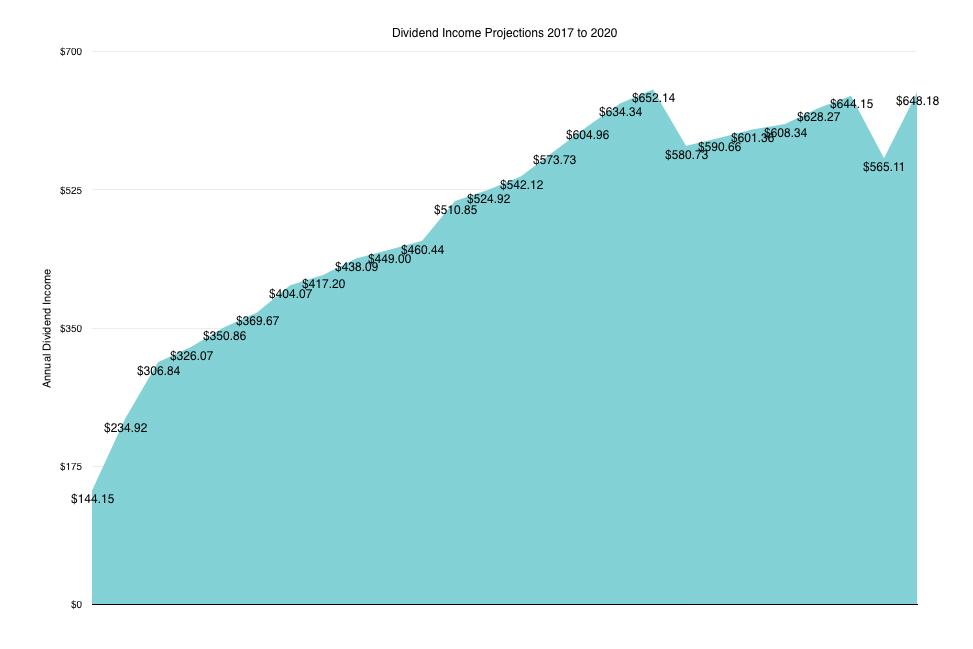

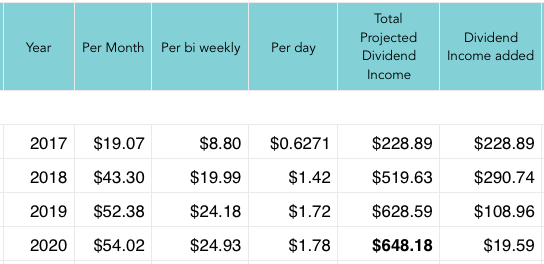

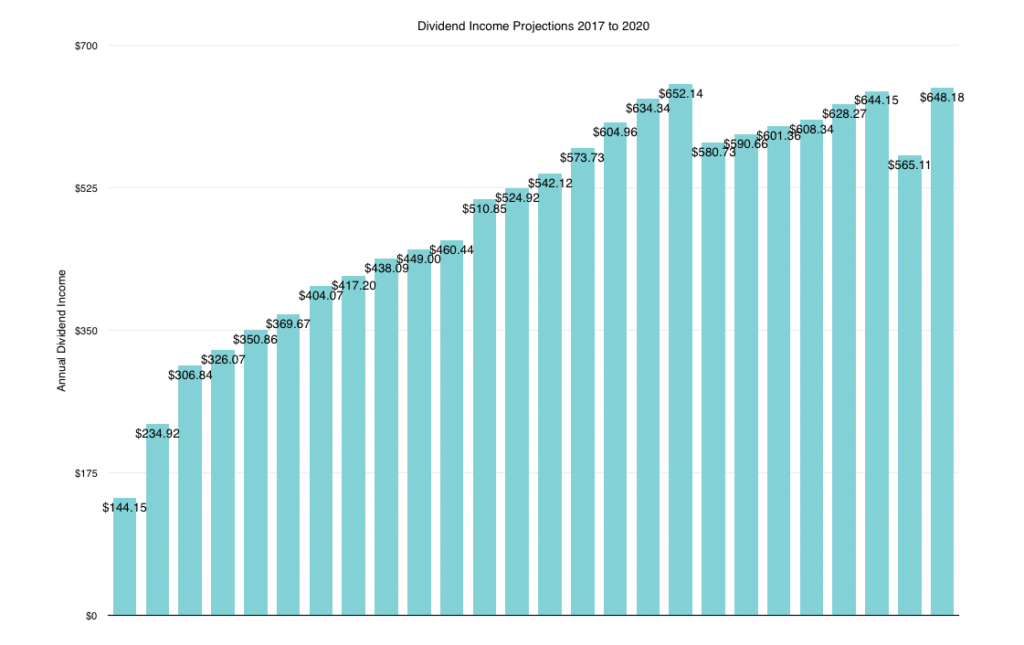

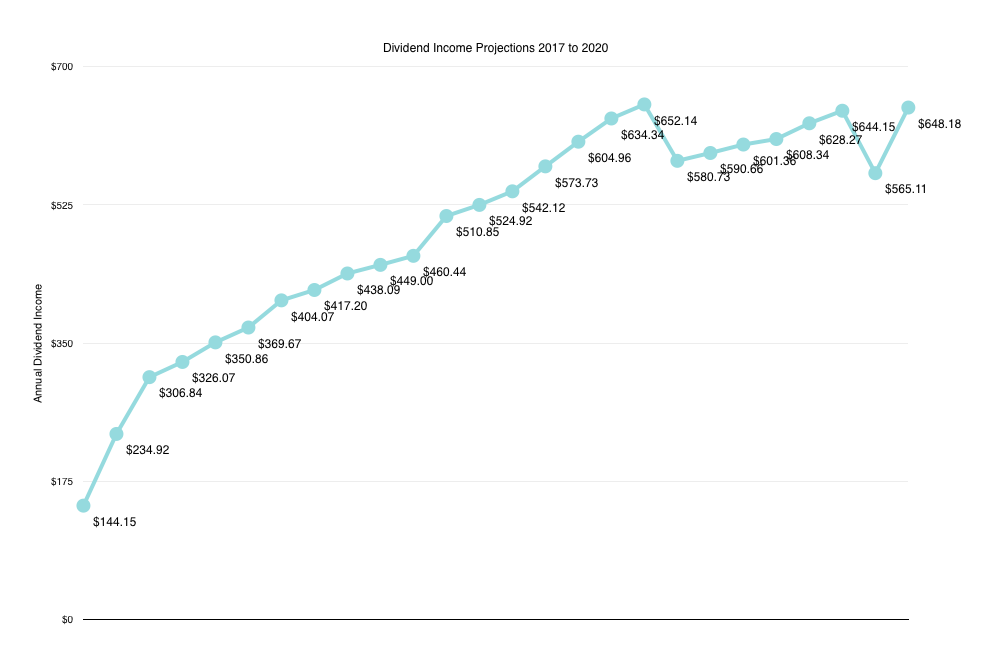

Forward Dividend Income Projection September 2020 – Q3: $648.18

In total, my portfolio is expected to generate $648.18 worth of passive income from dividend stocks from January to December.

It may not seem like progress compared to last September’s projection. However, income is up by $83.07 compared to last quarter’s total of $565.11.

On a monthly basis, the portfolio is expected to generate an average of $54.02 per month.

Otherwise, the portfolio generates $24.93 bi-weekly or $1.78 daily from dividends.

Even though dividend growth has slowed down over the past year, I am still in position to reach my target to push forward dividend beyond $700 by the end of the year.

Why Portfolio Growth Has Been Slower

It has been a challenging year for long-term investors.

Unfortunately, Coronavirus put non-essential businesses to a halt.

In turn, many companies were forced to cut or slash dividends because no revenue was being generated.

Due to some of the positions held in my portfolio, mainly Suncor and Sir Royalty Income Fund, my projected annual income took a hit. Suncor slashed its dividend in half, and Sir Royalty Income Fund suspended their payment altogether. In turn, annual dividend income was down to $565 compared to a peak of $652 back in June 2019.

Another reason why my portfolio growth has been slower is I’ve been working a part-time job for the last year. I wasn’t saving or investing as much, because I took a risk that temporarily meant a lower savings rate.

But now, the risk is beginning to pay off—I save money by working from home and I am earning more.

So, the end of the slower growth stage is in sight.

October, November, and December 2020 should see solid year-over-year growth.

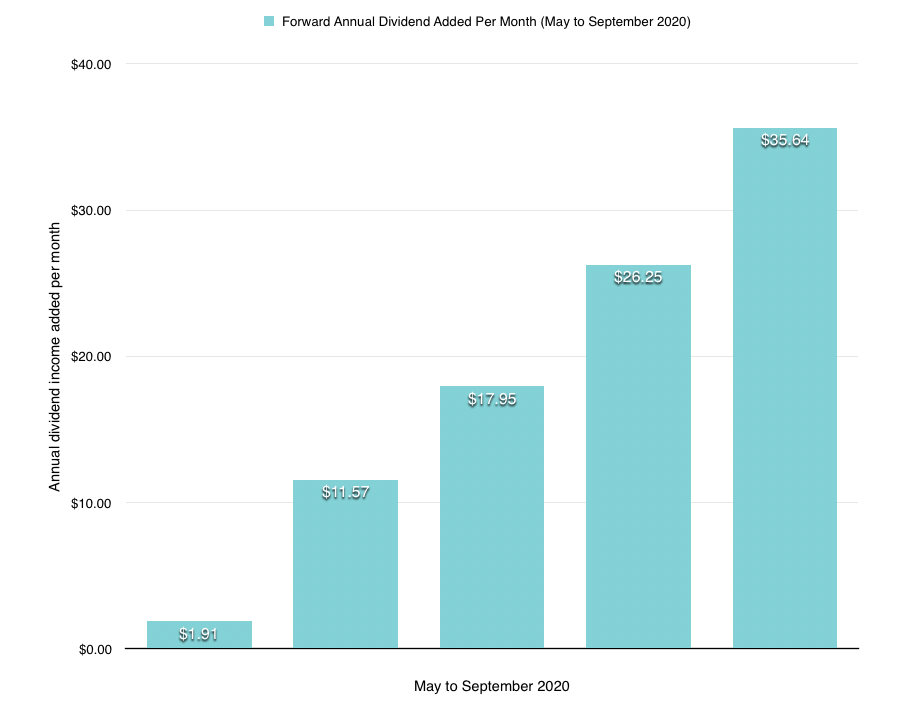

How Annual Dividend Income Increased by $83.07 Since Last Quarter

Annual Dividend income increased by $83.07 through investing money saved from working, by reinvesting dividend payments, through a DRIP, and by investing money earned from Monumetric.

As soon as I get paid from work, I put a minimum of 15% into my TFSA, which holds Canadian equities. In addition, on paydays that I don’t have to pay rent, I put another 10% of my net income into an RRSP, and then another 10% into a high interest savings account. Any money invested in TFSA and RRSP is then invested into dividend paying equities. Most of the $83.07 was a result of savings from work.

Additionally, I was able to increase dividend income by reinvesting all dividend payments. For shares of Enbrige ($ENB), I have the position set up for DRIP, so shares automatically reinvest without commission each quarter.

Furthermore, I have started receiving monthly income from blogging via Monumetric. Since I have minimal blog expenses, I save all blog income and invest it into dividend stocks.

Revenue Growth Is Speeding Up

Overall, the combination of income streams (savings from work, reinvesting dividends, and blog income) is beginning to speed up annual revenue growth of the dividend business.

Simply put, dividend income is increasing rapidly because I have more money to invest.

To properly illustrate the rate of growth happening, I created the chart shown above.

As you can see, annual revenue has been increasing rapidly each month since May 2020.

Ideally, this trend will continue as long as my hours remain consistent at work.

Stocks In The Portfolio

In total, the portfolio consists of 16 dividend paying stocks:

- ENB

- RY

- CM

- FTS

- AAPL

- REI.UN

- PLC

- BNS

- MO

- T

- SBUX

- KO

- SU

- CHP.UN

- RCI.B

- VCI

Although the portfolio is fairly diversified, there are still some major gaps and stocks missing.

Companies such as JNJ, MSFT, PG, O, and WMT are must-own, in my opinion. I must save more money to build positions in these stocks.

In addition, I must add to the following existing positions:

- RY

- CM

- FTS

- PLC

- SBUX

- AAPL

Of course, investing is a long-term game, so I can take my time building my portfolio to perfection.

$351.82 Until This Is A $1,000 Business

For years I have been working towards earning $1,000 in one year from dividends.

At that point, dividend investing is a substantial income stream that helps you save money.

Frankly, the portfolio should already be earning $1,000 annually from dividends. But several factors have affected my ability to invest.

As such, I still have to grow revenue by $351.82 more to reach $1,000 annually.

If I can maintain my recent savings rate up, it should be easy to achieve within one year.

$648.18 Annually is $12,963.60 in 20 years

If you know what you are doing with money, you realize that one dollar is not just one dollar.

In 20, 30 or 40 years, one dollar can be worth much more than one dollar, if properly invested.

With that philosophy in mind, it’s interesting to consider how much dividend income will be earned over longer periods of time.

For example, my portfolio now earns $648.18 annually. If I receive that amount for 20 years, I will earn $12,963.60 worth of dividends! That’s without factoring in dividend raises or reinvesting dividends, so it could actually be worth a lot more.

Expectations For Annual Dividend Income Growth Going Forward

Simply put, my life went through a lot of changes at the end of 2019. I moved and began a new job.

In turn, my savings rate and dividend growth suffered.

But now that my life has resumed some level of normalcy, I expect dividend income to grow by at least $200 to $300 annually per year moving forward. And I expect that amount to gradually increase each year, because I will have more money to invest.

With blog income slowly rising, increased savings by working from home, and with more dividends to reinvest, I am looking forward to chronicling the growth of annual dividend income for years to come.

Forward Dividend Income Projection September 2020 – Q3 – Concluding Thoughts

Forward dividend income covers how much dividend income the portfolio is expected to generate annually from January to December.

As a recap, the portfolio is expected to generate at least $648.18 annually from 16 dividend paying stocks. This works out to 7.8% higher revenue than one year ago, and $83.07 higher than last quarter.

Although revenue growth has slowed in 2020, dividend growth is rapidly picking up again due to increased savings, more dividend income to reinvest, and from monthly blog income earned through Monumetric.

So, by the end of 2020, I expect to have earned more than $600 annually in dividend income. And by the end of 2021, I expect this portfolio to generate more than $1,000 per year.

I looking forward to documenting the process.

Related:

Forward Dividend Income Projections

I am not a licensed investment or tax adviser. All opinions are my own. This post may contain advertisements by Monumetric and Google Adsense. This post may also contains internal links, affiliate links to BizBudding, Amazon, Bluehost, Tangerine, Fintel Connect and Questrade, links to trusted external sites, and links to RTC social media accounts.

Connect with RTC

Twitter: @Reversethecrush

Pinterest: @reversethecrushblog

Instagram: @reversethecrush_

Facebook: @reversethecrushblog

Email: graham@reversethecrush.com

Are Work From Home Jobs Legit? (17) Amazing Benefits Of WFH

Are Work From Home Jobs Legit? (17) Amazing Benefits Of WFH