Dividend Income Report July 2020 – Chronicling monthly dividend income to document the journey to financial independence.

Dividend Income July 2020 Highlights

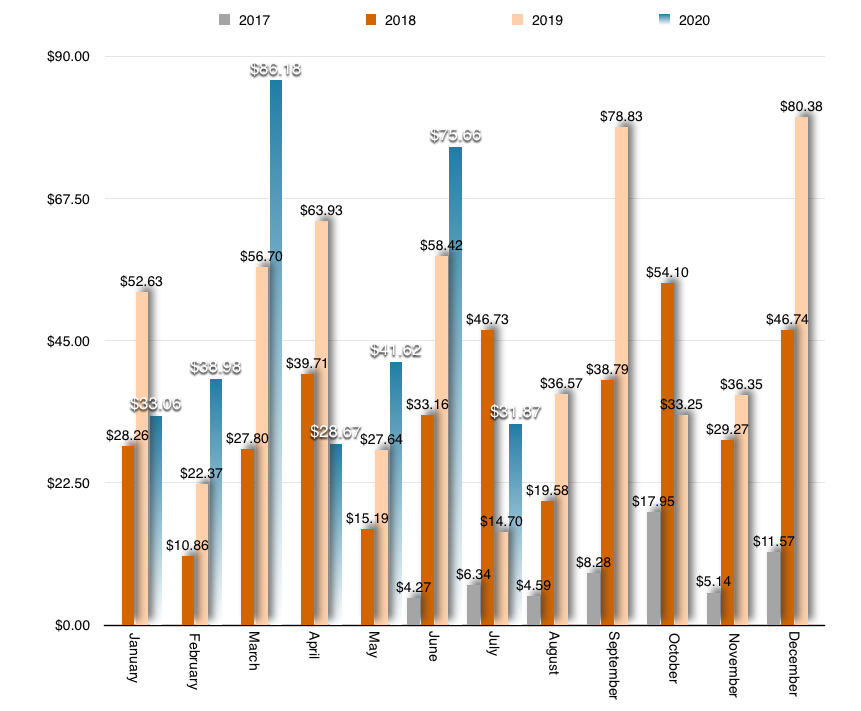

- $31.87 was received in July 2020 (Up 117% compared to July 2020)

- $336.04 has been earned YTD (January to July 2020)

- All-time dividend income received is $1,346.14 (June 2017 to July 2020)

- This is the 38th dividend income update

Dividend income investing is an investment strategy that involves buying high-quality, blue chip stocks that pay dividends to shareholders.

It’s a fantastic way to build predictable, growing income streams for financial independence.

Although it takes time and effort to learn how to analyze stocks, once you acquire dividend paying stocks, the dividend income is completely passive. It gets deposited directly to your brokerage account overnight, which makes it one of the most viable ways to make money while you sleep.

Considering that dividend investing is such an outstanding way to build a predictable income stream, dividend investing is my main investment strategy.

So, on the 1st of each month, I publish a report to document how much dividend income was earned.

In this post, I will provide details on how much dividend income was earned in July 2020, which companies paid dividends, and provide an update on whether I’m on track to meet my total dividend income target for 2020.

Let’s dive into the report.

Dividend Income Report July 2020 – Net Earnings

$31.87 was received from dividend paying stocks in July 2020.

Unfortunately, it was one of the lower months for income this year.

But on the bright side, income was up 117% compared to July 2019. So, at least the portfolio is moving in the right direction.

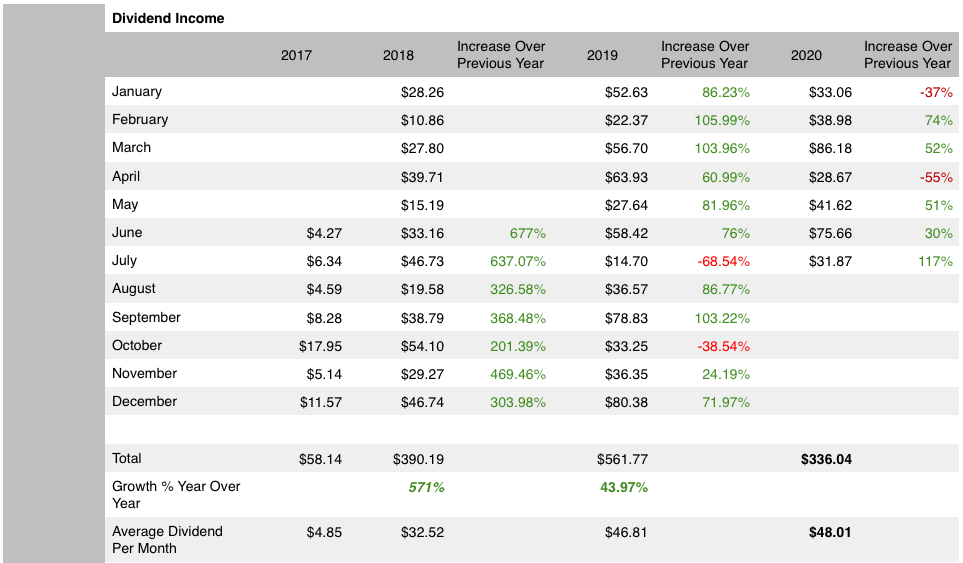

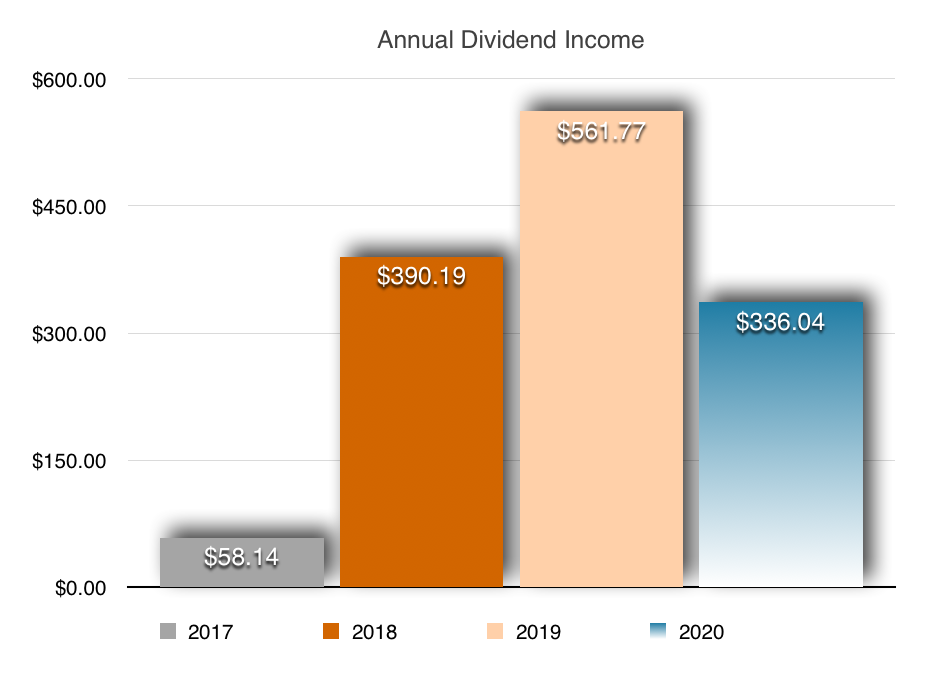

Now, 7 months into 2020, a total of $336.04 has been earned year-to-date.

Based on the year-to-date total, the portfolio’s average monthly income is $48.01.

Revenue Breakdown

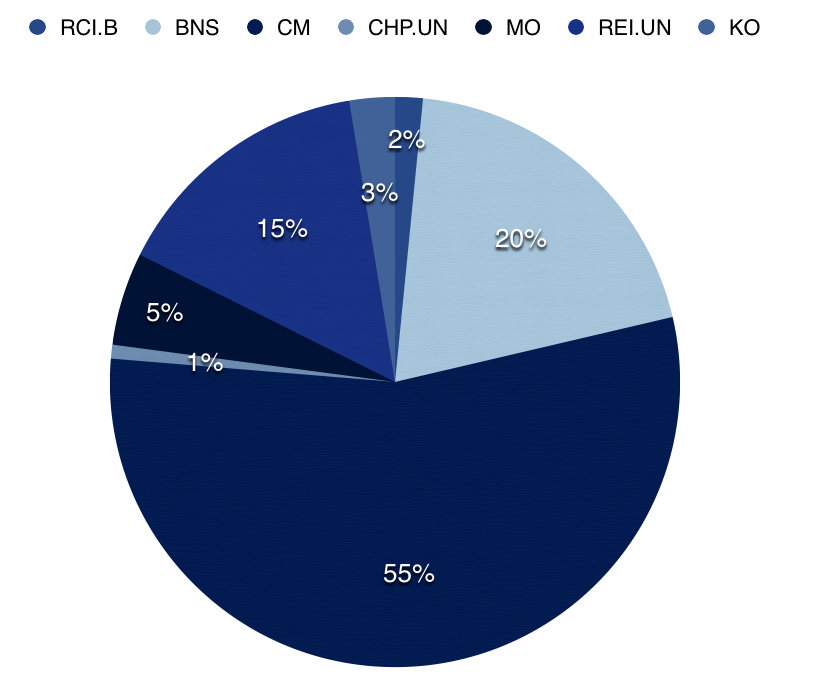

In total, 7 different companies paid dividends in July 2020:

- CIBC (Ticker: CM)

- Bank of Nova Scotia (Ticker: BNS)

- Riocan Real Estate Investment Trust (Ticker: REI.UN)

- Altria Group (Ticker: MO)

- Coca Cola (Ticker: KO)

- Rogers (Ticker: RCI.B)

- Choice Properties Real Estate Investment Trust (Ticker: CHP.UN)

The bulk of this month’s dividend income was received from CIBC.

In total, 55% of this month’s income was from CIBC. Meanwhile, 20% of July’s income was from Bank of Nova Scotia, and 15% was from Riocan.

The other 4 positions accounted for 5% or less of this month’s income.

Here is a revenue breakdown of this month’s dividend income:

CIBC (Ticker: CM) – $17.52

In total, I received $17.52 by owning 12 shares of CIBC (CM).

Each share of CM pays $1.46 quarterly or $5.84 annually. At the current stock price, this works out to a 6.30% yield.

Back in July 2019, total dividend income for the month was $14.70.

Only one year later, I receive more dividend income from one company than I did during the entire month a year before. This is further evidence that dividend investing is a viable way to build a cash flow machine.

Overall, CM accounted for 55% of this month’s dividend income.

Bank of Nova Scotia (Ticker: BNS) – $6.30

Another financial services company that paid dividends in July 2020 was Bank of Nova Scotia (BNS).

Since I own 7 shares, $6.30 was deposited to my account. This represents 20% of the $31.87 received in July.

In all honestly, I prefer RY, CM, and TD in the Canadian banking sector.

If I have the opportunity to exit the position, I would likely reallocate the money into one of the other bank stocks.

Riocan Real Estate Investment Trust (Ticker: REI.UN) – $4.80

The third highest dividend income payer of the month was the Riocan.

The commercial and residential REIT accounted for 15% of this month’s income.

In total, $4.80 was received.

Each share of Riocan pays $0.12 monthly or $1.44 annually.

At present, the yield is quite high at 9.63%.

Related: Monthly Dividend Stocks: 4 REITS That Pay Every Month

Altria Group (Ticker: MO) – $1.68

Altria Group (MO) is a global cigarette company with stakes in Juul, Cronos Group, and the wine industry.

I like this company because it’s a way to invest in the cannabis industry while still receiving a dividend. Hopefully they can brand cannabis as successfully as the iconic cigarette brands they created.

At present, they pay a whopping 8.63% yield, which they just increased.

Each share of MO pays $0.86 quarterly or $3.44 annually.

Since I owned 2 shares on the ex-dividend date, I earned $1.68.

In the long-term, I plan to build this position up. Next quarter will already be higher.

Related: High Dividend Stocks That Pay Over 4.5%

Coca Cola (Ticker: KO) – $0.82

Once upon a time I owned 55 shares of Coca Cola (KO).

But now, I only own 2.

Since each share pays $0.41 quarterly, I received $0.82 from the soda maker.

Eventually, I plan to own as many shares as I did in the past.

Rogers (Ticker: RCI.B) – $0.50

Rogers (RCI.B) paid $0.50 for the 1 share I own.

Regrettably, I didn’t take advantage of their stock sharing plan when I worked there back in 2010.

Nevertheless, I plan to build up this position along with Telus.

Choice Properties Real Estate Investment Trust (Ticker: CHP.UN) – $0.25

Another REIT that I am slowly building up is Choice Properties Real Estate Investment Trust (Ticker: CHP.UN).

Since I owned 5 shares on the ex-dividend date, I was paid $0.25.

Total from all 7 stocks: $31.87

Dividend Income report July 2020 (key stats)

- Dividend income earned in July 2020: $31.87

- Total 2020 Year to date dividend income: $336.04

- Dividend income in July 2019: $14.70

- Total Dividend income in July 2018 : $46.73

- Dividend Income July 2017: $6.34

- July 2020 YoY earnings increased by 117% compared to July 2019

- Monthly Average Dividend income in 2020: $48.01

- How many stocks paid dividends in July 2020: 7

- All-time dividend income is $1,346.14 (June 2017 to July 2020)

- This is the 38th dividend income update

Outlook: $292.23 To Reach My Target

At the beginning of the year, I set a financial goal to earn at least $628.27 worth of dividend income in 2020.

Just past the halfway point, I received $336.04. This means I must earn $292.23 more to reach my target. At least I’m finally less than $300 away!

This could be challenging, though, given the pandemic and unusual circumstances.

Further, I will need to earn an average of $58.45 per month over the remaining 5 months to reach my goal. This is $10 more than the portfolio generated per month so far this year.

But I have been investing more money from savings recently to increase dividend income, and September and December are expected to be the highest paying months of the year.

Because of these two factors, RTC’s goal to earn $628.27 in dividend income this year remains unchanged.

Dividend Income Report July 2020 – Concluding Thoughts

In conclusion, I received $31.87 from 7 stocks in July 2020. Year-to-date dividend income is up to $336.04.

The stocks that paid dividends this month were the following:

- CIBC (Ticker: CM)

- Bank of Nova Scotia (Ticker: BNS)

- Riocan Real Estate Investment Trust (Ticker: REI.UN)

- Altria Group (Ticker: MO)

- Coca Cola (Ticker: KO)

- Rogers (Ticker: RCI.B)

- Choice Properties Real Estate Investment Trust (Ticker: CHP.UN)

Moreover, the bulk of this month’s income was from CIBC, as it accounted for 55% of the $31.87.

In order to reach my goal to earn at least $628.27 from dividend investing in 2020, I must earn at least $292.23 over the 5 remaining months of the year.

How was your dividend income for July 2020? Do you own any of the same stocks?

Related:

Best Stock Apps: (4) Must-Have Apps For Tracking Stock Prices

I am not a licensed investment or tax adviser. All opinions are my own. This post may contain advertisements by Monumetric and Google Adsense. This post may also contains internal links, affiliate links to BizBudding, Amazon, Bluehost, and Questrade, links to trusted external sites, and links to RTC social media accounts.

Connect with RTC

Twitter: @Reversethecrush

Pinterest: @reversethecrushblog

Instagram: @reversethecrush_

Facebook: @reversethecrushblog

Email: graham@reversethecrush.com

Best Stock Apps: (4) Must-Have Apps For Tracking Stock Prices

Best Stock Apps: (4) Must-Have Apps For Tracking Stock Prices